Competition prizes Prize summary Co

... 1st prize: 1 winner only Co-funding to the amount the winner managed to raise elsewhere within the competition period. Our matched funding will be up to a maximum value of $200k in total cash and non-cash prizes. Entrepreneurship visa is offered to entrepreneurship visa entrant if the applicatio ...

... 1st prize: 1 winner only Co-funding to the amount the winner managed to raise elsewhere within the competition period. Our matched funding will be up to a maximum value of $200k in total cash and non-cash prizes. Entrepreneurship visa is offered to entrepreneurship visa entrant if the applicatio ...

Essay on Agent-Principal Conflicts in Corporations

... avoid the scrutiny associated with the security issuance process: due diligence, rating agencies, protective covenants, prospectuses, and so on. When a company obtains external funds, new security holders will want their questions answered before committing money. This process creates an additional ...

... avoid the scrutiny associated with the security issuance process: due diligence, rating agencies, protective covenants, prospectuses, and so on. When a company obtains external funds, new security holders will want their questions answered before committing money. This process creates an additional ...

Land Valuation - Universitas Brawijaya

... Value theory Background factors: The Swedish Hand-book Fastighetsvärdering (Real Estate Valuation): ...

... Value theory Background factors: The Swedish Hand-book Fastighetsvärdering (Real Estate Valuation): ...

Economic impact assessment

... An option has value which is higher the higher the uncertainty Offshore oil exploration is an options play ...

... An option has value which is higher the higher the uncertainty Offshore oil exploration is an options play ...

FREE Sample Here - We can offer most test bank and

... unless it increases the prospect of bankruptcy. Systematic risk, the risk of the market in general, cannot be eliminated. Corporate Wealth Maximization (CWM) firms define risk in a much more qualitative sense. The term “patient capital” is sometimes used to imply that only performance over a very lo ...

... unless it increases the prospect of bankruptcy. Systematic risk, the risk of the market in general, cannot be eliminated. Corporate Wealth Maximization (CWM) firms define risk in a much more qualitative sense. The term “patient capital” is sometimes used to imply that only performance over a very lo ...

prognoses - Sid Klein Global Strategy

... good prospects. Value stocks are often unpopular, out of favour companies with some sort of perceived problem that makes them unattractive to most investors. Conversely, growth stocks are popular companies, priced at a premium for their anticipated exceptional earnings growth. While popularity can a ...

... good prospects. Value stocks are often unpopular, out of favour companies with some sort of perceived problem that makes them unattractive to most investors. Conversely, growth stocks are popular companies, priced at a premium for their anticipated exceptional earnings growth. While popularity can a ...

Document

... Product life cycle - more than 2 years Contribution to overheads - 5 to 20 % Product variety - low Forecasting error - 10% Mean stockout rate - 1 to 2% End of sale mark down – not relevant ...

... Product life cycle - more than 2 years Contribution to overheads - 5 to 20 % Product variety - low Forecasting error - 10% Mean stockout rate - 1 to 2% End of sale mark down – not relevant ...

- Distribly

... c. If you were asked to respond to complete parts a. and b. as part of a training exercise, what could you tell your boss about the company’s financial condition based on your answers? ...

... c. If you were asked to respond to complete parts a. and b. as part of a training exercise, what could you tell your boss about the company’s financial condition based on your answers? ...

DIRECTIVE - Financial Services Board

... In this directive, unless the context indicates otherwise: “Act” means the Short-term Insurance Act, 1998 (Act No. 53 of 1998), and a word or expression to which a meaning has been given in the Act, has that meaning; “capital requirement”, in relation to a regulated financial institution, means the ...

... In this directive, unless the context indicates otherwise: “Act” means the Short-term Insurance Act, 1998 (Act No. 53 of 1998), and a word or expression to which a meaning has been given in the Act, has that meaning; “capital requirement”, in relation to a regulated financial institution, means the ...

The Arguments Against Business Ethics

... that there should be a law against it, and that they should act as if there were one. But conversely, it also shows that if there is not a law against it, it is quite all right. The law's prohibitions do not exhaust the prohibitions of morality. The businessman who takes not a simpliste view of law, ...

... that there should be a law against it, and that they should act as if there were one. But conversely, it also shows that if there is not a law against it, it is quite all right. The law's prohibitions do not exhaust the prohibitions of morality. The businessman who takes not a simpliste view of law, ...

Chapter 2

... • The SWM model assumes that the stock market is efficient. • An equity share price is always correct because it captures all the expectations of return and risk as perceived by investors, quickly incorporating new information into the share price. • Share prices are, in turn, the best allocators of ...

... • The SWM model assumes that the stock market is efficient. • An equity share price is always correct because it captures all the expectations of return and risk as perceived by investors, quickly incorporating new information into the share price. • Share prices are, in turn, the best allocators of ...

First Quarter 2016 Newsletter Commentary

... The last period of value underperformance started in March 2007 reflecting the U.S. housing collapse and subsequent financial crisis. Aggressive monetary and fiscal intervention provided massive liquidity to unfreeze the financial system and stimulus to mitigate a collapse in aggregate demand. Unnat ...

... The last period of value underperformance started in March 2007 reflecting the U.S. housing collapse and subsequent financial crisis. Aggressive monetary and fiscal intervention provided massive liquidity to unfreeze the financial system and stimulus to mitigate a collapse in aggregate demand. Unnat ...

CHAPTER 20 Hybrid Financing: Preferred Stock, Leasing

... In a lease analysis, at what discount rate should cash flows be discounted? Since cash flows in a lease analysis are evaluated on an after-tax basis, we should use the after-tax cost of borrowing. Previously, we were told the cost of debt, kd, was 10%. Therefore, we should discount cash flows a ...

... In a lease analysis, at what discount rate should cash flows be discounted? Since cash flows in a lease analysis are evaluated on an after-tax basis, we should use the after-tax cost of borrowing. Previously, we were told the cost of debt, kd, was 10%. Therefore, we should discount cash flows a ...

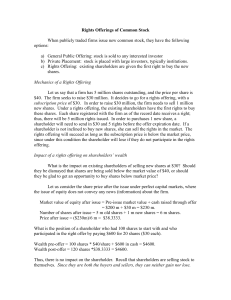

Rights Offerings of Common Stock

... discount in the subscription price compared to the market price. Value of one right What is the market value of 1 right? Five rights have a value of $8.3333, since they allow an investor to buy a share that is going to be worth $38.3333 for $30. Hence the value of 1 right is $8.3333/5 = $1.6667. Eve ...

... discount in the subscription price compared to the market price. Value of one right What is the market value of 1 right? Five rights have a value of $8.3333, since they allow an investor to buy a share that is going to be worth $38.3333 for $30. Hence the value of 1 right is $8.3333/5 = $1.6667. Eve ...

Price/Book and Price/Sales Ratios

... a. They're less subject to accounting manipulation. b. They both give a truer picture of how profitable a company is. c. They're better predictors of where the stock's price is going. 2. What is one disadvantage to using book value in a valuation measure? a. It doesn't reflect the changing value of ...

... a. They're less subject to accounting manipulation. b. They both give a truer picture of how profitable a company is. c. They're better predictors of where the stock's price is going. 2. What is one disadvantage to using book value in a valuation measure? a. It doesn't reflect the changing value of ...

Value Chain Strategies

... Value Chain Strategies Facts To Consider Studies show that most Organizations spend 7-10X more time analyzing financial and operational performance, than they spend analyzing and understanding their customer’s business model. (Spend more time on internal issues than external issues) ...

... Value Chain Strategies Facts To Consider Studies show that most Organizations spend 7-10X more time analyzing financial and operational performance, than they spend analyzing and understanding their customer’s business model. (Spend more time on internal issues than external issues) ...

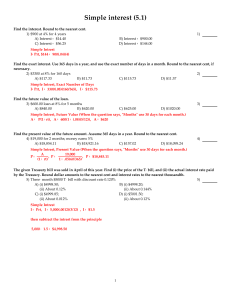

Simple interest (5.1)

... C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity due, it also says present value. The wording on this type of question is not as clear as the prior question.) You may have a simular but different answer due to rounding errors unless you keep the ...

... C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity due, it also says present value. The wording on this type of question is not as clear as the prior question.) You may have a simular but different answer due to rounding errors unless you keep the ...

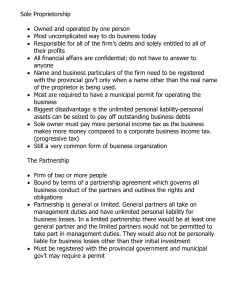

Sole Proprietorship - hrsbstaff.ednet.ns.ca

... Another disadvantage is the personal incentive of its employees (managers etc) is not as strong as the owner of the corporation. To try and solve this they offer stock options, profit sharing, performance bonuses etc. The Co-operative Enterprise ...

... Another disadvantage is the personal incentive of its employees (managers etc) is not as strong as the owner of the corporation. To try and solve this they offer stock options, profit sharing, performance bonuses etc. The Co-operative Enterprise ...

fact sheet

... Business model: Our ownership interests are concentrated on key Norwegian industries that are international in scope and of which we have in-depth knowledge: oil and gas, seafood & marine biotechnology, and maritime assets. Through our participation on the board of directors, Aker drives operational ...

... Business model: Our ownership interests are concentrated on key Norwegian industries that are international in scope and of which we have in-depth knowledge: oil and gas, seafood & marine biotechnology, and maritime assets. Through our participation on the board of directors, Aker drives operational ...

Corporate Finance - Yossi Spiegel Problem set 2 Problem 1 This

... invests, the firm knows the exact realization of z (and hence its cash flow if it invests). If the firm does not invest at date 1, then its cash flow at date 2 is X. (a) ...

... invests, the firm knows the exact realization of z (and hence its cash flow if it invests). If the firm does not invest at date 1, then its cash flow at date 2 is X. (a) ...

Knott The Trillion-Dollar RD Fix

... alignment and culture, let alone link them to profitability or market value. R&D is thus an easy target when firms face quarterly earnings pressure. Since it is expensed rather than capitalized, cuts yield immediate increases in profit, while the detrimental impact of those cuts aren’t felt for a fe ...

... alignment and culture, let alone link them to profitability or market value. R&D is thus an easy target when firms face quarterly earnings pressure. Since it is expensed rather than capitalized, cuts yield immediate increases in profit, while the detrimental impact of those cuts aren’t felt for a fe ...

eagle us large cap value 1q 2017

... Eagle Asset Management, Inc. is an investment adviser registered with the Securities and Exchange Commission and is engaged in providing discretionary management services to client accounts. Founded in 1976, Eagle Asset Management provides institutional and individual investors with a broad array of ...

... Eagle Asset Management, Inc. is an investment adviser registered with the Securities and Exchange Commission and is engaged in providing discretionary management services to client accounts. Founded in 1976, Eagle Asset Management provides institutional and individual investors with a broad array of ...

info.cba.ksu.edu

... long term shareholders due to the compensation structure and high levels of stock ownership. • Managers’ personal success closely tied to that of the company. ...

... long term shareholders due to the compensation structure and high levels of stock ownership. • Managers’ personal success closely tied to that of the company. ...