What causes house price bubble in an emerging economy

... witnessing structural changes with regard to their pattern of consumption and investments. There is an increasing demand for housing as an asset for future returns and an asset to live. This is backed up by increasing speculations by the foreign investors in the housing market of emerging economies ...

... witnessing structural changes with regard to their pattern of consumption and investments. There is an increasing demand for housing as an asset for future returns and an asset to live. This is backed up by increasing speculations by the foreign investors in the housing market of emerging economies ...

Land-Price Dynamics and Macroeconomic Fluctuations

... assets (Berger and Udell, 1990). An important collateral asset for both small firms and large corporations is real estate. In the U.S. data, real estate represents a large fraction of the tangible assets held by nonfinancial corporate firms on their balance sheets. According to the Flow-of-Funds tab ...

... assets (Berger and Udell, 1990). An important collateral asset for both small firms and large corporations is real estate. In the U.S. data, real estate represents a large fraction of the tangible assets held by nonfinancial corporate firms on their balance sheets. According to the Flow-of-Funds tab ...

Section III. Business Cycles B. Rational Expectations Inflation

... is the case, then monetary policy makers can choose the parameters of monetary policy to stabilize the economy. However, an alternative is to examine rational expectations. Rational expectations is just another way of saying model consistent expectations. We think of the exogenous variables as being ...

... is the case, then monetary policy makers can choose the parameters of monetary policy to stabilize the economy. However, an alternative is to examine rational expectations. Rational expectations is just another way of saying model consistent expectations. We think of the exogenous variables as being ...

View/Open

... import demand curve is, relative to the export supply curve, the closer the equilibrium trade price will be to the isolation equilibrium price level in the importing country. The elasticity of the export supply and import demand curves is a function of the underlying domestic supply and demand curve ...

... import demand curve is, relative to the export supply curve, the closer the equilibrium trade price will be to the isolation equilibrium price level in the importing country. The elasticity of the export supply and import demand curves is a function of the underlying domestic supply and demand curve ...

Chapter 10

... • Rapid depreciation of the currency, which raises the domestic cost of imported raw materials, combined with wage indexation ...

... • Rapid depreciation of the currency, which raises the domestic cost of imported raw materials, combined with wage indexation ...

Click www.ondix.com to visit our student-to

... © The incomes received by households, business firms, and governments provide the purchasing power required to buy the nation's output. As that purchasing power is spent, further GDP is created and the circular flow continues. © Income and output are two entirely different things. This is fundament ...

... © The incomes received by households, business firms, and governments provide the purchasing power required to buy the nation's output. As that purchasing power is spent, further GDP is created and the circular flow continues. © Income and output are two entirely different things. This is fundament ...

pse06 kletzer2 2463190 en

... model with imperfect competition and stochastic productivity. The model is set up to allow for a complete solution of the impact of stochastic disturbances to productivity with and without nominal wage rigidity allowing for analytical welfare comparisons following Obstfeld and Rogoff [2000]. To do t ...

... model with imperfect competition and stochastic productivity. The model is set up to allow for a complete solution of the impact of stochastic disturbances to productivity with and without nominal wage rigidity allowing for analytical welfare comparisons following Obstfeld and Rogoff [2000]. To do t ...

WIKILEAKS

... curve. They argued that while monetary or fiscal policy might be conducted in such a way as to realize a particular combination of unemployment and inflation in the short run, it would not necessarily be a sustainable combination.5 This new argument contended that the trade-off along the Phillips cu ...

... curve. They argued that while monetary or fiscal policy might be conducted in such a way as to realize a particular combination of unemployment and inflation in the short run, it would not necessarily be a sustainable combination.5 This new argument contended that the trade-off along the Phillips cu ...

what do we know about macroeconomics

... future or contingent markets, an economy in which people and firms therefore had to make decisions based partly on state variahles—^variables reflecting past decisions—and partly on expectations ofthe future. Once current equilihrium conditions were imposed, the current equilihrium depended partly o ...

... future or contingent markets, an economy in which people and firms therefore had to make decisions based partly on state variahles—^variables reflecting past decisions—and partly on expectations ofthe future. Once current equilihrium conditions were imposed, the current equilihrium depended partly o ...

Lecture 2-3: Measuring Macroeconomic

... Definition: Gross Domestic Product (GDP) is the market value of all _____ goods and services produced within a country in its own currency and in a given period of time. ...

... Definition: Gross Domestic Product (GDP) is the market value of all _____ goods and services produced within a country in its own currency and in a given period of time. ...

Some Definitions and Preliminaries

... first four categories minus the fifth. These 5 categories of expenditure can be measured either in nominal terms, that is quantities times current prices, or in real terms, that is quantities times base year prices. When measured in the first of these ways the sum of the first four categories minus ...

... first four categories minus the fifth. These 5 categories of expenditure can be measured either in nominal terms, that is quantities times current prices, or in real terms, that is quantities times base year prices. When measured in the first of these ways the sum of the first four categories minus ...

63 “KEYNESIANS”, MONETARISTS, NEW CLASSICALS AND NEW

... infinitely elastic with respect to the rate of interest, the Keynesian and classical demands for money have a similar relation: in both models the demand for money depends only on the income level. Consequently, Hicks argues that Keynesian involuntary unemployment persists solely because monetary p ...

... infinitely elastic with respect to the rate of interest, the Keynesian and classical demands for money have a similar relation: in both models the demand for money depends only on the income level. Consequently, Hicks argues that Keynesian involuntary unemployment persists solely because monetary p ...

Topic 5: Nominal and Real GDP - Sam Houston State University

... happened to the multiplication of P and Q but not what happened only to Q. For instance from 2003 to 2004 GDP increase by $28. However, it could have been because production when up and prices went down, or prices went up and production down, or all both went up. In other words, I cannot distinguish ...

... happened to the multiplication of P and Q but not what happened only to Q. For instance from 2003 to 2004 GDP increase by $28. However, it could have been because production when up and prices went down, or prices went up and production down, or all both went up. In other words, I cannot distinguish ...

Lecture_11.3_Keynes SR Model. ppt

... • The classical economists’ world was one of fully utilized resources. • In the 1930s, Europe and the United States entered a period of economic decline that could not be explained by the classical model • John Maynard Keynes developed an explanation that has become known as the Keynesian model. ...

... • The classical economists’ world was one of fully utilized resources. • In the 1930s, Europe and the United States entered a period of economic decline that could not be explained by the classical model • John Maynard Keynes developed an explanation that has become known as the Keynesian model. ...

Aggregate Supply, Aggregate Demand, and Inflation: Putting It All

... prices (their tendency to be slow in adjusting downwards) produces little pressure for inflation to fall. 26. There is no immediate response to inflation in the short run, because it takes time for people to notice the higher inflation and to incorporate it into their contracts. 27. Shifts in the AS ...

... prices (their tendency to be slow in adjusting downwards) produces little pressure for inflation to fall. 26. There is no immediate response to inflation in the short run, because it takes time for people to notice the higher inflation and to incorporate it into their contracts. 27. Shifts in the AS ...

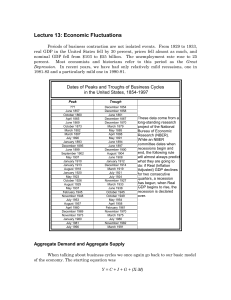

Lecture 13

... And, adjusting for the price level, Real Aggregate Demand = Y = MV/P If we want to see the slope of the aggregate demand curve, the second equation is more convenient. Holding both the money supply and velocity constant, aggregate demand curve is a downward sloping function of price. The higher the ...

... And, adjusting for the price level, Real Aggregate Demand = Y = MV/P If we want to see the slope of the aggregate demand curve, the second equation is more convenient. Holding both the money supply and velocity constant, aggregate demand curve is a downward sloping function of price. The higher the ...

NBER WORKING PAPER SERIES LAND-PRICE DYNAMICS AND MACROECONOMIC FLUCTUATIONS Zheng Liu Pengfei Wang

... market and the macroeconomy. Although it is widely accepted that house prices could have an important influence on macroeconomic fluctuations, quantitative studies in a general equilibrium framework have been scant. This paper aims to fill part of this gap by modeling, through econometric estimation ...

... market and the macroeconomy. Although it is widely accepted that house prices could have an important influence on macroeconomic fluctuations, quantitative studies in a general equilibrium framework have been scant. This paper aims to fill part of this gap by modeling, through econometric estimation ...

PDF

... destroyed by war. Large parts of the rural agricultural areas were effectively cut off from the rest of the economy, and many rural people were driven away from their homes to seek refuge in safer urban areas and neighbouring countries. Following the peace agreement in 1992 and the first free genera ...

... destroyed by war. Large parts of the rural agricultural areas were effectively cut off from the rest of the economy, and many rural people were driven away from their homes to seek refuge in safer urban areas and neighbouring countries. Following the peace agreement in 1992 and the first free genera ...

Unemployment

... Unemployment and Full Employment The Churning Economy Some of the change in the churning economy comes from the transitions that people make through the stages of life: From being in school to finding a job, to working, perhaps to becoming unhappy with a job and looking for a new one, and finally, ...

... Unemployment and Full Employment The Churning Economy Some of the change in the churning economy comes from the transitions that people make through the stages of life: From being in school to finding a job, to working, perhaps to becoming unhappy with a job and looking for a new one, and finally, ...

Formulas to Know: MPC = ∆ consumer spending ∆ disposable

... Potential Output • The horizontal intercept represents an economy’s potential output – the level of production if all prices were fully flexible. • Actual output fluctuates around YP from year to year. ...

... Potential Output • The horizontal intercept represents an economy’s potential output – the level of production if all prices were fully flexible. • Actual output fluctuates around YP from year to year. ...