The Global Financial Crisis: Explaining Cross-Country

... Latin America, have avoided big collapses, suggesting that the region’s efforts to reduce macroeconomic and financial vulnerabilities after previous crises may have paid off. It seems, however, important to understand these issues in more detail, both for formulating the current policy response and ...

... Latin America, have avoided big collapses, suggesting that the region’s efforts to reduce macroeconomic and financial vulnerabilities after previous crises may have paid off. It seems, however, important to understand these issues in more detail, both for formulating the current policy response and ...

demographics and global savings glut[1]

... The above model of the Asian Miracle, depends crucially on a sharp increase in domestic savings feeding an investment boom. In our view, this is the result of imperfect capital mobility that bottles up savings inside the country. This is not a new finding and was first established by Feldstein and H ...

... The above model of the Asian Miracle, depends crucially on a sharp increase in domestic savings feeding an investment boom. In our view, this is the result of imperfect capital mobility that bottles up savings inside the country. This is not a new finding and was first established by Feldstein and H ...

THE IMF Lecture 6 LIUC 2010 1

... of currencies produced a collapse of world trade, which only worsened the problems in the world economy. Two economists, White (USA) and Keynes (GB) put forward proposals in the early 1940s for an international institution that would foster international monetary cooperation after the war. Negotia ...

... of currencies produced a collapse of world trade, which only worsened the problems in the world economy. Two economists, White (USA) and Keynes (GB) put forward proposals in the early 1940s for an international institution that would foster international monetary cooperation after the war. Negotia ...

IV.Protecting and managing the natural resource base of economic

... of developing countries to enable them to benefit from safe and sustainable livelihood opportunities in small-scale mining ventures; (e) Provide support to developing countries for the development of safe low-cost technologies that provide or conserve fuel for cooking and water heating; (f) Provide ...

... of developing countries to enable them to benefit from safe and sustainable livelihood opportunities in small-scale mining ventures; (e) Provide support to developing countries for the development of safe low-cost technologies that provide or conserve fuel for cooking and water heating; (f) Provide ...

PPT

... exclusively on financial volatility is debatable. In a sense, this goes to the other extreme, compared to the literature focusing only on trade-related volatility. Key problem for developing countries in deciding how much reserves to hold: their higher exposure to “bad” shocks (both real and financi ...

... exclusively on financial volatility is debatable. In a sense, this goes to the other extreme, compared to the literature focusing only on trade-related volatility. Key problem for developing countries in deciding how much reserves to hold: their higher exposure to “bad” shocks (both real and financi ...

1 What`s in it for us? Globalisation, International Institutions and the

... countries and the poor ones. The variance of income distribution is itself much more extreme within developing countries than within developed countries. Consider the following statistics for the 1990s: in Europe the Gini-index, was between 0.247 for Belgium in 1992 and 0.361 for the UK in 1991; in ...

... countries and the poor ones. The variance of income distribution is itself much more extreme within developing countries than within developed countries. Consider the following statistics for the 1990s: in Europe the Gini-index, was between 0.247 for Belgium in 1992 and 0.361 for the UK in 1991; in ...

ASIA AND THE IMF

... controls cannot prevent a devaluation if domestic policies are fundamentally inconsistent with maintaining the peg. Once controls are in place it is never easy to remove them. They should be removed gradually, at a time when the exchange rate is not under pressure, and when the necessary infrastruct ...

... controls cannot prevent a devaluation if domestic policies are fundamentally inconsistent with maintaining the peg. Once controls are in place it is never easy to remove them. They should be removed gradually, at a time when the exchange rate is not under pressure, and when the necessary infrastruct ...

Maastricht criteria - Graduate Institute of International and

... matters is behavior within the monetary union. As entry conditions, the criteria do not provide any guarantee that, once admitted, member countries will behave as they are expected to. This criticism was anticipated in two ways. First, good monetary policy would enforce price stability and low inter ...

... matters is behavior within the monetary union. As entry conditions, the criteria do not provide any guarantee that, once admitted, member countries will behave as they are expected to. This criticism was anticipated in two ways. First, good monetary policy would enforce price stability and low inter ...

united - UN

... appeals and initiatives for a substantial increase of Foundation resources; (d) Calls for the active participation and collaboration of organizations and bodies within and outside the United Nations system, including the World Bank and regional development banks, in the activities of the Programme a ...

... appeals and initiatives for a substantial increase of Foundation resources; (d) Calls for the active participation and collaboration of organizations and bodies within and outside the United Nations system, including the World Bank and regional development banks, in the activities of the Programme a ...

Why should the global reserve system be reformed?

... Any of these solutions would also solve the recurrent problem of making more resources available to the IMF during crises to increase its lending. The traditional way of doing so, which was approved by the G-20 in April 2009, has been to expand the IMF’s borrowing from member states. But this mechan ...

... Any of these solutions would also solve the recurrent problem of making more resources available to the IMF during crises to increase its lending. The traditional way of doing so, which was approved by the G-20 in April 2009, has been to expand the IMF’s borrowing from member states. But this mechan ...

PPTX, 5.37 MB - Adaptation Fund NGO Network

... Lesson 1: Direct access is proving that national entities can successfully implement projects/programmes • Practical arrangements vary: – In some countries, the accredited agency is the main development coordination institution of the country – In others, a more agile and special organization was c ...

... Lesson 1: Direct access is proving that national entities can successfully implement projects/programmes • Practical arrangements vary: – In some countries, the accredited agency is the main development coordination institution of the country – In others, a more agile and special organization was c ...

full text pdf

... 2. Capital flows, sudden stops and current account reversals in EMU One of the principal goals of Europe’s common currency has always been to promote greater financial market integration among member countries. It was expected that the common currency would make it easier for investors of certain eu ...

... 2. Capital flows, sudden stops and current account reversals in EMU One of the principal goals of Europe’s common currency has always been to promote greater financial market integration among member countries. It was expected that the common currency would make it easier for investors of certain eu ...

The Global Financial Crisis Chapter 4

... The aim of such policies was to help bailout recipient countries gain international competiveness and attain growth by improving their trade balances. Germany followed such policies before the Eurocrisis and attained growth. Such policies are known as internal ...

... The aim of such policies was to help bailout recipient countries gain international competiveness and attain growth by improving their trade balances. Germany followed such policies before the Eurocrisis and attained growth. Such policies are known as internal ...

The global economic system

... establishment or acquisition of local banks. On both the assets and liabilities sides, banking is now international, its loans and borrowings denominated in various currencies, its scope and reach covering the whole globe. Perhaps just as telling, but more atypical, is the increased convergence of ...

... establishment or acquisition of local banks. On both the assets and liabilities sides, banking is now international, its loans and borrowings denominated in various currencies, its scope and reach covering the whole globe. Perhaps just as telling, but more atypical, is the increased convergence of ...

PDF Download

... have economic costs (and erode the real value of tax revenues). Seigniorage considerations are thus not a sufficient argument for a high inflation regime. But a credible low inflation regime cannot be created overnight by conventional means. This is why one has to resort to unconventional measures. ...

... have economic costs (and erode the real value of tax revenues). Seigniorage considerations are thus not a sufficient argument for a high inflation regime. But a credible low inflation regime cannot be created overnight by conventional means. This is why one has to resort to unconventional measures. ...

Slides. - Harvard Kennedy School

... Conference on Developments in Monetary Economics, European Central Bank, Frankfurt 29-30 October, 2009 ...

... Conference on Developments in Monetary Economics, European Central Bank, Frankfurt 29-30 October, 2009 ...

Uri Dadush Bennett Stancil 9 May 2011, VOX.EU

... short-term debt plus 20% of M2. Fifteen of the top 20 reserve holders are included in the IMF analysis; eight are determined to hold excessive reserves. 3 It should be noted that for countries with low reserves and high debt, the opportunity cost of reserves may be negative (i.e., a net gain) becaus ...

... short-term debt plus 20% of M2. Fifteen of the top 20 reserve holders are included in the IMF analysis; eight are determined to hold excessive reserves. 3 It should be noted that for countries with low reserves and high debt, the opportunity cost of reserves may be negative (i.e., a net gain) becaus ...

This PDF is a selection from a published volume from... Economic Research Volume Title: NBER International Seminar on Macroeconom

... some empirical issues: there are some endogeneity issues that are hard to deal with. Indeed, foreign aid is not randomly assigned and targeted toward countries that most need it. In particular, in periods of large current account deficits, low‐income countries should receive more aid; this can bias ...

... some empirical issues: there are some endogeneity issues that are hard to deal with. Indeed, foreign aid is not randomly assigned and targeted toward countries that most need it. In particular, in periods of large current account deficits, low‐income countries should receive more aid; this can bias ...

Preview Sample 1

... countries and/or whether there is likely to be a significant difference between the two. Look up some examples for different countries. Stressing this issue depends, of course, on the background of the students. When discussing the classification of developing countries as either low income, lower-m ...

... countries and/or whether there is likely to be a significant difference between the two. Look up some examples for different countries. Stressing this issue depends, of course, on the background of the students. When discussing the classification of developing countries as either low income, lower-m ...

The Bretton Woods Debates: A Memoir

... 1942. By 1944, at least government officials realized that the Bretton Woods institutions could not be counted on to deal with the financial needs at the close of hostilities. The creation of the United Nations (UN) to address postwar political issues also influenced economic planning. The U.S, gove ...

... 1942. By 1944, at least government officials realized that the Bretton Woods institutions could not be counted on to deal with the financial needs at the close of hostilities. The creation of the United Nations (UN) to address postwar political issues also influenced economic planning. The U.S, gove ...

Sample

... Ask the students what they think the common features of developing countries are and make a list of their suggestions on the board. At the end, add anything that they have missed. Along the way you can elaborate on their suggestions. Ask the students whether they think becoming more economically ...

... Ask the students what they think the common features of developing countries are and make a list of their suggestions on the board. At the end, add anything that they have missed. Along the way you can elaborate on their suggestions. Ask the students whether they think becoming more economically ...

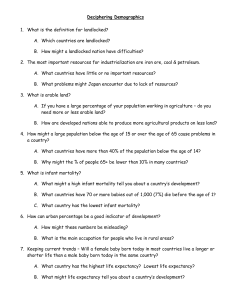

Deciphering Demographics

... 24. Which country is the most recent to gain independence? A. The majority of countries gained independence from the UK in which century? B. The majority of countries gained independence from Spain in which century? C. How many countries were unified rather than granted independence? 25. Do all coun ...

... 24. Which country is the most recent to gain independence? A. The majority of countries gained independence from the UK in which century? B. The majority of countries gained independence from Spain in which century? C. How many countries were unified rather than granted independence? 25. Do all coun ...

Problem 1 On infant industry argument Answers: This question is to

... nations ... Preventing the developing countries from adopting these policies constitutes a serious constraint on their capacity to generate economic development." In my view, this statement is erroneous on two counts -- that infant industries were the key to economic development, and that developing ...

... nations ... Preventing the developing countries from adopting these policies constitutes a serious constraint on their capacity to generate economic development." In my view, this statement is erroneous on two counts -- that infant industries were the key to economic development, and that developing ...

Percent of GDP (right axis)

... Global Development Finance 2006 The Development Potential of Surging Capital Flows By Mansoor Dailami TDLC, Tokyo, Japan May 31, 2006 ...

... Global Development Finance 2006 The Development Potential of Surging Capital Flows By Mansoor Dailami TDLC, Tokyo, Japan May 31, 2006 ...

Impact Of The Crisis On The Financial Systems in AFR

... Middle-income countries Low-income countries Fragile countries ...

... Middle-income countries Low-income countries Fragile countries ...

![demographics and global savings glut[1]](http://s1.studyres.com/store/data/004066353_1-3a1bf46bb044c14c6a59b2aaaffe732d-300x300.png)