Price Indexes and the Inflation Rate

... Purchasing Power Inflation can erode purchasing power. In an inflationary economy, a dollar will not buy the same number of goods that it did in years past. ...

... Purchasing Power Inflation can erode purchasing power. In an inflationary economy, a dollar will not buy the same number of goods that it did in years past. ...

Worksheet #4 - The Digital Economist

... Calculate the rate of inflation between 1999 & 2000, derive the real rate of interest (return) for the year 2000 if nominal interest rates are 7%: Is this real rate of interest above or below the rate of economic growth for the same period of time?____________ Is this to the benefit of lenders or bo ...

... Calculate the rate of inflation between 1999 & 2000, derive the real rate of interest (return) for the year 2000 if nominal interest rates are 7%: Is this real rate of interest above or below the rate of economic growth for the same period of time?____________ Is this to the benefit of lenders or bo ...

Chapter 5

... Keynesian theory and credit crunches Banks’ willingness to lend affects monetary policy Banks lend based on evaluation of borrower’s ability to repay, not just availability of funds Monetary policy to stimulate the economy works only if banks find enough qualified borrowers Restrictive monetar ...

... Keynesian theory and credit crunches Banks’ willingness to lend affects monetary policy Banks lend based on evaluation of borrower’s ability to repay, not just availability of funds Monetary policy to stimulate the economy works only if banks find enough qualified borrowers Restrictive monetar ...

OCM 2012 Spring Folio - Q4 Wealth Management

... fire (pardon the pun) with the OPEC-induced oil shortage and you have classic stagflation. The comparison to the 1970s is not necessarily an egregious one. Currently, we see very low interest rates that are coupled with deficit spending (increase in the money supply) and we have the rise in oil and ...

... fire (pardon the pun) with the OPEC-induced oil shortage and you have classic stagflation. The comparison to the 1970s is not necessarily an egregious one. Currently, we see very low interest rates that are coupled with deficit spending (increase in the money supply) and we have the rise in oil and ...

ECON-262 Principles of Macroeconomics

... After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payments, exchange rates) • Analyze the aggregate demand – aggregate supply model, the concept of the multiplier and the busines ...

... After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payments, exchange rates) • Analyze the aggregate demand – aggregate supply model, the concept of the multiplier and the busines ...

economic polices to control inflation

... negotiations. This is rarely sufficient on its own. Wage inflation normally falls when the economy is heading into recession and unemployment starts to rise. This causes greater job insecurity and some workers may trade off lower pay claims for some degree of employment protection. Equally so Govern ...

... negotiations. This is rarely sufficient on its own. Wage inflation normally falls when the economy is heading into recession and unemployment starts to rise. This causes greater job insecurity and some workers may trade off lower pay claims for some degree of employment protection. Equally so Govern ...

Emergence in the Post-Crisis World: Increasing Asymmetries between Advanced and Emerging Economies

... • Rapidly declining price and increasing quality of especially CIT products. ...

... • Rapidly declining price and increasing quality of especially CIT products. ...

No: 2012 – 56 Release date: 27 November 2012

... Although domestic demand shows some recovery for the final quarter of the year, aggregate demand conditions are still expected to support disinflation. 12. The Committee assessed that cost factors have been contributing to the disinflation as well. With the recent stable course of exchange rates an ...

... Although domestic demand shows some recovery for the final quarter of the year, aggregate demand conditions are still expected to support disinflation. 12. The Committee assessed that cost factors have been contributing to the disinflation as well. With the recent stable course of exchange rates an ...

Inflation

... goods and services in an economy over a period of time. • The term "inflation" once referred to increases in the money supply (monetary inflation); however, the relationship between money supply and price levels have led to its primary use today in describing price inflation. • A loss of purchasing ...

... goods and services in an economy over a period of time. • The term "inflation" once referred to increases in the money supply (monetary inflation); however, the relationship between money supply and price levels have led to its primary use today in describing price inflation. • A loss of purchasing ...

Economics

... 1. Demand-Pull Inflation • Usually, increases in the price level are caused by an excess of total spending beyond the economy’s capacity to produce. Where inflation is rapid and sustained, the cause invariably is an overissuance (перевыпуск) of money by the central bank (the Federal Reserve in the ...

... 1. Demand-Pull Inflation • Usually, increases in the price level are caused by an excess of total spending beyond the economy’s capacity to produce. Where inflation is rapid and sustained, the cause invariably is an overissuance (перевыпуск) of money by the central bank (the Federal Reserve in the ...

2.2.

... Consumer Prices Buying power of money changes over time. Technology becomes less expensive over time Amounts of an time may be sold for the same price in smaller quantities. Changes may occur as either inflation or deflation. ...

... Consumer Prices Buying power of money changes over time. Technology becomes less expensive over time Amounts of an time may be sold for the same price in smaller quantities. Changes may occur as either inflation or deflation. ...

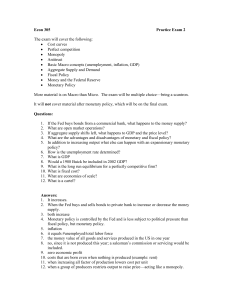

Practice Midterm 2

... 2. When the Fed buys and sells bonds to private bank to increase or decrease the money supply. 3. both increase 4. Monetary policy is controlled by the Fed and is less subject to political pressure than fiscal policy, but monetary policy. 5. inflation 6. it equals #unemployed/total labor force 7. th ...

... 2. When the Fed buys and sells bonds to private bank to increase or decrease the money supply. 3. both increase 4. Monetary policy is controlled by the Fed and is less subject to political pressure than fiscal policy, but monetary policy. 5. inflation 6. it equals #unemployed/total labor force 7. th ...

FedViews

... Of course, age is just one factor that could increase the likelihood of death or the demise of an economic recovery. For people, someone with, say, high blood pressure faces higher probabilities of death at any age than this actuarial baseline. Similarly, for the economy, we can calculate recession ...

... Of course, age is just one factor that could increase the likelihood of death or the demise of an economic recovery. For people, someone with, say, high blood pressure faces higher probabilities of death at any age than this actuarial baseline. Similarly, for the economy, we can calculate recession ...

Measuring Health, Unemployment, Inflation

... According to the cost-push theory, inflation occurs when producers raise prices in order to meet increased costs, or changes in aggregate supply. Cost-push inflation can lead to a wage-price spiral — the process by which rising wages cause higher prices, and higher prices cause higher wages. ...

... According to the cost-push theory, inflation occurs when producers raise prices in order to meet increased costs, or changes in aggregate supply. Cost-push inflation can lead to a wage-price spiral — the process by which rising wages cause higher prices, and higher prices cause higher wages. ...

FedViews

... China now faces the challenge of whether to expand credit again, implement more targeted accommodative policies, or accept lower growth. ...

... China now faces the challenge of whether to expand credit again, implement more targeted accommodative policies, or accept lower growth. ...

Meeting Date: August 16, 2012

... undertaken on credit, domestic demand, and inflation expectations will be monitored closely and the funding amount will be adjusted in either direction, as needed. 15. The Committee stated that a further weakening in global economic outlook may prompt central banks of developed economies to implemen ...

... undertaken on credit, domestic demand, and inflation expectations will be monitored closely and the funding amount will be adjusted in either direction, as needed. 15. The Committee stated that a further weakening in global economic outlook may prompt central banks of developed economies to implemen ...

Fed Focus: A Community Conference Dixie Center, St. George, Utah

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

Price level

... Change of inflation • If price level change about 5 % between period 1 and 2 and also between period 2 and 3, the value of the inflation become same = stable inflation. • If price level change about 5 % between period 1 and 2 and e.g. A bout 8 % between period 2 and 3 we speak about acceleration of ...

... Change of inflation • If price level change about 5 % between period 1 and 2 and also between period 2 and 3, the value of the inflation become same = stable inflation. • If price level change about 5 % between period 1 and 2 and e.g. A bout 8 % between period 2 and 3 we speak about acceleration of ...