Study: Returns to Angel Investors in Groups

... Angel Group Financial Performance Research • Angel Capital Education Foundation, paid by Kauffman Foundation • Rob Wiltbank (Willamette University) and Warren Boeker (University of Washington) • First opportunity to understand the ROI of angels connected to angel groups and drivers behind returns • ...

... Angel Group Financial Performance Research • Angel Capital Education Foundation, paid by Kauffman Foundation • Rob Wiltbank (Willamette University) and Warren Boeker (University of Washington) • First opportunity to understand the ROI of angels connected to angel groups and drivers behind returns • ...

Infrastructure Investments - ForUM for Utvikling og Miljø

... income securities and real estate – all liquid assets, most of which are also exposed to market volatility. In contrast, listed and unlisted infrastructure matches the profile of the Fund as a long-term investor able to afford taking a long-term outlook to ride out market volatilities and crises. In ...

... income securities and real estate – all liquid assets, most of which are also exposed to market volatility. In contrast, listed and unlisted infrastructure matches the profile of the Fund as a long-term investor able to afford taking a long-term outlook to ride out market volatilities and crises. In ...

Portfolio rebalancing: Why it`s important, what to consider

... Paula Fuchsberg: Well, Yan, you’ve given us a lot of important insights. Thanks so much for joining us today. Yan Zilbering: Thank you very much, Paula. It’s been a pleasure. Paula Fuchsberg: And we hope you’ve enjoyed this Vanguard Investment Commentary Podcast. Be sure to check back with us each m ...

... Paula Fuchsberg: Well, Yan, you’ve given us a lot of important insights. Thanks so much for joining us today. Yan Zilbering: Thank you very much, Paula. It’s been a pleasure. Paula Fuchsberg: And we hope you’ve enjoyed this Vanguard Investment Commentary Podcast. Be sure to check back with us each m ...

Minutes 08-02-12 - The Resource Centers, LLC

... Jeff Swanson appeared before the Board on behalf of Southeastern Advisory Services to provide a report on performance of the portfolio for the quarter ending June 30, 2012. He reported that the portfolio experienced a 2.8% loss for the quarter, and advised that the portfolio value has increased by 1 ...

... Jeff Swanson appeared before the Board on behalf of Southeastern Advisory Services to provide a report on performance of the portfolio for the quarter ending June 30, 2012. He reported that the portfolio experienced a 2.8% loss for the quarter, and advised that the portfolio value has increased by 1 ...

Corporate Social Responsibility and the Market Pricing of Corporate

... Corporate Social Responsibility and the Market Pricing of Corporate Earnings ...

... Corporate Social Responsibility and the Market Pricing of Corporate Earnings ...

ECONOMIC GROWTH AND DEVELOPMENT

... (JPMNT) Journal of Process Management – New Technologies, International Vol. 3, No.1, 2015. ...

... (JPMNT) Journal of Process Management – New Technologies, International Vol. 3, No.1, 2015. ...

Opportunities Abound… Trading Is The Key!

... maintains. “The 1990s gave investors the impression that all they had to do to make money was to buy a good fund or stock and sit back,” he explained. “But if you look at the history of the stock market, there are long periods when the market as a whole declines or goes sideways. In fact, the st ...

... maintains. “The 1990s gave investors the impression that all they had to do to make money was to buy a good fund or stock and sit back,” he explained. “But if you look at the history of the stock market, there are long periods when the market as a whole declines or goes sideways. In fact, the st ...

March 2017 Portfolio Performance

... The NLPFM Discretionary Management Service offers a number of different portfolios to clients. The needs of each client are considered independently and different portfolios are selected based on suitability and approach to risk after a discussion directly with the client. The philosophy of NLPFM is ...

... The NLPFM Discretionary Management Service offers a number of different portfolios to clients. The needs of each client are considered independently and different portfolios are selected based on suitability and approach to risk after a discussion directly with the client. The philosophy of NLPFM is ...

Investment

... The Definition of Investment Investment is defined as the commitment of current financial resources in order to achieve higher gains in the future. It deals with what is called uncertainty domains. From this definition, the importance of time and future arises as they are two important elements in ...

... The Definition of Investment Investment is defined as the commitment of current financial resources in order to achieve higher gains in the future. It deals with what is called uncertainty domains. From this definition, the importance of time and future arises as they are two important elements in ...

COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN

... – Responsible fiscal policies – (i) there is a need to continue to support growth- and equityfriendly fiscal consolidation in many countries, (ii) tax systems need to address disincentives to employment creation and be made fairer and still more effective, (iii) social protection systems should be m ...

... – Responsible fiscal policies – (i) there is a need to continue to support growth- and equityfriendly fiscal consolidation in many countries, (ii) tax systems need to address disincentives to employment creation and be made fairer and still more effective, (iii) social protection systems should be m ...

Revolving doors, musical chairs and portfolio performance

... on that result in any particular instance. The second important question is whether these results, while they are statistically significant, are economically significant. That is, are the signals sufficiently large to be worth worrying about in reality? The answer again would seem to be “yes”. The d ...

... on that result in any particular instance. The second important question is whether these results, while they are statistically significant, are economically significant. That is, are the signals sufficiently large to be worth worrying about in reality? The answer again would seem to be “yes”. The d ...

Investment Provisions in Trade and Investment

... investment to host nations. The majority of these studies have found weak or nonexistent correlations between treaties and attracting investment flows.17 The foreign investment that does result from opening up an economy does not necessarily have the desired impacts of economic growth and wellbeing. ...

... investment to host nations. The majority of these studies have found weak or nonexistent correlations between treaties and attracting investment flows.17 The foreign investment that does result from opening up an economy does not necessarily have the desired impacts of economic growth and wellbeing. ...

October 31 , 2016 This is what late cycle looks like… Weakness

... Performance, dividends and other figures have been obtained from sources believed reliable but have not been audited and cannot be guaranteed. Past performance does not ensure future results. Investing inherently contains risk including loss of principle. Corey Casilio is a founding partner of Casil ...

... Performance, dividends and other figures have been obtained from sources believed reliable but have not been audited and cannot be guaranteed. Past performance does not ensure future results. Investing inherently contains risk including loss of principle. Corey Casilio is a founding partner of Casil ...

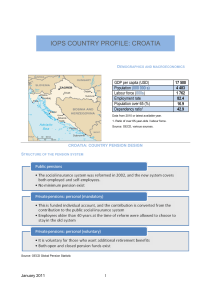

IOPS COUNTRY PROFILE: CROATIA

... (OMFs), which can only manage one mandatory fund each. By law, these funds must invest at least 50% of their assets in conservative government securities issued by the Republic of Croatia or the Croatian National Bank. In addition, no more than 45% of pension fund assets may be invested outside Croa ...

... (OMFs), which can only manage one mandatory fund each. By law, these funds must invest at least 50% of their assets in conservative government securities issued by the Republic of Croatia or the Croatian National Bank. In addition, no more than 45% of pension fund assets may be invested outside Croa ...

register your private contractual investment fund in armenia

... REGISTER YOUR PRIVATE CONTRACTUAL INVESTMENT FUND IN ARMENIA In order to develop private market for investment funds, the Regulator adopted a regulation which enables fast registration process for private contractual investment funds (PCF). Now you can register your PCF in Armenia by uploading the n ...

... REGISTER YOUR PRIVATE CONTRACTUAL INVESTMENT FUND IN ARMENIA In order to develop private market for investment funds, the Regulator adopted a regulation which enables fast registration process for private contractual investment funds (PCF). Now you can register your PCF in Armenia by uploading the n ...

Australia`s foreign investment

... All three countries increased their individual shares of Australian investment between 1983 and 2013 with the United Kingdom being the standout. In 1983 the United Kingdom accounted for 3.9 per cent of Australian investment abroad. By 1998 this had risen to nearly 20 per cent and in 2013, although l ...

... All three countries increased their individual shares of Australian investment between 1983 and 2013 with the United Kingdom being the standout. In 1983 the United Kingdom accounted for 3.9 per cent of Australian investment abroad. By 1998 this had risen to nearly 20 per cent and in 2013, although l ...

Provisions on Issues concerning the Implementation of the

... management in the latest fiscal year shall not be less than USD 500 million; (2) For an insurance company, it shall have been formed for more than two years and the securities assets held by it in the latest fiscal year shall not be less than USD 500 million; (3) For a securities company, it shall h ...

... management in the latest fiscal year shall not be less than USD 500 million; (2) For an insurance company, it shall have been formed for more than two years and the securities assets held by it in the latest fiscal year shall not be less than USD 500 million; (3) For a securities company, it shall h ...

Pepperdine University Retirement Plan Committee Meeting 08/31/09

... Retirement Plan Committee Meeting Minutes The Committee reviewed the performance of the Portfolio Xpress models against the T. Rowe Price Retirement Date funds. The Portfolio Xpress models have slightly underperformed the T. Rowe Price funds on a 1 year basis, but have outperformed on a 3 and 5 yea ...

... Retirement Plan Committee Meeting Minutes The Committee reviewed the performance of the Portfolio Xpress models against the T. Rowe Price Retirement Date funds. The Portfolio Xpress models have slightly underperformed the T. Rowe Price funds on a 1 year basis, but have outperformed on a 3 and 5 yea ...

Provisions on Issues concerning the Implementation of the

... management in the latest fiscal year shall not be less than USD 500 million; (2) For an insurance company, it shall have been formed for more than two years and the securities assets held by it in the latest fiscal year shall not be less than USD 500 million; (3) For a securities company, it shall h ...

... management in the latest fiscal year shall not be less than USD 500 million; (2) For an insurance company, it shall have been formed for more than two years and the securities assets held by it in the latest fiscal year shall not be less than USD 500 million; (3) For a securities company, it shall h ...

ESG - Mondrian Investment Partners

... factors, Mondrian is a signatory of the Principles for Responsible Investment. ...

... factors, Mondrian is a signatory of the Principles for Responsible Investment. ...

understanding stable value - Galliard Capital Management

... Qualified plan participant withdrawals are allowed any time without a penalty, regardless of their frequency or amount. If your Plan has a competing option to a stable value fund, a 90-Day Equity Wash Requirement may apply. A 90-Day Equity Wash Requirement requires participants to invest in a “non-c ...

... Qualified plan participant withdrawals are allowed any time without a penalty, regardless of their frequency or amount. If your Plan has a competing option to a stable value fund, a 90-Day Equity Wash Requirement may apply. A 90-Day Equity Wash Requirement requires participants to invest in a “non-c ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... This document has been prepared by Sharekhan Limited (Sharekhan) and is meant for sole use by the recipient and not for circulation. The information contained in this report is intended for general information purposes only. The information published should not be used as a substitute for any form o ...

... This document has been prepared by Sharekhan Limited (Sharekhan) and is meant for sole use by the recipient and not for circulation. The information contained in this report is intended for general information purposes only. The information published should not be used as a substitute for any form o ...

HSBC GIF BRIC Freestyle Equity Fund

... China and India have had phases of good economic performance through the 1990’s and later. At the same time, though not as remarkable, the Russian Federation, after the collapse of the communist regime, has also shown potential for rapid economic growth. The BRIC economies face challenges to improve ...

... China and India have had phases of good economic performance through the 1990’s and later. At the same time, though not as remarkable, the Russian Federation, after the collapse of the communist regime, has also shown potential for rapid economic growth. The BRIC economies face challenges to improve ...

Market Penetration and Investment Pattern: A Study

... Market Penetration and Investment Pattern: A Study of Mutual Funds in India individuals is only 39.77%, where as its percentage to total investor's accounts is 97.07%. This analysis clearly suggests a timely action to be taken by mutual Fund Industry regarding market penetration. This under penetra ...

... Market Penetration and Investment Pattern: A Study of Mutual Funds in India individuals is only 39.77%, where as its percentage to total investor's accounts is 97.07%. This analysis clearly suggests a timely action to be taken by mutual Fund Industry regarding market penetration. This under penetra ...

direct investment between canada and the world

... Balance of payments–based data: Balance of payments–based data calculate trade flows using surveys of international trade and investment activity of firms and other entities. Foreign direct investment (FDI): FDI occurs when an investor residing in one country holds at least 10% equity in an enterpri ...

... Balance of payments–based data: Balance of payments–based data calculate trade flows using surveys of international trade and investment activity of firms and other entities. Foreign direct investment (FDI): FDI occurs when an investor residing in one country holds at least 10% equity in an enterpri ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.