MANDATORY EMPHASIS PARAGRAPHS, CLARIFYING

... uncertainty, etc.). The PCAOB’s proposal, therefore, reflects the notion that disclosure of the most significant matters that the auditor encounters during the audit within the actual body of audit report will increase the relevance of the audit report. While the Big 4 audit firms agree that the ide ...

... uncertainty, etc.). The PCAOB’s proposal, therefore, reflects the notion that disclosure of the most significant matters that the auditor encounters during the audit within the actual body of audit report will increase the relevance of the audit report. While the Big 4 audit firms agree that the ide ...

extract

... understand that which we cannot directly observe or measure rather than only “what is” (Bastiat, 1848; Hayek, 1989; Smith, 2003). Second, historical data provide unique opportunities to study issues of enduring importance. Finance and economics scholars increasingly use historical data to study impo ...

... understand that which we cannot directly observe or measure rather than only “what is” (Bastiat, 1848; Hayek, 1989; Smith, 2003). Second, historical data provide unique opportunities to study issues of enduring importance. Finance and economics scholars increasingly use historical data to study impo ...

The Role of Accounting in a Society

... that accounting actually “has no virtue outside that which the social, legal and economic frameworks in which it operates allows it... [and that the] relevance of accounting to a society depends upon the aims of that society”. Thus, if society is organized around the principles of competition, the s ...

... that accounting actually “has no virtue outside that which the social, legal and economic frameworks in which it operates allows it... [and that the] relevance of accounting to a society depends upon the aims of that society”. Thus, if society is organized around the principles of competition, the s ...

working program - Almaty Management University

... 4. Main requirements to information-based audit. 5. Elements of financial statements. Stages of disaggregation financial statements. 6. Objective and cyclical audit approach. Theme 2. The system regulatory audit activities in the Republic of Kazakhstan Questions to review: 1. System of regulatory au ...

... 4. Main requirements to information-based audit. 5. Elements of financial statements. Stages of disaggregation financial statements. 6. Objective and cyclical audit approach. Theme 2. The system regulatory audit activities in the Republic of Kazakhstan Questions to review: 1. System of regulatory au ...

PUBLIC SECTOR ACCOUNTING REFORM Tatjana Jovanović

... The global economic crisis has underscored the importance of accountable and transparent use of public funds, in particular in light of deteriorating fiscal position and rising public debts. There is now a growing consensus that good information on government activities matters. It can help policy ...

... The global economic crisis has underscored the importance of accountable and transparent use of public funds, in particular in light of deteriorating fiscal position and rising public debts. There is now a growing consensus that good information on government activities matters. It can help policy ...

Accounting for Government and Society

... Accounting is an activity that is pervasive in the modern world and has been the object of academic interest from a variety of disciplines for at least the last hundred years. Accounting is clearly technical, but it is much more than that since how and what we account for affects everyone in society ...

... Accounting is an activity that is pervasive in the modern world and has been the object of academic interest from a variety of disciplines for at least the last hundred years. Accounting is clearly technical, but it is much more than that since how and what we account for affects everyone in society ...

GAAP

... Moreover, the subjective judgments of senior management, accountants, auditors, boards of directors, stockholders, and potential business partners, can differ, especially when competing interests are involved. Financial statement items are considered material (large enough to matter) if they could ...

... Moreover, the subjective judgments of senior management, accountants, auditors, boards of directors, stockholders, and potential business partners, can differ, especially when competing interests are involved. Financial statement items are considered material (large enough to matter) if they could ...

Unit F011 - Accounting principles - Scheme of work and

... depreciation is provided in the final accounts and the causes of depreciation ...

... depreciation is provided in the final accounts and the causes of depreciation ...

RAILROAD ACCOUNTING: ITS PROBLEMS AND THEIR EFFECT

... as defined in the Uniform System which are not being depreciated. 2. Most railroads have been making provisions for depreciation on depreciable road property only since January 1, 1943. Under generally accepted accounting principles when provision for depreciation is commenced sometime during the li ...

... as defined in the Uniform System which are not being depreciated. 2. Most railroads have been making provisions for depreciation on depreciable road property only since January 1, 1943. Under generally accepted accounting principles when provision for depreciation is commenced sometime during the li ...

Auditor Liability and Professional Skepticism: A Look at Lehman

... independent sales and later re-acquisitions. U.S. accounting standards have long recognized the need to report the substance, not simply the form, of such two-part coordinated transactions. It is thought that most, perhaps almost all, parties engaging in repos – a market of almost $3 trillion before ...

... independent sales and later re-acquisitions. U.S. accounting standards have long recognized the need to report the substance, not simply the form, of such two-part coordinated transactions. It is thought that most, perhaps almost all, parties engaging in repos – a market of almost $3 trillion before ...

The Auditor - Whose Agent Is He Anyway

... creating artificial profits they increase their own return. The downside is that a perceived increase in returns prompts shareholders to increase their share in the company, based on biased financial statements. The auditor’s duty is to monitor the agent (i.e. management) and ensure his objectives a ...

... creating artificial profits they increase their own return. The downside is that a perceived increase in returns prompts shareholders to increase their share in the company, based on biased financial statements. The auditor’s duty is to monitor the agent (i.e. management) and ensure his objectives a ...

Accounting Processes

... a. Accounting posts journal entries to the ledger if no documentation is required and/or if documentation has been received. b. If required, Accounting will contact the user asking him/her to make changes/corrections to the journal prior to posting. 2. In addition to reviewing and posting journal en ...

... a. Accounting posts journal entries to the ledger if no documentation is required and/or if documentation has been received. b. If required, Accounting will contact the user asking him/her to make changes/corrections to the journal prior to posting. 2. In addition to reviewing and posting journal en ...

The purposes of accounting

... • Conforming to GAAP/IFRS does not mean that the information provided is good, but it is the start ...

... • Conforming to GAAP/IFRS does not mean that the information provided is good, but it is the start ...

1. The primary function of financial accounting is

... 36. Porite Company recognizes revenue in the period in which it records an asset for the related account receivable, rather than in the period in which the account receivable is collected in cash. Porite's practice is an example of: A. Cash basis accounting. B. Accrual accounting. C. The matching p ...

... 36. Porite Company recognizes revenue in the period in which it records an asset for the related account receivable, rather than in the period in which the account receivable is collected in cash. Porite's practice is an example of: A. Cash basis accounting. B. Accrual accounting. C. The matching p ...

accounting - WordPress.com

... skill and imagination, typically in a visual form such as painting or sculpture, producing works to be appreciated primarily for their beauty or emotional power. ...

... skill and imagination, typically in a visual form such as painting or sculpture, producing works to be appreciated primarily for their beauty or emotional power. ...

Chapter 1 - Pearson Schools and FE Colleges

... and Republic of Ireland there is also an international organisation that issues accounting standards. The International Accounting Standards Committee (IASC) was established in 1973 and in 2000 this committee changed its name to the International Accounting Standards Board (IASB). The IASB is an ind ...

... and Republic of Ireland there is also an international organisation that issues accounting standards. The International Accounting Standards Committee (IASC) was established in 1973 and in 2000 this committee changed its name to the International Accounting Standards Board (IASB). The IASB is an ind ...

APES 205 Conformity with Accounting Standards

... Professional Activity means an activity requiring accountancy or related skills undertaken by a Member, including accounting, auditing, taxation, management consulting, and financial management. Professional Bodies means Chartered Accountants Australia and New Zealand, CPA Australia and the Institut ...

... Professional Activity means an activity requiring accountancy or related skills undertaken by a Member, including accounting, auditing, taxation, management consulting, and financial management. Professional Bodies means Chartered Accountants Australia and New Zealand, CPA Australia and the Institut ...

What is Accounting?

... private investors; in others, the primary users are tax authorities or central government planners. ...

... private investors; in others, the primary users are tax authorities or central government planners. ...

the relevance of auditing in a computerized accounting system

... Abstract - The world is changing faster than ever before as computer is affecting every sectors of the economy. Accounting profession is not left out of this change as the quality of information to be provided to users for decision making have to be improved on. This paper, therefore provide a detai ...

... Abstract - The world is changing faster than ever before as computer is affecting every sectors of the economy. Accounting profession is not left out of this change as the quality of information to be provided to users for decision making have to be improved on. This paper, therefore provide a detai ...

Financial Accounting Standards Board (FASB)

... 8. The final statement not only sets forth the actual standards but also establishes the effective date and method of transition. 9. Currently, a simple majority (three out of five) is required for approval of an Exposure Draft or a final statement of standards. ...

... 8. The final statement not only sets forth the actual standards but also establishes the effective date and method of transition. 9. Currently, a simple majority (three out of five) is required for approval of an Exposure Draft or a final statement of standards. ...

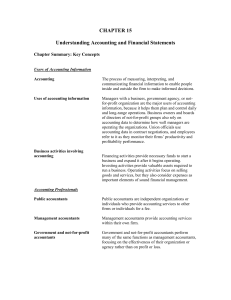

CHAPTER 15 Understanding Accounting and Financial

... and long-range operations. Business owners and boards of directors of not-for-profit groups also rely on accounting data to determine how well managers are operating the organizations. Union officials use accounting data in contract negotiations, and employees refer to it as they monitor their firms ...

... and long-range operations. Business owners and boards of directors of not-for-profit groups also rely on accounting data to determine how well managers are operating the organizations. Union officials use accounting data in contract negotiations, and employees refer to it as they monitor their firms ...

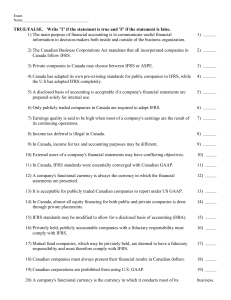

Exam Name___________________________________ TRUE

... ongoing endeavour. Besides income tax minimization, what are some of the reasons why management would want to minimize earnings? 81) Briefly explain how the CRA (Revenue Canada) differs from most GAAP based policies in terms of revenue recognition 82) Do you think that most companies in the oil sect ...

... ongoing endeavour. Besides income tax minimization, what are some of the reasons why management would want to minimize earnings? 81) Briefly explain how the CRA (Revenue Canada) differs from most GAAP based policies in terms of revenue recognition 82) Do you think that most companies in the oil sect ...

The Impact Of Switching To International Financial Reporting

... The ongoing discussion regarding what standards will be adopted in the area of International Accounting will continue until a conclusion is reached on the convergence. The United States GAAP can no longer be assumed to be the governing standard for financial standards worldwide. The FASB has stated: ...

... The ongoing discussion regarding what standards will be adopted in the area of International Accounting will continue until a conclusion is reached on the convergence. The United States GAAP can no longer be assumed to be the governing standard for financial standards worldwide. The FASB has stated: ...

Institute for Accounting and Auditing of FBiH

... Tasks and Goals 2. Modernizing University Curricula Reform - To have BiH universities adopt a modern accounting and auditing curriculum fully in accordance with UNCTAD and IFAC guidelines. - Seven BiH Universities signed MOA for implementing new ...

... Tasks and Goals 2. Modernizing University Curricula Reform - To have BiH universities adopt a modern accounting and auditing curriculum fully in accordance with UNCTAD and IFAC guidelines. - Seven BiH Universities signed MOA for implementing new ...

Institute of Chartered Accountants of India

The Institute of Chartered Accountants of India (ICAI) is the national professional accounting body of India. It was established on 1 July 1949 as a body corporate under the Chartered Accountants Act, 1949 enacted by the Parliament (acting as the provisional Parliament of India) to regulate the profession of Chartered Accountancy in India. ICAI is the second largest professional accounting body in the world in terms of membership, after American Institute of Certified Public Accountants. ICAI is the only licensing cum regulating body of the financial audit and accountancy profession in India. It recommends the accounting standards to be followed by companies in India to The National Financial Reporting Authority (NFRA) and sets the accounting standards to be followed by other types of organisations. ICAI is solely responsible for setting the auditing and assurance standards to be followed in the audit of financial statements in India. It also issues other technical standards like Standards on Internal Audit (SIA), Corporate Affairs Standards (CAS) etc. to be followed by practicing Chartered Accountants. It works closely with the Government of India, Reserve Bank of India and the Securities and Exchange Board of India in formulating and enforcing such standards.Members of the Institute are known as Chartered Accountants. However the word chartered does not refer to or flow from any Royal Charter. Chartered Accountants are subject to a published Code of Ethics and professional standards, violation of which is subject to disciplinary action. Only a member of ICAI can be appointed as statutory auditor of an Indian company under the Companies Act, 2013. The management of the Institute is vested with its Council with the president acting as its Chief Executive Authority. A person can become a member of ICAI by taking prescribed examinations and undergoing three years of practical training. The membership course is well known for its rigorous standards. ICAI has entered into mutual recognition agreements with other professional accounting bodies world-wide for reciprocal membership recognition.ICAI is one of the founder members of the International Federation of Accountants (IFAC), South Asian Federation of Accountants (SAFA), and Confederation of Asian and Pacific Accountants (CAPA). ICAI was formerly the provisional jurisdiction for XBRL International in India.The Institute of Chartered Accountants of India was established under the Chartered Accountants Act, 1949 passed by the Parliament of India with the objective of regulating accountancy profession in India. ICAI is the second largest professional accounting body in the world in terms of membership second only to AICPA. It prescribes the qualifications for a Chartered Accountant, conducts the requisite examinations and grants license in the form of Certificate of Practice. Apart from this primary function, it also helps various government agencies like RBI, SEBI, MCA, CAG, IRDA, etc. in policy formulation. ICAI actively engages itself in aiding and advising economic policy formulation. For example ICAI has submitted its suggestions on the proposed Direct Taxes Code Bill, 2010. It also has submitted its suggestions on the Companies Bill, 2009. The government also takes the suggestions of ICAI as expert advice and considers it favorably. ICAI presented an approach paper on issues in implementing Goods and Service Tax in India to the Ministry of Finance. In response to this, Ministry of Finance has suggested that ICAI take a lead and help the government in implementing Goods and Services Tax (GST). It is because of this active participation in formulation economic legislation, it has been designated by A. P. J. Abdul Kalam as a ""Partner in Nation Building"".