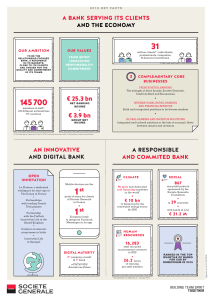

€ 25.3 bn € 3.9 bn

... GLOBAL BANKING AND INVESTOR SOLUTIONS Integrated and tailored solutions at the hub of economic flows ...

... GLOBAL BANKING AND INVESTOR SOLUTIONS Integrated and tailored solutions at the hub of economic flows ...

What Is a Bank, and How Do We Go About

... • Market wide dangers in light of liquidity mismatches (i.e., run on banks generally) • Effect on broader economy when reserve source of credit and liquidity taken away • Lose transmission source for monetary policy ...

... • Market wide dangers in light of liquidity mismatches (i.e., run on banks generally) • Effect on broader economy when reserve source of credit and liquidity taken away • Lose transmission source for monetary policy ...

Annexure-E

... PROFORMA FOR BANKER’S REPORT To be submitted on the Bankers’ Letterhead) NSIC Limited (name and address of the registering branch of NSIC) Subject: Financial credibility report in respect of M/s ...

... PROFORMA FOR BANKER’S REPORT To be submitted on the Bankers’ Letterhead) NSIC Limited (name and address of the registering branch of NSIC) Subject: Financial credibility report in respect of M/s ...

The Development of the Great Depression

... those banks failed. For ordinary Americans, the collapse of banks was an especially unnerving new development. Most people did not have money invested in stocks, but many had entrusted their savings to banks. Today, most Americans do not have to worry that they will lose their savings if their bank ...

... those banks failed. For ordinary Americans, the collapse of banks was an especially unnerving new development. Most people did not have money invested in stocks, but many had entrusted their savings to banks. Today, most Americans do not have to worry that they will lose their savings if their bank ...

VBA Bank Day Scholarship Program Sample schedule for your bank

... Loan Department - Reviewing the loan process, the importance of good credit, and the importance of saving to become a qualified borrower. You might complete a mock loan application to gain an understanding of the loan process. Marketing Department - Learning how banks are involved in the community. ...

... Loan Department - Reviewing the loan process, the importance of good credit, and the importance of saving to become a qualified borrower. You might complete a mock loan application to gain an understanding of the loan process. Marketing Department - Learning how banks are involved in the community. ...

Bank of England

The Bank of England, formally the Governor and Company of the Bank of England, is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world, after the Sveriges Riksbank, and the world's 8th oldest bank. It was established to act as the English Government's banker, and is still the banker for the Government of the United Kingdom. The Bank was privately owned by stockholders from its foundation in 1694 until nationalised in 1946.In 1998, it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with independence in setting monetary policy.The Bank is one of eight banks authorised to issue banknotes in the United Kingdom, but has a monopoly on the issue of banknotes in England and Wales and regulates the issue of banknotes by commercial banks in Scotland and Northern Ireland.The Bank's Monetary Policy Committee has devolved responsibility for managing monetary policy. The Treasury has reserve powers to give orders to the committee ""if they are required in the public interest and by extreme economic circumstances"" but such orders must be endorsed by Parliament within 28 days. The Bank's Financial Policy Committee held its first meeting in June 2011 as a macro prudential regulator to oversee regulation of the UK's financial sector.The Bank's headquarters have been in London's main financial district, the City of London, on Threadneedle Street, since 1734. It is sometimes known by the metonym The Old Lady of Threadneedle Street or The Old Lady, a name taken from the legend of Sarah Whitehead, whose ghost is said to haunt the Bank's garden. The busy road junction outside is known as Bank junction.Mark Carney assumed the post of The Governor of the Bank of England on 1 July 2013. He succeeded Mervyn King, who took over on 30 June 2003. Carney, a Canadian, will serve an initial five-year term rather than the typical eight, and will seek UK citizenship. He is the first non-British citizen to hold the post. As of January 2014, the Bank also has four Deputy Governors.