Financial Stability Report November 2011 Contents

... relatively robust, strong capital inflows and rapid domestic credit growth have created vulnerabilities in some economies, including China. A sharp slowdown in emerging economies would reduce the growth prospects of both Australia and New Zealand, through weaker export demand and lower commodity pri ...

... relatively robust, strong capital inflows and rapid domestic credit growth have created vulnerabilities in some economies, including China. A sharp slowdown in emerging economies would reduce the growth prospects of both Australia and New Zealand, through weaker export demand and lower commodity pri ...

Economics 104B - Lecture Notes Part III

... Which perspective is correct? The answer is complex and subject to debate. One simple resolution is that the demand-side perspective is correct in the short run (when demand-side theory is most relevant) while the supply-side theory applies to the long run. This resolution suggests that a rise in sa ...

... Which perspective is correct? The answer is complex and subject to debate. One simple resolution is that the demand-side perspective is correct in the short run (when demand-side theory is most relevant) while the supply-side theory applies to the long run. This resolution suggests that a rise in sa ...

View PDF in new window - Tetragon Financial Group

... expectations and beliefs concerning future events impacting TFG and therefore involve a number of risks and uncertainties. Forward-looking statements are not guarantees of future performance, and TFG’s actual results of operations, financial condition and liquidity may differ materially and adversel ...

... expectations and beliefs concerning future events impacting TFG and therefore involve a number of risks and uncertainties. Forward-looking statements are not guarantees of future performance, and TFG’s actual results of operations, financial condition and liquidity may differ materially and adversel ...

Will an inverted yield curve predict the next recession … again

... reduce demand for credit (such as car loans, business loans and mortgage rates). This is a delicate balance, as these rate adjustments tend to have the desired effect on the economy in the near term, but ultimately, a number of market factors (including inflation expectation, employment growth and g ...

... reduce demand for credit (such as car loans, business loans and mortgage rates). This is a delicate balance, as these rate adjustments tend to have the desired effect on the economy in the near term, but ultimately, a number of market factors (including inflation expectation, employment growth and g ...

Financial Research Company

... – KMV EDF credit measures on >25,000 publicly-traded firms globally – Reports EDF credit measures updated on daily basis – Tailor-made features to those operating in a real-time Internet environment, make buy and sell decisions quickly and often ...

... – KMV EDF credit measures on >25,000 publicly-traded firms globally – Reports EDF credit measures updated on daily basis – Tailor-made features to those operating in a real-time Internet environment, make buy and sell decisions quickly and often ...

Democratic Commissioners’ Views Is America’s trade deficit sustainable? The

... How much longer can the U.S. current account deficit be sustained? In the context of the economics of a country’s external balance, "sustainable" refers to a stable state or a stable path where the external balance generates no economic forces of its own to change its trajectory.3 In other words, a ...

... How much longer can the U.S. current account deficit be sustained? In the context of the economics of a country’s external balance, "sustainable" refers to a stable state or a stable path where the external balance generates no economic forces of its own to change its trajectory.3 In other words, a ...

Using Financial Ratios to Predict Financial Distress of Jordanian

... distress. Moreover, the model`s accuracy in classifying another sample of ten firms, half of which had failed, was 90% in the first year before distress. The study concluded with some useful recommendations. The most important of them is the utilization of the proposed model by the companies control ...

... distress. Moreover, the model`s accuracy in classifying another sample of ten firms, half of which had failed, was 90% in the first year before distress. The study concluded with some useful recommendations. The most important of them is the utilization of the proposed model by the companies control ...

Why the current account may matter in a monetary union 1

... speci…cally the Euro area, they use an intertemporal model to show that foreign borrowing is optimal for a converging country: the recommended level of external borrowing is higher, and hence savings are lower or investment higher, the greater the country’s expected output growth relative to the are ...

... speci…cally the Euro area, they use an intertemporal model to show that foreign borrowing is optimal for a converging country: the recommended level of external borrowing is higher, and hence savings are lower or investment higher, the greater the country’s expected output growth relative to the are ...

Bulletin Reserve Bank of New Zealand The insurance sector and

... The Reserve Bank is responsible for promoting the maintenance of a sound and efficient financial system. The New Zealand insurance sector forms a key part of the financial system, and makes an important contribution to economic growth and development. Disruption to the insurance sector and the servi ...

... The Reserve Bank is responsible for promoting the maintenance of a sound and efficient financial system. The New Zealand insurance sector forms a key part of the financial system, and makes an important contribution to economic growth and development. Disruption to the insurance sector and the servi ...

Download817 KB - Long

... ensure that such new financial products are well designed in terms of assets and liabilities management. From this point of view, the infrastructure asset class has interesting characteristics. The financial institutions that manage a substantial proportion of households’ investments must be able to ...

... ensure that such new financial products are well designed in terms of assets and liabilities management. From this point of view, the infrastructure asset class has interesting characteristics. The financial institutions that manage a substantial proportion of households’ investments must be able to ...

Solutions to Chapter 11

... to yield higher returns when the rest of the economy fares poorly. In contrast, the Leaning Tower of Pita has returns that are positively correlated with the rest of the economy. It does best in a boom and goes out of business in a recession. For this reason, Leaning Tower would be a risky investmen ...

... to yield higher returns when the rest of the economy fares poorly. In contrast, the Leaning Tower of Pita has returns that are positively correlated with the rest of the economy. It does best in a boom and goes out of business in a recession. For this reason, Leaning Tower would be a risky investmen ...

Consolidated Edison Company of New York, Inc. - corporate

... of the derivative instruments subsidiaries of Con Edison Clean Energy Businesses, Inc. use to economically hedge market price fluctuations in related underlying physical transactions for the purchase or sale of electricity and gas. Adjusted earnings may also exclude from net income certain other ite ...

... of the derivative instruments subsidiaries of Con Edison Clean Energy Businesses, Inc. use to economically hedge market price fluctuations in related underlying physical transactions for the purchase or sale of electricity and gas. Adjusted earnings may also exclude from net income certain other ite ...

Training - NYU Stern

... Activist investors: Some investors have been willing to challenge management practices at companies by offering proposals for change at annual meetings. While they have been for the most part unsuccessful at getting these proposals adopted, they have shaken up incumbent managers. Proxy contests: In ...

... Activist investors: Some investors have been willing to challenge management practices at companies by offering proposals for change at annual meetings. While they have been for the most part unsuccessful at getting these proposals adopted, they have shaken up incumbent managers. Proxy contests: In ...

CapStrStu

... A, B, and C form Dine, Inc. to operate a restaurant that C previously operated as a sole proprietorship. After the initial contribution (see diagram), Dine needs $1.8 million more capital to renovate the building, acquire equipment, and provide working capital. So, Dine obtains a $900,000 loan from ...

... A, B, and C form Dine, Inc. to operate a restaurant that C previously operated as a sole proprietorship. After the initial contribution (see diagram), Dine needs $1.8 million more capital to renovate the building, acquire equipment, and provide working capital. So, Dine obtains a $900,000 loan from ...

Gains and Risks of Financial and Economic Globalization for

... benefits from the globalization on the developing countries. The result shows that application of these benefits for developing countries is as follows: 1. The main advantage of financial globalization for developing countries would be a significant reduction in poverty and as a result reduction in ...

... benefits from the globalization on the developing countries. The result shows that application of these benefits for developing countries is as follows: 1. The main advantage of financial globalization for developing countries would be a significant reduction in poverty and as a result reduction in ...

In recent years, the personal saving rate in the

... in Figure 1, the steep rise in the financial wealth of households beginning in the mid-1990s—which was principally due to the soaring stock market— is almost a mirror image of the falloff in the personal saving rate. Some argue that capital gains should be added to personal income, thus raising hous ...

... in Figure 1, the steep rise in the financial wealth of households beginning in the mid-1990s—which was principally due to the soaring stock market— is almost a mirror image of the falloff in the personal saving rate. Some argue that capital gains should be added to personal income, thus raising hous ...

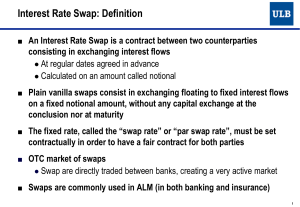

Interest Rate Swap

... Interest Rate Swap: Use in ALM (6/10) ■ Example (continued) ● If the spread government – interbank is zero, then K2=C1 (see later) Coupons received from the new bonds allow exactly to pay the fixed leg of this new swap Floating legs of both swaps (forward and spot) are compensating. Globally ...

... Interest Rate Swap: Use in ALM (6/10) ■ Example (continued) ● If the spread government – interbank is zero, then K2=C1 (see later) Coupons received from the new bonds allow exactly to pay the fixed leg of this new swap Floating legs of both swaps (forward and spot) are compensating. Globally ...

Gideon I: the FTC equity strategy

... FTC Gideon I was created in January 2006. This was the first UCITS compliant mutual fund with an FTC trading system. The original strategy combined two different trend-following systems which generated trading signals in a universe of over 1,000 equity mutual funds. This strategy, which can have bet ...

... FTC Gideon I was created in January 2006. This was the first UCITS compliant mutual fund with an FTC trading system. The original strategy combined two different trend-following systems which generated trading signals in a universe of over 1,000 equity mutual funds. This strategy, which can have bet ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.