Growth without Scale Effects

... An increase in the size (scale) of an economy increases the total quantity of rents that can be captured by successful innovators, which, in equilibrium, should lead to a rise in innovative activity. Conventional wisdom and the theoretical predictions of models of endogenous innovation suggest that ...

... An increase in the size (scale) of an economy increases the total quantity of rents that can be captured by successful innovators, which, in equilibrium, should lead to a rise in innovative activity. Conventional wisdom and the theoretical predictions of models of endogenous innovation suggest that ...

MARX, CLASSICAL POLITICAL ECONOMY AND THE PROBLEM

... determination of the supply curve, given quantities and prices . In the light of this H .L . Moore, quite correctly, characterised Marshall's method of study as "static and limited to functions of one variable" . [7] ) .B . Clark, the influential American theorist of a generation ago, did, in Schump ...

... determination of the supply curve, given quantities and prices . In the light of this H .L . Moore, quite correctly, characterised Marshall's method of study as "static and limited to functions of one variable" . [7] ) .B . Clark, the influential American theorist of a generation ago, did, in Schump ...

classical liberalism, neoliberalism and ordoliberalism1

... Britain, which were oriented towards the neoliberal principles of spontaneous order, monetarism, and a supply economy. In the 1980s, the British Prime Minister referred to the neoliberal economic policies she pursued using the slogan TINA, standing for “there is no alternative” — meaning no alterna ...

... Britain, which were oriented towards the neoliberal principles of spontaneous order, monetarism, and a supply economy. In the 1980s, the British Prime Minister referred to the neoliberal economic policies she pursued using the slogan TINA, standing for “there is no alternative” — meaning no alterna ...

Answers to the Problems – Chapter 13

... The strategies are whether to offer highly advanced, moderately advanced, or less advanced technology and whether to set a high price, moderate price, or low price. Your students’ answers will differ according to how the market evolves. Immediately after the Sony and Nintendo consoles were introduce ...

... The strategies are whether to offer highly advanced, moderately advanced, or less advanced technology and whether to set a high price, moderate price, or low price. Your students’ answers will differ according to how the market evolves. Immediately after the Sony and Nintendo consoles were introduce ...

Reconciling behavioural and neoclassical economics - Hal-SHS

... that the paretian homo œconomicus took in modern economics, as the model of a representative individual and of an actual individual, although it was fundamentally designed for the study of human institutions and not human actions. We conclude by stressing the imperative methodological distinction be ...

... that the paretian homo œconomicus took in modern economics, as the model of a representative individual and of an actual individual, although it was fundamentally designed for the study of human institutions and not human actions. We conclude by stressing the imperative methodological distinction be ...

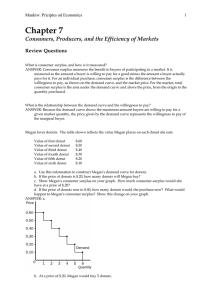

What is consumer surplus, and how is it measured

... ANSWER: Producer surplus measures the benefit to sellers of participating in a market. It is measured as the amount a seller is paid minus the cost of production. For an individual sale, producer surplus is measured as the difference between the market price and the cost of production, as shown on t ...

... ANSWER: Producer surplus measures the benefit to sellers of participating in a market. It is measured as the amount a seller is paid minus the cost of production. For an individual sale, producer surplus is measured as the difference between the market price and the cost of production, as shown on t ...

as a PDF

... In Austrian business cycle theory (ABCT), the rates of interest are artificially lowered when commercial banks create fiduciary media by using the proceeds of demand deposits to create loans. Lower interest rates on the producers’ loan market falsify the process of economic calculation for entrepren ...

... In Austrian business cycle theory (ABCT), the rates of interest are artificially lowered when commercial banks create fiduciary media by using the proceeds of demand deposits to create loans. Lower interest rates on the producers’ loan market falsify the process of economic calculation for entrepren ...

- ePub WU - Wirtschaftsuniversität Wien

... Exploring the way in which consumers determine production, Hutt argues that there is a direct parallel between choices in the market place and at the ballot box. This “voting analogy” fits nicely with the desire to claim market economies are naturally democratic and so supportive of a liberal democr ...

... Exploring the way in which consumers determine production, Hutt argues that there is a direct parallel between choices in the market place and at the ballot box. This “voting analogy” fits nicely with the desire to claim market economies are naturally democratic and so supportive of a liberal democr ...

History of macroeconomic thought

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not have an impact on real factors such as real output. John Maynard Keynes attacked some of these ""classical"" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle. The word macroeconomics was first used by Ragnar FrischThe generation of economists that followed Keynes synthesized his theory with neoclassical microeconomics to form the neoclassical synthesis. Although Keynesian theory originally omitted an explanation of price levels and inflation, later Keynesians adopted the Phillips curve to model price-level changes. Some Keynesians opposed the synthesis method of combining Keynes's theory with an equilibrium system and advocated disequilibrium models instead. Monetarists, led by Milton Friedman, adopted some Keynesian ideas, such as the importance of the demand for money, but argued that Keynesians ignored the role of money supply in inflation. Robert Lucas and other new classical macroeconomists criticized Keynesian models that did not work under rational expectations. Lucas also argued that Keynesian empirical models would not be as stable as models based on microeconomic foundations.The new classical school culminated in real business cycle theory (RBC). Like early classical economic models, RBC models assumed that markets clear and that business cycles are driven by changes in technology and supply, not demand. New Keynesians tried to address many of the criticisms leveled by Lucas and other new classical economists against Neo-Keynesians. New Keynesians adopted rational expectations and built models with microfoundations of sticky prices that suggested recessions could still be explained by demand factors because rigidities stop prices from falling to a market-clearing level, leaving a surplus of goods and labor. The new neoclassical synthesis combined elements of both new classical and new Keynesian macroeconomics into a consensus. Other economists avoided the new classical and new Keynesian debate on short-term dynamics and developed the new growth theories of long-run economic growth. The Great Recession led to a retrospective on the state of the field and some popular attention turned toward heterodox economics.