The Dutch housing market - mortgage interest rates, house prices

... A third cost component of financing using borrowed capital is that of interest on deposits at the Dutch banks. A high interest on deposits could reflect a larger willingness of Dutch banks to attract money from individual savers than from banks in other countries. Differences in deposit interest rat ...

... A third cost component of financing using borrowed capital is that of interest on deposits at the Dutch banks. A high interest on deposits could reflect a larger willingness of Dutch banks to attract money from individual savers than from banks in other countries. Differences in deposit interest rat ...

85th Annual Report - Bank for International Settlements

... Fiscal positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Early warning indicators of domestic banking crisis . . . . . . . . . . . . . . . . . . . . . . . . . . Annual changes in foreign exchange reserves . . . . . . . . . ...

... Fiscal positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Early warning indicators of domestic banking crisis . . . . . . . . . . . . . . . . . . . . . . . . . . Annual changes in foreign exchange reserves . . . . . . . . . ...

pdf

... absolute funds, we offer competitive fixed fees that are discounted when we fail to preserve capital. We believe these changes will enhance outcomes for our investors, and confirm our commitment to put clients first. We require investor permission to complete the process of broadening mandates in th ...

... absolute funds, we offer competitive fixed fees that are discounted when we fail to preserve capital. We believe these changes will enhance outcomes for our investors, and confirm our commitment to put clients first. We require investor permission to complete the process of broadening mandates in th ...

Group annual financial statements

... Primary capital consists of issued ordinary share capital and perpetual preference share capital, retained earnings and reserves. Rehabilitated loans Where a loan or receivable which has previously been written off as bad, starts generating cash repayments at a certain minimum level to that required ...

... Primary capital consists of issued ordinary share capital and perpetual preference share capital, retained earnings and reserves. Rehabilitated loans Where a loan or receivable which has previously been written off as bad, starts generating cash repayments at a certain minimum level to that required ...

ca-ipcc (1st group) financial management (71 imp questions)

... could continue to show profit increased by merely issuing stock and using the proceeds to invest in risk-free or near to risk-free securities. He may also opt for increasing profit through other non-operational activities like disposal of fixed assets etc. This would result in a consistent decrease ...

... could continue to show profit increased by merely issuing stock and using the proceeds to invest in risk-free or near to risk-free securities. He may also opt for increasing profit through other non-operational activities like disposal of fixed assets etc. This would result in a consistent decrease ...

MYLAN LABORATORIES INC

... competition in the generic drug industry and the lack of significant new product approvals for the Company over the last 15 months is the primary cause of the decreases from last year's first quarter to the current quarter. The modest increase in sales and gross profits over the quarter ended March ...

... competition in the generic drug industry and the lack of significant new product approvals for the Company over the last 15 months is the primary cause of the decreases from last year's first quarter to the current quarter. The modest increase in sales and gross profits over the quarter ended March ...

Are Entrepreneur-Led Companies Better?

... interests of management and shareholders are better aligned. On the other hand, Fama (1980), in his managerial labor market hypothesis posits that good managerial talent can be hired away by other organizations. Value accrues to shareholders only after netting out the pay premium afforded profession ...

... interests of management and shareholders are better aligned. On the other hand, Fama (1980), in his managerial labor market hypothesis posits that good managerial talent can be hired away by other organizations. Value accrues to shareholders only after netting out the pay premium afforded profession ...

Deutsche Invest I Top Asia - Deutsche Asset Management

... benchmark are calculated. In the event of strong market movements during this period, this may result in the over- or understatement of the Fund's performance relative to the benchmark at the end of the month (this is referred to as the "pricing effect"). The information in this document does not co ...

... benchmark are calculated. In the event of strong market movements during this period, this may result in the over- or understatement of the Fund's performance relative to the benchmark at the end of the month (this is referred to as the "pricing effect"). The information in this document does not co ...

The Price Effects of Australian Structured Share Buybacks

... nouncement, the franking credits detach from the buyback offer. This should correspond to a price fall over the night before. The size of the fall depends on the franking credit value and the share price premium above the 'true' market price. ...

... nouncement, the franking credits detach from the buyback offer. This should correspond to a price fall over the night before. The size of the fall depends on the franking credit value and the share price premium above the 'true' market price. ...

US Macro Announcements and the Euro/Dollar Exchange

... To foreign investors, a strong American economy is viewed more favorably than a weak one. Robust economic activity in the US motivates corporate profits and firms interest rates; foreign investors see opportunities to make money in the stock market and from higher-yielding Treasury bills and bonds. ...

... To foreign investors, a strong American economy is viewed more favorably than a weak one. Robust economic activity in the US motivates corporate profits and firms interest rates; foreign investors see opportunities to make money in the stock market and from higher-yielding Treasury bills and bonds. ...

relationship - University of St Andrews

... recovered from a significant decline during the 1990s, and at the time of writing, trades at around a quarter of the value it saw at its peak in 1989. 2 The aim of this paper is to see whether the same model can explain the US and Japanese stock market while yielding consistent factor loadings. This ...

... recovered from a significant decline during the 1990s, and at the time of writing, trades at around a quarter of the value it saw at its peak in 1989. 2 The aim of this paper is to see whether the same model can explain the US and Japanese stock market while yielding consistent factor loadings. This ...

Plunder Blunder Cover Mech.indd

... families face the loss of their homes, and tens of millions have seen their life’s savings evaporate with the plunge in home prices, most of the financiers responsible for this disaster remain fabulously rich. The failure was also in the economics profession. With extremely few exceptions, economist ...

... families face the loss of their homes, and tens of millions have seen their life’s savings evaporate with the plunge in home prices, most of the financiers responsible for this disaster remain fabulously rich. The failure was also in the economics profession. With extremely few exceptions, economist ...

Basic Stock Valuation

... If the actual price is lower than the fundamental value, then the stock is a “bargain.” Buy orders will exceed sell orders, the actual price will be bid up. The opposite occurs if the actual price is higher than the fundamental value. (More…) ...

... If the actual price is lower than the fundamental value, then the stock is a “bargain.” Buy orders will exceed sell orders, the actual price will be bid up. The opposite occurs if the actual price is higher than the fundamental value. (More…) ...

Valuing stock markets and the equity risk premium

... return, the riskier the asset is deemed to be and the higher the required rate of return for holding the asset. Similarly to the CAPM, a stock which is expected to move broadly in tandem with aggregate consumption growth tends to deliver wealth when this is least desirable, i.e. when consumption is ...

... return, the riskier the asset is deemed to be and the higher the required rate of return for holding the asset. Similarly to the CAPM, a stock which is expected to move broadly in tandem with aggregate consumption growth tends to deliver wealth when this is least desirable, i.e. when consumption is ...

Bank lending and commercial property cycles: some

... (iii) Common economic factors for lending and real estate prices • Credit affected by shocks to variables such as GDP and interest rates… • …which also provoke demand and supply imbalances in real estate (iv) Will changing nature of finance affect the creditproperty price interrelation? • Note in p ...

... (iii) Common economic factors for lending and real estate prices • Credit affected by shocks to variables such as GDP and interest rates… • …which also provoke demand and supply imbalances in real estate (iv) Will changing nature of finance affect the creditproperty price interrelation? • Note in p ...

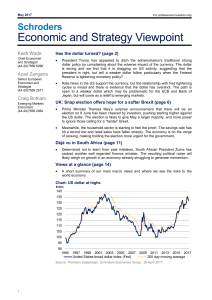

Economic and Strategy Viewpoint

... Has the dollar become a major drag on the US? Looking at the current account deficit the answer would be no: the deficit remains around 1.5% of GDP and has been relatively stable since 2014. If we strip out oil and only look at trade, the deficit is larger at 2.8% of GDP, but again has been relative ...

... Has the dollar become a major drag on the US? Looking at the current account deficit the answer would be no: the deficit remains around 1.5% of GDP and has been relatively stable since 2014. If we strip out oil and only look at trade, the deficit is larger at 2.8% of GDP, but again has been relative ...

A Look Forward— Understanding Forward Curves in Energy

... Another common usage case is asset valuation for either planning purposes or dynamic hedging. Since these valuations are not for financial statement preparation purposes, companies may use something other than exchange-based curves. This is especially helpful in cases where the operating characteris ...

... Another common usage case is asset valuation for either planning purposes or dynamic hedging. Since these valuations are not for financial statement preparation purposes, companies may use something other than exchange-based curves. This is especially helpful in cases where the operating characteris ...

integrative problem

... 2) You own a bond that pays $100 in interest annually, has a par value of $1000, and matures in 15 years. What is the value of the bond if your required rate of return is 12%? What is the value of the bond if your required rate of return (a) increases to 15% or (b) decreases to 8%? Now, recompute al ...

... 2) You own a bond that pays $100 in interest annually, has a par value of $1000, and matures in 15 years. What is the value of the bond if your required rate of return is 12%? What is the value of the bond if your required rate of return (a) increases to 15% or (b) decreases to 8%? Now, recompute al ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.