Municipal Pension Plan AGM

... MPP’s Investment Manager bcIMC is an investment management corporation for BC’s public sector funds and entities ...

... MPP’s Investment Manager bcIMC is an investment management corporation for BC’s public sector funds and entities ...

Exchange Fund Results for 2003

... The reported investment return of 10.2% is computed in US dollar terms in accordance with AIMR Global Investment Performance Standards. The difference between investment return as reported and simple return is attributable primarily to the difference between gross assets at year-end and average inve ...

... The reported investment return of 10.2% is computed in US dollar terms in accordance with AIMR Global Investment Performance Standards. The difference between investment return as reported and simple return is attributable primarily to the difference between gross assets at year-end and average inve ...

Rule of 72

... 72 / 10 years = 7.2% interest Students will need the internet to complete the first two columns of the activity. A variety of websites can be used to find funds and rates, although two resources are listed. Students will use the Rule of 72 to fill in the third column and answer the questions. ...

... 72 / 10 years = 7.2% interest Students will need the internet to complete the first two columns of the activity. A variety of websites can be used to find funds and rates, although two resources are listed. Students will use the Rule of 72 to fill in the third column and answer the questions. ...

Chap2 - John Zietlow

... • The arithmetic mean is the “simple average” of a series of returns. • Calculated by summing all of the returns in the series and dividing by the number of values. RA = (SHPR)/n • Oddly enough, earning the arithmetic mean return for n years is not generally equivalent to the actual amount of money ...

... • The arithmetic mean is the “simple average” of a series of returns. • Calculated by summing all of the returns in the series and dividing by the number of values. RA = (SHPR)/n • Oddly enough, earning the arithmetic mean return for n years is not generally equivalent to the actual amount of money ...

Nedgroup Investments Positive Return Fund

... The fund seeks to offer investors total returns that are in excess of inflation over the medium-term through active asset allocation and with a high emphasis on capital protection. The fund specifically aims not to have negative returns over any 12-month period. The manager may invest in a mix of lo ...

... The fund seeks to offer investors total returns that are in excess of inflation over the medium-term through active asset allocation and with a high emphasis on capital protection. The fund specifically aims not to have negative returns over any 12-month period. The manager may invest in a mix of lo ...

Returns and Statistics

... – Sn= the value you will receive at the end of year n – r = return associated with risk of receiving Sn – n = number of time periods until money is received ...

... – Sn= the value you will receive at the end of year n – r = return associated with risk of receiving Sn – n = number of time periods until money is received ...

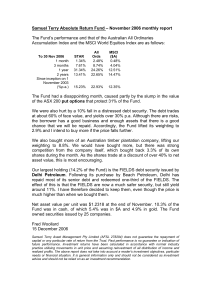

November 2006 - Samuel Terry

... Fund was in cash, of which 5.4% was in $A and 4.9% in gold. The Fund owned securities issued by 25 companies. Fred Woollard 15 December 2006 Samuel Terry Asset Management Pty Limited (AFSL 278294) does not guarantee the repayment of capital or any particular rate of return from the Trust. Past perfo ...

... Fund was in cash, of which 5.4% was in $A and 4.9% in gold. The Fund owned securities issued by 25 companies. Fred Woollard 15 December 2006 Samuel Terry Asset Management Pty Limited (AFSL 278294) does not guarantee the repayment of capital or any particular rate of return from the Trust. Past perfo ...

Investment Opportunities

... Daily activities that are developmentally and age appropriate. Breakfast, lunch, and snack provided daily. Infant and toddler areas separate from others. Outside play area. Drop off from 6:30 AM with pick up at 6:30 PM Monday through Friday State approved and licensed Educational curriculum based in ...

... Daily activities that are developmentally and age appropriate. Breakfast, lunch, and snack provided daily. Infant and toddler areas separate from others. Outside play area. Drop off from 6:30 AM with pick up at 6:30 PM Monday through Friday State approved and licensed Educational curriculum based in ...

Investment Analysis

... Theoretically, people want to translate a future cash flow into an equivalent cash flow today. We rather have a dollar now, than a dollar in the future. This means that a dollar in the future is less than a dollar now. The discount function d(t) indicates how much we are willing to pay for €1 at s ...

... Theoretically, people want to translate a future cash flow into an equivalent cash flow today. We rather have a dollar now, than a dollar in the future. This means that a dollar in the future is less than a dollar now. The discount function d(t) indicates how much we are willing to pay for €1 at s ...

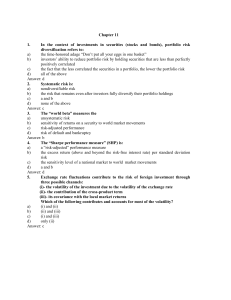

TEST BANK

... The realized dollar returns for a U.S. resident investing in a foreign market will depend on the return in the foreign market as well as on the exchange rate fluctuations between the dollar and the foreign currency. Calculate the variance of the monthly rate of return in dollar terms, if the varianc ...

... The realized dollar returns for a U.S. resident investing in a foreign market will depend on the return in the foreign market as well as on the exchange rate fluctuations between the dollar and the foreign currency. Calculate the variance of the monthly rate of return in dollar terms, if the varianc ...

Stock Return Probabilities - The American Association of Individual

... thors produced tables of the probability of achieving compound annual average rates of return by investing in common stocks over various holdings periods of one to 40 years. Probability tables were developed based on two historical time periods, one covering 1871-1993, which included lower rates of ...

... thors produced tables of the probability of achieving compound annual average rates of return by investing in common stocks over various holdings periods of one to 40 years. Probability tables were developed based on two historical time periods, one covering 1871-1993, which included lower rates of ...

ps2 - uc-davis economics

... Let X and Y represent the rates of return (in percent) on two stocks. You are told that X ~ N(15, 25) and Y ~ N(8, 4), and that the correlation coefficient between the two rates of return is -0.4. Suppose you want to hold the two stocks in your portfolio in equal proportion. [a] What is the probabil ...

... Let X and Y represent the rates of return (in percent) on two stocks. You are told that X ~ N(15, 25) and Y ~ N(8, 4), and that the correlation coefficient between the two rates of return is -0.4. Suppose you want to hold the two stocks in your portfolio in equal proportion. [a] What is the probabil ...