Reference Value of Customer Relationships

... 1998). Customer relationships can be considered as one of the key sources of competitive advantage as, besides revenues, they can generate new technologies, market access, and critical information for suppliers (Anderson, Håkansson, and Johanson, 1994; Biggeman and Buttle, 2005; Walter, 1999; Walter ...

... 1998). Customer relationships can be considered as one of the key sources of competitive advantage as, besides revenues, they can generate new technologies, market access, and critical information for suppliers (Anderson, Håkansson, and Johanson, 1994; Biggeman and Buttle, 2005; Walter, 1999; Walter ...

Chapter 1 - Universidade do Minho

... Shareholders vote for the board of directors, who in turn hire the management team. Contracts can be carefully constructed to be incentive compatible. There is a market for managerial talent—this may provide market discipline to the managers—they can be replaced. If the managers fail to maximize sha ...

... Shareholders vote for the board of directors, who in turn hire the management team. Contracts can be carefully constructed to be incentive compatible. There is a market for managerial talent—this may provide market discipline to the managers—they can be replaced. If the managers fail to maximize sha ...

Value Creation in Private Equity

... Note: Average (mean) value creation across 701 deals. Combo I is the combination of EBITDA and Multiple, Combo II is the combination of Sales and Margin ...

... Note: Average (mean) value creation across 701 deals. Combo I is the combination of EBITDA and Multiple, Combo II is the combination of Sales and Margin ...

Tips for Startups – Understanding Debt vs. Equity

... Preferred shares are the favoured form of equity for most sophisticated investors, whether venture capital firms, other institutional investors, or just those savvy in the modern realm of investment. Preferred shares are the most common form of security sold in a private company financing, particula ...

... Preferred shares are the favoured form of equity for most sophisticated investors, whether venture capital firms, other institutional investors, or just those savvy in the modern realm of investment. Preferred shares are the most common form of security sold in a private company financing, particula ...

Bankruptcy and Firm Value

... discouraged from working for such firms. Loss of Receivables: Firms in bankruptcy might be distracted and be less able to collect from trade debtors. Ordinarily, customers would pay in order to continue being able to do business with the firm – if a firm is in bankruptcy, this is less of an incentiv ...

... discouraged from working for such firms. Loss of Receivables: Firms in bankruptcy might be distracted and be less able to collect from trade debtors. Ordinarily, customers would pay in order to continue being able to do business with the firm – if a firm is in bankruptcy, this is less of an incentiv ...

session 1 ppt

... some selling. But the aim of marketing is to make selling superfluous. The aim of marketing is to know and understand the customer so well that the product or service fits him and sells itself. Ideally, marketing should result in a customer who is ready to buy. All that should be needed is to make t ...

... some selling. But the aim of marketing is to make selling superfluous. The aim of marketing is to know and understand the customer so well that the product or service fits him and sells itself. Ideally, marketing should result in a customer who is ready to buy. All that should be needed is to make t ...

Chapter 5 The Time Value of Money

... This comes in two forms: grants of restricted stock awarded under incentive plans, and stock options, for which if the company’s stock price goes above a certain level, the executive gets the right to buy the stock at a fixed lower price, referred to as the exercise or strike price. The idea behind ...

... This comes in two forms: grants of restricted stock awarded under incentive plans, and stock options, for which if the company’s stock price goes above a certain level, the executive gets the right to buy the stock at a fixed lower price, referred to as the exercise or strike price. The idea behind ...

CF072M

... “Summary of key financial ratios during the track record period” (Checklist V.D.); (ii) exclude all exceptional items which did not generate from the ordinary and usual course of business for comparison purpose; and (iii) for listing applicant which engages in more than one principal business, discl ...

... “Summary of key financial ratios during the track record period” (Checklist V.D.); (ii) exclude all exceptional items which did not generate from the ordinary and usual course of business for comparison purpose; and (iii) for listing applicant which engages in more than one principal business, discl ...

The empirical study of ownership structure and performance of listed

... forward to provide a new train of thought and a new solution for evaluating banks, and it is a indicator of economic value after adjusting the profit. It can accurately reflect the value for shareholders created by company in a certain period. EVA is actually the economic profit evaluation of enterp ...

... forward to provide a new train of thought and a new solution for evaluating banks, and it is a indicator of economic value after adjusting the profit. It can accurately reflect the value for shareholders created by company in a certain period. EVA is actually the economic profit evaluation of enterp ...

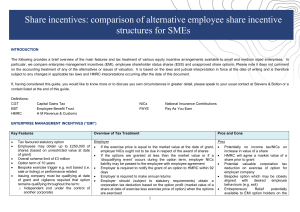

comparison of employee share incentive structures for SMEs

... The following provides a brief overview of the main features and tax treatment of various equity incentive arrangements available to small and medium sized enterprises. In particular, we compare enterprise management incentives (EMI), employee shareholder status shares (ESS) and unapproved share opt ...

... The following provides a brief overview of the main features and tax treatment of various equity incentive arrangements available to small and medium sized enterprises. In particular, we compare enterprise management incentives (EMI), employee shareholder status shares (ESS) and unapproved share opt ...

Beyond Shareholder Value: Normative Standards for Sustainable

... America was formed in 1587.17 In England, formal chartering of a jointstock company required special permission by the Crown or an act of Parliament. 8 Typical of the joint-stock companies formed during this time was the East India Company, chartered by Queen Elizabeth in 1600, granting a monopoly t ...

... America was formed in 1587.17 In England, formal chartering of a jointstock company required special permission by the Crown or an act of Parliament. 8 Typical of the joint-stock companies formed during this time was the East India Company, chartered by Queen Elizabeth in 1600, granting a monopoly t ...

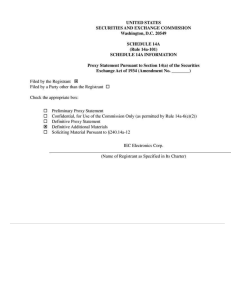

IEC ELECTRONICS CORP (Form: DEFA14A

... 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (1) Proposed maximum aggregate value of transaction: (2) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 ...

... 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (1) Proposed maximum aggregate value of transaction: (2) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 ...

Firm Value

... MM’s propositions suggest that debt policy should not matter. However, in reality, debt matters a lot, and financial managers spend a great deal of their time worrying about the optimal debt to equity ratio for their firm. Which leads to a critical question: What is wrong with MM’s theory? copyright ...

... MM’s propositions suggest that debt policy should not matter. However, in reality, debt matters a lot, and financial managers spend a great deal of their time worrying about the optimal debt to equity ratio for their firm. Which leads to a critical question: What is wrong with MM’s theory? copyright ...

diluting - McGraw Hill Higher Education

... that the conversion option finishes out-of-the-money, but the firm would have been even better off selling equity when the price was high. • But if the stock price does well, the firm is better off issuing convertible debt rather than equity. • In an efficient financial market, convertible bonds wil ...

... that the conversion option finishes out-of-the-money, but the firm would have been even better off selling equity when the price was high. • But if the stock price does well, the firm is better off issuing convertible debt rather than equity. • In an efficient financial market, convertible bonds wil ...

Shearman & Sterling - NYU Stern School of Business

... Shares of Eastman Kodak rose 75 cents yesterday, closing at $47.50 on the New York Stock Exchange. Samuel D. Isaly an analyst , said the announcement was “very good for Sanofi and very good for Kodak.” “When the divestitures are complete, Kodak will be entirely focused on imaging,” said George M. C. ...

... Shares of Eastman Kodak rose 75 cents yesterday, closing at $47.50 on the New York Stock Exchange. Samuel D. Isaly an analyst , said the announcement was “very good for Sanofi and very good for Kodak.” “When the divestitures are complete, Kodak will be entirely focused on imaging,” said George M. C. ...

CHAPTER THIRTEEN

... Here is a particular scam to watch for. Management exercise stock options (at less than market price). The increased number of shares from the issue will reduce eps, for dilution of earnings occurs when shares are issued at less than market price. So the firm repurchases stock to maintain eps growth ...

... Here is a particular scam to watch for. Management exercise stock options (at less than market price). The increased number of shares from the issue will reduce eps, for dilution of earnings occurs when shares are issued at less than market price. So the firm repurchases stock to maintain eps growth ...

Chapter 13 - Corporate Financing and Market Efficiency (pages 321

... Therefore, the important decisions for the firm are those that affect the asset side of the balance sheet - such as project selection/rejection. Firm value cannot be increased by the financing decision. The above statements are valid at time 0. But, at a future point in time, one decision is likely ...

... Therefore, the important decisions for the firm are those that affect the asset side of the balance sheet - such as project selection/rejection. Firm value cannot be increased by the financing decision. The above statements are valid at time 0. But, at a future point in time, one decision is likely ...

AGM Notice - Argo Group Limited

... the number of shares in relation to which they are authorised to act as your proxy (which, in aggregate, should not exceed the number of shares held by you). Please also indicate if the proxy instruction is one of multiple instructions being given. All forms must be signed and should be returned tog ...

... the number of shares in relation to which they are authorised to act as your proxy (which, in aggregate, should not exceed the number of shares held by you). Please also indicate if the proxy instruction is one of multiple instructions being given. All forms must be signed and should be returned tog ...

SVP-SV and Rising Interest Rates.indd

... performance of a stable value fund using yield changes as implied by the current forward Treasury yield curve. While this analysis is simplistic in market assumptions, it provides a reasonable scenario of expected changes in market interest rates and how stable value could subsequently perform over ...

... performance of a stable value fund using yield changes as implied by the current forward Treasury yield curve. While this analysis is simplistic in market assumptions, it provides a reasonable scenario of expected changes in market interest rates and how stable value could subsequently perform over ...

Compensation Best Practices Overview

... good results over several years without assuming unnecessarily high risk.” ...

... good results over several years without assuming unnecessarily high risk.” ...

Squeeze-out – Sell-out a significant reform to come.

... registered office, One Silk Street, London EC2Y 8HQ or on www.linklaters.com and such persons are either solicitors, registered foreign lawyers or European lawyers. Please refer to www.linklaters.com/regulation for important information on our regulatory position. We currently hold your contact deta ...

... registered office, One Silk Street, London EC2Y 8HQ or on www.linklaters.com and such persons are either solicitors, registered foreign lawyers or European lawyers. Please refer to www.linklaters.com/regulation for important information on our regulatory position. We currently hold your contact deta ...

Solutions to Chapter 1

... and compute n = 24. Therefore, the solution is n = 24 months, or 2 years. The effective annual rate on the loan is: (1.01)12 1 = 0.1268 = 12.68% ...

... and compute n = 24. Therefore, the solution is n = 24 months, or 2 years. The effective annual rate on the loan is: (1.01)12 1 = 0.1268 = 12.68% ...

Chapter 9 The Economics of Valuation

... The value of an asset is the risk adjusted presented value of all future net benefits. Whether or not the market price of an asset will always reflect its value is a source of contention among market participants and academics that study financial markets. Some participants and academics believe tha ...

... The value of an asset is the risk adjusted presented value of all future net benefits. Whether or not the market price of an asset will always reflect its value is a source of contention among market participants and academics that study financial markets. Some participants and academics believe tha ...