KDE Capital Asset Guide

... The Department of Education originally prepared this Capital Asset Guide to help districts implement the reporting requirements of Governmental Accounting Standards Board (GASB) Statement No. 34 Basic Financial Statements and Management’s Discussion in 2003. The challenge for local school districts ...

... The Department of Education originally prepared this Capital Asset Guide to help districts implement the reporting requirements of Governmental Accounting Standards Board (GASB) Statement No. 34 Basic Financial Statements and Management’s Discussion in 2003. The challenge for local school districts ...

Brochure - The Brookdale Group

... funds and their joint venture partners. Brookdale has been an active investor and investment manager through both strong and weak real estate and capital market cycles, including those markets which accompanied the “S&L crisis” of the early 1990’s, the rapid expansion and subsequent market collapse ...

... funds and their joint venture partners. Brookdale has been an active investor and investment manager through both strong and weak real estate and capital market cycles, including those markets which accompanied the “S&L crisis” of the early 1990’s, the rapid expansion and subsequent market collapse ...

Gift Acceptance Policy - West Central Initiative

... services. Specifically excluded from the definition are: Holdings that take the form of bonds or other debt instruments unless they are a disguised form of equity Income from dividends, interest, royalties and from the sale of capital assets Income from leases unless the income would be taxed ...

... services. Specifically excluded from the definition are: Holdings that take the form of bonds or other debt instruments unless they are a disguised form of equity Income from dividends, interest, royalties and from the sale of capital assets Income from leases unless the income would be taxed ...

Transfer of Limited Partnership Interests

... ©2015 Duane Morris LLP. All Rights Reserved. Duane Morris is a registered service mark of Duane Morris LLP. Duane Morris – Firm and Affiliate Offices | New York | London | Singapore | Philadelphia | Chicago | Washington, D.C. | San Francisco | Silicon Valley | San Diego | Boston | Houston | Los Ange ...

... ©2015 Duane Morris LLP. All Rights Reserved. Duane Morris is a registered service mark of Duane Morris LLP. Duane Morris – Firm and Affiliate Offices | New York | London | Singapore | Philadelphia | Chicago | Washington, D.C. | San Francisco | Silicon Valley | San Diego | Boston | Houston | Los Ange ...

A Note on the Comparative Statics of Optimal Procurement Auctions

... Mechanism Design, Distributional Upgrade. JEL D44, C7, C72. ...

... Mechanism Design, Distributional Upgrade. JEL D44, C7, C72. ...

How to Read Your Form 1099-B

... of mutual fund shares acquired (purchased) on or after January 1, 2012 (i.e.,“covered” securities). For purposes of your 2013 Form 1099-B, cost basis information needs to be reported only for those mutual fund shares acquired and sold after January 1, 2012. Example: To continue our example, suppose ...

... of mutual fund shares acquired (purchased) on or after January 1, 2012 (i.e.,“covered” securities). For purposes of your 2013 Form 1099-B, cost basis information needs to be reported only for those mutual fund shares acquired and sold after January 1, 2012. Example: To continue our example, suppose ...

Property Portfolio - Falcon Real Estate Investment

... for our clients since our inception. Taking into consideration all of the properties that we have purchased and for which we have provided asset management, Falcon has earned a reputation for providing world class advisory services in U.S. real estate. For more information on our firm and updates on ...

... for our clients since our inception. Taking into consideration all of the properties that we have purchased and for which we have provided asset management, Falcon has earned a reputation for providing world class advisory services in U.S. real estate. For more information on our firm and updates on ...

Passive Activity Rules

... basis must be reduced by any non-recourse debt. In the event that the activity being considered is real estate, however, the taxpayer may consider any qualified non-recourse financing in determining the amount at risk. There are two basic forms of debt – recourse debt and non-recourse debt. Recourse ...

... basis must be reduced by any non-recourse debt. In the event that the activity being considered is real estate, however, the taxpayer may consider any qualified non-recourse financing in determining the amount at risk. There are two basic forms of debt – recourse debt and non-recourse debt. Recourse ...

(“PIRET”) announces that it has filed today with the secu

... Certain statements contained in this press release may constitute forward-looking statements. Forwardlooking statements are often, but not always, identified by the use of words such as "anticipate", "plan", "expect", "may", "will", "intend", "should", and similar expressions. These statements invol ...

... Certain statements contained in this press release may constitute forward-looking statements. Forwardlooking statements are often, but not always, identified by the use of words such as "anticipate", "plan", "expect", "may", "will", "intend", "should", and similar expressions. These statements invol ...

Real Estate and Unconventional Securities under the Arkansas

... represents that after a given period of time, five years for example, he would buy back the property for twenty thousand dollars. The promoter could retain control with his contribution accounting for only a small portion of the entire venture. The risk of loss in case of whole or partial failure of ...

... represents that after a given period of time, five years for example, he would buy back the property for twenty thousand dollars. The promoter could retain control with his contribution accounting for only a small portion of the entire venture. The risk of loss in case of whole or partial failure of ...

Capital Gains Reporting

... investment held via a Novia GIA is disposed of. The tool determines the difference between the proceeds received for the sale of the investment minus the cost of the investment when it was acquired. This means the investment sold has to be linked to it’s purchase and therefore the purchase cost, to ...

... investment held via a Novia GIA is disposed of. The tool determines the difference between the proceeds received for the sale of the investment minus the cost of the investment when it was acquired. This means the investment sold has to be linked to it’s purchase and therefore the purchase cost, to ...

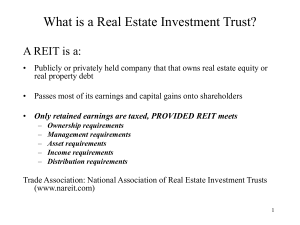

Real Estate Investment Trusts (REITs)

... • Funds from operations (FFO) is REIT cash flow (no depreciation/amortization) • FFO means net income (computed in accordance with GAAP), excluding gains (or losses) from debt restructuring and sales of property, plus depreciation and amortization of assets uniquely significant to the real estate in ...

... • Funds from operations (FFO) is REIT cash flow (no depreciation/amortization) • FFO means net income (computed in accordance with GAAP), excluding gains (or losses) from debt restructuring and sales of property, plus depreciation and amortization of assets uniquely significant to the real estate in ...

Real estate has a place in a well-diversified investment

... and severity of losses due to market risks by diversifying assets across multiple properties (sometimes hundreds), property types, regions and tenants and by limiting the use of leverage. Liquidity Risk Liquidity risk is the risk of loss when an investor does not receive its money when expected. The ...

... and severity of losses due to market risks by diversifying assets across multiple properties (sometimes hundreds), property types, regions and tenants and by limiting the use of leverage. Liquidity Risk Liquidity risk is the risk of loss when an investor does not receive its money when expected. The ...

BOMA Standard - Building Area Measurement

... Standard. This helps immensely in the operation of real estate markets where landlords compete for tenants using the same measure of floor area but base rent rates that vary to reflect the unique location and amenities of individual properties. However, serving the interests of the real estate indus ...

... Standard. This helps immensely in the operation of real estate markets where landlords compete for tenants using the same measure of floor area but base rent rates that vary to reflect the unique location and amenities of individual properties. However, serving the interests of the real estate indus ...

Constructive Sales

... position where the other position’s security is the patriarch of a family that includes the new transaction. For this part of the analysis, we only consider transactions that open a position. These transactions of interest are potentially “Leg-2.” If the offsetting position is an appreciated positio ...

... position where the other position’s security is the patriarch of a family that includes the new transaction. For this part of the analysis, we only consider transactions that open a position. These transactions of interest are potentially “Leg-2.” If the offsetting position is an appreciated positio ...

Standard on Verification and Adjustment of Sales

... In jurisdictions that do not have laws mandating full disclosure of sales data, assessing officials work under a severe handicap and should seek legislation that provides for such disclosure (see the results of the 2008 Survey of Ratio Study Practices [Technical Standards Committee IAAO 2009]). In a ...

... In jurisdictions that do not have laws mandating full disclosure of sales data, assessing officials work under a severe handicap and should seek legislation that provides for such disclosure (see the results of the 2008 Survey of Ratio Study Practices [Technical Standards Committee IAAO 2009]). In a ...

Schroder Real Estate Investment Management Limited

... Schroders has managed real estate funds since 1971 and currently has £12.4 billioni (€16.8 billion /US$18.7 billion) of gross real estate assets under management as at 30 September 2015. Most of the property funds referred to are unauthorised collective investment schemes as defined in the Financial ...

... Schroders has managed real estate funds since 1971 and currently has £12.4 billioni (€16.8 billion /US$18.7 billion) of gross real estate assets under management as at 30 September 2015. Most of the property funds referred to are unauthorised collective investment schemes as defined in the Financial ...

Is Intellectual Property "Investment"? Eli Lilly v. Canada and the

... any contribution in cash, in kind or in services, invested or reinvested in any sector of economic activity.” 11 Investment may also be defined by reference to an illustrative, but non-exhaustive list, which explicitly mentions intellectual property. 12 Many commentators have taken the inclusion of ...

... any contribution in cash, in kind or in services, invested or reinvested in any sector of economic activity.” 11 Investment may also be defined by reference to an illustrative, but non-exhaustive list, which explicitly mentions intellectual property. 12 Many commentators have taken the inclusion of ...

Understanding the Appraisal

... Income-producing real estate is typically purchased as an investment, and earning power is the critical element affecting property value from an investor’s point of view. In the income capitalization approach, value is measured as the present value of the future benefits of property ownership. There ...

... Income-producing real estate is typically purchased as an investment, and earning power is the critical element affecting property value from an investor’s point of view. In the income capitalization approach, value is measured as the present value of the future benefits of property ownership. There ...

C10-1 Individual Income Taxes Individual

... of Capital Gain Property (slide 2 of 3) • For contributions of tangible personalty – The charitable deduction may limited to the adjusted basis if • The asset contributed is not used in charity’s exempt function, or • The property (for deductions > $5,000) is disposed of by the donee before the clos ...

... of Capital Gain Property (slide 2 of 3) • For contributions of tangible personalty – The charitable deduction may limited to the adjusted basis if • The asset contributed is not used in charity’s exempt function, or • The property (for deductions > $5,000) is disposed of by the donee before the clos ...

Document

... There are many ways of negotiating a price. Counsel for the Taxpayer argued at length that the price had been calculated in a reverse manner. He pointed out that the price to be paid for the bad and doubtful loans was an amount which reduced the book value of C Institution so that the third party pu ...

... There are many ways of negotiating a price. Counsel for the Taxpayer argued at length that the price had been calculated in a reverse manner. He pointed out that the price to be paid for the bad and doubtful loans was an amount which reduced the book value of C Institution so that the third party pu ...

SHOULD RESIDENTIAL PROPERTY BE ALLOWED WITHIN

... • It is an easy to manage asset and should produce good income and capital growth for a pension owner. • To allow SIPP’s to invest in a broader range of investments and to stimulate the residential property market. • More to the point - why not? A capital asset generating income/growth should sur ...

... • It is an easy to manage asset and should produce good income and capital growth for a pension owner. • To allow SIPP’s to invest in a broader range of investments and to stimulate the residential property market. • More to the point - why not? A capital asset generating income/growth should sur ...

Demutualization of Stock Exchanges - SelectedWorks

... set the listing criterion to be too high, many firms may not be able to list their securities in the trading platform. This in turn implies that exchange will lose revenue from listing fees. On the other hand, if the eligibility criterion is set too low poor quality securities will get listed which ...

... set the listing criterion to be too high, many firms may not be able to list their securities in the trading platform. This in turn implies that exchange will lose revenue from listing fees. On the other hand, if the eligibility criterion is set too low poor quality securities will get listed which ...

Form L-8 - State of New Jersey

... PART II – SUCCESSION: Check the box that shows how the assets pass to the beneficiary. • Check Box 1 if the assets on the form pass directly to the beneficiary by operation of law. This means they were jointly held, POD, or Transfer On Death (TOD) (a copy of the will is not needed). • Check Box 2 if ...

... PART II – SUCCESSION: Check the box that shows how the assets pass to the beneficiary. • Check Box 1 if the assets on the form pass directly to the beneficiary by operation of law. This means they were jointly held, POD, or Transfer On Death (TOD) (a copy of the will is not needed). • Check Box 2 if ...

III. Types of Listing Agreements

... comparison of prices of properties similar to the seller’s property that recently have been sold. 3. Brokers are allowed by law to partake in preliminary negotiations and the drafting of documents leading to an agreement between the parties. Brokers may draft memoranda, deposit receipts, and in som ...

... comparison of prices of properties similar to the seller’s property that recently have been sold. 3. Brokers are allowed by law to partake in preliminary negotiations and the drafting of documents leading to an agreement between the parties. Brokers may draft memoranda, deposit receipts, and in som ...