Available-for-Sale Securities

... The percent of the investee’s outstanding stock purchased by the investor determines the degree of control that the investor has over the investee. This, in turn, determines the accounting method used to record the stock investment. The percent of the investee’s outstanding stock purchased by the in ...

... The percent of the investee’s outstanding stock purchased by the investor determines the degree of control that the investor has over the investee. This, in turn, determines the accounting method used to record the stock investment. The percent of the investee’s outstanding stock purchased by the in ...

EVA VERSUS TRADITIONAL ACCOUNTING MEASURES OF

... Grant studied the relationship between MVA divided by capital and EVA divided by capital for 983 companies selected from the Stern Stewart Performance 1000 for 1993 and 1994. The results for 1993 showed a correlation of 32% for all the companies. For the 50 largest US wealth creators, the correlatio ...

... Grant studied the relationship between MVA divided by capital and EVA divided by capital for 983 companies selected from the Stern Stewart Performance 1000 for 1993 and 1994. The results for 1993 showed a correlation of 32% for all the companies. For the 50 largest US wealth creators, the correlatio ...

Securities Trading Floor Monthly Reports (April

... The objective of the seminar was to sensitize the public on the ways in which, a good corporate governance culture could best be promoted within companies and other organizations. This is important for companies with plans to ‘go public’ in terms of internal restructuring as this has a relevance for ...

... The objective of the seminar was to sensitize the public on the ways in which, a good corporate governance culture could best be promoted within companies and other organizations. This is important for companies with plans to ‘go public’ in terms of internal restructuring as this has a relevance for ...

OCTAGON 88 RESOURCES, INC.

... Other long-lived assets – Property and equipment are stated at cost less accumulated depreciation computed principally using accelerated methods over the estimated useful lives of the assets. Repairs are charged to expense as incurred. Impairment of long-lived assets is recognized when the fair valu ...

... Other long-lived assets – Property and equipment are stated at cost less accumulated depreciation computed principally using accelerated methods over the estimated useful lives of the assets. Repairs are charged to expense as incurred. Impairment of long-lived assets is recognized when the fair valu ...

Announcement: Asian Growth Properties Limited

... may not wish to hold the AGP Shares, the Offeror, as a means to provide enhanced liquidity in the AGP Shares to be received by the qualifying SEA Shareholders, intends to make a voluntary Share Exchange Offer to the qualifying Shareholders (both existing and arising as a result of the Distribution i ...

... may not wish to hold the AGP Shares, the Offeror, as a means to provide enhanced liquidity in the AGP Shares to be received by the qualifying SEA Shareholders, intends to make a voluntary Share Exchange Offer to the qualifying Shareholders (both existing and arising as a result of the Distribution i ...

Institutional Investors and Corporate Behavior

... many empirical studies fail to find a correlation between performance (that is, return on equity, assets, or excess returns) and current or lagged values of institutional ownership, or ownership by institutions that have submitted shareholder proposals (see, for example, Daily, Johnson, Ellstrand, a ...

... many empirical studies fail to find a correlation between performance (that is, return on equity, assets, or excess returns) and current or lagged values of institutional ownership, or ownership by institutions that have submitted shareholder proposals (see, for example, Daily, Johnson, Ellstrand, a ...

VC – Sample Term Sheet

... subject to a one-year non-compete and non-solicitation agreement. The Company may choose to waive its rights related to this non-competition agreement on a case-by-case basis. ...

... subject to a one-year non-compete and non-solicitation agreement. The Company may choose to waive its rights related to this non-competition agreement on a case-by-case basis. ...

What is Preference Shares - Oman College of Management

... Aright issue is a cheapest form of raising finance. It is an issue in which the existing shareholders have a pre emptive right to subscribe for new shares. In right issue no prospectus is issued or offer for sale of shares is made; instead, existing equity shareholders are given the rights certifi ...

... Aright issue is a cheapest form of raising finance. It is an issue in which the existing shareholders have a pre emptive right to subscribe for new shares. In right issue no prospectus is issued or offer for sale of shares is made; instead, existing equity shareholders are given the rights certifi ...

Shareholder Resolutions on Lobbying 2016

... at the Securities and Exchange Commission (SEC) to require disclosure of corporate political spending has received a record level of support. More than 1.2 million comment letters have been submittedthe vast majority in support of the proposed rule. Moreover, according to a 2015 survey, a majority ...

... at the Securities and Exchange Commission (SEC) to require disclosure of corporate political spending has received a record level of support. More than 1.2 million comment letters have been submittedthe vast majority in support of the proposed rule. Moreover, according to a 2015 survey, a majority ...

Transcript

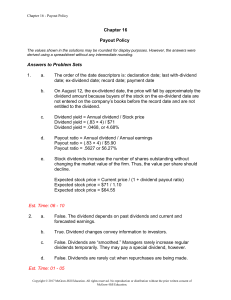

... stock dividend where shareholders get additional stock based upon their current level of ownership. For example, let us say a company declared a stock dividend of 1 share for every 4 shares someone owns. We call this a “pro rata” distribution. This dividend distribution results in a decrease in reta ...

... stock dividend where shareholders get additional stock based upon their current level of ownership. For example, let us say a company declared a stock dividend of 1 share for every 4 shares someone owns. We call this a “pro rata” distribution. This dividend distribution results in a decrease in reta ...

Commissioner`s Statement CS 17/01

... All methods should take into account the diluting effect of issuing new shares to employees, particularly if using Option B. Example: Company A has previously issued 1m shares to non-associated third parties for $1m. Subsequently, Company A issues 100,000 new shares to employees for no consideration ...

... All methods should take into account the diluting effect of issuing new shares to employees, particularly if using Option B. Example: Company A has previously issued 1m shares to non-associated third parties for $1m. Subsequently, Company A issues 100,000 new shares to employees for no consideration ...

Global Intangible Financial Tracker 2016 An annual

... entity and sold, transferred or licensed) or it must arise from contractual or legal rights (Irrespective of whether those rights are themselves ‘separable’). Therefore, intangible assets that may be recognised on a balance sheet under IFRS are only a fraction of what are often considered to be ‘int ...

... entity and sold, transferred or licensed) or it must arise from contractual or legal rights (Irrespective of whether those rights are themselves ‘separable’). Therefore, intangible assets that may be recognised on a balance sheet under IFRS are only a fraction of what are often considered to be ‘int ...

Daniels Corporate Advisory Company, Inc. (Form: 10

... requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results c ...

... requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results c ...

chapter 1

... Under current tax law, and the assumption that capital gains taxes cannot be deferred, all investors should be indifferent with the exception of the corporation. Corporations prefer cash dividends because they pay corporate income tax on only 30 percent of dividends received, lowering their effectiv ...

... Under current tax law, and the assumption that capital gains taxes cannot be deferred, all investors should be indifferent with the exception of the corporation. Corporations prefer cash dividends because they pay corporate income tax on only 30 percent of dividends received, lowering their effectiv ...

PROFIT and Its Theories

... • (i) Profit is rental in character. Just as superior grades of land earn more rent than the inferior grades of land, similarly superior entrepreneurs due to their exceptional ability or opportunity earn more profits than the inferior entrepreneurs. • (ii) As in the case of land, there is a no-rent ...

... • (i) Profit is rental in character. Just as superior grades of land earn more rent than the inferior grades of land, similarly superior entrepreneurs due to their exceptional ability or opportunity earn more profits than the inferior entrepreneurs. • (ii) As in the case of land, there is a no-rent ...

Jayne Elizabeth Zanglein - The Texas Tech University School of

... rule. This rule requires fiduciaries to act solely in the interest of plan participants and beneficiaries and for the exclusive purpose of providing plan benefits and defraying reasonable .expenses of plan administration. 30 Fiduciaries must act "with an eye single to the interests of the participan ...

... rule. This rule requires fiduciaries to act solely in the interest of plan participants and beneficiaries and for the exclusive purpose of providing plan benefits and defraying reasonable .expenses of plan administration. 30 Fiduciaries must act "with an eye single to the interests of the participan ...

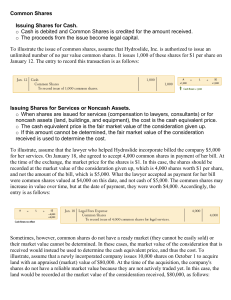

Common Shares

... to a new shareholders' equity account for the contributed capital from the reacquisition of the shares. The balance in this account is reported as contributed capital in the shareholders' equity section of the balance sheet, along with the share capital, to indicate the total capital contributed by ...

... to a new shareholders' equity account for the contributed capital from the reacquisition of the shares. The balance in this account is reported as contributed capital in the shareholders' equity section of the balance sheet, along with the share capital, to indicate the total capital contributed by ...

Schedule 14D-9 - Piedmont Office Realty Trust, Inc.

... not expect a significant market in the Class B common stock to develop. The Company’s Board of Directors believes the Charter Amendment may minimize concentrated sales of the Company’s stock at the time of the listing that could depress the trading price of the Company’s common stock. The Board of D ...

... not expect a significant market in the Class B common stock to develop. The Company’s Board of Directors believes the Charter Amendment may minimize concentrated sales of the Company’s stock at the time of the listing that could depress the trading price of the Company’s common stock. The Board of D ...

faculty of business - MacSphere

... the country into two major cultures is recognized in many st udies that attempt to isolate differences in consumption behavior within Canada (see Kindra, Laroche & Muller, in press, chap. 8; Lawrence, Shapiro & Lalji, 1986; ...

... the country into two major cultures is recognized in many st udies that attempt to isolate differences in consumption behavior within Canada (see Kindra, Laroche & Muller, in press, chap. 8; Lawrence, Shapiro & Lalji, 1986; ...

Enterprise Risk Management

... An acknowledged and deep understanding of how risks can affect organisations (companies, government, social systems and others). Renowned training in the modelling and quantification of financial risks to provide a sound technical foundation to the broader understanding of risk. Understanding of the ...

... An acknowledged and deep understanding of how risks can affect organisations (companies, government, social systems and others). Renowned training in the modelling and quantification of financial risks to provide a sound technical foundation to the broader understanding of risk. Understanding of the ...

Decomposing the Value of Word-of

... (played by James Stewart) by showing him what life in his town would have been like had he never existed. The message is that only in someone’s absence can we really appreciate his or her value. We suggest an analogous premise for assessing the customers’ social value: Assume that a customer in a so ...

... (played by James Stewart) by showing him what life in his town would have been like had he never existed. The message is that only in someone’s absence can we really appreciate his or her value. We suggest an analogous premise for assessing the customers’ social value: Assume that a customer in a so ...

Introduction to Share Buyback Valuation

... its current market price and holding the shares for eternity is called the value yield and is estimated using Monte Carlo simulation in [7]. For the S&P 500 index the estimated mean value yield is which is calculated from the current P/Book of the S&P 500 index. For the period 1984-2011 the mean val ...

... its current market price and holding the shares for eternity is called the value yield and is estimated using Monte Carlo simulation in [7]. For the S&P 500 index the estimated mean value yield is which is calculated from the current P/Book of the S&P 500 index. For the period 1984-2011 the mean val ...

One Share, One Vote and the False Promise of Shareholder

... theory envisions. Instead, shareholders are likely to have a variety of interests that can potentially compete with their interests as shareholders. In addition, even shareholders who have no other financial interests may still have different views on how best to maximize shareholder wealth or their ...

... theory envisions. Instead, shareholders are likely to have a variety of interests that can potentially compete with their interests as shareholders. In addition, even shareholders who have no other financial interests may still have different views on how best to maximize shareholder wealth or their ...

CHAPTER 7 STRATEGIC ACQUISITION AND

... Provide enough additional financial resources so that profitable projects may be capitalized upon rather than forgone ...

... Provide enough additional financial resources so that profitable projects may be capitalized upon rather than forgone ...

? WHY ARE STOCKS SO RISKY Introduction

... Stock prices respond both to prevailing economic conditions and to perceptions of future conditions. Consequently, both the average rate of appreciation and the variation of stock prices shift as economic conditions change, sometimes by considerable amounts.4 During economic booms and busts, periods ...

... Stock prices respond both to prevailing economic conditions and to perceptions of future conditions. Consequently, both the average rate of appreciation and the variation of stock prices shift as economic conditions change, sometimes by considerable amounts.4 During economic booms and busts, periods ...