Calculation of Simple Interest and Maturity Value

... Using the interest formula, calculate the unknown when the other two (principal, rate, or time) are given. ...

... Using the interest formula, calculate the unknown when the other two (principal, rate, or time) are given. ...

File

... party. What is the percentage increase of the number of guests from the first party to the second party? ...

... party. What is the percentage increase of the number of guests from the first party to the second party? ...

instructional objectives

... market for loanable funds, and governments may borrow to finance deficits. C. Banks and other financial institutions not only gather and make available the savings of households, but also create funds through the lending process. Federal Reserve policy influences how much money financial institution ...

... market for loanable funds, and governments may borrow to finance deficits. C. Banks and other financial institutions not only gather and make available the savings of households, but also create funds through the lending process. Federal Reserve policy influences how much money financial institution ...

The Impact of Higher Interest Rates on the Cost of

... of their debts toward longer terms to maturity. In this way, they are able to postpone the need to refinance their debts at higher interest rates, if rates were to rise. However, in the long run all of the government’s debt eventually matures. The final part of the study explores the budgetary impli ...

... of their debts toward longer terms to maturity. In this way, they are able to postpone the need to refinance their debts at higher interest rates, if rates were to rise. However, in the long run all of the government’s debt eventually matures. The final part of the study explores the budgetary impli ...

Chapter 1 Simple and compound interest

... following investments would be best for him? A 6.7% p.a. simple interest B 6.75% p.a. compound interest with yearly rests C 6.5% p.a. compound interest with quarterly rests D 6.25% p.a. compound interest with monthly rests E 6% compound interest with daily rests. ...

... following investments would be best for him? A 6.7% p.a. simple interest B 6.75% p.a. compound interest with yearly rests C 6.5% p.a. compound interest with quarterly rests D 6.25% p.a. compound interest with monthly rests E 6% compound interest with daily rests. ...

TxLOR - Texas Digital Library

... The amount of the annual payments is _________________. d. In total, how much money was deposited into the account? 18*PMT = _________________ e. Interest Earned = Final Value of the Account – Amount Deposited = ________________ − ________________ = __________________ f. Why are the interest amounts ...

... The amount of the annual payments is _________________. d. In total, how much money was deposited into the account? 18*PMT = _________________ e. Interest Earned = Final Value of the Account – Amount Deposited = ________________ − ________________ = __________________ f. Why are the interest amounts ...

VII. Banking, Credit, And Finance In Late-Medieval Europe

... • Cardinal Hostiensis (Henry of Susa): ca. 1270 • If some merchant, who is accustomed to pursue trade and the commerce of fairs, and there profit from, has, out of charity to me, who needs it badly, lent money with which he would have done business, I remain obliged to his interesse, provided that n ...

... • Cardinal Hostiensis (Henry of Susa): ca. 1270 • If some merchant, who is accustomed to pursue trade and the commerce of fairs, and there profit from, has, out of charity to me, who needs it badly, lent money with which he would have done business, I remain obliged to his interesse, provided that n ...

25 The impact of interest rates

... Businesses need to borrow money for different reasons:It may have long term loans to help pay for equipment (loans taken out over a period of longer than 1 year), Or the business may run an overdraft, this allows the business to use money that it does not have at the time. It is good business practi ...

... Businesses need to borrow money for different reasons:It may have long term loans to help pay for equipment (loans taken out over a period of longer than 1 year), Or the business may run an overdraft, this allows the business to use money that it does not have at the time. It is good business practi ...

Islamic Financial System

... Usury on a loan Analogous to the charging of interest on the loan of an asset Any excess for precondition to the borrower ...

... Usury on a loan Analogous to the charging of interest on the loan of an asset Any excess for precondition to the borrower ...

English

... pay an interest amount on the loan amount. The interest amount is a portion of the total loan amount. Credit cards can sometimes have high interest rates sometimes upwards of 20%! In these cases the amount of interest you must pay can be very large. Simple Interest is calculated based on the loan am ...

... pay an interest amount on the loan amount. The interest amount is a portion of the total loan amount. Credit cards can sometimes have high interest rates sometimes upwards of 20%! In these cases the amount of interest you must pay can be very large. Simple Interest is calculated based on the loan am ...

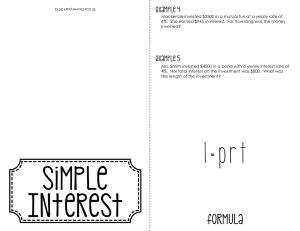

I = prt - SWMStbradford

... Mrs. Smith invested $4000 in a bond with a yearly interest rate of 4%. Her total interest on the investment was $800. What was the length of the investment? ...

... Mrs. Smith invested $4000 in a bond with a yearly interest rate of 4%. Her total interest on the investment was $800. What was the length of the investment? ...

Industrial Revolution History Final Paper

... participation in wars or crusades. But the Reformation reduced the Church’s importance as a lender (Kohn, 3).! ...

... participation in wars or crusades. But the Reformation reduced the Church’s importance as a lender (Kohn, 3).! ...

PSSA 1.8 Percent and Simple Interest PSSA PREP

... In Chicago the sales tax on clothing is 8%. In Philadelphia there is no sales tax on clothing. How much more would you pay at a store in Chicago for a sweater that costs $79.99? ...

... In Chicago the sales tax on clothing is 8%. In Philadelphia there is no sales tax on clothing. How much more would you pay at a store in Chicago for a sweater that costs $79.99? ...

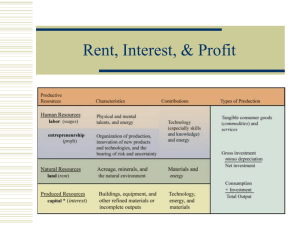

Rent, Interest, and Profit

... Risk—how likely it is to be paid back Maturity—length of time to pay it back Loan Size—typically the larger it is, the higher the interest rate Taxability—exemptions lead to greater willingness to lend and borrow ...

... Risk—how likely it is to be paid back Maturity—length of time to pay it back Loan Size—typically the larger it is, the higher the interest rate Taxability—exemptions lead to greater willingness to lend and borrow ...

RELIGION`S EFFECT ON FINANCE by W. Garrett Lucas Submitted

... received interest nor increase, hath executed Mine ordinances, hath walked in My statutes; he shall not die for the iniquity of his father, he shall surely live. Psalm 15:5 — He that putteth not out his money on interest, nor taketh a bribe against the innocent. He that doeth these things shall neve ...

... received interest nor increase, hath executed Mine ordinances, hath walked in My statutes; he shall not die for the iniquity of his father, he shall surely live. Psalm 15:5 — He that putteth not out his money on interest, nor taketh a bribe against the innocent. He that doeth these things shall neve ...

Ch. 29 Rent, Interest, & Profit

... -- What is the value of land at each Demand curve? -- The supply of land is perfectly inelastic ...

... -- What is the value of land at each Demand curve? -- The supply of land is perfectly inelastic ...

Simple Interest:

... Simple Interest: Principal (P) is the sum of money you borrow from or lend to a person. The Interest rate (r) is the fee you earn from lending money or a fee you pay for borrowing money. The interest rate, unless otherwise stated, is an annual rate. Simple Interest I Prt where P = Principal r = An ...

... Simple Interest: Principal (P) is the sum of money you borrow from or lend to a person. The Interest rate (r) is the fee you earn from lending money or a fee you pay for borrowing money. The interest rate, unless otherwise stated, is an annual rate. Simple Interest I Prt where P = Principal r = An ...

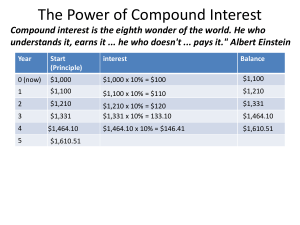

The Power of Compound Interest

... •If your growth slips to 2%, it will double in 36 years. If growth increases to 4%, the economy doubles in 18 years. •Given the speed at which technology develops, shaving years off your growth time could be very important ...

... •If your growth slips to 2%, it will double in 36 years. If growth increases to 4%, the economy doubles in 18 years. •Given the speed at which technology develops, shaving years off your growth time could be very important ...

Chp. 1.1 Simple Interest

... Term (T): The contracted duration of an investment or loan. Principal (P): The original amount of money invested or loaned Future Value (A): The amount A, that an investment will be worth after a specified period of time. ...

... Term (T): The contracted duration of an investment or loan. Principal (P): The original amount of money invested or loaned Future Value (A): The amount A, that an investment will be worth after a specified period of time. ...

Simple Interest Name Homework Period ______ Find the interest

... Find the interest and total amount to the nearest cent. 1) $315 at 6% per year for 5 years ...

... Find the interest and total amount to the nearest cent. 1) $315 at 6% per year for 5 years ...

Usury

Usury (/ˈjuːʒəri/) is today the practice of making unethical or immoral monetary loans that unfairly enrich the lender. Originally, usury meant interest of any kind. A loan may be considered usurious because of excessive or abusive interest rates or other factors. Historically in Christian societies, and in many Islamic societies today, simply charging any interest at all can be considered usury. Someone who practices usury can be called a usurer, but a more common term in contemporary English is loan shark.The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense where interest rates may be regulated by law. Historically, some cultures (e.g., Christianity in much of Medieval Europe, and Islam in many parts of the world today) have regarded charging any interest for loans as sinful.Some of the earliest known condemnations of usury come from the Vedic texts of India. Similar condemnations are found in religious texts from Buddhism, Judaism, Christianity, and Islam (the term is riba in Arabic and ribbit in Hebrew). At times, many nations from ancient China to ancient Greece to ancient Rome have outlawed loans with any interest. Though the Roman Empire eventually allowed loans with carefully restricted interest rates, the Christian church in medieval Europe banned the charging of interest at any rate (as well as charging a fee for the use of money, such as at a bureau de change).The pivotal change in the English-speaking world seems to have come with lawful rights to charge interest on lent money, particularly the 1545 Act, ""An Act Against Usurie"" (37 H. viii 9) of King Henry VIII of England.