BUSINESS CORPORATIONS ACT - Alberta

... (iii) a trust or estate in which that person has a substantial interest or in respect of which that person serves as a trustee or in a similar capacity, (iv) a spouse or adult interdependent partner of that person, or (v) a relative of that person or of that person’s spouse or adult interdependent p ...

... (iii) a trust or estate in which that person has a substantial interest or in respect of which that person serves as a trustee or in a similar capacity, (iv) a spouse or adult interdependent partner of that person, or (v) a relative of that person or of that person’s spouse or adult interdependent p ...

A review of Israel`s Capital market:

... primary regulator of public companies in Israel. Its mandate, as stated in the law, is to protect the interests of the investing public. The ISA is responsible for overseeing both the primary and secondary markets – including approval of the publication of prospectuses for public offerings, monitori ...

... primary regulator of public companies in Israel. Its mandate, as stated in the law, is to protect the interests of the investing public. The ISA is responsible for overseeing both the primary and secondary markets – including approval of the publication of prospectuses for public offerings, monitori ...

LLC`s, LLP`s, DST`s, LP`s: Why And How Are Alternative Entities

... The parties will want to address many of the management issues, including replacement of managers, meetings of members and actions by members without a meeting. All can be addressed in the agreement and the Act provides great flexibility to the parties. Fiduciary Duties of Members and Managers The A ...

... The parties will want to address many of the management issues, including replacement of managers, meetings of members and actions by members without a meeting. All can be addressed in the agreement and the Act provides great flexibility to the parties. Fiduciary Duties of Members and Managers The A ...

Limited Liability and the Corporation - Chicago Unbound

... Henry Manne, in an important contribution, argues that the modern publicly held corporation with many small shareholders could not exist without limited liability. 2 If investors could be required to supply unlimited amounts of additional capital, wealthy people would be reluctant to make small inve ...

... Henry Manne, in an important contribution, argues that the modern publicly held corporation with many small shareholders could not exist without limited liability. 2 If investors could be required to supply unlimited amounts of additional capital, wealthy people would be reluctant to make small inve ...

hostile takeovers and defensive mechanisms in the united kingdom

... regulatory models. In light of the growing skepticism against the Takeover Code’s lenient approach to hostile takeovers, a question naturally arises. Should the United Kingdom abandon its restrictive approach towards takeover defenses and adopt the laxer and more lenient U.S. model? The answer shou ...

... regulatory models. In light of the growing skepticism against the Takeover Code’s lenient approach to hostile takeovers, a question naturally arises. Should the United Kingdom abandon its restrictive approach towards takeover defenses and adopt the laxer and more lenient U.S. model? The answer shou ...

Allen - NYU Law

... assumes the best case scenario for trustees in cases of breach. (e.g., if stock fluctuated between $9 & $16, court would give $7)… profits that would have accrued to the trust if there had been no breach. ...

... assumes the best case scenario for trustees in cases of breach. (e.g., if stock fluctuated between $9 & $16, court would give $7)… profits that would have accrued to the trust if there had been no breach. ...

The Role of Corporate Law in French Corporate Governance

... engaging in conflict-of-interest transactions. Yet the law could further market capitalism if it increased the corporations' disclosure obligations with regard to both these transactions and executive compensation. This Part also explains how monitoring by French company accountants supplements, rat ...

... engaging in conflict-of-interest transactions. Yet the law could further market capitalism if it increased the corporations' disclosure obligations with regard to both these transactions and executive compensation. This Part also explains how monitoring by French company accountants supplements, rat ...

Comparison of the Principal Provisions of the

... In addition, sometimes a party to litigation may prefer fewer rather than more cases. In the absence of decided Maryland cases on an issue of law, the Maryland courts will regard cases decided by courts of other states as “persuasive authority” if supported by sound reasoning, Cates v. State, 21 Md. ...

... In addition, sometimes a party to litigation may prefer fewer rather than more cases. In the absence of decided Maryland cases on an issue of law, the Maryland courts will regard cases decided by courts of other states as “persuasive authority” if supported by sound reasoning, Cates v. State, 21 Md. ...

FREE Sample Here - We can offer most test bank and

... 13. Which of the following statements is correct? a. A major disadvantage of a regular partnership or a corporation as a form of business is the fact that they do not offer their owners limited liability, whereas proprietorships do. b. An advantage of the corporate form for many businesses is the fa ...

... 13. Which of the following statements is correct? a. A major disadvantage of a regular partnership or a corporation as a form of business is the fact that they do not offer their owners limited liability, whereas proprietorships do. b. An advantage of the corporate form for many businesses is the fa ...

Fiduciary Obligations of Directors of a Target Company in Resisting

... This article examines the fiduciary obligations of directors of a corporation that is the subject of an unsolicited takeover bid. An attempt is made in this article to avoid the emotion-charged terminology that has become common parlance in the mergers and acquisitions industry. Terms like "raider" ...

... This article examines the fiduciary obligations of directors of a corporation that is the subject of an unsolicited takeover bid. An attempt is made in this article to avoid the emotion-charged terminology that has become common parlance in the mergers and acquisitions industry. Terms like "raider" ...

From Enactment to Mariner: Does the Statutory Business Judgment

... Since the control rights over corporations are centralized and delegated, directors’ duties broadly correspond with the two main risks faced by the legal entity and those who contributed specific investments: foolish and knavish management.12 Shareholders and other specific-investors relinquish thei ...

... Since the control rights over corporations are centralized and delegated, directors’ duties broadly correspond with the two main risks faced by the legal entity and those who contributed specific investments: foolish and knavish management.12 Shareholders and other specific-investors relinquish thei ...

Is the future here? - American Bar Association

... transferability and centralization of management. Limited partnerships also had to deal with the state-imposed "control rule," which treated the limited partners as general partners if they participated too heavily in management. In 1977, there was a little-noticed development that ultimately led to ...

... transferability and centralization of management. Limited partnerships also had to deal with the state-imposed "control rule," which treated the limited partners as general partners if they participated too heavily in management. In 1977, there was a little-noticed development that ultimately led to ...

Defenders of the Corporate Bastion in Revlon Zone: Paramount

... original plan to merge with Warner in order to avoid a vote by Time's shareholders.' 7 The board feared that the shareholders would not approve the merger.' 8 ...

... original plan to merge with Warner in order to avoid a vote by Time's shareholders.' 7 The board feared that the shareholders would not approve the merger.' 8 ...

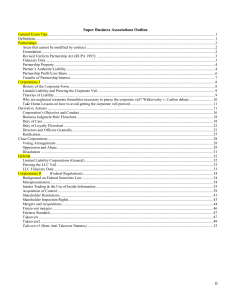

Corporations I - Phi Delta Phi

... Corporations I ....................................................................................................................................................................................... 8 History of the Corporate Form ..................................................................... ...

... Corporations I ....................................................................................................................................................................................... 8 History of the Corporate Form ..................................................................... ...

Corporate Practice Problem 7-16-13 (00014077

... Because PTs are licensed in Michigan, they may incorporate only as PCs. The analysis might stress that PT does not fall within the sorts of health professions listed in the 1972 Act, applying a slightly adulterated version of ejusdem generis. That law’s list is fairly eclectic (it comes from an actu ...

... Because PTs are licensed in Michigan, they may incorporate only as PCs. The analysis might stress that PT does not fall within the sorts of health professions listed in the 1972 Act, applying a slightly adulterated version of ejusdem generis. That law’s list is fairly eclectic (it comes from an actu ...

On the Hook: Directors Liability for Corporate Tax

... proceeding can be brought against a director if it is commenced more than two years after the person last ceased to be a director of the corporation.12 If there is more than one director of a corporation, the director who absorbs the liability of the claim is entitled to seek contribution from the o ...

... proceeding can be brought against a director if it is commenced more than two years after the person last ceased to be a director of the corporation.12 If there is more than one director of a corporation, the director who absorbs the liability of the claim is entitled to seek contribution from the o ...

Simple Joint-Stock Company: Breakthrough for

... enjoys priority rights concerning the distribution of profit (off-set by elimination of voting rights). It is obvious that this framework does not allow shareholders to shape the company according to their needs and their position by issuing various classes of shares. Strict antidilution rules, rela ...

... enjoys priority rights concerning the distribution of profit (off-set by elimination of voting rights). It is obvious that this framework does not allow shareholders to shape the company according to their needs and their position by issuing various classes of shares. Strict antidilution rules, rela ...

A Contractarian Defense of Corporate

... responsible” ways, including contributing to “socially responsible” causes.2 Corporate officers and directors, who act for this entity, must therefore be protected when they expend corporate resources on philanthropy. But while the law appears to be settled, there is still an influential strand of l ...

... responsible” ways, including contributing to “socially responsible” causes.2 Corporate officers and directors, who act for this entity, must therefore be protected when they expend corporate resources on philanthropy. But while the law appears to be settled, there is still an influential strand of l ...

Mobile Site | Terms of Use | Privacy policy | Feedback | Advertise

... entity with certain legal protections. In contrast, unincorporated businesses or persons working on their own are usually not so protected. Tax advantages. Different structures are treated differently in tax law, and may have advantages for this reason. Disclosure and compliance requirements. Differ ...

... entity with certain legal protections. In contrast, unincorporated businesses or persons working on their own are usually not so protected. Tax advantages. Different structures are treated differently in tax law, and may have advantages for this reason. Disclosure and compliance requirements. Differ ...

Capital Return and Dividend Announcement

... The directors of Australian Masters Corporate Bond Fund No 4 Limited (AMCBF4) have determined to pay a capital return of $27.75 per share. This represents the Fourth Return Capital approved by shareholders on 24 November 2011 at the Annual General Meeting. At the Annual General Meeting, shareholders ...

... The directors of Australian Masters Corporate Bond Fund No 4 Limited (AMCBF4) have determined to pay a capital return of $27.75 per share. This represents the Fourth Return Capital approved by shareholders on 24 November 2011 at the Annual General Meeting. At the Annual General Meeting, shareholders ...

Recent Developments in Oklahoma Business and Corporate Law

... expensive. In addition, a website that hosted a securities offering could be charged with acting as an unregistered broker-dealer by facilitating the offer and sale of securities.17 The JOBS Act unknotted the conundrum by exempting crowdfunding offerings providing a regulatory framework for the bro ...

... expensive. In addition, a website that hosted a securities offering could be charged with acting as an unregistered broker-dealer by facilitating the offer and sale of securities.17 The JOBS Act unknotted the conundrum by exempting crowdfunding offerings providing a regulatory framework for the bro ...

`C` Corporation

... "A Wyoming Business Advantage" The Close Corporation was created by an act of legislature especially for small corporations which have a small number of stock holders usually having ties to one another through family relationships or friends and business partners. Close corporations are special case ...

... "A Wyoming Business Advantage" The Close Corporation was created by an act of legislature especially for small corporations which have a small number of stock holders usually having ties to one another through family relationships or friends and business partners. Close corporations are special case ...

Cooperatives as Unique Corporations

... A. A corporation is a business that is treated as a single entity, yet it is owned by several people. 1. The corporation is treated as a single entity; it can own property. 2. The corporation is owned by shareholders —people who own stock in the company. 3. Capital is raised by selling shares of ...

... A. A corporation is a business that is treated as a single entity, yet it is owned by several people. 1. The corporation is treated as a single entity; it can own property. 2. The corporation is owned by shareholders —people who own stock in the company. 3. Capital is raised by selling shares of ...

United States corporate law

United States corporate law regulates the governance, finance and power of corporations in US law. Every state and territory has its own basic corporate code, while federal law creates minimum standards for trade in company shares and governance rights, found mostly in the Securities Act of 1933 and the Securities and Exchange Act of 1934, as amended by laws like the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Act of 2010. The US Constitution was interpreted by the US Supreme Court to allow corporations to incorporate in the state of their choice, regardless of where their headquarters are. Over the 20th century, most major corporations incorporated under the Delaware General Corporation Law, which offered lower corporate taxes, fewer shareholder rights against directors, and developed a specialized court and legal profession. Nevada has done the same. Twenty-four states follow the Model Business Corporation Act, while New York and California are important due to their size.