Monetary Policy Fall 2016 (material for last course outline)

... If the Fed wants to stimulate the economy it will inject reserves with open market purchases until the federal funds rate falls to a lower target. If the Fed wants to slow down the economy, it will sell bonds on the open market and drain reserves until the federal funds rate rises to a higher target ...

... If the Fed wants to stimulate the economy it will inject reserves with open market purchases until the federal funds rate falls to a lower target. If the Fed wants to slow down the economy, it will sell bonds on the open market and drain reserves until the federal funds rate rises to a higher target ...

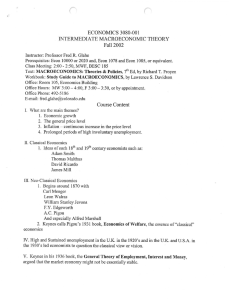

ECON 3080-001 Intermediate Macroeconomic Theory

... 1. Starting in the 1950's Milton Friedman challenges the Keynesian view. 2. Friedman produces a series of theoretical and empirical works which argue against Keynesianism. These ideas are called Monetarism. 3. Friedman predicts in 1967 that high rates of inflation will cause unemployment to mcrease. ...

... 1. Starting in the 1950's Milton Friedman challenges the Keynesian view. 2. Friedman produces a series of theoretical and empirical works which argue against Keynesianism. These ideas are called Monetarism. 3. Friedman predicts in 1967 that high rates of inflation will cause unemployment to mcrease. ...

slides

... short-term rate of interest cannot fall any lower than zero, whereas a negative nominal short-term rate would be needed to achieve full employment. This is no different from Patinkin ...

... short-term rate of interest cannot fall any lower than zero, whereas a negative nominal short-term rate would be needed to achieve full employment. This is no different from Patinkin ...

Impact on Public Sector Finances

... as tax paid direct to the EU, must now be shown as paid to the UK Government and then distributed as a transfer to the EU. This reflects that UK VAT is being used to define the level of a budget payment to the EU, rather than EU VAT being a specific tax on products imposed by the EU. The impact of t ...

... as tax paid direct to the EU, must now be shown as paid to the UK Government and then distributed as a transfer to the EU. This reflects that UK VAT is being used to define the level of a budget payment to the EU, rather than EU VAT being a specific tax on products imposed by the EU. The impact of t ...

Interest Rates

... Another is that OMOs directly influence the interest rate, by affecting the interest rate at the very short end of the yield curve: the “cash” rate. This is the basic block of the yield curve (a plot of interest rates against period of the asset, so that overnight cash rates is one extreme and ten-y ...

... Another is that OMOs directly influence the interest rate, by affecting the interest rate at the very short end of the yield curve: the “cash” rate. This is the basic block of the yield curve (a plot of interest rates against period of the asset, so that overnight cash rates is one extreme and ten-y ...

The Political Economy of Balanced Budget

... 1960s, but their size had increased to 61 percent by 2010 (Figure 2). The composition of spending shifted from temporary to structural expenditures. A balanced budget rule is seen by proponents as a way to limit these expenditures. They argue that reducing debt will result in lower interest rate pay ...

... 1960s, but their size had increased to 61 percent by 2010 (Figure 2). The composition of spending shifted from temporary to structural expenditures. A balanced budget rule is seen by proponents as a way to limit these expenditures. They argue that reducing debt will result in lower interest rate pay ...

Macroeconomic Impact of Public Sector Enterprises: Some

... An analysisof the macroeconomicimpactof public sector enterprises(PSEs)for 1960-61to 1989-90shows. (i) relativelylittle increasein their overalldeficit comparedto the sharp deteriorationof the grossfiscal deficit and (ii) a steep declinein their budgetarydependence.Whilethe PSEs' internalresourcesin ...

... An analysisof the macroeconomicimpactof public sector enterprises(PSEs)for 1960-61to 1989-90shows. (i) relativelylittle increasein their overalldeficit comparedto the sharp deteriorationof the grossfiscal deficit and (ii) a steep declinein their budgetarydependence.Whilethe PSEs' internalresourcesin ...

Chapter 21 : The Monetary Policy and Aggregate Demand Curves

... IS curve slopes downward because as (a) Investment : i ↑ ⇒ cost of borrowing ↑ ⇒ Expected return on Investments ↓ ⇒ I ↓ ⇒ Y ad ↓ ⇒ Y ∗ ↓. (b) Net Export : i ↑ ⇒ Demand for US denominated assets relative to foreign assets ↑ ⇒ Appreciation of $ (E ↑) ⇒ Domestic goods relatively more expensive than for ...

... IS curve slopes downward because as (a) Investment : i ↑ ⇒ cost of borrowing ↑ ⇒ Expected return on Investments ↓ ⇒ I ↓ ⇒ Y ad ↓ ⇒ Y ∗ ↓. (b) Net Export : i ↑ ⇒ Demand for US denominated assets relative to foreign assets ↑ ⇒ Appreciation of $ (E ↑) ⇒ Domestic goods relatively more expensive than for ...

The St~cture of Financial Markets and the Monetary Mechanism

... those monetary assets which possess similar characteristics and functions. Although these redefinitions have resulted, at least for the time being, in a better identification of the quantity of money immediately available as a means of payment (M 1B), their usefulness as indicators or targets of mon ...

... those monetary assets which possess similar characteristics and functions. Although these redefinitions have resulted, at least for the time being, in a better identification of the quantity of money immediately available as a means of payment (M 1B), their usefulness as indicators or targets of mon ...

Advanced Placement Macroeconomics Study Notes

... manufacturing supplies (as opposed to a negative shock to supplies) and, therefore, tend to lead the business cycle. 9. Money supply: In inflation-adjusted dollars, this is the M2 version of the money supply. When the money supply does not keep pace with inflation, bank lending may fall in real term ...

... manufacturing supplies (as opposed to a negative shock to supplies) and, therefore, tend to lead the business cycle. 9. Money supply: In inflation-adjusted dollars, this is the M2 version of the money supply. When the money supply does not keep pace with inflation, bank lending may fall in real term ...

Principles of Macroeconomics, Case/Fair/Oster, 10e

... The AD curve is a useful summary of this analysis in that every point on the curve corresponds to equilibrium in both the goods and money markets for the given value of the price level. We have not yet, however, determined the price level. This is the task of the next chapter. ...

... The AD curve is a useful summary of this analysis in that every point on the curve corresponds to equilibrium in both the goods and money markets for the given value of the price level. We have not yet, however, determined the price level. This is the task of the next chapter. ...

ch17

... Inflation targeting rule is a monetary policy strategy in which the central bank makes a public commitment to achieving an explicit inflation target and to explaining how its policy actions will achieve that target. Of the alternatives to the Fed’s current strategy, inflation targeting is the most l ...

... Inflation targeting rule is a monetary policy strategy in which the central bank makes a public commitment to achieving an explicit inflation target and to explaining how its policy actions will achieve that target. Of the alternatives to the Fed’s current strategy, inflation targeting is the most l ...

Advanced Placement Macroeconomics Study Notes 17th edition of

... manufacturing supplies (as opposed to a negative shock to supplies) and, therefore, tend to lead the business cycle. 9. Money supply: In inflation-adjusted dollars, this is the M2 version of the money supply. When the money supply does not keep pace with inflation, bank lending may fall in real term ...

... manufacturing supplies (as opposed to a negative shock to supplies) and, therefore, tend to lead the business cycle. 9. Money supply: In inflation-adjusted dollars, this is the M2 version of the money supply. When the money supply does not keep pace with inflation, bank lending may fall in real term ...

Fiscal Policy in an Emerging Market Economy Andrés Velasco Harvard University

... its members or spending on a public good that only benefits those in group i. Expenditure can be financed out of a variable stream of revenue or by borrowing in the world capital market. Accumulated debts are a joint liability of all n groups, as would be the case with the national debt in any count ...

... its members or spending on a public good that only benefits those in group i. Expenditure can be financed out of a variable stream of revenue or by borrowing in the world capital market. Accumulated debts are a joint liability of all n groups, as would be the case with the national debt in any count ...

The Thatcher Experiment: The First Two Years

... "a broad balance of power in the framework of collective bargaining"2 (measures to remove specific abuses in picketing and the closed shop) and by other measures aimed at encouraging market forces to work as freely and flexibly as possible (such as the abolition of price, dividend, and exchange cont ...

... "a broad balance of power in the framework of collective bargaining"2 (measures to remove specific abuses in picketing and the closed shop) and by other measures aimed at encouraging market forces to work as freely and flexibly as possible (such as the abolition of price, dividend, and exchange cont ...

DEFICIT

... well known: an increased national debt that must be serviced by distortionary taxes and a reduced volume of capital accumulation. Moreover, when budget deficits raise the level of real interest rates, they thereby increase politi— ...

... well known: an increased national debt that must be serviced by distortionary taxes and a reduced volume of capital accumulation. Moreover, when budget deficits raise the level of real interest rates, they thereby increase politi— ...

MONEY MARKET EQUILIBRIUM IN THE CZECH REPUBLIC

... as food, clothing, housing, or even uncommon expenditures, for example, spending on health care and legal fees. If the price level rises, individual households and firms have to spend more money to buy the usual basket of goods and services. Therefore, to maintain the same level of liquidity as it ...

... as food, clothing, housing, or even uncommon expenditures, for example, spending on health care and legal fees. If the price level rises, individual households and firms have to spend more money to buy the usual basket of goods and services. Therefore, to maintain the same level of liquidity as it ...

Eco220Int Subject Ou.. - CSUSAP

... This subject builds on previous study of the principles of macroeconomics. The focus of the subject is slanted towards understanding the impact of global macroeconomic activity and international finance markets on the domestic economy. Australia can be described as a small open economy. With its adv ...

... This subject builds on previous study of the principles of macroeconomics. The focus of the subject is slanted towards understanding the impact of global macroeconomic activity and international finance markets on the domestic economy. Australia can be described as a small open economy. With its adv ...

Chapter 1

... Analysis of the relationship between the CA and fiscal policy has attracted theoretical as well as empirical attention. There are two major competing theories: the positive association of CA deficit and the government budget deficit, known as the twin deficit hypothesis, derives from the Keynesian t ...

... Analysis of the relationship between the CA and fiscal policy has attracted theoretical as well as empirical attention. There are two major competing theories: the positive association of CA deficit and the government budget deficit, known as the twin deficit hypothesis, derives from the Keynesian t ...

Document

... – Take representative person in each generation, compute present value of all taxes paid. ...

... – Take representative person in each generation, compute present value of all taxes paid. ...

Macroeconomics of the Government Budget: (Things

... Printing money is one way to finance a deficit. So long as the demand for base money is growing, as in a growing economy, governments can print money without raising inflation. If elasticity of money demand is unity, base money could be increased at the same rate as GDP growth. Increasing base money ...

... Printing money is one way to finance a deficit. So long as the demand for base money is growing, as in a growing economy, governments can print money without raising inflation. If elasticity of money demand is unity, base money could be increased at the same rate as GDP growth. Increasing base money ...

An Empirical Analysis of Foreign Exchange Reserves in Emerging

... Over the past few years, the ability of the United States to finance its current account deficit has been facilitated by massive purchases of U.S. Treasury bonds and agency securities by Asian central banks. In this process, Asian central banks have accumulated large stockpiles of U.S.-dollar foreig ...

... Over the past few years, the ability of the United States to finance its current account deficit has been facilitated by massive purchases of U.S. Treasury bonds and agency securities by Asian central banks. In this process, Asian central banks have accumulated large stockpiles of U.S.-dollar foreig ...

fgfdgfd

... States. On the other hand, Burdekin and Wohar (1990) indicate that in the United States, deficits that are not monetized negatively affect inflation in the short-run. In Greece, Hondroyiannis and Papapetrou (1994) showed that the direction of causality between the price and public budget is bidirect ...

... States. On the other hand, Burdekin and Wohar (1990) indicate that in the United States, deficits that are not monetized negatively affect inflation in the short-run. In Greece, Hondroyiannis and Papapetrou (1994) showed that the direction of causality between the price and public budget is bidirect ...

Chapter 14

... The government budget equation (14.2) has a stable steady state if the interest rate is lower than the growth rate of nominal GDP. This is consistent with U.S. data before 1979. In this case, the national debt would eventually have converged to a steady state level, and a small positive primary de ...

... The government budget equation (14.2) has a stable steady state if the interest rate is lower than the growth rate of nominal GDP. This is consistent with U.S. data before 1979. In this case, the national debt would eventually have converged to a steady state level, and a small positive primary de ...