Chapter 19 The theory of effective demand

... whole has to satisfy an aggregate budget constraint for the period in question. It follows that the equilibrium condition 0 = is ensured as soon as there is clearing in the output and labor markets. Consequently, with ( ) = ( ) there is general equilibrium in this flexwage-flexpric ...

... whole has to satisfy an aggregate budget constraint for the period in question. It follows that the equilibrium condition 0 = is ensured as soon as there is clearing in the output and labor markets. Consequently, with ( ) = ( ) there is general equilibrium in this flexwage-flexpric ...

The Macroeconomics of Shadow Banking Alan Moreira Alexi Savov July 2014

... recovery. Thus it is not liquidity provision per se but liquidity transformation that enables growth.5 Our model produces amplification via endogenous “collateral runs” or margin spirals, episodes when movements in prices and haircuts reinforce each other (Brunnermeier and Pedersen, 2009).6 Collate ...

... recovery. Thus it is not liquidity provision per se but liquidity transformation that enables growth.5 Our model produces amplification via endogenous “collateral runs” or margin spirals, episodes when movements in prices and haircuts reinforce each other (Brunnermeier and Pedersen, 2009).6 Collate ...

9 Keynes and money

... revolution in economic theory was truly a revolt against orthodox theory since it aimed at rejecting some basic mainstream axioms to provide a logical foundation for a non-Say’s Law model applicable to the real world in which we happen to live. Unfortunately, since Keynes, orthodox economists, seduc ...

... revolution in economic theory was truly a revolt against orthodox theory since it aimed at rejecting some basic mainstream axioms to provide a logical foundation for a non-Say’s Law model applicable to the real world in which we happen to live. Unfortunately, since Keynes, orthodox economists, seduc ...

Commercial Real Estate and the 1990

... been famously asserted by Reinhart and Rogoff, recessions caused by financial crises tend to last longer than other types of recessions, because of the de-leveraging that must occur and which takes time, suppressing aggregate demand and/or constraining liquidity in the meantime. In the U.S. by the 1 ...

... been famously asserted by Reinhart and Rogoff, recessions caused by financial crises tend to last longer than other types of recessions, because of the de-leveraging that must occur and which takes time, suppressing aggregate demand and/or constraining liquidity in the meantime. In the U.S. by the 1 ...

Price-level targeting as a monetary policy strategy

... taken in this context to mean a low inflation rate. In recent times, however, an ever-growing number of academics, in particular, have been asking whether it would not be better to base monetary policy on a target path for the price level. Theory does suggest that price-level targeting could wield a ...

... taken in this context to mean a low inflation rate. In recent times, however, an ever-growing number of academics, in particular, have been asking whether it would not be better to base monetary policy on a target path for the price level. Theory does suggest that price-level targeting could wield a ...

Economics: Explore and Apply 1/e by Ayers and Collinge Chapter

... The Substitutability of Money and Bonds The market interest rate will adjust to the equilibrium interest rate. A market interest rate that is above the equilibrium interest rate will fall until the equilibrium interest rate is reached. A market interest rate that is below the equilibrium interes ...

... The Substitutability of Money and Bonds The market interest rate will adjust to the equilibrium interest rate. A market interest rate that is above the equilibrium interest rate will fall until the equilibrium interest rate is reached. A market interest rate that is below the equilibrium interes ...

NBER WOR}(ING PAPERS SERIES MONEY, INTEREST AND PRICES Stanley Fischer

... Lipsey extended the analysis over time, and showed that under reasonable assumptions, the long—run equilibrium of the economy would exhibit neutrality of money even if there were distribution effects: the redistributions of cash balances among individuals from week to week ultimately reproduce the i ...

... Lipsey extended the analysis over time, and showed that under reasonable assumptions, the long—run equilibrium of the economy would exhibit neutrality of money even if there were distribution effects: the redistributions of cash balances among individuals from week to week ultimately reproduce the i ...

Transmission of Monetary Policy with Heterogeneity in Household

... A household’s portfolio generally consists of non-tradable and tradable assets. The most important non-tradable asset is human capital. It is the primary source of income for most households and at the same time subject to substantial idiosyncratic shocks. The presence of such shocks gives rise to b ...

... A household’s portfolio generally consists of non-tradable and tradable assets. The most important non-tradable asset is human capital. It is the primary source of income for most households and at the same time subject to substantial idiosyncratic shocks. The presence of such shocks gives rise to b ...

Meeting the Challenge of Asia

... widespread price cuts so far; the rate of inflation remains between 1% and 2%. Overall, there are no signs of a generalised reduction in prices. Chart 3 shows the share of HICP items experiencing price falls, year on year. In terms of expenditure weights, around 20% of the HICP items reported negati ...

... widespread price cuts so far; the rate of inflation remains between 1% and 2%. Overall, there are no signs of a generalised reduction in prices. Chart 3 shows the share of HICP items experiencing price falls, year on year. In terms of expenditure weights, around 20% of the HICP items reported negati ...

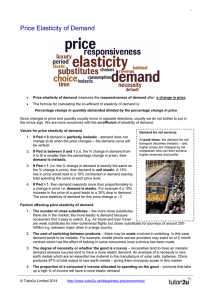

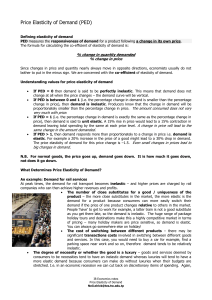

Price Elasticity of Demand

... increase in the price of a good leads to a 30% drop in demand. The price elasticity of demand for this price change is –3 Factors affecting price elasticity of demand 1. The number of close substitutes – the more close substitutes there are in the market, the more elastic is demand because consumers ...

... increase in the price of a good leads to a 30% drop in demand. The price elasticity of demand for this price change is –3 Factors affecting price elasticity of demand 1. The number of close substitutes – the more close substitutes there are in the market, the more elastic is demand because consumers ...

effect of cost push inflation on financial performance of

... of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future. Positiv ...

... of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future. Positiv ...

International Financial Reporting Standard 13 Fair Value

... unobservable inputs. Because fair value is a market-based measurement, it is measured using the assumptions that market participants would use when pricing the asset or liability, including assumptions about risk. As a result, an entity’s intention to hold an asset or to settle or otherwise fulfil a ...

... unobservable inputs. Because fair value is a market-based measurement, it is measured using the assumptions that market participants would use when pricing the asset or liability, including assumptions about risk. As a result, an entity’s intention to hold an asset or to settle or otherwise fulfil a ...

Paper - IIOA!

... More problematic area is the deflation of output of market services. For services, the available deflators are the CPI (at purchasers’ prices) and SPPI (at basic prices). For a number of business services, such as legal and accounting, courier, storage and warehousing, investigation and security act ...

... More problematic area is the deflation of output of market services. For services, the available deflators are the CPI (at purchasers’ prices) and SPPI (at basic prices). For a number of business services, such as legal and accounting, courier, storage and warehousing, investigation and security act ...

Supply and demand - David E. Harrington

... Here the dynamic process is that prices adjust until supply equals demand. It is a powerfully simple technique that allows one to study equilibrium, efficiency and comparative statics. The stringency of the simplifying assumptions inherent in this approach make the model considerably more tractable, ...

... Here the dynamic process is that prices adjust until supply equals demand. It is a powerfully simple technique that allows one to study equilibrium, efficiency and comparative statics. The stringency of the simplifying assumptions inherent in this approach make the model considerably more tractable, ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... Business cycles are a type of fluctuation found in the aggregate activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and reviv ...

... Business cycles are a type of fluctuation found in the aggregate activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and reviv ...

LESSON 2: DEMAND AND SUPPLY

... also approach the problem in qualitative terms. For instance: Suppose you are told that the price goes up and that the demand curve is inelastic. Does revenue go up or go down? Reason like this: If demand is inelastic (less than 1), the percentage decrease in the quantity demanded will be smaller th ...

... also approach the problem in qualitative terms. For instance: Suppose you are told that the price goes up and that the demand curve is inelastic. Does revenue go up or go down? Reason like this: If demand is inelastic (less than 1), the percentage decrease in the quantity demanded will be smaller th ...

Margin Regulation and Volatility

... agents. We first show that, in line with the evidence on Regulation T, changes in the regulation of one class of collateralizable assets may have only small effects on the assets’ return volatility if investors have access to another (unregulated) class of assets to leverage their positions. We also ...

... agents. We first show that, in line with the evidence on Regulation T, changes in the regulation of one class of collateralizable assets may have only small effects on the assets’ return volatility if investors have access to another (unregulated) class of assets to leverage their positions. We also ...

Financial Innovation, Collateral and Investment.

... Debreu. Their result may appear intuitive since one would expect that the need for collateral would prevent some investors from borrowing the money to invest, thus reducing production. In our model borrowers may also find themselves constrained: they cannot borrow more at the same interest rate on t ...

... Debreu. Their result may appear intuitive since one would expect that the need for collateral would prevent some investors from borrowing the money to invest, thus reducing production. In our model borrowers may also find themselves constrained: they cannot borrow more at the same interest rate on t ...

Chapter 6: Prices and Decision Making

... At first, automakers thought the increase in gas prices would be temporary, so they were reluctant to switch over to smaller, more fuel-efficient models. As time went on, however, the surplus of unsold cars remained. To move their inventories, some manufacturers began to offer a rebate—a partial ref ...

... At first, automakers thought the increase in gas prices would be temporary, so they were reluctant to switch over to smaller, more fuel-efficient models. As time went on, however, the surplus of unsold cars remained. To move their inventories, some manufacturers began to offer a rebate—a partial ref ...

The financial cycle and macroeconomics

... The close association of the financial cycle with financial crises helps explain another empirical regularity: recessions that coincide with the contraction phase of the financial cycle are especially severe. On average, GDP drops by around 50% more than otherwise (Drehmann et al (2012)). This quali ...

... The close association of the financial cycle with financial crises helps explain another empirical regularity: recessions that coincide with the contraction phase of the financial cycle are especially severe. On average, GDP drops by around 50% more than otherwise (Drehmann et al (2012)). This quali ...

The data are collected at a quarterly frequency, over a

... Second, we collect data on several measures of excess liquidity for a relatively large number of industrialised and developing countries and we analyse the co-movement across them by means of a factor analysis. Moreover, we analyse whether the common factor – which we interpret as a measure of "glob ...

... Second, we collect data on several measures of excess liquidity for a relatively large number of industrialised and developing countries and we analyse the co-movement across them by means of a factor analysis. Moreover, we analyse whether the common factor – which we interpret as a measure of "glob ...

Price Elasticity of Demand (PED) - Business-TES

... you ‘HAVE’ to get to work so ‘have’ to pay the higher price. Train companies know this and so put the price up without affecting the levels of demand. The % of a consumer’s income allocated to spending on the good – goods and services that take up a high proportion of a household’s income will tend ...

... you ‘HAVE’ to get to work so ‘have’ to pay the higher price. Train companies know this and so put the price up without affecting the levels of demand. The % of a consumer’s income allocated to spending on the good – goods and services that take up a high proportion of a household’s income will tend ...

irving fisher`s debt deflation analysis

... contraction of M’ that nominal interest rate now decreases more rapidly than price and the real rate of interest starts decreasing. The contraction brought about by this cycle of causes becomes self-limiting as soon as the rate of interest overtakes the rate of fall in prices. After a time, normal c ...

... contraction of M’ that nominal interest rate now decreases more rapidly than price and the real rate of interest starts decreasing. The contraction brought about by this cycle of causes becomes self-limiting as soon as the rate of interest overtakes the rate of fall in prices. After a time, normal c ...

Economic bubble

An economic bubble (sometimes referred to as a speculative bubble, a market bubble, a price bubble, a financial bubble, a speculative mania or a balloon) is trade in an asset at a price or price range that strongly deviates from the corresponding asset's intrinsic value. It could also be described as a situation in which asset prices appear to be based on implausible or inconsistent views about the future.Because it is often difficult to observe intrinsic values in real-life markets, bubbles are often conclusively identified only in retrospect, when a sudden drop in prices appears. Such a drop is known as a crash or a bubble burst. Both the boom and the burst phases of the bubble are examples of a positive feedback mechanism, in contrast to the negative feedback mechanism that determines the equilibrium price under normal market circumstances. Prices in an economic bubble can fluctuate erratically, and become impossible to predict from supply and demand alone.While some economists deny that bubbles occur, the cause of bubbles remains disputed by those who are convinced that asset prices often deviate strongly from intrinsic values. Many explanations have been suggested, and research has recently shown that bubbles may appear even without uncertainty, speculation, or bounded rationality. In such cases, the bubbles may be argued to be rational, where investors at every point fully compensated for the possibility that the bubble might collapse by higher returns. These approaches require that the timing of the bubble collapse can only be forecast probabilistically and the bubble process is often modelled using a Markov switching model. It has also been suggested that bubbles might ultimately be caused by processes of price coordination or emerging social norms.