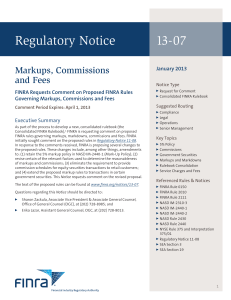

Regulatory Notice 13-07

... policy (or a similar quantitative standard) in the proposed markup rules because it helps firms in establishing effective supervisory and compliance procedures and setting upper benchmarks applicable to almost all transactions (e.g., the 5% policy aids compliance personnel in surveillance efforts us ...

... policy (or a similar quantitative standard) in the proposed markup rules because it helps firms in establishing effective supervisory and compliance procedures and setting upper benchmarks applicable to almost all transactions (e.g., the 5% policy aids compliance personnel in surveillance efforts us ...

The Impact of the French Securities Transaction Tax on Market

... Will a tax on financial transactions curb speculative activity and render financial markets more stable? Or will it hurt market liquidity and price discovery, thus, making markets even more volatile? Although the idea to tax financial transactions dates to Keynes (1936) and Tobin (1978), it has rece ...

... Will a tax on financial transactions curb speculative activity and render financial markets more stable? Or will it hurt market liquidity and price discovery, thus, making markets even more volatile? Although the idea to tax financial transactions dates to Keynes (1936) and Tobin (1978), it has rece ...

Trading Rules and Practices

... on dividends and capital gains have caused investors to discount the value of taxable cash distributions relative to capital gains. Poterba (1986) re-examines the ex-day price drop for two classes of Citizens Utilities originally studied by Long (1978), one of which distributed only a cash dividend ...

... on dividends and capital gains have caused investors to discount the value of taxable cash distributions relative to capital gains. Poterba (1986) re-examines the ex-day price drop for two classes of Citizens Utilities originally studied by Long (1978), one of which distributed only a cash dividend ...

Finance as a Magnet for the Best and Brightest

... A number of empirical studies document that there are compensation premiums to working in finance and provide evidence suggesting that these premiums are rents rather than returns to skills. Philippon and Reshef (forthcoming) find that in the decade prior to the financial crisis, rents accounted for ...

... A number of empirical studies document that there are compensation premiums to working in finance and provide evidence suggesting that these premiums are rents rather than returns to skills. Philippon and Reshef (forthcoming) find that in the decade prior to the financial crisis, rents accounted for ...

FRAUD AND ERROR IN MANIPULATIVE FINANCIAL SITUATIONS

... Fraud, even if it is a fraudulent misrepresentation or asset fraud, implies gains and pressure to commit the fraud, an opportunity and motivations that represent the beginning of the action2, such as: - Gains or pressure to commit a fraudulent financial misrepresentation may appear when the manageme ...

... Fraud, even if it is a fraudulent misrepresentation or asset fraud, implies gains and pressure to commit the fraud, an opportunity and motivations that represent the beginning of the action2, such as: - Gains or pressure to commit a fraudulent financial misrepresentation may appear when the manageme ...

EUROPEAN COMMISSION Brussels, 14.7.2016 C(2016) 4390 final

... (RMs) and multilateral trading facilities (MTFs) offering trading in shares admitted to trading on a regulated market and for systematic internalisers (SIs) in the same asset class. It also introduced post-trade transparency requirements for investment firms in such shares. Based on the experience w ...

... (RMs) and multilateral trading facilities (MTFs) offering trading in shares admitted to trading on a regulated market and for systematic internalisers (SIs) in the same asset class. It also introduced post-trade transparency requirements for investment firms in such shares. Based on the experience w ...

Materiality in Planning and Performing an Audit

... .10 When establishing the overall audit strategy, the auditor should determine materiality for the financial statements as a whole. If, in the specific circumstances of the entity, one or more particular classes of transactions, account balances, or disclosures exist for which misstatements of lesse ...

... .10 When establishing the overall audit strategy, the auditor should determine materiality for the financial statements as a whole. If, in the specific circumstances of the entity, one or more particular classes of transactions, account balances, or disclosures exist for which misstatements of lesse ...

Ch 26 PPT

... Column 3 Company Name and Type of Stock: If there are no special symbols or letters following the company name, it is common stock (shares without a fixed rate of return of investment.) Other types of stock are “pf“ or preferred, etc. Column 4 Ticker symbol: This alphabetic symbol is a unique stock ...

... Column 3 Company Name and Type of Stock: If there are no special symbols or letters following the company name, it is common stock (shares without a fixed rate of return of investment.) Other types of stock are “pf“ or preferred, etc. Column 4 Ticker symbol: This alphabetic symbol is a unique stock ...

RTF format

... the pie distribution market to forecourt and convenience channels through its distribution relationship with the manufacturer of Piemans Pies, namely, Foodcorp (Pty) Ltd ("Foodcorp"). The competitor further submits it that its efforts to compete in the pie clistribution market have been unsuccessful ...

... the pie distribution market to forecourt and convenience channels through its distribution relationship with the manufacturer of Piemans Pies, namely, Foodcorp (Pty) Ltd ("Foodcorp"). The competitor further submits it that its efforts to compete in the pie clistribution market have been unsuccessful ...

The Case for CosT- BenefiT analysis of finanCial

... are rules that require banks and other financial institutions to maintain a minimum ratio of capital to assets. To use a simple example, a 5 percent capital requirement implies that a firm that buys $100 in assets cannot finance the purchase with more than $95 in debt, so that at least $5 in equity ...

... are rules that require banks and other financial institutions to maintain a minimum ratio of capital to assets. To use a simple example, a 5 percent capital requirement implies that a firm that buys $100 in assets cannot finance the purchase with more than $95 in debt, so that at least $5 in equity ...

International Accounting Standard 10

... (IAS 33 Earnings per Share requires an entity to disclose a description of such transactions, other than when such transactions involve capitalisation or bonus issues, share splits or reverse share splits all of which are required to be adjusted under IAS 33); ...

... (IAS 33 Earnings per Share requires an entity to disclose a description of such transactions, other than when such transactions involve capitalisation or bonus issues, share splits or reverse share splits all of which are required to be adjusted under IAS 33); ...

In Whose Best Interest?

... legally permitted to steer investors’ retirement assets into investment funds that are not necessarily in their clients’ best interests due to high cost and/or bad performance, but that may be more lucrative for the advisor. Under the new rule, this would no longer be permitted. All financial adviso ...

... legally permitted to steer investors’ retirement assets into investment funds that are not necessarily in their clients’ best interests due to high cost and/or bad performance, but that may be more lucrative for the advisor. Under the new rule, this would no longer be permitted. All financial adviso ...

Financial capital

... 2015. During this period, a new viability plan was published, along with indicative conditions of capital structure restructuring, which is in the process of being signed up to by our creditors. Due to this situation, Abengoa’s financing model will change dramatically, given that a portion of curren ...

... 2015. During this period, a new viability plan was published, along with indicative conditions of capital structure restructuring, which is in the process of being signed up to by our creditors. Due to this situation, Abengoa’s financing model will change dramatically, given that a portion of curren ...

Taxation of corporate profits, inflation and income

... new rolls’ issues after 1925, see graph 1). Before comparing these amounts to macroeconomic variables, one must take into account two elements that decrease the actual weight of the tax. The first one is the possibility that had been given to pay the tax using government debt, namely 4% or 5% recent ...

... new rolls’ issues after 1925, see graph 1). Before comparing these amounts to macroeconomic variables, one must take into account two elements that decrease the actual weight of the tax. The first one is the possibility that had been given to pay the tax using government debt, namely 4% or 5% recent ...

Trade Reporting Notice - 12/21/11

... If the originator includes an allowable variance(s) regarding the settlement date or the final delivery amount in good faith as a condition in a transaction in an SBA pool or a Multi-Family MBS TBA (and is not establishing an allowable variance(s) for the purpose of avoiding trade reporting obligati ...

... If the originator includes an allowable variance(s) regarding the settlement date or the final delivery amount in good faith as a condition in a transaction in an SBA pool or a Multi-Family MBS TBA (and is not establishing an allowable variance(s) for the purpose of avoiding trade reporting obligati ...

Financial Management: Principles and Applications

... Keywords: financial intermediaries Principles: Principle 2: There Is a Risk-Return Tradeoff 2) Financial intermediaries help bring savers and borrowers together. Answer: TRUE Diff: 1 Topic: 2.1 The Basic Structure of the U.S. Financial Markets Keywords: financial intermediaries Principles: Principle ...

... Keywords: financial intermediaries Principles: Principle 2: There Is a Risk-Return Tradeoff 2) Financial intermediaries help bring savers and borrowers together. Answer: TRUE Diff: 1 Topic: 2.1 The Basic Structure of the U.S. Financial Markets Keywords: financial intermediaries Principles: Principle ...

Market vs. Residence Principle

... Few other issues stir emotions as easily as “taxes”. This also holds for a Financial Transaction Tax (FTT) – dubbed “Robin Hood Tax” by its supporters, but fiercely contested by others as seemingly threatening to destroy the financial sector. Especially since eleven member countries of the European Un ...

... Few other issues stir emotions as easily as “taxes”. This also holds for a Financial Transaction Tax (FTT) – dubbed “Robin Hood Tax” by its supporters, but fiercely contested by others as seemingly threatening to destroy the financial sector. Especially since eleven member countries of the European Un ...

An Introduction to GAAP Basis Financial Report

... report on the State’s capital assets. • The types of assets and dollar thresholds for capitalization are: Equipment with cost greater than $40,000 Building or land improvements with cost greater than $100,000 Infrastructure with cost greater than $1 million Any land or buildings owned by an ...

... report on the State’s capital assets. • The types of assets and dollar thresholds for capitalization are: Equipment with cost greater than $40,000 Building or land improvements with cost greater than $100,000 Infrastructure with cost greater than $1 million Any land or buildings owned by an ...

19-21 Deferred tax assets and deferred tax liabilities

... to offset taxable income derived in future years ...

... to offset taxable income derived in future years ...

Financial Institutions — Get Ready for GST/HST Obligations

... Your financial institution will soon face various GST/HST, QST and payroll deadlines. As the end of 2016 approaches, financial institutions can take proactive steps to manage their tax compliance obligations, risks and unrecoverable tax costs as they prepare for upcoming indirect tax deadlines and o ...

... Your financial institution will soon face various GST/HST, QST and payroll deadlines. As the end of 2016 approaches, financial institutions can take proactive steps to manage their tax compliance obligations, risks and unrecoverable tax costs as they prepare for upcoming indirect tax deadlines and o ...

PREMIUM NUTRIENTS BERHAD (“PNB” OR “COMPANY

... Announcement”), as may be applicable. PNB must make the PN16 Monthly Announcement simultaneously with the announcement of its quarterly report and in any event, PNB must make the said announcement not later than 2 months after the end of each quarter of a financial year, until further notice from Bu ...

... Announcement”), as may be applicable. PNB must make the PN16 Monthly Announcement simultaneously with the announcement of its quarterly report and in any event, PNB must make the said announcement not later than 2 months after the end of each quarter of a financial year, until further notice from Bu ...

Financial Transaction Tax and Financial Market Stability with

... The recent banking and financial crisis has reignited the public debate about a financial transactions tax as proposed by Keynes (1936) for the stock market or Tobin (1978, 1996) for the foreign-exchange market. The proponents of a financial transaction tax claim that a financial transaction would r ...

... The recent banking and financial crisis has reignited the public debate about a financial transactions tax as proposed by Keynes (1936) for the stock market or Tobin (1978, 1996) for the foreign-exchange market. The proponents of a financial transaction tax claim that a financial transaction would r ...

Explanations

... Explanations The survey covered all enterprises with a legal person right (except budget establishments) which are situated on the region's territory. to the table: Data are given without of taking into account the result of activity of banks. The financial result before taxation has used from 2009 ...

... Explanations The survey covered all enterprises with a legal person right (except budget establishments) which are situated on the region's territory. to the table: Data are given without of taking into account the result of activity of banks. The financial result before taxation has used from 2009 ...

accountability - Mercer County Community College

... Since fiduciary resources cannot be used by the government, they are reported only in the fiduciary fund financial statements—not in the government-wide statements ...

... Since fiduciary resources cannot be used by the government, they are reported only in the fiduciary fund financial statements—not in the government-wide statements ...

Negotiable European Commercial Paper

... This document (including any attachments thereto) is confidential and intended solely for the use of the addressee(s). It should not be transmitted to any person(s) other than the original addressee(s) without the prior written consent of Natixis. If you receive this document in error, please delete ...

... This document (including any attachments thereto) is confidential and intended solely for the use of the addressee(s). It should not be transmitted to any person(s) other than the original addressee(s) without the prior written consent of Natixis. If you receive this document in error, please delete ...

European Union financial transaction tax

The European Union financial transaction tax (EU FTT) is a proposal made by the European Commission to introduce a financial transaction tax (FTT) within some of the member states of the European Union initially by 1 January 2014, later postponed to 1 January 2016. The tax would impact financial transactions between financial institutions charging 0.1% against the exchange of shares and bonds and 0.01% across derivative contracts, if just one of the financial institutions resides in a member state of the EU FTT.One of the flaws in the tax as proposed is its insensitivity to the economics and dynamics of the time characteristics of money market and fixed interest trades. The application, as proposed, of applying the same flat rate tax on the market value of a transaction, be it for one week or fifty years, to fixed interest bills or bonds, will fatally compromise monetary policy transmission mechanisms.To avoid an unwanted negative impact on the real economy, the FTT will not apply to: Day-to-day financial activities of citizens and businesses (e.g. loans, payments, insurance, deposits etc.). Investment banking activities in the context of raising capital. Transactions carried out as part of restructuring operations. Refinancing transactions with central banks and the ECB, with the EFSF and the ESM, and transactions with EU.The proposed EU financial transaction tax would be separate from a bank levy, or a resolution levy, which some governments are also proposing to impose on banks to insure them against the costs of any future bailouts. The tax that could raise 57 billion Euros per year if implemented across the entire EU was however a controversial topic for the EU member states to agree upon ever since it was first time debated in June 2010. In October 2012, after discussions had failed to establish unanimous support for an EU-wide FTT, the European Commission proposed that the use of enhanced co-operation should be permitted to implement the tax in the states which wished to participate. This framework proposal, supported by 11 EU member states, was approved in the European Parliament in December 2012, and by the Council of the European Union in January 2013.On 14 February 2013, the European Commission put forward a revised proposal outlining the details of the FTT to be enacted under enhanced co-operation, which was only slightly different from its initial proposal in September 2011. The proposal was approved by the European Parliament in July 2013, and must now be unanimously approved by the 11 initial participating states before coming into force. The legal service of the Council of the European Union concluded in September 2013 that the European Commission's proposal would not tax ""systemic risk"" activities but only healthy activities, and that it was incompatible with the EU treaty on several grounds while also being illegal because of ""exceeding member states' jurisdiction for taxation under the norms of international customary law"". The Financial Transaction Tax can no longer be blocked by the Council of the European Union on legal grounds, but each individual EU member state is still entitled to launch legal complaints against the FTT if approved to the European Court of Justice, potentially annulling the scheme. On 6 May 2014, ten out of the initial eleven participating member states (all except Slovenia) agreed to seek a ""progressive"" tax on equities and ""some derivatives"" by 1 January 2016, and aimed for a final agreement on the details to be negotiated and unanimously agreed upon later in 2014.