A Model of Capital and Crises Zhiguo He Arvind Krishnamurthy May 2011

... constraint. Consider a given state, described by the specialists’ wealth Wt and the households’ wealth Wth . The capital constraint requires that the household can invest at most mWt (which may be less than Wth ) in intermediaries as outside equity capital. Thus, intermediaries have total capital of ...

... constraint. Consider a given state, described by the specialists’ wealth Wt and the households’ wealth Wth . The capital constraint requires that the household can invest at most mWt (which may be less than Wth ) in intermediaries as outside equity capital. Thus, intermediaries have total capital of ...

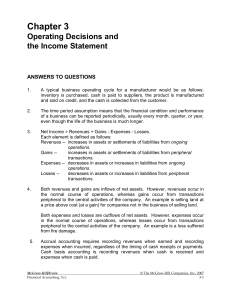

Considering the effects of operating lease capitalization on

... draft on leases which introduces significant changes in the way operating leases should be recognized and measured in the fi nancial statements. This draft was issued in August 2010 and, at the moment, it is under discussion. A preliminary document was issued by IASB and FASB in March 2009 «Leasings ...

... draft on leases which introduces significant changes in the way operating leases should be recognized and measured in the fi nancial statements. This draft was issued in August 2010 and, at the moment, it is under discussion. A preliminary document was issued by IASB and FASB in March 2009 «Leasings ...

long-term portfolio guide - Responsible Investment Association

... owners...Action must start with [them]. If they adopt investment strategies aimed at maximizing long-term results, then other key players—asset managers, corporate boards, and company executives—will likely follow suit”.2 In a recent survey of public and private pension plans and sovereign-wealth fu ...

... owners...Action must start with [them]. If they adopt investment strategies aimed at maximizing long-term results, then other key players—asset managers, corporate boards, and company executives—will likely follow suit”.2 In a recent survey of public and private pension plans and sovereign-wealth fu ...

Corruption`s Impact on Liquidity, Investment

... government involvement should have an adverse effect on a nation’s liquidity, foreign investment, and should also increase the cost of equity. The trade-off between the development and political aspects of corruption, as well as the differential abilities of domestic and foreign institutional inves ...

... government involvement should have an adverse effect on a nation’s liquidity, foreign investment, and should also increase the cost of equity. The trade-off between the development and political aspects of corruption, as well as the differential abilities of domestic and foreign institutional inves ...

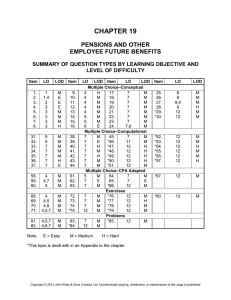

chapter study objectives

... 8. Account for defined benefit plans with benefits that vest or accumulate other than pension plans. Under ASPE, any non-pension defined benefit plans with benefits that vest or accumulate are accounted for in the same way as defined benefit pension plans. Under IFRS, short-term employee benefits ar ...

... 8. Account for defined benefit plans with benefits that vest or accumulate other than pension plans. Under ASPE, any non-pension defined benefit plans with benefits that vest or accumulate are accounted for in the same way as defined benefit pension plans. Under IFRS, short-term employee benefits ar ...

Self-esteem and Individual Wealth

... may reduce the time and psychic costs of investing. Marital status is controlled due to differences in disposable income and life cycle saving between married and unmarried households, and differences in investment preferences (Zagorsky, 2007). Yamokoski and Keister (2006) find that gender may impac ...

... may reduce the time and psychic costs of investing. Marital status is controlled due to differences in disposable income and life cycle saving between married and unmarried households, and differences in investment preferences (Zagorsky, 2007). Yamokoski and Keister (2006) find that gender may impac ...

Bureaucratic Corruption, MNEs and FDI

... transaction costs. North (1990) claims that the main function of institutions is to reduce the transaction costs in the economy. The advantage of institutions is that they put constraints on the behaviour of economic agents and reduce the risk of opportunistic behaviour. Institutions can be formal ...

... transaction costs. North (1990) claims that the main function of institutions is to reduce the transaction costs in the economy. The advantage of institutions is that they put constraints on the behaviour of economic agents and reduce the risk of opportunistic behaviour. Institutions can be formal ...

BARCLAYS BANK PLC /ENG/ (Form: 424B2, Received: 12

... Reference Asset on the related Valuation Date and the corresponding return of each Reference Asset as measured from that Valuation Date to the Initial Valuation Date. The Reference Asset with the lowest Reference Asset Return on a Valuation Date will be deemed the Lowest Performing Reference Asset a ...

... Reference Asset on the related Valuation Date and the corresponding return of each Reference Asset as measured from that Valuation Date to the Initial Valuation Date. The Reference Asset with the lowest Reference Asset Return on a Valuation Date will be deemed the Lowest Performing Reference Asset a ...

Complying with Bribery laws in key European jurisdictions

... adopt procedures which are designed to prevent bribery. In Germany, the corporate offence is committed if the corporate has failed to take “supervisory measures” to prevent the act of bribery occurring (or if the bribery is committed by authorised agents or representatives). However, German law prov ...

... adopt procedures which are designed to prevent bribery. In Germany, the corporate offence is committed if the corporate has failed to take “supervisory measures” to prevent the act of bribery occurring (or if the bribery is committed by authorised agents or representatives). However, German law prov ...

The Impact of Costs and Returns on the Investment

... among large Swiss pension funds. Public, corporate, and industry-wide/multiemployer pension funds participated in the survey. The report reveals that portfolio diversification is the main decision criteria for Swiss pension fund managers when structuring their portfolios. The riskreturn-relation is ...

... among large Swiss pension funds. Public, corporate, and industry-wide/multiemployer pension funds participated in the survey. The report reveals that portfolio diversification is the main decision criteria for Swiss pension fund managers when structuring their portfolios. The riskreturn-relation is ...

International asset recovery

International asset recovery is any effort by governments to repatriate the proceeds of corruption hidden in foreign jurisdictions. Such assets may include monies in bank accounts, real estate, vehicles, arts and artifacts, and precious metals. As defined under the United Nations Convention against Corruption, asset recovery refers to recovering the proceeds of corruption, rather than broader terms such as asset confiscation or asset forfeiture which refer to recovering the proceeds or instrumentalities of crime in general.Often used to emphasize the ‘multi-jurisdictional’ or ‘cross-border’ aspects of a corruption investigation, international asset recovery includes numerous processes such as the tracing, freezing, confiscation, and repatriation of proceeds stored in foreign jurisdictions, thus ""making it one of the most complex projects in the field of law"". Even considering the difficulties present, Africa specialist Daniel Scher counters that international asset recovery's ""potential rewards in developing countries make it a highly attractive undertaking"".Despite domestic legislation in some countries allowing for the confiscation and forfeiture of proceeds of corruption, it is improvements in finance, transportation, and communications technologies in the 20th century that have made it easier for corrupt leaders and other “Politically Exposed Persons’ to conceal massive amounts of stolen wealth in offshore financial centers.By taking advantage of differences in legal systems, the high costs in coordinating investigations, lack of international cooperation, and bank secrecy in some recipient countries, corrupt officials have been able to preserve much of their loot overseas.