UNIT TITLE: FINANCIAL SERVICES, REGULATION and ETHICS

... The role of the Financial Services Authority (FSA), HM Treasury and the Bank of England – market regulation The role of other regulating bodies such as the Competition Commission, the Office of Fair Trading, the Pensions Regulator, the ...

... The role of the Financial Services Authority (FSA), HM Treasury and the Bank of England – market regulation The role of other regulating bodies such as the Competition Commission, the Office of Fair Trading, the Pensions Regulator, the ...

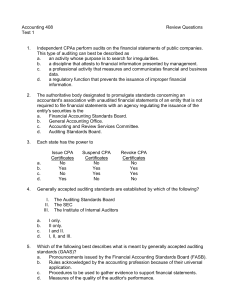

Test 1, Review Questions

... Which of the following best describes what is meant by generally accepted auditing standards (GAAS)? a. Pronouncements issued by the Financial Accounting Standards Board (FASB). b. Rules acknowledged by the accounting profession because of their universal application. c. Procedures to be used to gat ...

... Which of the following best describes what is meant by generally accepted auditing standards (GAAS)? a. Pronouncements issued by the Financial Accounting Standards Board (FASB). b. Rules acknowledged by the accounting profession because of their universal application. c. Procedures to be used to gat ...

Some issues with rating of PI 25 – Quality and

... (ii) If consolidated financial annual statements are is prepared, it is they are generally not submitted for external audit within 10 15 months of the end of the fiscal year ...

... (ii) If consolidated financial annual statements are is prepared, it is they are generally not submitted for external audit within 10 15 months of the end of the fiscal year ...

Word - IRBA

... Provisional and Abridged Reports Required by the JSE Listings Requirements was prepared by the Committee for Auditing Standards (CFAS) of the Independent Regulatory Board for Auditors (the IRBA) and was approved for issue in November 2013. The purpose of this Guide is to provide guidance to a JSE ac ...

... Provisional and Abridged Reports Required by the JSE Listings Requirements was prepared by the Committee for Auditing Standards (CFAS) of the Independent Regulatory Board for Auditors (the IRBA) and was approved for issue in November 2013. The purpose of this Guide is to provide guidance to a JSE ac ...

Section 1: 8-K

... "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities under that Section, nor shall it be deemed incorporated by reference into any of the Company's reports or filings under the Securities Act of 1933 or th ...

... "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities under that Section, nor shall it be deemed incorporated by reference into any of the Company's reports or filings under the Securities Act of 1933 or th ...

Good Better Best for Annual Independent Financial

... Less in scope than an audit, in the “Reviewed Financial Statement” a CPA issues report indicating a review has been performed and did not become aware of any material modifications that should be made in order for the statements to be in conformance with generally accepted accounting principles. Rev ...

... Less in scope than an audit, in the “Reviewed Financial Statement” a CPA issues report indicating a review has been performed and did not become aware of any material modifications that should be made in order for the statements to be in conformance with generally accepted accounting principles. Rev ...

[Business Communication]

... reports are simple documents that include: 1. Four basic financial statements. 2. Related notes (footnotes). ...

... reports are simple documents that include: 1. Four basic financial statements. 2. Related notes (footnotes). ...

Diapositive 1 - Brand Center

... This presentation may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business, strategy and plans of TOTAL GROUP that are subject to risk factors and uncertainties caused by ...

... This presentation may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business, strategy and plans of TOTAL GROUP that are subject to risk factors and uncertainties caused by ...

Is it time to change SOX? Solongo Batbaatar MA0N0228

... Is it time to change SOX? Solongo Batbaatar MA0N0228 ...

... Is it time to change SOX? Solongo Batbaatar MA0N0228 ...

![[Business Communication]](http://s1.studyres.com/store/data/019415784_1-ce36fb3f425a6ddeee29c0708b32d6a8-300x300.png)