Monetary Policy Practice Questions

... A) reduced, but the multiple by which the commercial banking system can lend is unaffected. B) reduced and the multiple by which the commercial banking system can lend is increased. C) increased and the multiple by which the commercial banking system can lend is increased. D) increased and the multi ...

... A) reduced, but the multiple by which the commercial banking system can lend is unaffected. B) reduced and the multiple by which the commercial banking system can lend is increased. C) increased and the multiple by which the commercial banking system can lend is increased. D) increased and the multi ...

Inflation differentials in the euro area during the last decade

... Eπit+1 is the Consensus Economics forecast for inflation for the next calendar year from its December survey, outputgapit denotes the cyclical component of GDP (extracted using the Hodrick-Prescott filter with data since the start of Eurostat’s annual GDP time series), riskpremiumit denotes the dist ...

... Eπit+1 is the Consensus Economics forecast for inflation for the next calendar year from its December survey, outputgapit denotes the cyclical component of GDP (extracted using the Hodrick-Prescott filter with data since the start of Eurostat’s annual GDP time series), riskpremiumit denotes the dist ...

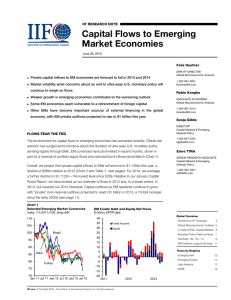

Capital Flows to Emerging Market Economies

... another. When analyzing capital flows, we care about who buys an asset and who sells it. If a foreign investor (a non-resident) buys an emerging market asset, we refer to this as a capital inflow in our terminology. We report capital inflows on a net basis. For example, if foreign investors buy $10 ...

... another. When analyzing capital flows, we care about who buys an asset and who sells it. If a foreign investor (a non-resident) buys an emerging market asset, we refer to this as a capital inflow in our terminology. We report capital inflows on a net basis. For example, if foreign investors buy $10 ...

NBER WORKING PAPER SERIES UNION Matteo Cacciatore

... The intuition for our results is straightforward. We show that high regulation in goods and labor markets implies that steady-state markups are too high and job creation too low. Inefficiency wedges with respect to the first-best allocation are sizable. Regulation makes cyclical unemployment fluctuat ...

... The intuition for our results is straightforward. We show that high regulation in goods and labor markets implies that steady-state markups are too high and job creation too low. Inefficiency wedges with respect to the first-best allocation are sizable. Regulation makes cyclical unemployment fluctuat ...

Optimal Mane~ary Palicy and Sacrifice Ra~ia Jeffrey C. Fuhrer*

... average of the unconditional variances implied by the policy for policy goals. Thus, an optimal monetary policy according to this metric will systematically set the policy instrument in response to deviations of policy goals--usually inflation and real output from their targets so as to minimize thi ...

... average of the unconditional variances implied by the policy for policy goals. Thus, an optimal monetary policy according to this metric will systematically set the policy instrument in response to deviations of policy goals--usually inflation and real output from their targets so as to minimize thi ...

A simple method to switch endogenous and exogenous

... reduction of local subsidies). On the trade balance, the impact of FDI is generally positive, but it can increase the import of equipment goods in the short run. But when capacities build up, they will be more productive, more profitable, and create more export potential. Also, a higher disinf ...

... reduction of local subsidies). On the trade balance, the impact of FDI is generally positive, but it can increase the import of equipment goods in the short run. But when capacities build up, they will be more productive, more profitable, and create more export potential. Also, a higher disinf ...

Robrt J. Gordon Working 1050 OF EVENTS AND

... revolved around logically separate sets of issues. It would have been possible, for instance, to believe that monetary policy was potent and fiscal policy impotent to control aggregate demand, and yet still be in favor of activist ...

... revolved around logically separate sets of issues. It would have been possible, for instance, to believe that monetary policy was potent and fiscal policy impotent to control aggregate demand, and yet still be in favor of activist ...

Research Paper 2011/08 Modeling the Inflation

... income, ms means money supply and it refers to the cost of holding cash (interest rate). Classical theorists have also constructed models in an effort to better understand the causes of sustained price increases in an economy. Their approach is quite similar to that of the monetarists where inflatio ...

... income, ms means money supply and it refers to the cost of holding cash (interest rate). Classical theorists have also constructed models in an effort to better understand the causes of sustained price increases in an economy. Their approach is quite similar to that of the monetarists where inflatio ...

Public Sector Stability and Balance of Payments Crisis

... deficits jumped to record high levels in some economies mainly due to the low level of exports, consisting predominately of low valued agricultural and primary goods as well as uncompetitive manufacturing goods. In addition, due to the regional pickup in growth and investment and other factors (e.g. ...

... deficits jumped to record high levels in some economies mainly due to the low level of exports, consisting predominately of low valued agricultural and primary goods as well as uncompetitive manufacturing goods. In addition, due to the regional pickup in growth and investment and other factors (e.g. ...

Public Sector Stability and Balance of Payments Crises in Selected

... deficits jumped to record high levels in some economies mainly due to the low level of exports, consisting predominately of low valued agricultural and primary goods as well as uncompetitive manufacturing goods. In addition, due to the regional pickup in growth and investment and other factors (e.g. ...

... deficits jumped to record high levels in some economies mainly due to the low level of exports, consisting predominately of low valued agricultural and primary goods as well as uncompetitive manufacturing goods. In addition, due to the regional pickup in growth and investment and other factors (e.g. ...

Chapter 28(13): Monetary Policy

... far the Fed’s most important policy tool. Open market operations occur every business day. The term “open market operation” refers to the Fed’s purchase or sale of government securities. There is nothing mysterious about this process: All the Fed does is buy or sell government securities. However, e ...

... far the Fed’s most important policy tool. Open market operations occur every business day. The term “open market operation” refers to the Fed’s purchase or sale of government securities. There is nothing mysterious about this process: All the Fed does is buy or sell government securities. However, e ...

Trade liberalization and the balance of payments constraint with

... in the income (GDP) elasticity of import demand may be, rather, a reflection of the increases in the shares of manufactured exports and intermediate imports in their respective totals. In this vein, Ibarra (2011a, 2011b) has shown that the income elasticity of Mexico’s demand for imports of intermed ...

... in the income (GDP) elasticity of import demand may be, rather, a reflection of the increases in the shares of manufactured exports and intermediate imports in their respective totals. In this vein, Ibarra (2011a, 2011b) has shown that the income elasticity of Mexico’s demand for imports of intermed ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Monetary Policy Rules

... . ~ particular, changes in output that result from nominal disturbances are always accompanied by changes in the markup. The approach that we take differs from those taken in other chapters in this volume. While we are making progress on building a small-scale, fully articulated macroeconomic model ...

... . ~ particular, changes in output that result from nominal disturbances are always accompanied by changes in the markup. The approach that we take differs from those taken in other chapters in this volume. While we are making progress on building a small-scale, fully articulated macroeconomic model ...

Advanced Macroeconomics - Juridica – Kolegji Evropian

... Many researchers and academicians have contributed to the field of macroeconomics. Each one has made a unique contribution to the advancement of the field. With this book, I am making my small contribution, which, though subject to various limitations, should reflect my sincere efforts to study the ...

... Many researchers and academicians have contributed to the field of macroeconomics. Each one has made a unique contribution to the advancement of the field. With this book, I am making my small contribution, which, though subject to various limitations, should reflect my sincere efforts to study the ...

Animal Spirits and the International Transmission of Business Cycles

... correlation coefficient is 0.82, suggesting a very high degree of synchronization of the business cycles within the Eurozone. This is confirmed in Figure 1 showing the evolution of the business cycle compo ...

... correlation coefficient is 0.82, suggesting a very high degree of synchronization of the business cycles within the Eurozone. This is confirmed in Figure 1 showing the evolution of the business cycle compo ...

Foreign Direct Investment: South Africa’s Elixir of Life?

... Countries experiencing an increase in their debt burden have higher risk ratings and tend to be less attractive to foreign investors. This high-risk rating implies that the probability of defaulting on the foreign debt becomes greater. This could lead to the implementation of restrictions on the out ...

... Countries experiencing an increase in their debt burden have higher risk ratings and tend to be less attractive to foreign investors. This high-risk rating implies that the probability of defaulting on the foreign debt becomes greater. This could lead to the implementation of restrictions on the out ...

fiscal policy in an expectations driven liquidity trap

... A fundamental liquidity traps may occur when a large economic shock causes sufficient deflation such that the ZLB on the short term nominal interest rate becomes binding. One example of such a deflationary shock is a taste shock affecting households preferences for current vs. future consumption. W ...

... A fundamental liquidity traps may occur when a large economic shock causes sufficient deflation such that the ZLB on the short term nominal interest rate becomes binding. One example of such a deflationary shock is a taste shock affecting households preferences for current vs. future consumption. W ...

The Role of Firm-Level Productivity Growth for the Optimal Rate of

... In economies in which firms set their price based on marginal costs, firm-level productivity growth affects a firm’s price setting. Ideally, a profit-maximizing firm sets its nominal price in a way that guarantees that its real price exceeds its real marginal costs by some markup. In this ideal case ...

... In economies in which firms set their price based on marginal costs, firm-level productivity growth affects a firm’s price setting. Ideally, a profit-maximizing firm sets its nominal price in a way that guarantees that its real price exceeds its real marginal costs by some markup. In this ideal case ...

Inflation, Deflation and All That

... cause for much more concern than crossing the 2 per cent line would be in the other imaginary economy here. At least, that is so provided that the drop is temporary, and that expectations about future price changes remain well-anchored at a bit above zero. But what happens when expectations about on ...

... cause for much more concern than crossing the 2 per cent line would be in the other imaginary economy here. At least, that is so provided that the drop is temporary, and that expectations about future price changes remain well-anchored at a bit above zero. But what happens when expectations about on ...

EMU enlargement and government debt - Otto-Wolff

... balances that the convergence period had a significant, positive impact on the balances. More recently, though, fiscal balances in the EU analysed in detail by Hughes Hallett, Lewis and von Hagen (2003), as well as by Hughes Hallett and Lewis (2005) provide a different picture. Most notably, they id ...

... balances that the convergence period had a significant, positive impact on the balances. More recently, though, fiscal balances in the EU analysed in detail by Hughes Hallett, Lewis and von Hagen (2003), as well as by Hughes Hallett and Lewis (2005) provide a different picture. Most notably, they id ...

Inflation and Economic Growth

... inflation/GDP growth relationship. Of course, these data plots do not control for factors other than inflation that could be affecting economic growth. FIGURE 1 BELONGS HERE We label in the four diagrams the data points that emerge as outliers through simple observation. This provides some useful pe ...

... inflation/GDP growth relationship. Of course, these data plots do not control for factors other than inflation that could be affecting economic growth. FIGURE 1 BELONGS HERE We label in the four diagrams the data points that emerge as outliers through simple observation. This provides some useful pe ...

Free Full text

... in early 2016 expenditure and revenue initiatives with estimated annual fiscal costs of 3 percent of GDP. After the opposition won a majority in parliament in September, the President announced his resignation and the Vice President took over. With low commodity prices and strong tourist arrivals, t ...

... in early 2016 expenditure and revenue initiatives with estimated annual fiscal costs of 3 percent of GDP. After the opposition won a majority in parliament in September, the President announced his resignation and the Vice President took over. With low commodity prices and strong tourist arrivals, t ...

Interest_Rates_NY_Fed

... "APY" is the effective interest rate from the standpoint of a person receiving interest. If you have $1,000 in each of two bank accounts, each paying the same interest rate, but the interest is credited more often (let’s say, every month, rather than once a year) on one of the accounts, that account ...

... "APY" is the effective interest rate from the standpoint of a person receiving interest. If you have $1,000 in each of two bank accounts, each paying the same interest rate, but the interest is credited more often (let’s say, every month, rather than once a year) on one of the accounts, that account ...

NBER WORKING PAPER SERIES NEW-KEYNESIAN ECONOMICS: AN AS-AD VIEW Pierpaolo Benigno

... efficacy of fiscal policy stimulus has mostly been couched in terms of Keynesian multipliers. “New Classical and New Keynesian research has had little impact on practical macroeconomists who are charged with the messy task of conducting actual monetary and fiscal policy. It has also had little impact ...

... efficacy of fiscal policy stimulus has mostly been couched in terms of Keynesian multipliers. “New Classical and New Keynesian research has had little impact on practical macroeconomists who are charged with the messy task of conducting actual monetary and fiscal policy. It has also had little impact ...

Chapter 12 - Dr. George Fahmy

... sloped, increases in aggregate demand raise both output and the price level. A. W. Phillips, investigating unemployment and price/wage increases over time, found that low rates of unemployment in Great Britain were associated with high rates of price/wage rate increase, while higher levels of unempl ...

... sloped, increases in aggregate demand raise both output and the price level. A. W. Phillips, investigating unemployment and price/wage increases over time, found that low rates of unemployment in Great Britain were associated with high rates of price/wage rate increase, while higher levels of unempl ...