Revenue Sharing Fund Families

... on achieving any sales target. Administrative Service Fees Morgan Stanley and/or its affiliates receive compensation from funds or their affiliated service providers for providing certain recordkeeping and related services to the funds. These charges typically are based upon the number or aggregate ...

... on achieving any sales target. Administrative Service Fees Morgan Stanley and/or its affiliates receive compensation from funds or their affiliated service providers for providing certain recordkeeping and related services to the funds. These charges typically are based upon the number or aggregate ...

1 World`s Leading Financial and Trusts Centres

... locations. Consequently, being constantly under the microscope, countries are required to actively identify and market their unique value propositions, and in some cases, market themselves to investors who may not be at the time interested in them. The business environment in Barbados has such allur ...

... locations. Consequently, being constantly under the microscope, countries are required to actively identify and market their unique value propositions, and in some cases, market themselves to investors who may not be at the time interested in them. The business environment in Barbados has such allur ...

Personal Perspectives

... 3 / Do you hold offshore assets? Take care not to trip up! Individuals and trustees who hold offshore assets normally report the correct amounts and pay the right amount of UK tax, but with complex tax rules unintentional errors can easily happen. HM Revenue and Customs (HMRC) have raised the stake ...

... 3 / Do you hold offshore assets? Take care not to trip up! Individuals and trustees who hold offshore assets normally report the correct amounts and pay the right amount of UK tax, but with complex tax rules unintentional errors can easily happen. HM Revenue and Customs (HMRC) have raised the stake ...

4212201 WFA Hedge Fund Guide

... from the fund or to U.S. estate taxes on fund shares. Generally, offshore hedge funds are exempt from withholding taxes as well, because the funds are located outside the United States. Because of the nature of the U.S. tax and securities laws, non-U.S. investors may not want to invest in hedge fund ...

... from the fund or to U.S. estate taxes on fund shares. Generally, offshore hedge funds are exempt from withholding taxes as well, because the funds are located outside the United States. Because of the nature of the U.S. tax and securities laws, non-U.S. investors may not want to invest in hedge fund ...

Important Information about Hedge Funds

... Investors should be aware of the risks associated with hedge funds. Certain of the potential benefits of hedge fund investing also present special risks. While the risks will vary from fund to fund, and a hedge fund’s PPM will generally describe the primary risks, some of the more common risks inclu ...

... Investors should be aware of the risks associated with hedge funds. Certain of the potential benefits of hedge fund investing also present special risks. While the risks will vary from fund to fund, and a hedge fund’s PPM will generally describe the primary risks, some of the more common risks inclu ...

InnovFin Equity Investment Guidelines

... Intermediary, including joint ventures, spin-offs, spin-outs, technology transfer projects or technology rights. Means an entity2 established or in formation but excluding entities targeting buy out or replacement capital intended for asset stripping), which: a) undertakes risk capital investments b ...

... Intermediary, including joint ventures, spin-offs, spin-outs, technology transfer projects or technology rights. Means an entity2 established or in formation but excluding entities targeting buy out or replacement capital intended for asset stripping), which: a) undertakes risk capital investments b ...

The fight against tax havens and tax evasion Progress since the

... The fact that in many cases MNCs present their accounting information for the whole group has resulted in the widespread abuse of practices of transfer mispricing (we must not forget that 60% of world trade is intra-group). Transfer mispricing occurs when subsidiaries of the same group located in di ...

... The fact that in many cases MNCs present their accounting information for the whole group has resulted in the widespread abuse of practices of transfer mispricing (we must not forget that 60% of world trade is intra-group). Transfer mispricing occurs when subsidiaries of the same group located in di ...

ANZ EMERGING MARKETS FOREIGN EXCHANGE GUIDE

... Market participants are able to buy INR freely from any bank for transactions approved under the Foreign Exchange Management Act (FEMA). Approval is not required for most current account transactions. However, some types of transactions are subject to limits, where approval from the Reserve Bank of ...

... Market participants are able to buy INR freely from any bank for transactions approved under the Foreign Exchange Management Act (FEMA). Approval is not required for most current account transactions. However, some types of transactions are subject to limits, where approval from the Reserve Bank of ...

The End of Bank Secrecy?

... n August 2009, France and Switzerland amended their tax treaty. The two countries agreed to exchange upon request all information necessary for tax enforcement, including bank information otherwise protected by Swiss bank secrecy laws. Over the following months, one of France’s richest persons and h ...

... n August 2009, France and Switzerland amended their tax treaty. The two countries agreed to exchange upon request all information necessary for tax enforcement, including bank information otherwise protected by Swiss bank secrecy laws. Over the following months, one of France’s richest persons and h ...

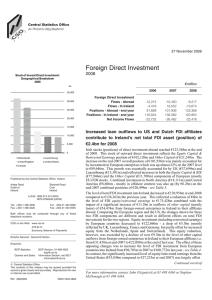

Foreign Direct Investment Annual (PDF 239KB)

... Irish stocks (positions) of direct investment abroad reached €123,368m at the end of 2008. This stock of outward direct investment reflects the Equity Capital & Reinvested Earnings position of €102,120m and Other Capital of €21,248m. The increase on the end-2007 overall position of €101,936m was mai ...

... Irish stocks (positions) of direct investment abroad reached €123,368m at the end of 2008. This stock of outward direct investment reflects the Equity Capital & Reinvested Earnings position of €102,120m and Other Capital of €21,248m. The increase on the end-2007 overall position of €101,936m was mai ...

Non deliverable forwards: 2013 and beyond

... Non-deliverable forwards (NDFs) are contracts for the difference between an exchange rate agreed months before and the actual spot rate at maturity. The spot rate at maturity is taken as the officially announced domestic rate or a marketdetermined rate. The contract is settled with a single US dolla ...

... Non-deliverable forwards (NDFs) are contracts for the difference between an exchange rate agreed months before and the actual spot rate at maturity. The spot rate at maturity is taken as the officially announced domestic rate or a marketdetermined rate. The contract is settled with a single US dolla ...

Jeremy Askew FPFS IMC - Town Close Financial Planning

... Furthermore I am in the top 5% of UK advisers by qualification by virtue of being a Chartered Financial Planner, a Fellow of the Personal Finance Society, holding the Chartered Financial Analyst Society's Investment Management Certificate and having a BA (Hons) in Financial Services. Client reviews ...

... Furthermore I am in the top 5% of UK advisers by qualification by virtue of being a Chartered Financial Planner, a Fellow of the Personal Finance Society, holding the Chartered Financial Analyst Society's Investment Management Certificate and having a BA (Hons) in Financial Services. Client reviews ...

Questions and answers on the automatic exchange of financial

... How will Switzerland use data on Swiss taxpayers with accounts abroad that it receives within the scope of the reciprocal exchange of information? The domestic use of data received from abroad is up to the individual countries. In Switzerland, the cantonal and/or communal tax administrations are res ...

... How will Switzerland use data on Swiss taxpayers with accounts abroad that it receives within the scope of the reciprocal exchange of information? The domestic use of data received from abroad is up to the individual countries. In Switzerland, the cantonal and/or communal tax administrations are res ...

Growing the UK`s coastal economy Learning from

... The government has recognised this challenge and created over 100 Coastal Communities Teams. These teams can apply for shares in a £100 million Coastal Communities Fund to support projects which stimulate local economic growth. The development of the UK’s offshore wind market over the past 15 years ...

... The government has recognised this challenge and created over 100 Coastal Communities Teams. These teams can apply for shares in a £100 million Coastal Communities Fund to support projects which stimulate local economic growth. The development of the UK’s offshore wind market over the past 15 years ...

Thrivent Investment Management Inc. Statement of Financial

... In the normal course of business, the Company may indemnify and guarantee certain service providers against potential losses in connection with their acting as service providers to the Company. The maximum potential amount of future payments the Company could be required to make under these indemnif ...

... In the normal course of business, the Company may indemnify and guarantee certain service providers against potential losses in connection with their acting as service providers to the Company. The maximum potential amount of future payments the Company could be required to make under these indemnif ...

The role of hedge funds (II)

... difficult to manage. Most regulators address the issue by regulating the counterparties of the hedge funds, mostly the banks and securities firms. But the effectiveness of this indirect regulatory approach depends on two critical factors: market discipline and how well the regulated institutions man ...

... difficult to manage. Most regulators address the issue by regulating the counterparties of the hedge funds, mostly the banks and securities firms. But the effectiveness of this indirect regulatory approach depends on two critical factors: market discipline and how well the regulated institutions man ...

Aruba - Financial Secrecy Index

... Aruba accounts for less than 0.1 per cent of the global market for offshore financial services, making it a tiny player compared with other secrecy jurisdictions. ...

... Aruba accounts for less than 0.1 per cent of the global market for offshore financial services, making it a tiny player compared with other secrecy jurisdictions. ...

201308060000000004_20130806 Press release Interim

... Arnhem, 6 August 2013 - In the first half year of 2013 TenneT posted solid financial results arising from continuing investments in the Dutch and German electricity grids, thereby ensuring a high reliability of electricity supply and enabling future expansion of electricity transport capacity for th ...

... Arnhem, 6 August 2013 - In the first half year of 2013 TenneT posted solid financial results arising from continuing investments in the Dutch and German electricity grids, thereby ensuring a high reliability of electricity supply and enabling future expansion of electricity transport capacity for th ...

The Redback comes of age

... The creation of the CNH market was initially aimed at supporting Chinese firms involved in global cross-border trade settlement, but in turn it has also created opportunities for international investors,” says Gary Lin, head of foreign exchange Hong Kong at Brown Brothers Harriman (BBH). In an indus ...

... The creation of the CNH market was initially aimed at supporting Chinese firms involved in global cross-border trade settlement, but in turn it has also created opportunities for international investors,” says Gary Lin, head of foreign exchange Hong Kong at Brown Brothers Harriman (BBH). In an indus ...

Richard Carter, Launch of the Allan Gray

... Commentary by Richard Carter, Allan Gray Unit Trust Management Limited Allan Gray Limited is an authorised financial services provider. Collective Investment Schemes (unit trusts) are generally medium- to long-term investments. The value of participatory interest (units) may go down as well as up. F ...

... Commentary by Richard Carter, Allan Gray Unit Trust Management Limited Allan Gray Limited is an authorised financial services provider. Collective Investment Schemes (unit trusts) are generally medium- to long-term investments. The value of participatory interest (units) may go down as well as up. F ...

TTIP undermines financial regulation and leaves citizens unprotected

... sector lobby, including the investor-to-state dispute settlement that would allow investors to claim millions of dollars in compensation while not allowing citizens to take companies or governments to nonnational courts. Financial services exports are a very lucrative industry for the EU, especially ...

... sector lobby, including the investor-to-state dispute settlement that would allow investors to claim millions of dollars in compensation while not allowing citizens to take companies or governments to nonnational courts. Financial services exports are a very lucrative industry for the EU, especially ...

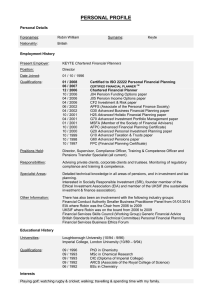

personal profile - Keyte Chartered Financial Planners

... The Sunday Times, the Financial Times and the Independent on Sunday, as well as featuring on Radio 4’s Money Box Live as one of the panel of specialists several times. Robin was a founding member of the Ethical Investment Association (EIA) and served as Chair and also on the board of UKSIF (the UK s ...

... The Sunday Times, the Financial Times and the Independent on Sunday, as well as featuring on Radio 4’s Money Box Live as one of the panel of specialists several times. Robin was a founding member of the Ethical Investment Association (EIA) and served as Chair and also on the board of UKSIF (the UK s ...

RTF 250.6 KB - Productivity Commission

... A frequently cited point of conflict between Landlords and Tenants is the question of renewal of Leases at expiry. Both parties need to decide whether they wish to continue with the relationship and questions such as potential relocations and shop fitouts form part of the process. The very nature o ...

... A frequently cited point of conflict between Landlords and Tenants is the question of renewal of Leases at expiry. Both parties need to decide whether they wish to continue with the relationship and questions such as potential relocations and shop fitouts form part of the process. The very nature o ...

the full WindEurope report on 2016 mid

... the level of installations of foundations and turbines, and the subsequent despatch of first power to the grid. Data includes demonstration sites and factors in decommissioning when they occur, representing net installations per site and ...

... the level of installations of foundations and turbines, and the subsequent despatch of first power to the grid. Data includes demonstration sites and factors in decommissioning when they occur, representing net installations per site and ...

Offshore financial centre

An offshore financial centre (OFC), though not precisely defined, is usually a small, low-tax jurisdiction specializing in providing corporate and commercial services to non-resident offshore companies, and for the investment of offshore funds. The term was coined in the 1980s. Academics Rose & Spiegel, Société Générale, and the International Monetary Fund (IMF) consider offshore centres to include all economies with financial sectors disproportionate to their resident population:An OFC is a country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy.Academics opt for a similar definition focus on the non-resident business and cross-border elements:An offshore financial centre may itself be defined as a regime which has chosen as a main or important path to development, legislative, financial and business infrastructure which is more flexible than orthodox infrastructure and which caters more specifically, and often exclusively, to the needs of non-resident investors ... this legislative framework includes innovations in trust, banking, fiscal, insurance, financial and company law.