Exposure draft - explanatory materials - Foreign

... recipient’s final income tax liability. The recipient is still required to lodge an income tax return and pay any outstanding debit. They claim a credit for the amount of tax withheld in the income tax return at this time. Pay as you go withholding from salary and wages is an example of a nonfinal w ...

... recipient’s final income tax liability. The recipient is still required to lodge an income tax return and pay any outstanding debit. They claim a credit for the amount of tax withheld in the income tax return at this time. Pay as you go withholding from salary and wages is an example of a nonfinal w ...

lecture 16

... • VEP, plus VAT, VAT exclusive – VAT is not included = multiply by 15% to calculate VAT • VIP, VAT inclusive – VAT is included = Multiply by 3 and divide by 23 to calculate VAT • VAT collected (VAT output) = add all plus(+) to ...

... • VEP, plus VAT, VAT exclusive – VAT is not included = multiply by 15% to calculate VAT • VIP, VAT inclusive – VAT is included = Multiply by 3 and divide by 23 to calculate VAT • VAT collected (VAT output) = add all plus(+) to ...

a summary of thailand's tax laws

... b. The term "carrying on business in Thailand", for income tax purposes, is very broad. Foreign juristic entities are deemed to be "carrying on business in Thailand" if they have in Thailand an employee, agent, representative or go-between and thereby derive income or gains in Thailand. Accordingly, ...

... b. The term "carrying on business in Thailand", for income tax purposes, is very broad. Foreign juristic entities are deemed to be "carrying on business in Thailand" if they have in Thailand an employee, agent, representative or go-between and thereby derive income or gains in Thailand. Accordingly, ...

N5 Lifeskills Homework - Budgeting, Planning, Choice and Cost 1

... Mark is going to the bowling alley with friends. He has £28 in his pocket. He plays two games of bowls … the first game costs him £8.50 and with the second he gets a 20% reduction. He buys a hotdog and a drink between games costing him £5.40. He also bought a return ticket on the train to get there ...

... Mark is going to the bowling alley with friends. He has £28 in his pocket. He plays two games of bowls … the first game costs him £8.50 and with the second he gets a 20% reduction. He buys a hotdog and a drink between games costing him £5.40. He also bought a return ticket on the train to get there ...

Tax Deduction at Source 2015-2016

... making payment The Government or any other authority, corporation or body, company, any NGO, or any school or any college or any university or any hospital or any clinic or any diagnostic ...

... making payment The Government or any other authority, corporation or body, company, any NGO, or any school or any college or any university or any hospital or any clinic or any diagnostic ...

The Coalition Government and income inequality

... Chartered Institute of Taxation, finds the impact of tax-rate changes to be a mixed picture. He concludes that the ‘bottom end of the top decile’ (i.e not the very richest) have fared worst, for example through the loss of tax allowances for high earners and that those at the lower end of the pay sc ...

... Chartered Institute of Taxation, finds the impact of tax-rate changes to be a mixed picture. He concludes that the ‘bottom end of the top decile’ (i.e not the very richest) have fared worst, for example through the loss of tax allowances for high earners and that those at the lower end of the pay sc ...

India - Tax Facts

... Residential Status of a company An Indian company is always resident in India. A foreign company is resident in India only if during the relevant tax year the control and management of its affairs is situated wholly in India. The scope of total income, which is subject to tax in India, depends on th ...

... Residential Status of a company An Indian company is always resident in India. A foreign company is resident in India only if during the relevant tax year the control and management of its affairs is situated wholly in India. The scope of total income, which is subject to tax in India, depends on th ...

East Africa at a glance Kenya

... The types of reorganisations that are entitled to roll-over relief for capital gains tax purposes have been defined. The definition of a “Branch” of a non-resident company has been extended to include a place where a person furnishes services including consultancy services, if the services continue ...

... The types of reorganisations that are entitled to roll-over relief for capital gains tax purposes have been defined. The definition of a “Branch” of a non-resident company has been extended to include a place where a person furnishes services including consultancy services, if the services continue ...

Year 11 Mathematics Standard Topic Guidance

... taxable income, the Medicare levy, and tax already paid as per the Payment Summary. Students complete a tax return form (as included in the Tax Pack) using a typical PAYG employee’s earnings and deductions. The aim is to calculate the refund from or amount owed to the ATO. Students use an online tax ...

... taxable income, the Medicare levy, and tax already paid as per the Payment Summary. Students complete a tax return form (as included in the Tax Pack) using a typical PAYG employee’s earnings and deductions. The aim is to calculate the refund from or amount owed to the ATO. Students use an online tax ...

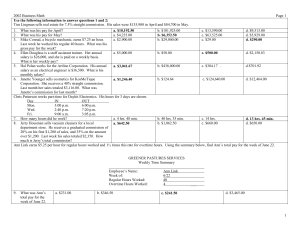

Day IN OUT

... department store. He receives a graduated commission of 20% on his first $1,200 of sales, and 35% on the amount over $1,200. Last week his sales totaled $2,350. How much is Jerry’s total commission? Ann Link earns $5.25 per hour for regular hours worked and 1½ times this rate for overtime hours. Usi ...

... department store. He receives a graduated commission of 20% on his first $1,200 of sales, and 35% on the amount over $1,200. Last week his sales totaled $2,350. How much is Jerry’s total commission? Ann Link earns $5.25 per hour for regular hours worked and 1½ times this rate for overtime hours. Usi ...

1. Background

... Basic rate : 10% of added value Zero-rating : Transactions relating to the exported goods and the services provided in foreign countries. ...

... Basic rate : 10% of added value Zero-rating : Transactions relating to the exported goods and the services provided in foreign countries. ...

Math 113A – Exam Review – Consumer Math

... The difference between what a person pays using an in store credit plan and what they could have paid with cash is called a ______________________________. All earnings is called _________________________. A government plan that pays people some money when they retire is called ____________________. ...

... The difference between what a person pays using an in store credit plan and what they could have paid with cash is called a ______________________________. All earnings is called _________________________. A government plan that pays people some money when they retire is called ____________________. ...

Oct. 28 Homework/Test Review File

... 4. Rebecca earns $4250 per month, of which 24% is taken out of her paycheck for federal and state income taxes and other required deductions. Last month she spent $975 for rent and $317 for food. What percent of her take-home pay did she spend on rent and food combined? ...

... 4. Rebecca earns $4250 per month, of which 24% is taken out of her paycheck for federal and state income taxes and other required deductions. Last month she spent $975 for rent and $317 for food. What percent of her take-home pay did she spend on rent and food combined? ...

Campain issues explained

... - It was passed in order to keep the American people/consumer more informed about the processes and workings of large corporations (banks) and Wall Street businesses - It includes the creation of certain groups (ex: The Consumer Financial Protection Bureau) who have specific jobs to watch over certa ...

... - It was passed in order to keep the American people/consumer more informed about the processes and workings of large corporations (banks) and Wall Street businesses - It includes the creation of certain groups (ex: The Consumer Financial Protection Bureau) who have specific jobs to watch over certa ...

Taxation in the Republic of Ireland

In Ireland there is an income tax, a VAT, and various other taxes. Employees pay pay-as-you-earn (PAYE) taxes based on their income, less certain allowances. The taxation of earnings is progressive, with little or no income tax paid by low earners and a high rate applied to middle to top earners. However a large proportion of central government tax revenue is also derived from value added tax (VAT), excise duties and other taxes on consumption. The standard rate of corporation tax is among the lowest in the world at 12.5%.The Irish tax system is primarily in place to pay for current expenditure programs, such as education, healthcare, social protection payments such as old age pensions and unemployment benefit and public capital expenditure, such as the National Development Plan and to pay for the Public Service.