chapter 1 - McGraw Hill Higher Education

... as separate entities. However, for tax purposes the income is allocated annually to the owners of the entities and included in their income for tax purposes. The owners are normally one of the taxable entities, individuals, corporations or trusts. ...

... as separate entities. However, for tax purposes the income is allocated annually to the owners of the entities and included in their income for tax purposes. The owners are normally one of the taxable entities, individuals, corporations or trusts. ...

PART ONE - the United Nations

... A major goal of bilateral tax treaties is to remove impediments to international trade and investment by reducing the threat of double taxation that can occur when both Contracting States impose tax on the same income. This goal is advanced in four distinct ways. First, a bilateral tax treaty genera ...

... A major goal of bilateral tax treaties is to remove impediments to international trade and investment by reducing the threat of double taxation that can occur when both Contracting States impose tax on the same income. This goal is advanced in four distinct ways. First, a bilateral tax treaty genera ...

Schedularity in U.S. Income Taxation and Its Effect on Tax Distribution

... ABSTRACT—Income tax systems in some countries follow primarily schedular models that classify income by type, match it with deductions from the same class, and compute a separate tax on each class. The United States income tax uses a global tax model under which it taxes citizens and permanent resid ...

... ABSTRACT—Income tax systems in some countries follow primarily schedular models that classify income by type, match it with deductions from the same class, and compute a separate tax on each class. The United States income tax uses a global tax model under which it taxes citizens and permanent resid ...

Annet Oguttu (Statement)

... mobilisation from the public and private sectors. The public sector does this through taxation, non-tax and other forms of government revenues generation. DRM can ensure a stable and predictable source of own revenue to facilitate long term fiscal planning in that be resources are allocated to prior ...

... mobilisation from the public and private sectors. The public sector does this through taxation, non-tax and other forms of government revenues generation. DRM can ensure a stable and predictable source of own revenue to facilitate long term fiscal planning in that be resources are allocated to prior ...

C17 - 1 Comprehensive Volume

... • Separate entity, only pays special taxes (e.g., built-in gains) • Allocates entity income to shareholders – Shareholders report entity income on personal tax return ...

... • Separate entity, only pays special taxes (e.g., built-in gains) • Allocates entity income to shareholders – Shareholders report entity income on personal tax return ...

Proposed Tax Regulations Protect U.S. Tax Exemption for Sovereign Wealth Investors

... written policies and operational procedures are in place to monitor the entity’s worldwide activities. Provided that adequate written policies and operational procedures are maintained, the proposed regulations include a “5%” safe harbor, under which an entity’s failure to avoid conducting commercia ...

... written policies and operational procedures are in place to monitor the entity’s worldwide activities. Provided that adequate written policies and operational procedures are maintained, the proposed regulations include a “5%” safe harbor, under which an entity’s failure to avoid conducting commercia ...

chapter 4 - CSUN.edu

... I am responding to your suggestion that Aspen Associates should change to the accrual method of accounting for tax purposes as a means of reducing accounting fees. Under the accrual method of accounting, your receivables for more than 45 days services, over $75,000, would be included in gross income ...

... I am responding to your suggestion that Aspen Associates should change to the accrual method of accounting for tax purposes as a means of reducing accounting fees. Under the accrual method of accounting, your receivables for more than 45 days services, over $75,000, would be included in gross income ...

THE MINISTRY OF FINANCE ------- SOCIALIST REPUBLIC OF VIET

... signed with other countries are properly and fully enforced, the Ministry of Finance provides the following for the organization and guidance for enforcement of the treaties: 1. Tasks and powers of the General Department of Taxation in enforcing the treaties: Under the provisions of the treaties, al ...

... signed with other countries are properly and fully enforced, the Ministry of Finance provides the following for the organization and guidance for enforcement of the treaties: 1. Tasks and powers of the General Department of Taxation in enforcing the treaties: Under the provisions of the treaties, al ...

Continued

... • Intangible assets are generally divided between • Intangibles, such as patents or intellectual property, that are legally owned or controlled by an enterprise and can be transferred separately from any other asset, and • “Residual” intangibles, such as goodwill or going concern value, that ordinar ...

... • Intangible assets are generally divided between • Intangibles, such as patents or intellectual property, that are legally owned or controlled by an enterprise and can be transferred separately from any other asset, and • “Residual” intangibles, such as goodwill or going concern value, that ordinar ...

PAGE ONE - St. Louis Fed - Federal Reserve Bank of St. Louis

... Income inequality has been rising in the United States. The recent recession may partially explain this phenomenon because higher unemployment and reduced working hours affect the incomes earned by many people during a downturn and weaker-than-expected recovery. Longer-term historical trends in inco ...

... Income inequality has been rising in the United States. The recent recession may partially explain this phenomenon because higher unemployment and reduced working hours affect the incomes earned by many people during a downturn and weaker-than-expected recovery. Longer-term historical trends in inco ...

Review of Business Regulation

... Way in which Regulation is Inappropriate FATA [section 11(1)] considers both beneficial shareholdings and “legal” shareholdings (ie the registered shareholder) when determining if a substantial or an aggregate substantial foreign interest is held for the purpose of the Act.1 The implications of this ...

... Way in which Regulation is Inappropriate FATA [section 11(1)] considers both beneficial shareholdings and “legal” shareholdings (ie the registered shareholder) when determining if a substantial or an aggregate substantial foreign interest is held for the purpose of the Act.1 The implications of this ...

SOA Insert - PaymentOfDeathBenefits.doc

... One or each provides the other with financial support; and One or each provides the other with domestic support and personal care. Note: An ‘interdependency relationship’ may still exist where the parties are temporarily living apart, or either, or both of them suffer from a disability. As can be se ...

... One or each provides the other with financial support; and One or each provides the other with domestic support and personal care. Note: An ‘interdependency relationship’ may still exist where the parties are temporarily living apart, or either, or both of them suffer from a disability. As can be se ...

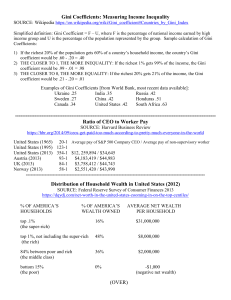

Gini Coefficients: Measuring Income Inequality

... When average rate of return (r) exceeds rate of economic growth (g), wealth ownership becomes more concentrated. r has exceeded g for most of the capitalist era (1790 to present), resulting in increasing concentration of wealth Increasing equality between 1930s and 1970s was exception to long term t ...

... When average rate of return (r) exceeds rate of economic growth (g), wealth ownership becomes more concentrated. r has exceeded g for most of the capitalist era (1790 to present), resulting in increasing concentration of wealth Increasing equality between 1930s and 1970s was exception to long term t ...

Decoding the U.S. Corporate Tax

... Plan of Chapter 2 Examine the 5 key features of U.S. international tax law to help evaluate means of compromise / placement between the WW & exemption poles. E.g., look at planning responses, importance / feasibility of underlying goals, can rules be reformulated to work better. The 5 key features ...

... Plan of Chapter 2 Examine the 5 key features of U.S. international tax law to help evaluate means of compromise / placement between the WW & exemption poles. E.g., look at planning responses, importance / feasibility of underlying goals, can rules be reformulated to work better. The 5 key features ...

The regrouping of activities for RE professionals under the 3.8% Net

... does not necessarily mean that the activity will qualify as a trade or ...

... does not necessarily mean that the activity will qualify as a trade or ...

Document

... Income from capital assets Income from treasury operations The return to some risks ...

... Income from capital assets Income from treasury operations The return to some risks ...

International taxation

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residency, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more.Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems may impose tax on local income only or on worldwide income. Generally, where worldwide income is taxed, reductions of tax or foreign credits are provided for taxes paid to other jurisdictions. Limits are almost universally imposed on such credits. Multinational corporations usually employ international tax specialists, a specialty among both lawyers and accountants, to decrease their worldwide tax liabilities.With any system of taxation, it is possible to shift or recharacterize income in a manner that reduces taxation. Jurisdictions often impose rules relating to shifting income among commonly controlled parties, often referred to as transfer pricing rules. Residency based systems are subject to taxpayer attempts to defer recognition of income through use of related parties. A few jurisdictions impose rules limiting such deferral (""anti-deferral"" regimes). Deferral is also specifically authorized by some governments for particular social purposes or other grounds. Agreements among governments (treaties) often attempt to determine who should be entitled to tax what. Most tax treaties provide for at least a skeleton mechanism for resolution of disputes between the parties.