VANDEMOORTELE NV public limited liability company (naamloze

... These Bonds constitute debt instruments. An investment in the Bonds involves risks. By subscribing to the Bonds, investors lend money to the Issuer who undertakes to pay interest on an annual basis and to reimburse the principal on the maturity date. In case of bankruptcy or default by the Issuer, h ...

... These Bonds constitute debt instruments. An investment in the Bonds involves risks. By subscribing to the Bonds, investors lend money to the Issuer who undertakes to pay interest on an annual basis and to reimburse the principal on the maturity date. In case of bankruptcy or default by the Issuer, h ...

Credit PP - Westmoreland Central School

... purchases but allows the borrower more time to repay the money • Principal is the total amount of money outstanding on the loan ...

... purchases but allows the borrower more time to repay the money • Principal is the total amount of money outstanding on the loan ...

An Empirical Analysis of Counterparty Risk in CDS Prices

... of failing to make the periodic payments by protection buyer. A higher default correlation between reference entity and protection seller leads to a lower CDS spread since protection seller in this case offers less protection on the reference entity. By Leung and Kwok (2005), if reference entity has ...

... of failing to make the periodic payments by protection buyer. A higher default correlation between reference entity and protection seller leads to a lower CDS spread since protection seller in this case offers less protection on the reference entity. By Leung and Kwok (2005), if reference entity has ...

The Cost of Capital for Alternative Investments

... With a complete state-contingent description of an investable risk-matched alternative to the aggregate hedge fund universe, we can determine the rate of return that an investor would require as a function of his risk aversion and the underlying return distributions of other asset classes, all of w ...

... With a complete state-contingent description of an investable risk-matched alternative to the aggregate hedge fund universe, we can determine the rate of return that an investor would require as a function of his risk aversion and the underlying return distributions of other asset classes, all of w ...

Primary and Secondary Obligations

... The surety becomes liable contemporaneously with the principal, undertaking to pay his obligation, and the consideration which binds the principal is sufficient to bind the surety. If the surety is compelled to pay. he has the right, without any express agreement, to bring an action against the prin ...

... The surety becomes liable contemporaneously with the principal, undertaking to pay his obligation, and the consideration which binds the principal is sufficient to bind the surety. If the surety is compelled to pay. he has the right, without any express agreement, to bring an action against the prin ...

Zvi Wiener slide 1

... Modeling a Swap A simple fixed versus floating swap. Current fixed rate on a 30 years loan is 7% with semi annual payments for simplicity. Current floating rate is 6%. Notional amount is 1,000. How can we model our future payments? ...

... Modeling a Swap A simple fixed versus floating swap. Current fixed rate on a 30 years loan is 7% with semi annual payments for simplicity. Current floating rate is 6%. Notional amount is 1,000. How can we model our future payments? ...

base prospectus £100000000 secured bond issuance

... on the Issuer’s financial results, trading prospects and the ability of the Issuer to fulfil its obligations under the Bonds. The risks and uncertainties discussed below may not be the only ones that the Issuer faces. Additional risks and uncertainties, including those which the Directors of the Iss ...

... on the Issuer’s financial results, trading prospects and the ability of the Issuer to fulfil its obligations under the Bonds. The risks and uncertainties discussed below may not be the only ones that the Issuer faces. Additional risks and uncertainties, including those which the Directors of the Iss ...

Export to Word - Botswana e-Laws

... The applicant now points at these securities and contends that the first respondent is not entitled to proceed against his property without first realizing these securities. In the present case, however, the applicant did not just bind himself as a surety but also as a coprincipal debtor, and expre ...

... The applicant now points at these securities and contends that the first respondent is not entitled to proceed against his property without first realizing these securities. In the present case, however, the applicant did not just bind himself as a surety but also as a coprincipal debtor, and expre ...

united states securities and exchange commission - corporate

... This Statement on Schedule 13D (this “Statement”) is being filed on behalf of the Reporting Persons (as defined in Item 2(a) below) with respect to the ordinary shares, par value US$0.00004 per share (the “ Ordinary Shares ”), of Bitauto Holdings Limited, an exempted company incorporated and existin ...

... This Statement on Schedule 13D (this “Statement”) is being filed on behalf of the Reporting Persons (as defined in Item 2(a) below) with respect to the ordinary shares, par value US$0.00004 per share (the “ Ordinary Shares ”), of Bitauto Holdings Limited, an exempted company incorporated and existin ...

Systematic Mortality Risk

... A detailed analysis of the impact of systematic mortality risk on valuation and hedging, as well as its interaction with other risks underlying the GLWB is required. These issues are the focus of the present paper. We apply the risk management process described above to analyze equity and systemati ...

... A detailed analysis of the impact of systematic mortality risk on valuation and hedging, as well as its interaction with other risks underlying the GLWB is required. These issues are the focus of the present paper. We apply the risk management process described above to analyze equity and systemati ...

Introduction to Consumer Credit

... 2. Differentiate among various types of credit. 3. Assess your credit capacity and build your credit rating. 4. Describe the information creditors look for when you apply for credit. 5. Identify the steps you can take to avoid and correct credit mistakes. 2006 McGraw-Hill Ryerson Ltd. ...

... 2. Differentiate among various types of credit. 3. Assess your credit capacity and build your credit rating. 4. Describe the information creditors look for when you apply for credit. 5. Identify the steps you can take to avoid and correct credit mistakes. 2006 McGraw-Hill Ryerson Ltd. ...

The market for borrowing corporate bonds

... bond and stock shorting. In Section 7, we check if bond short sellers have private information. The next two sections consider how corporate bond shorting relates to the CDS market and whether it was impacted by the Credit Crunch of 2007. Finally, Section 10 outlines some implications of our results ...

... bond and stock shorting. In Section 7, we check if bond short sellers have private information. The next two sections consider how corporate bond shorting relates to the CDS market and whether it was impacted by the Credit Crunch of 2007. Finally, Section 10 outlines some implications of our results ...

Hybrid Securities: A Basic Look at Monthly Income Preferred

... however, is unavailable to corporate investors who invest in MIPS, which in turn makes them more favorable to individual investors. Table 1 summarizes the rates of return on MIPS in comparison to corporate bonds and conventional preferred stock with a comparable rating from Standard & Poor’s for bot ...

... however, is unavailable to corporate investors who invest in MIPS, which in turn makes them more favorable to individual investors. Table 1 summarizes the rates of return on MIPS in comparison to corporate bonds and conventional preferred stock with a comparable rating from Standard & Poor’s for bot ...

Form 424B5 RFS HOLDING LLC - N/A Filed: August 23, 2012

... (1) The issuing entity is also issuing Class C notes in the amount of $85,173,501. The Class C notes are not offered by this prospectus supplement and the accompanying prospectus and will initially be purchased by an affiliate of the depositor. The Class A notes benefit from credit enhancement in th ...

... (1) The issuing entity is also issuing Class C notes in the amount of $85,173,501. The Class C notes are not offered by this prospectus supplement and the accompanying prospectus and will initially be purchased by an affiliate of the depositor. The Class A notes benefit from credit enhancement in th ...

nextera energy, inc. - corporate

... Debentures of the Thirty-Second Series, or the applicable portion of the principal amount thereof, will not recognize income, gain or loss for United States federal income tax purposes as a result of the satisfaction and discharge of the Company’s indebtedness in respect thereof and will be subject ...

... Debentures of the Thirty-Second Series, or the applicable portion of the principal amount thereof, will not recognize income, gain or loss for United States federal income tax purposes as a result of the satisfaction and discharge of the Company’s indebtedness in respect thereof and will be subject ...

2013 CFA Level 1 - Book 5 - Apache

... why its price may e. expl dicalculate ffer fromandparinterpret value. (page 29) and dollar duration of a bond. (page 30) the duration describrisk. e yiel(page d-curve32)risk and explain why duration does not account for yield g. curve ain34)the disadvantages of a callable or prepayable security to ...

... why its price may e. expl dicalculate ffer fromandparinterpret value. (page 29) and dollar duration of a bond. (page 30) the duration describrisk. e yiel(page d-curve32)risk and explain why duration does not account for yield g. curve ain34)the disadvantages of a callable or prepayable security to ...

CHAPTER 6

... deviation of the changes and the correlations between them – Estimate the standard deviation of the value of the portfolio by multiplying the sensitivities by the standard deviations, taking ...

... deviation of the changes and the correlations between them – Estimate the standard deviation of the value of the portfolio by multiplying the sensitivities by the standard deviations, taking ...

Collective Investment Schemes Control Act: Determination on

... Legal rights: A manager must ensure that the collateral obligation is legally enforceable and that the collateral will be available to a ...

... Legal rights: A manager must ensure that the collateral obligation is legally enforceable and that the collateral will be available to a ...

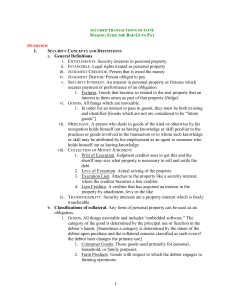

MAKING SURE THE BAD GUYS PAY

... attaches [or is created] only if the parties agree to do so. a. Generally. A security interest is created and enforceable only when the agreement is said to have attached to the collateral. b. Creation of an enforceable security Interest. A security interest is enforceable against the debtor and thi ...

... attaches [or is created] only if the parties agree to do so. a. Generally. A security interest is created and enforceable only when the agreement is said to have attached to the collateral. b. Creation of an enforceable security Interest. A security interest is enforceable against the debtor and thi ...

forward contract

... The manager believes interest rates will rise, causing the each bond price to fall. The manager can: 1. Sell bonds and hold cash till the threat of rising interest rates pass, or until the change in rates has occurred, and then repurchase the bonds 2. Sell long term bonds and replace with shorter te ...

... The manager believes interest rates will rise, causing the each bond price to fall. The manager can: 1. Sell bonds and hold cash till the threat of rising interest rates pass, or until the change in rates has occurred, and then repurchase the bonds 2. Sell long term bonds and replace with shorter te ...

Structural Features of Australian Residential Mortgage

... expected losses on a residential mortgage portfolio, securities backed by such a portfolio without some form of credit support to reduce the expected losses would not appeal to most fixed-income investors. Moreover, the typical Australian residential mortgage has a legal maturity of around 30 years, ...

... expected losses on a residential mortgage portfolio, securities backed by such a portfolio without some form of credit support to reduce the expected losses would not appeal to most fixed-income investors. Moreover, the typical Australian residential mortgage has a legal maturity of around 30 years, ...

Institutional Investors in Corporate Loans

... banks, revolving credit, and in some cases, some additional forms of debt. In order to properly identify the demand elasticities, I employ two empirical strategies. First, I examine time series patterns of corporate bond and syndicated loan issuance and estimate the elasticity of issuance with respe ...

... banks, revolving credit, and in some cases, some additional forms of debt. In order to properly identify the demand elasticities, I employ two empirical strategies. First, I examine time series patterns of corporate bond and syndicated loan issuance and estimate the elasticity of issuance with respe ...

CGZ CGF CGB

... Hedging consists of operations that minimize or eliminate risk arising from the fluctuations of an underlying bond or any security having similarities with these bonds (i.e. yield, maturity). A buy position or a “long” position in an underlying bond or security can be covered by a sell position or “ ...

... Hedging consists of operations that minimize or eliminate risk arising from the fluctuations of an underlying bond or any security having similarities with these bonds (i.e. yield, maturity). A buy position or a “long” position in an underlying bond or security can be covered by a sell position or “ ...

CONSIDERATION DOCTRINE AND REGULATORY ARBITRAGE IN

... Confronted with the foreclosure crisis and robosigning scandal, defenders of the mortgage securitization industry’s past practices have adopted the catchy phrase, “The mortgage follows the note.” Sometimes the catchphrase is cast in more authoritative language: “The Uniform Commercial Code says the ...

... Confronted with the foreclosure crisis and robosigning scandal, defenders of the mortgage securitization industry’s past practices have adopted the catchy phrase, “The mortgage follows the note.” Sometimes the catchphrase is cast in more authoritative language: “The Uniform Commercial Code says the ...

interest rate swaps - McGraw Hill Higher Education

... – As a dealer, the swap bank stands ready to accept either side of a currency swap, and then later lay off their risk, or match it with a counterparty. ...

... – As a dealer, the swap bank stands ready to accept either side of a currency swap, and then later lay off their risk, or match it with a counterparty. ...