Trading and Investment Strategies

... investing experience. Through simulated trading experience, we learned how to invest in different markets and develop strategies for trading them. For example, trading currencies can be a great means for consistent short term returns but requires a lot of time and management, whereas trading equitie ...

... investing experience. Through simulated trading experience, we learned how to invest in different markets and develop strategies for trading them. For example, trading currencies can be a great means for consistent short term returns but requires a lot of time and management, whereas trading equitie ...

doc - corporate

... officer, chief operating officer, chief financial officer, chief restructuring officer, controller and treasurer, and other senior positions that report to them. Transactions. We combine the disciplines of structured finance, investment banking, lender services, M&A, M&A integration and valuation se ...

... officer, chief operating officer, chief financial officer, chief restructuring officer, controller and treasurer, and other senior positions that report to them. Transactions. We combine the disciplines of structured finance, investment banking, lender services, M&A, M&A integration and valuation se ...

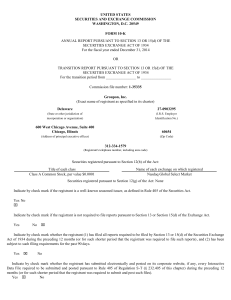

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... We are a Maryland corporation that, with its subsidiaries, is focused on investing on a leveraged basis in mortgage-backed securities, or MBS, and other real estate-related assets. We were formed in March 2012 and commenced operations in May 2012; we completed our initial public offering, or our IPO ...

... We are a Maryland corporation that, with its subsidiaries, is focused on investing on a leveraged basis in mortgage-backed securities, or MBS, and other real estate-related assets. We were formed in March 2012 and commenced operations in May 2012; we completed our initial public offering, or our IPO ...

united states securities and exchange commission - corporate

... This report contains “forward-looking statements.” All statements other than statements of historical fact contained in this report are forward-looking statements, including, without limitation, statements regarding our business growth strategy and projected costs; future financial position; the suf ...

... This report contains “forward-looking statements.” All statements other than statements of historical fact contained in this report are forward-looking statements, including, without limitation, statements regarding our business growth strategy and projected costs; future financial position; the suf ...

Vanguard Natural Resources LLC

... “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management ...

... “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management ...

european commission - Institute for Transport Studies

... The financing of a project can be said to be purely private if ...

... The financing of a project can be said to be purely private if ...

2016The World`s Leading Islamic Finance News Provider

... & Poor’s Ratings Services’s opinion. The industry has achieved critical mass, with total assets exceeding US$2 trillion by our estimate. But we now think the industry faces three main challenges: The decline in oil prices; the rapid changes in the global financial regulation; and its fragmented natu ...

... & Poor’s Ratings Services’s opinion. The industry has achieved critical mass, with total assets exceeding US$2 trillion by our estimate. But we now think the industry faces three main challenges: The decline in oil prices; the rapid changes in the global financial regulation; and its fragmented natu ...

morgans hotel group co. - corporate

... We have enhanced our management team through new hires with a renewed focus on acquisitions and growth. We believe that our current management team and existing operating infrastructure provide us with the ability to successfully integrate assets into our portfolio as we grow and expand. We believe ...

... We have enhanced our management team through new hires with a renewed focus on acquisitions and growth. We believe that our current management team and existing operating infrastructure provide us with the ability to successfully integrate assets into our portfolio as we grow and expand. We believe ...

An Overview of Fee Structures in Real Estate Funds and Their

... assets ought to decline as the size 8 of the portfolio increases; that is, the scalable nature of the investment management business lends itself to the belief that increasing economies of scale are realized as assets under management (AUM) grow. When looking at the fees for large “core” funds, we s ...

... assets ought to decline as the size 8 of the portfolio increases; that is, the scalable nature of the investment management business lends itself to the belief that increasing economies of scale are realized as assets under management (AUM) grow. When looking at the fees for large “core” funds, we s ...

the yale law journal - Queen`s Economics Department

... drafting. In acquisition agreements, this would suggest that vague MAC clauses yield benefits only by reducing front-end drafting costs. Yet, some proxies for material adverse change, such as quantitative thresholds in stock price, revenues, or accounting earnings, are easy to draft and can be verif ...

... drafting. In acquisition agreements, this would suggest that vague MAC clauses yield benefits only by reducing front-end drafting costs. Yet, some proxies for material adverse change, such as quantitative thresholds in stock price, revenues, or accounting earnings, are easy to draft and can be verif ...

saving behaviour - Utrecht University Repository

... In the last decades, global inequality between the developed and the developing world has been the focus theme amongst scholars, newspapers, international organisations and celebrities in order to raise public awareness of this worldwide problem. The major gap between the income levels around the wo ...

... In the last decades, global inequality between the developed and the developing world has been the focus theme amongst scholars, newspapers, international organisations and celebrities in order to raise public awareness of this worldwide problem. The major gap between the income levels around the wo ...

Groupon, Inc. (Form: 10-K, Received: 02/13/2015 06

... This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding our future results of operations and financial position, business str ...

... This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding our future results of operations and financial position, business str ...

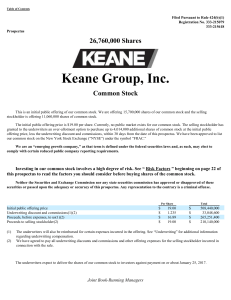

Keane Group, Inc.

... independent industry publications, government publications and other published independent sources, such as the “Drilling and Production Outlook—December 2016” and “NAM Activity by Region_Dec_2016” reports prepared by Spears & Associates. Although we believe these third-party sources are reliable as ...

... independent industry publications, government publications and other published independent sources, such as the “Drilling and Production Outlook—December 2016” and “NAM Activity by Region_Dec_2016” reports prepared by Spears & Associates. Although we believe these third-party sources are reliable as ...

Read Now - Vaughn Woods Financial Group

... CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-U.S ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectiv ...

... CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-U.S ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectiv ...

PepsiCo 2014 Form 10-K

... Pepsi, Pepsi Max, 7UP, Diet Pepsi and Tropicana. These branded products are sold to authorized bottlers, independent distributors and retailers. In certain markets, however, Europe operates its own bottling plants and distribution facilities. Europe also, either independently or in conjunction with ...

... Pepsi, Pepsi Max, 7UP, Diet Pepsi and Tropicana. These branded products are sold to authorized bottlers, independent distributors and retailers. In certain markets, however, Europe operates its own bottling plants and distribution facilities. Europe also, either independently or in conjunction with ...

Azure Power Global Ltd (Form: F-1/A, Received: 10/07

... buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 30, 2016, which is the date of our last reported financial statements. We make no representation that the Indian rupee or U.S. dollar amounts refer ...

... buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 30, 2016, which is the date of our last reported financial statements. We make no representation that the Indian rupee or U.S. dollar amounts refer ...

Fair Value Measurement (Topic 820)

... the counterparties. The amendments permit an exception to the requirements in Topic 820 for measuring fair value when a reporting entity manages its financial instruments on the basis of its net exposure, rather than its gross exposure, to those risks. Financial institutions and similar reporting en ...

... the counterparties. The amendments permit an exception to the requirements in Topic 820 for measuring fair value when a reporting entity manages its financial instruments on the basis of its net exposure, rather than its gross exposure, to those risks. Financial institutions and similar reporting en ...

Background Paper on Cooperatives *

... per cent of the market, despite the fact that the consumers actually own the cooperatives. These cooperatives are seeking a compromise on the monopoly law. In addition, there have been de-mutualizations in insurance coops, engendered by minimal relationship between members and management and self-pe ...

... per cent of the market, despite the fact that the consumers actually own the cooperatives. These cooperatives are seeking a compromise on the monopoly law. In addition, there have been de-mutualizations in insurance coops, engendered by minimal relationship between members and management and self-pe ...

Repo and Securities Lending - Federal Reserve Bank of New York

... or securities lending contracts. Repos allow one firm to sell a security to another firm with a simultaneous promise to buy the security back at a later date at a specified price. The economic effect of this transaction is similar to that of a collateralized loan. Securities lending involves a short ...

... or securities lending contracts. Repos allow one firm to sell a security to another firm with a simultaneous promise to buy the security back at a later date at a specified price. The economic effect of this transaction is similar to that of a collateralized loan. Securities lending involves a short ...

Property and inflation - Investment Property Forum

... 10. High GDP growth is generally beneficial for property allocations, unless high growth is also accompanied by high inflation. This means that the 'Demand-Pull' scenario combination (when strong economic growth causes competition for resources and rising prices) does not imply a higher property all ...

... 10. High GDP growth is generally beneficial for property allocations, unless high growth is also accompanied by high inflation. This means that the 'Demand-Pull' scenario combination (when strong economic growth causes competition for resources and rising prices) does not imply a higher property all ...

Nuveen Build America Bond Fund

... Currently, bonds issued after December 31, 2010 will not qualify as BABs unless the relevant provisions of the Act are extended. The Obama administration and Congress are considering a variety of proposals to extend or modify the BABs program, including changes that would make it permanent, reduce t ...

... Currently, bonds issued after December 31, 2010 will not qualify as BABs unless the relevant provisions of the Act are extended. The Obama administration and Congress are considering a variety of proposals to extend or modify the BABs program, including changes that would make it permanent, reduce t ...

NAB Annual Review 2015

... Over the last four years we have strongly focused on improving our asset quality, which has made NAB a stronger business. Cash earnings in 2015 were up 15.5% to $5.84 billion and statutory net profit attributable to the owners of NAB was $6.34 billion, up 19.7% from last year. The Board declared a f ...

... Over the last four years we have strongly focused on improving our asset quality, which has made NAB a stronger business. Cash earnings in 2015 were up 15.5% to $5.84 billion and statutory net profit attributable to the owners of NAB was $6.34 billion, up 19.7% from last year. The Board declared a f ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.