g - Weebly

... capital, and land to produce Y = 800 bushels of corn. V is constant. In 2008, MS = $2000, P = $5/bushel. For 2009, the Fed increases MS by 5%, to $2100. a. Compute the 2009 values of nominal GDP and P. Compute the inflation rate for 2008–2009. ...

... capital, and land to produce Y = 800 bushels of corn. V is constant. In 2008, MS = $2000, P = $5/bushel. For 2009, the Fed increases MS by 5%, to $2100. a. Compute the 2009 values of nominal GDP and P. Compute the inflation rate for 2008–2009. ...

Document

... capital, and land to produce Y = 800 bushels of corn. V is constant. In 2008, MS = $2000, P = $5/bushel. For 2009, the Fed increases MS by 5%, to $2100. a. Compute the 2009 values of nominal GDP and P. Compute the inflation rate for 2008–2009. ...

... capital, and land to produce Y = 800 bushels of corn. V is constant. In 2008, MS = $2000, P = $5/bushel. For 2009, the Fed increases MS by 5%, to $2100. a. Compute the 2009 values of nominal GDP and P. Compute the inflation rate for 2008–2009. ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... economy without any debt finance1. In such an economy, firms would use only equity finance and homeowners would have no mortgages. The same basic results about the allocation of capital would be obtained, indicating that the fundamental issue is the inflation-induced rise in the relative taxation of ...

... economy without any debt finance1. In such an economy, firms would use only equity finance and homeowners would have no mortgages. The same basic results about the allocation of capital would be obtained, indicating that the fundamental issue is the inflation-induced rise in the relative taxation of ...

Causes of Inflation in Turkey: A Literature Survey with

... clearly one-time increases in the price level.1 If equilibrium price level in a domestic market for goods and services rises continuously as a result of continued excess demand conditions in successive time periods, then economists speak in general from demand-pull inflation. In this case ...

... clearly one-time increases in the price level.1 If equilibrium price level in a domestic market for goods and services rises continuously as a result of continued excess demand conditions in successive time periods, then economists speak in general from demand-pull inflation. In this case ...

A Note on Unconventional Monetary Policy in HANK

... constrained in its ability to lower nominal rates, forward guidance, i.e. the public announcement of the monetary authority’s intention to implement a certain path of future rates, may be a tempting alternative policy tool. As highlighted by Carlstrom, Fuerst and Paustian (2012) and Del Negro, Giann ...

... constrained in its ability to lower nominal rates, forward guidance, i.e. the public announcement of the monetary authority’s intention to implement a certain path of future rates, may be a tempting alternative policy tool. As highlighted by Carlstrom, Fuerst and Paustian (2012) and Del Negro, Giann ...

Read the Full Report

... total demand for final goods and services in the economy – and aggregate supply drive aggregate price levels. Inflation is a sustained increase in aggregate price level – a situation sometimes described as “too much money chasing too few goods.” To adequately capture these phenomena, a price index s ...

... total demand for final goods and services in the economy – and aggregate supply drive aggregate price levels. Inflation is a sustained increase in aggregate price level – a situation sometimes described as “too much money chasing too few goods.” To adequately capture these phenomena, a price index s ...

Document

... aggregate demand curve all intersect. This is represented by point C and is the new equilibrium where short-run aggregate supply curve 2 meets the long-run aggregate supply curve and aggregate demand curve 2. Thus, contractionary policy causes output and the price level to decrease in the short run, ...

... aggregate demand curve all intersect. This is represented by point C and is the new equilibrium where short-run aggregate supply curve 2 meets the long-run aggregate supply curve and aggregate demand curve 2. Thus, contractionary policy causes output and the price level to decrease in the short run, ...

Low Interest Rates and High Asset Prices: An

... as Franco Modigliani and Richard Cohn argued nearly thirty years ago,5 it may be, because of a popular model related to money illusion, the nominal rate that is used in the market to convert today’s dividend into a price. The downtrend in nominal rates since the early 1980s is certainly tied up with ...

... as Franco Modigliani and Richard Cohn argued nearly thirty years ago,5 it may be, because of a popular model related to money illusion, the nominal rate that is used in the market to convert today’s dividend into a price. The downtrend in nominal rates since the early 1980s is certainly tied up with ...

Monetary Policy Statement March 2007 Contents

... The Official Cash Rate (OCR) will increase by 25 basis points to 7.50 percent. Recent indicators show clear evidence of a pick-up in economic activity in late 2006 and early 2007. Strengthening domestic demand is being supported by a resurgence in the housing market and an expansionary fiscal policy ...

... The Official Cash Rate (OCR) will increase by 25 basis points to 7.50 percent. Recent indicators show clear evidence of a pick-up in economic activity in late 2006 and early 2007. Strengthening domestic demand is being supported by a resurgence in the housing market and an expansionary fiscal policy ...

24 | The Aggregate Demand/Aggregate Supply Model

... The horizontal axis of the diagram shows real GDP—that is, the level of GDP adjusted for inflation. The vertical axis shows the price level. Remember that the price level is different from the inflation rate. Visualize the price level as an index number, like the GDP deflator, while the inflation ra ...

... The horizontal axis of the diagram shows real GDP—that is, the level of GDP adjusted for inflation. The vertical axis shows the price level. Remember that the price level is different from the inflation rate. Visualize the price level as an index number, like the GDP deflator, while the inflation ra ...

Is this money?

... “Sticky Prices” • The classical model assume that producers respond to increases in money by instantly raising their prices. Suppose that it is costly to raise prices (menu costs) • Therefore, when the fed increases the money supply, producers respond to this increase in demand by increasing produc ...

... “Sticky Prices” • The classical model assume that producers respond to increases in money by instantly raising their prices. Suppose that it is costly to raise prices (menu costs) • Therefore, when the fed increases the money supply, producers respond to this increase in demand by increasing produc ...

Chap 23

... b) All the factors that shift the long-run aggregate supply curve have the same effect on the short-run aggregate supply curve. One additional factor influences the short-run aggregate supply but not the long-run aggregate supply—a changes in resource prices, such as the money wage rate. a) An incre ...

... b) All the factors that shift the long-run aggregate supply curve have the same effect on the short-run aggregate supply curve. One additional factor influences the short-run aggregate supply but not the long-run aggregate supply—a changes in resource prices, such as the money wage rate. a) An incre ...

THE MULTIPLIER EFFECT A FORMULA FOR THE SPENDING

... of planes from Boeing, the resulting expansion in aggregate demand is necessarily larger than $20 billion. Yet another effect is working in the opposite direction. While an increase in government purchases stimulates the aggregate demand for goods and services, it also causes the interest rate to ri ...

... of planes from Boeing, the resulting expansion in aggregate demand is necessarily larger than $20 billion. Yet another effect is working in the opposite direction. While an increase in government purchases stimulates the aggregate demand for goods and services, it also causes the interest rate to ri ...

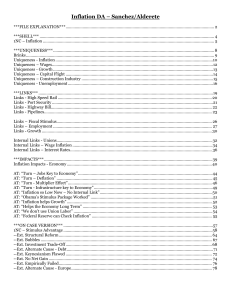

Inflation DA 7WK - Open Evidence Archive

... Stimulus, also known as a Spending Stimulus, or a Keynesian Stimulus (named after a guy named Keynes – he’s dead) or a Demand Side Stimulus. The basic argument is that when a recession occurs, there is a drop in Demand for products, because consumers and businesses cannot afford to buy them. Therefo ...

... Stimulus, also known as a Spending Stimulus, or a Keynesian Stimulus (named after a guy named Keynes – he’s dead) or a Demand Side Stimulus. The basic argument is that when a recession occurs, there is a drop in Demand for products, because consumers and businesses cannot afford to buy them. Therefo ...

Chapter 10: Classical Business Cycle Analysis: Market

... Should fiscal policy be used to dampen the cycle? Classical economists oppose attempts to dampen the cycle, since prices and wages adjust quickly to restore equilibrium. Besides, fiscal policy increases output by making workers worse off, since they face higher taxes. Instead, government spending s ...

... Should fiscal policy be used to dampen the cycle? Classical economists oppose attempts to dampen the cycle, since prices and wages adjust quickly to restore equilibrium. Besides, fiscal policy increases output by making workers worse off, since they face higher taxes. Instead, government spending s ...

12INFLATION*

... 12. If the aggregate demand curve shifts rightward less than expected, a. expectations could not be rational expectations. b. real GDP will be less than potential GDP. c. the real interest rate will be lower than expected. d. the real wage rate will be lower than expected. 13. Which of the following ...

... 12. If the aggregate demand curve shifts rightward less than expected, a. expectations could not be rational expectations. b. real GDP will be less than potential GDP. c. the real interest rate will be lower than expected. d. the real wage rate will be lower than expected. 13. Which of the following ...

AP 宏觀經濟學講義

... money demand, the course should proceed to investigate how equilibrium in the money market determines the equilibrium interest rate, how the investment demand curve provides the link between changes in the interest rate and changes in aggregate demand, and how changes in aggregate demand affect real ...

... money demand, the course should proceed to investigate how equilibrium in the money market determines the equilibrium interest rate, how the investment demand curve provides the link between changes in the interest rate and changes in aggregate demand, and how changes in aggregate demand affect real ...

Should Monetary Policy Target Labor’s Share of Income?

... divided by the price level. Real marginal cost therefore serves as the principal determinant of inflation in these models; moreover, the welfare loss associated with aggregate output’s differing from potential—the level of output that would obtain under perfectly flexible prices—is related to the di ...

... divided by the price level. Real marginal cost therefore serves as the principal determinant of inflation in these models; moreover, the welfare loss associated with aggregate output’s differing from potential—the level of output that would obtain under perfectly flexible prices—is related to the di ...

dees mmi08 6664950 en

... New Keynesian Phillips Curves (NKPC) have been widely used in the macroeconomic literature. Yet their empirical implementation raises a number of issues that continue to be of important concern. The first is whether such equations are identified. In order to determine whether the necessary and suffici ...

... New Keynesian Phillips Curves (NKPC) have been widely used in the macroeconomic literature. Yet their empirical implementation raises a number of issues that continue to be of important concern. The first is whether such equations are identified. In order to determine whether the necessary and suffici ...

Inflation and Economic Growth

... We begin by separating out the phenomenon of hyperinflation, which we broadly define as being annual inflation rates in excess of 40 percent per year. Hyperinflations occur through a variety of specific factors. But regardless of their specific origins, hyperinflations represent a breakdown of econo ...

... We begin by separating out the phenomenon of hyperinflation, which we broadly define as being annual inflation rates in excess of 40 percent per year. Hyperinflations occur through a variety of specific factors. But regardless of their specific origins, hyperinflations represent a breakdown of econo ...

This PDF is a selection from a published volume from

... the Fed in the sense that we use (as much as possible) sequential information sets that were available historically. (On the concept of realtime analysis, see Diebold and Rudebusch, 1991; Croushore and Stark, 1999; and Orphanides, 2001.) Since it is widely recognized that the Greenbook forecasts and ...

... the Fed in the sense that we use (as much as possible) sequential information sets that were available historically. (On the concept of realtime analysis, see Diebold and Rudebusch, 1991; Croushore and Stark, 1999; and Orphanides, 2001.) Since it is widely recognized that the Greenbook forecasts and ...

The Inflation–Output Trade-Off Revisited

... How can this clash be resolved? What is the interpretation of the non-existence result? We propose one interpretation of the non-existence result in Section 4 by relaxing the assumption of perfect foresight while still maintaining the assumption of rational expectations. We show that when introducin ...

... How can this clash be resolved? What is the interpretation of the non-existence result? We propose one interpretation of the non-existence result in Section 4 by relaxing the assumption of perfect foresight while still maintaining the assumption of rational expectations. We show that when introducin ...

Impact of Inflation on Economic Growth: Case Study of Nigeria (1970

... and results generated from conducted research states different views and opinions to the relationship existing between inflation and growth. (Mallik G. & Chowdhury A., 2001) are of the opinion that there is a positive relationship between inflation and growth, (Fisher, S, 1993) believes that there i ...

... and results generated from conducted research states different views and opinions to the relationship existing between inflation and growth. (Mallik G. & Chowdhury A., 2001) are of the opinion that there is a positive relationship between inflation and growth, (Fisher, S, 1993) believes that there i ...