Handout 4 - Wharton Finance Department

... no backward bend to the diagram. The standard deviation is steadily increasing. Even here, however, there are gains from diversification relative to the case of ρ = 1. Standard deviation increases, but it does so less than proportionally. For all values of ρ < 1, the standard deviation of a portfoli ...

... no backward bend to the diagram. The standard deviation is steadily increasing. Even here, however, there are gains from diversification relative to the case of ρ = 1. Standard deviation increases, but it does so less than proportionally. For all values of ρ < 1, the standard deviation of a portfoli ...

1. “Dissecting the Market Pricing of Return Volatility." Torben

... Torben ANDERSEN (Kellogg Management School, Northwestern University, Chicago, USA) and Oleg Bondarenko (University of Illinois at Chicago, USA). Abstract: In recent years, markets for direct trading of realized return volatility have emerged. A critical theoretical backdrop for these developments is ...

... Torben ANDERSEN (Kellogg Management School, Northwestern University, Chicago, USA) and Oleg Bondarenko (University of Illinois at Chicago, USA). Abstract: In recent years, markets for direct trading of realized return volatility have emerged. A critical theoretical backdrop for these developments is ...

Change of Time Method in Mathematical Finance

... Then M(t)=B(T(t)) (Dambis-DubinsSchwartz Theorem) Time-change is the quadratic variation process [M(t)] Then M(t) can be written as a SVM process (martingale representation theorem, Doob (1953)) ...

... Then M(t)=B(T(t)) (Dambis-DubinsSchwartz Theorem) Time-change is the quadratic variation process [M(t)] Then M(t) can be written as a SVM process (martingale representation theorem, Doob (1953)) ...

Full Article

... variables may be direct or indirect/inverse. Generally, correlation of two numbers is studyin statistics .The different types of correlation among numbers may be positively correlated, negatively correlated and perfectly correlated in statistics. Generally theserelationship is direct or indirect/inv ...

... variables may be direct or indirect/inverse. Generally, correlation of two numbers is studyin statistics .The different types of correlation among numbers may be positively correlated, negatively correlated and perfectly correlated in statistics. Generally theserelationship is direct or indirect/inv ...

Correlation of Risks, Integrating Risk Measurement – Risk

... Survival rate: derived from historical cumulative default experience for each rating cohort group Recovery rate: by seniority (historical) Correlation: by industry (historical) Standard deviation: concentration in each industry Default event: maturity structure ...

... Survival rate: derived from historical cumulative default experience for each rating cohort group Recovery rate: by seniority (historical) Correlation: by industry (historical) Standard deviation: concentration in each industry Default event: maturity structure ...

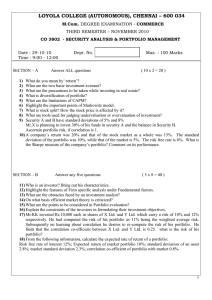

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 11) Who is an investor? Bring out his characteristics. 12) Highlight the features of Firm specific analysis under Fundamental factors. 13) What are the obstacles faced by an investment analyst? 14) On what basis efficient market theory is criticized? 15) What are the points to be considered in Portf ...

... 11) Who is an investor? Bring out his characteristics. 12) Highlight the features of Firm specific analysis under Fundamental factors. 13) What are the obstacles faced by an investment analyst? 14) On what basis efficient market theory is criticized? 15) What are the points to be considered in Portf ...

An introduction to pricing methods for credit derivatives

... until the default of C; If C defaults, B pays A a default payment (for instance, default payment could mimic the loss that A suffers on a bond issue by C to A). The premium payments are quoted in annualized percentage x ∗ of the notional value of the reference asset. This rate x ∗ is called the CDS ...

... until the default of C; If C defaults, B pays A a default payment (for instance, default payment could mimic the loss that A suffers on a bond issue by C to A). The premium payments are quoted in annualized percentage x ∗ of the notional value of the reference asset. This rate x ∗ is called the CDS ...

Economics 434 Financial Markets - SHANTI Pages

... • What if their correlation is one? (Which means that either both pay off or both default, not one or the other) • Then each of Security 1 and Security 2 have a 90 percent chance of paying off • Both get a B- rating • Compared to independence pricing – “Independence” assumption overprice Security On ...

... • What if their correlation is one? (Which means that either both pay off or both default, not one or the other) • Then each of Security 1 and Security 2 have a 90 percent chance of paying off • Both get a B- rating • Compared to independence pricing – “Independence” assumption overprice Security On ...

2007Flores

... How to produce bivariate distributions? The key resides in having nice marginal distributions and a copula function. How do we find the copula? There are several methods: inversion, geometric, and algebraic methods. The following are Weibull distributions derived from different copula functions. Exp ...

... How to produce bivariate distributions? The key resides in having nice marginal distributions and a copula function. How do we find the copula? There are several methods: inversion, geometric, and algebraic methods. The following are Weibull distributions derived from different copula functions. Exp ...

Measuring Association

... • Highly skewed or “floor” or “ceiling” effects – e.g. number of hospital admissions, percent humidity daily in Baltimore in July, minimental exam score • Ordinal: Takes finite number of values – e.g. on a scale of 1 to 5 ...

... • Highly skewed or “floor” or “ceiling” effects – e.g. number of hospital admissions, percent humidity daily in Baltimore in July, minimental exam score • Ordinal: Takes finite number of values – e.g. on a scale of 1 to 5 ...

Azzerare I rischi, l`illusione di una formula magica

... The LTC lesson has been de facto ignored. Derivatives amounted to $100 trillion in 2002, when Warren Buffet called them “financial weapons of mass destruction,” and amounted to $516 trillion at the end of 2007 – roughly 35 times the US GNP. “The problem is that a formula which is helpful in diminish ...

... The LTC lesson has been de facto ignored. Derivatives amounted to $100 trillion in 2002, when Warren Buffet called them “financial weapons of mass destruction,” and amounted to $516 trillion at the end of 2007 – roughly 35 times the US GNP. “The problem is that a formula which is helpful in diminish ...

Statistical analysis of fMRI data - Mathematics and Statistics

... Connectivity • Measured by the correlation between data at pairs of voxels: ...

... Connectivity • Measured by the correlation between data at pairs of voxels: ...

V Seminário sobre Riscos, Estabilidade Financeira e Economia

... • First they use a general equilibrium model to this ...

... • First they use a general equilibrium model to this ...

Possible Project for 2011 Mathematical Problems in Industry

... a regular basis until maturity, at which time the principle is repaid. If the firm runs into trouble, it may not be able to meet this obligation, or it may find it is more advantageous to default on the obligation and go through a restructuring or bankruptcy. In quantitative finance, in particular f ...

... a regular basis until maturity, at which time the principle is repaid. If the firm runs into trouble, it may not be able to meet this obligation, or it may find it is more advantageous to default on the obligation and go through a restructuring or bankruptcy. In quantitative finance, in particular f ...

Statistics_Tennis - Height and Speed

... speeds and their height, and then process that information. The teacher should groupteach any concept that the students might need in order to help them to proceed, e.g. after encouraging the use of measuring correlation via the shortest perpendicular distances, lead the students on to Spearman’s Ra ...

... speeds and their height, and then process that information. The teacher should groupteach any concept that the students might need in order to help them to proceed, e.g. after encouraging the use of measuring correlation via the shortest perpendicular distances, lead the students on to Spearman’s Ra ...