UNIT 2: PERSONAL FINANCE Introduction

... money to go on to university or college after graduation from Grade 12. Most commonly, students are paid an hourly wage. The more hours worked, the more income earned. Typically these jobs are found in retail or food service. Note: If you are paid an hourly rate and you work over your regular number ...

... money to go on to university or college after graduation from Grade 12. Most commonly, students are paid an hourly wage. The more hours worked, the more income earned. Typically these jobs are found in retail or food service. Note: If you are paid an hourly rate and you work over your regular number ...

PPT Presentation [ - 1.37 MB ]

... Return is usually guaranteed Can buy or sell at most financial institutions ...

... Return is usually guaranteed Can buy or sell at most financial institutions ...

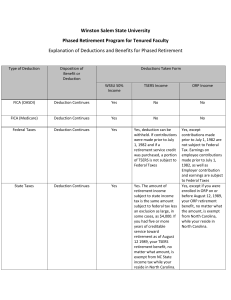

Explanation of Deductions and Benefits for Phased Retirement

... No. Individual coverage is paid by TSERS. Dependent coverage is ...

... No. Individual coverage is paid by TSERS. Dependent coverage is ...

Converting a Traditional IRA to a Roth IRA

... The case for converting The tax treatment of withdrawals is the biggest difference between Roth IRAs and other retirement savings vehicles. For that reason, investors considering converting to a Roth IRA will often ask themselves whether their tax liabilities are likely to be higher now or in retire ...

... The case for converting The tax treatment of withdrawals is the biggest difference between Roth IRAs and other retirement savings vehicles. For that reason, investors considering converting to a Roth IRA will often ask themselves whether their tax liabilities are likely to be higher now or in retire ...

2017 Teens and Personal Finance Survey.indd

... Cash is Still King with Teens More than 3 in 5 teens (62%) purchase items in a store using cash, while fewer than 1 in 3 (29%) said they use a credit/debit card. Far fewer (4%) use an electronic form of payment such as Apple Pay, Google Wallet, or PayPal; or use a check (1%). Five percent weren’t ...

... Cash is Still King with Teens More than 3 in 5 teens (62%) purchase items in a store using cash, while fewer than 1 in 3 (29%) said they use a credit/debit card. Far fewer (4%) use an electronic form of payment such as Apple Pay, Google Wallet, or PayPal; or use a check (1%). Five percent weren’t ...

Finding the Right Structure for Your Business

... All individual shareis taxed for income purposes as a holders must be citizens or residents of separate corporate entity at both the the United States. Unlike a C-Corporafederal and state levels. In addition, the tion, an S-Corporation cannot have number and types of shareholders are retained earnin ...

... All individual shareis taxed for income purposes as a holders must be citizens or residents of separate corporate entity at both the the United States. Unlike a C-Corporafederal and state levels. In addition, the tion, an S-Corporation cannot have number and types of shareholders are retained earnin ...

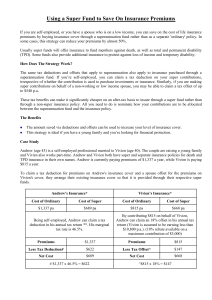

Using a Super Fund to Save On Insurance

... Using a Super Fund to Save On Insurance Premiums If you are self-employed, or you have a spouse who is on a low income, you can save on the cost of life insurance premiums by buying insurance cover through a superannuation fund rather than as a separate 'ordinary' policy. In some cases, this strateg ...

... Using a Super Fund to Save On Insurance Premiums If you are self-employed, or you have a spouse who is on a low income, you can save on the cost of life insurance premiums by buying insurance cover through a superannuation fund rather than as a separate 'ordinary' policy. In some cases, this strateg ...

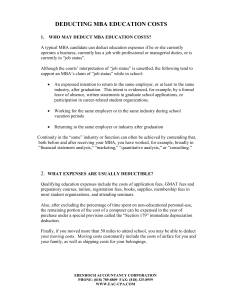

deducting mba education costs

... 10. DO LOANS REDUCE MY DEDUCTION? No. You are allowed to deduct the full amounts paid for your education, even if you spent money borrowed from your family, an employer, the government, or a financial institution. However, if a loan provided by an employer later is forgiven, you must report the debt ...

... 10. DO LOANS REDUCE MY DEDUCTION? No. You are allowed to deduct the full amounts paid for your education, even if you spent money borrowed from your family, an employer, the government, or a financial institution. However, if a loan provided by an employer later is forgiven, you must report the debt ...

Chapter 19: Accounting for Income Taxes

... Continuing operations Discontinued operations Extraordinary items Cumulative effect of an accounting change,– we won’t see this one any more after FAS154 ...

... Continuing operations Discontinued operations Extraordinary items Cumulative effect of an accounting change,– we won’t see this one any more after FAS154 ...

Want to feel good at tax time? Want to feel good at tax time? Want to

... (EITC), that is money lost to them — and to the local economy. Volunteer tax preparers help these families electronically file their return for free! ...

... (EITC), that is money lost to them — and to the local economy. Volunteer tax preparers help these families electronically file their return for free! ...

Slide 1 - Humble ISD

... Sole Proprietorship: business owned by one person – 72% of business = 5% of sales ...

... Sole Proprietorship: business owned by one person – 72% of business = 5% of sales ...

Georgia and the American Experience

... receive a greater benefit in the future. • Money can be invested in financial assets such as bank accounts, certificates of deposit, stocks, bonds, and mutual funds. • One of the major benefits of investing is that your money often earns a certain amount of interest which can then add to your total ...

... receive a greater benefit in the future. • Money can be invested in financial assets such as bank accounts, certificates of deposit, stocks, bonds, and mutual funds. • One of the major benefits of investing is that your money often earns a certain amount of interest which can then add to your total ...

PowerPoint-Notes-Unit-9-Lesson-1-Personal-Finance

... • The main goal of an entrepreneur is to make profit. Profit is the monetary gain a business owner makes by selling goods or providing services. • The total amount of profit a business makes comes from the following equation: • Total Income – Total expenses = Profit ...

... • The main goal of an entrepreneur is to make profit. Profit is the monetary gain a business owner makes by selling goods or providing services. • The total amount of profit a business makes comes from the following equation: • Total Income – Total expenses = Profit ...

Exam II with possible answers

... True. The financial sector pulls the savings of many individuals to create a pool of available for lending funds. In the absence of such sector, raising substantial capital becomes difficult. If the wealth distribution is concentrated, then it acts as a substitute to the pool of loanable funds creat ...

... True. The financial sector pulls the savings of many individuals to create a pool of available for lending funds. In the absence of such sector, raising substantial capital becomes difficult. If the wealth distribution is concentrated, then it acts as a substitute to the pool of loanable funds creat ...

Central Carolina Community College Program Planning Guide

... the role of financial information in decision-making, and address ethical considerations. This course has been approved for transfer under the CAA and ICAA a premajor and/or elective course requirement. ACC 122 Principles of Financial Accounting II ...

... the role of financial information in decision-making, and address ethical considerations. This course has been approved for transfer under the CAA and ICAA a premajor and/or elective course requirement. ACC 122 Principles of Financial Accounting II ...

Credential: Income Tax Preparer Certificate (C25100T0)

... the role of financial information in decision-making, and address ethical considerations. This course has been approved for transfer under the CAA and ICAA a premajor and/or elective course requirement. ACC 122 Principles of Financial Accounting II ...

... the role of financial information in decision-making, and address ethical considerations. This course has been approved for transfer under the CAA and ICAA a premajor and/or elective course requirement. ACC 122 Principles of Financial Accounting II ...

Federal Budget June 2011

... concessional contributions cap at $25,000 above the general concessional cap, for eligible individuals aged 50 and over with total superannuation balances of less than $500,000. The Government has confirmed that the higher cap will enable eligible persons over 50 to be able to contribute $25,000 mor ...

... concessional contributions cap at $25,000 above the general concessional cap, for eligible individuals aged 50 and over with total superannuation balances of less than $500,000. The Government has confirmed that the higher cap will enable eligible persons over 50 to be able to contribute $25,000 mor ...

![PPT Presentation [ - 1.37 MB ]](http://s1.studyres.com/store/data/013861489_1-933a2e2cdb1f2e99ba519c431dd25a9f-300x300.png)