US monetary policy normalisation tool box stocked

... • At the FOMC meeting this week, we expect the Fed to raise the Fed funds target range by 25bp to 0.500.75%, from the current 0.25-0.50%, by setting the IOER at the top of the range (0.75%) accompanied by the ON RRP rate 25bp lower at the bottom of the range (0.50%). For more details, see FOMC Previ ...

... • At the FOMC meeting this week, we expect the Fed to raise the Fed funds target range by 25bp to 0.500.75%, from the current 0.25-0.50%, by setting the IOER at the top of the range (0.75%) accompanied by the ON RRP rate 25bp lower at the bottom of the range (0.50%). For more details, see FOMC Previ ...

open joint stock company “aeroflot - russian airlines” and subsidiaries

... “Aeroflot - Russian Airlines” and its subsidiaries (the “Group”) as of 31 December 2003, and the related consolidated statements of income, cash flows and changes in shareholders’ equity for the year then ended. These consolidated financial statements are the responsibility of the Group’s management ...

... “Aeroflot - Russian Airlines” and its subsidiaries (the “Group”) as of 31 December 2003, and the related consolidated statements of income, cash flows and changes in shareholders’ equity for the year then ended. These consolidated financial statements are the responsibility of the Group’s management ...

NBER WORKING PAPER SERIES ON THE FUNDAMENTALS OF SELF-FULFILLING Craig Burnside Martin Eichenbaum

... liabilities. This transformation is the key mechanism by which government guar'The recent literature emphasizes the distinction between fundamental and multiple equilibrium explanations of twin crises.' For examples of papers that emphasize fundamentals see Corsetti, Pesenti and Roubini (1997), Bord ...

... liabilities. This transformation is the key mechanism by which government guar'The recent literature emphasizes the distinction between fundamental and multiple equilibrium explanations of twin crises.' For examples of papers that emphasize fundamentals see Corsetti, Pesenti and Roubini (1997), Bord ...

CENTRAL BANK OF THE REPUBLIC OF TURKEY

... the USA, which had been falling since mid-2007, dropped to its lowest level ...

... the USA, which had been falling since mid-2007, dropped to its lowest level ...

International Capital Flows II

... – This makes the balance of payments accounts seldom balance in practice. – Account keepers force the two sides to balance by adding to the accounts a statistical discrepancy. – It is very difficult to allocate this discrepancy among the current, capital, and financial accounts. ...

... – This makes the balance of payments accounts seldom balance in practice. – Account keepers force the two sides to balance by adding to the accounts a statistical discrepancy. – It is very difficult to allocate this discrepancy among the current, capital, and financial accounts. ...

Deconstructing Equity: Public Ownership, Agency Costs, and

... (observing that LBOs traditionally favored industries with stable cash flows but that current deals "are spreading to industries such as airlines that are inherently more cyclical and exposed to risk factors"); see also infra notes 106-108 and accompanying text. 12. In late June 2007, concerns arose ...

... (observing that LBOs traditionally favored industries with stable cash flows but that current deals "are spreading to industries such as airlines that are inherently more cyclical and exposed to risk factors"); see also infra notes 106-108 and accompanying text. 12. In late June 2007, concerns arose ...

Chapter 22 Credit Risk

... $100 at the end of 1 year if a certain company’s credit rating falls from A to Baa or lower during the year. The 1-year risk-free rate is 5%. Using Table 22.6, estimate a value for the derivative. What assumptions are you making? Do they tend to overstate or understate the value of the derivative. S ...

... $100 at the end of 1 year if a certain company’s credit rating falls from A to Baa or lower during the year. The 1-year risk-free rate is 5%. Using Table 22.6, estimate a value for the derivative. What assumptions are you making? Do they tend to overstate or understate the value of the derivative. S ...

American Superconductor Corporation

... The Company has experienced recurring operating losses and as of June 30, 2016 , the Company had an accumulated deficit of $938.5 million . In addition, the Company has experienced recurring negative operating cash flows. At June 30, 2016 , the Company had cash and cash equivalents of $35.2 million ...

... The Company has experienced recurring operating losses and as of June 30, 2016 , the Company had an accumulated deficit of $938.5 million . In addition, the Company has experienced recurring negative operating cash flows. At June 30, 2016 , the Company had cash and cash equivalents of $35.2 million ...

Form 10-K - corporate

... materials, precision photonic solutions used in life sciences, research and defense markets, and precision gear and peristaltic pump technologies that meet exacting original equipment manufacturer specifications. The segment accounted for 34% of IDEX’s sales and 31% of operating income in 2011, with ...

... materials, precision photonic solutions used in life sciences, research and defense markets, and precision gear and peristaltic pump technologies that meet exacting original equipment manufacturer specifications. The segment accounted for 34% of IDEX’s sales and 31% of operating income in 2011, with ...

Twin Crises in Emerging Markets:

... is crucial to provide thorough evidence on the new transmission channels that we emphasize here. To do so we use bank-level balance sheet and income statement data for a sample of commercial banks in several Latin American and Asian countries for the period 1996-2003. We focus on these two regions b ...

... is crucial to provide thorough evidence on the new transmission channels that we emphasize here. To do so we use bank-level balance sheet and income statement data for a sample of commercial banks in several Latin American and Asian countries for the period 1996-2003. We focus on these two regions b ...

Ethics Ch. 8

... standards closer by eliminating obviously unacceptable standards such as secret reserves – Major problem early on was lack of enforcement mechanism for the international accounting standards (IAS) set by the IASC ...

... standards closer by eliminating obviously unacceptable standards such as secret reserves – Major problem early on was lack of enforcement mechanism for the international accounting standards (IAS) set by the IASC ...

Number 67

... particular, the authors consider the strategic asset allocation of long-term investors who face risky liabilities and who can invest in a large menu of asset classes including real estate, credits, commodities and hedge funds. The analysis is performed by using a VAR for returns, liabilities and mac ...

... particular, the authors consider the strategic asset allocation of long-term investors who face risky liabilities and who can invest in a large menu of asset classes including real estate, credits, commodities and hedge funds. The analysis is performed by using a VAR for returns, liabilities and mac ...

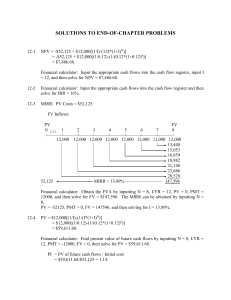

solutions to end-of

... If the firm goes with Plan B, it will forgo $10,250,000 in Year 1, but will receive $1,750,000 per year in Years 2-20. b. If the firm could invest the incremental $10,250,000 at a return of 16.07%, it would receive cash flows of $1,750,000. If we set up an amortization schedule, we would find that p ...

... If the firm goes with Plan B, it will forgo $10,250,000 in Year 1, but will receive $1,750,000 per year in Years 2-20. b. If the firm could invest the incremental $10,250,000 at a return of 16.07%, it would receive cash flows of $1,750,000. If we set up an amortization schedule, we would find that p ...

Quadrants of Risk

... Feedback: In the hazard risk quadrant, New Company would have property damage risks to its plant and equipment resulting from fire, storms, or other events. It would also have risk of injury to its employees and liability risks associated with its products. In the operational risk quadrant, New Comp ...

... Feedback: In the hazard risk quadrant, New Company would have property damage risks to its plant and equipment resulting from fire, storms, or other events. It would also have risk of injury to its employees and liability risks associated with its products. In the operational risk quadrant, New Comp ...

Bond Markets in Serbia: Regulatory Challenges for an Efficient Market

... four bond series accounted for 37.2% of the total debt, which meant that the government relied on acquiring bonds before they reach maturity through the process of privatization, or by allowing the possibility of purchasing government property with 'frozen savings' bonds. ...

... four bond series accounted for 37.2% of the total debt, which meant that the government relied on acquiring bonds before they reach maturity through the process of privatization, or by allowing the possibility of purchasing government property with 'frozen savings' bonds. ...

Phillip Securities Account Opening Application. (Only

... Futures (Licensing and Conduct of Business) Regulations ("Regulations"). While I understand that you will have some investment powers with respect to such surplus funds (the “Surplus Funds”) under the Regulations as supplemented by the Conditions Governing Phillip Securities Accounts (“Conditions”) ...

... Futures (Licensing and Conduct of Business) Regulations ("Regulations"). While I understand that you will have some investment powers with respect to such surplus funds (the “Surplus Funds”) under the Regulations as supplemented by the Conditions Governing Phillip Securities Accounts (“Conditions”) ...

capital structure and dividend policy

... of shares of common stock that are outstanding); and, in combination, when DTL = 4.20, a 10 percent decrease (increase) in sales will cause a 42 percent decrease (increase) in EPS. The concept of leverage can be used to determine the impact that a change in capital structure will have on the riskine ...

... of shares of common stock that are outstanding); and, in combination, when DTL = 4.20, a 10 percent decrease (increase) in sales will cause a 42 percent decrease (increase) in EPS. The concept of leverage can be used to determine the impact that a change in capital structure will have on the riskine ...

The Fed Needs to Change Course (Fall 2013)

... expanded its balance sheet by $2 trillion (from $900 billion to $2.9 trillion) through large-scale asset purchases during QE1 and QE2, and lengthened the duration of its assets during Operation Twist as it worked to push interest rates down toward zero for longer maturities. The Federal Reserve’s ba ...

... expanded its balance sheet by $2 trillion (from $900 billion to $2.9 trillion) through large-scale asset purchases during QE1 and QE2, and lengthened the duration of its assets during Operation Twist as it worked to push interest rates down toward zero for longer maturities. The Federal Reserve’s ba ...

A Review of the Chinese Real Estate Market

... "Market Capitalization of Listed Companies (% of GDP) | Data | Table." Data | The World ...

... "Market Capitalization of Listed Companies (% of GDP) | Data | Table." Data | The World ...

NBER WORKING PAPER SERIES ENDOGENOUS FINANCIAL AND TRADE OPENNESS Joshua Aizenman Ilan Noy

... financial openness to greater trade openness -- may hold due to different channels that are discussed in our theoretical work. Hence, we expect to find two-way positive linkages between financial and commercial openness and confirm these predictions empirically. We investigate the relative magnitude ...

... financial openness to greater trade openness -- may hold due to different channels that are discussed in our theoretical work. Hence, we expect to find two-way positive linkages between financial and commercial openness and confirm these predictions empirically. We investigate the relative magnitude ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.