A Tempestuous Season

... A confluence of events is responsible. As Mark Zandi, chief economist and co-founder of Moody’s Economy.com, and author of Financial Shock, 2009, puts it: “The reality is that there is plenty of blame to go around. A financial calamity of this magnitude could not have taken root without a great many ...

... A confluence of events is responsible. As Mark Zandi, chief economist and co-founder of Moody’s Economy.com, and author of Financial Shock, 2009, puts it: “The reality is that there is plenty of blame to go around. A financial calamity of this magnitude could not have taken root without a great many ...

Broader Measures of Progress J. Steven Landefeld, Director

... “Response to the Rio+20 Mandate for Broader Measures of Progress” High Level Forum Event for the UN Statistical Commission Meeting February 25th, 2013 ...

... “Response to the Rio+20 Mandate for Broader Measures of Progress” High Level Forum Event for the UN Statistical Commission Meeting February 25th, 2013 ...

Supply - Breathitt County Schools

... Remember that the law of demand states that the quantity demanded varies according to price. As the price rises for a good, the quantity demanded goes down. As the price of a good goes down, the quantity demanded rises. The quantity supplied also varies according to price—but in the opposite directi ...

... Remember that the law of demand states that the quantity demanded varies according to price. As the price rises for a good, the quantity demanded goes down. As the price of a good goes down, the quantity demanded rises. The quantity supplied also varies according to price—but in the opposite directi ...

Download attachment

... Berris (2007) point to the many UK companies that have opened Islamic banking and financial brokerage desks in order to create liquidity in the UK Islamic bond market, increase the growth of secondary markets and ensure equality between Islamic bonds and conventional bonds. Moreover, the UK treasury ...

... Berris (2007) point to the many UK companies that have opened Islamic banking and financial brokerage desks in order to create liquidity in the UK Islamic bond market, increase the growth of secondary markets and ensure equality between Islamic bonds and conventional bonds. Moreover, the UK treasury ...

NBER WORKING PAPER SERIES SUPPLY SHOCKS AND OPTIMAL MONETARY POLICY Stephen J. Turnovsky

... Fischer (1985) argues that as long as there is no real wage resistance by workers, supply shocks by themselves should require no monetary response. However, his results depend upon very specific assumptions regarding the form of the money demand function. Marston and Turnovsky (1985a) show how the m ...

... Fischer (1985) argues that as long as there is no real wage resistance by workers, supply shocks by themselves should require no monetary response. However, his results depend upon very specific assumptions regarding the form of the money demand function. Marston and Turnovsky (1985a) show how the m ...

Chapter 9 Chapter Outline Figure 9.1 The FE line

... relative to the expected or trend growth of money and inflation – Thus when we talk about “an increase in the money supply,” we have in mind an increase in the growth rate relative to the trend – Similarly, a result that the price level declines can be interpreted as the price level declining relati ...

... relative to the expected or trend growth of money and inflation – Thus when we talk about “an increase in the money supply,” we have in mind an increase in the growth rate relative to the trend – Similarly, a result that the price level declines can be interpreted as the price level declining relati ...

CH 9 PDF

... – The real interest rate did not rise during the 1973–1974 oil price shock (though it did during the 1979–1980 shock) • It could be that people expected the 1973–1974 oil price shock to be permanent • In that case the real interest rate would not necessarily rise • If so, people’s expectations were ...

... – The real interest rate did not rise during the 1973–1974 oil price shock (though it did during the 1979–1980 shock) • It could be that people expected the 1973–1974 oil price shock to be permanent • In that case the real interest rate would not necessarily rise • If so, people’s expectations were ...

Chapter 9

... – The real interest rate did not rise during the 1973–1974 oil price shock (though it did during the 1979–1980 shock) • It could be that people expected the 1973–1974 oil price shock to be permanent • In that case the real interest rate would not necessarily rise • If so, people’s expectations were ...

... – The real interest rate did not rise during the 1973–1974 oil price shock (though it did during the 1979–1980 shock) • It could be that people expected the 1973–1974 oil price shock to be permanent • In that case the real interest rate would not necessarily rise • If so, people’s expectations were ...

Chapter 9

... – The real interest rate did not rise during the 1973–1974 oil price shock (though it did during the 1979–1980 shock) • It could be that people expected the 1973–1974 oil price shock to be permanent • In that case the real interest rate would not necessarily rise • If so, people’s expectations were ...

... – The real interest rate did not rise during the 1973–1974 oil price shock (though it did during the 1979–1980 shock) • It could be that people expected the 1973–1974 oil price shock to be permanent • In that case the real interest rate would not necessarily rise • If so, people’s expectations were ...

Chapter 9

... – The real interest rate did not rise during the 1973–1974 oil price shock (though it did during the 1979–1980 shock) • It could be that people expected the 1973–1974 oil price shock to be permanent • In that case the real interest rate would not necessarily rise • If so, people’s expectations were ...

... – The real interest rate did not rise during the 1973–1974 oil price shock (though it did during the 1979–1980 shock) • It could be that people expected the 1973–1974 oil price shock to be permanent • In that case the real interest rate would not necessarily rise • If so, people’s expectations were ...

Liquidity Hoarding - Federal Reserve Bank of New York

... The fundamental reason for the ine¢ ciency of the laisser-faire equilibrium is the incompleteness of markets. Illiquid bankers are forced to acquire the liquid asset ex post by selling the illiquid asset on a spot market rather than entering into contingent contracts for the provision of liquidity ...

... The fundamental reason for the ine¢ ciency of the laisser-faire equilibrium is the incompleteness of markets. Illiquid bankers are forced to acquire the liquid asset ex post by selling the illiquid asset on a spot market rather than entering into contingent contracts for the provision of liquidity ...

Guide To The Markets - J.P. Morgan Asset Management

... 6. Eurozone: Unemployment and labour costs 7. Eurozone recovery monitor 8. Eurozone credit conditions 9. European Central Bank (ECB) policies 10. European monetary policy and relative bond supplies 11. European politics 12. UK economic indicators 13. Brexit: Outcomes for the UK 14. Brexit: Trade and ...

... 6. Eurozone: Unemployment and labour costs 7. Eurozone recovery monitor 8. Eurozone credit conditions 9. European Central Bank (ECB) policies 10. European monetary policy and relative bond supplies 11. European politics 12. UK economic indicators 13. Brexit: Outcomes for the UK 14. Brexit: Trade and ...

The postbellum deflation and its lessons for today

... and 1890s. Second, although the U.S. economy was undergoing a rapid expansion, this period was also one of social unrest, much of it attributed to the perceived economic harm to farmers caused by the ongoing deflation. These developments have led some observers to question whether the deflation of t ...

... and 1890s. Second, although the U.S. economy was undergoing a rapid expansion, this period was also one of social unrest, much of it attributed to the perceived economic harm to farmers caused by the ongoing deflation. These developments have led some observers to question whether the deflation of t ...

The low inflation

... Surprisingly low inflation leads to arbitrary reallocation Some of the problems with low inflation arise if inflation is surprisingly low. For example, this leads to arbitrary reallocations from borrowers to lenders. The real cost of a loan, that is, the interest cost adjusted for inflation, becomes ...

... Surprisingly low inflation leads to arbitrary reallocation Some of the problems with low inflation arise if inflation is surprisingly low. For example, this leads to arbitrary reallocations from borrowers to lenders. The real cost of a loan, that is, the interest cost adjusted for inflation, becomes ...

Housing and Endogenous Default ∗ Emily Marshall Paul Shea

... this literature consists of partial equilibrium analysis that does not examine the relationship between default and the business cycle. One exception is Fiore and Tristani (2012), who allow for commercial default in a New Keynesian setup. They show that higher default risk increases firms’ finance c ...

... this literature consists of partial equilibrium analysis that does not examine the relationship between default and the business cycle. One exception is Fiore and Tristani (2012), who allow for commercial default in a New Keynesian setup. They show that higher default risk increases firms’ finance c ...

NATIONAL BANK OF POLAND WORKING PAPER No. 135

... of money in monetary policy analyses. There is no consensus as to whether the There are many similar works (theoretical and empirical) indicating the importance of money as an argument of the central bank reaction function in a world of incomplete information. For example, in the work of Berg et al. ...

... of money in monetary policy analyses. There is no consensus as to whether the There are many similar works (theoretical and empirical) indicating the importance of money as an argument of the central bank reaction function in a world of incomplete information. For example, in the work of Berg et al. ...

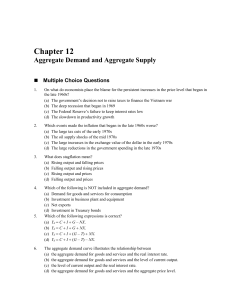

Aggregate Demand and Aggregate Supply

... • Since the government can shift aggregate demand with fiscal and monetary policy, stabilization policies can be used to offset the impact of shifts in aggregate demand and aggregate supply. • But, accommodating an adverse supply shock results in a permanently higher price level. ...

... • Since the government can shift aggregate demand with fiscal and monetary policy, stabilization policies can be used to offset the impact of shifts in aggregate demand and aggregate supply. • But, accommodating an adverse supply shock results in a permanently higher price level. ...

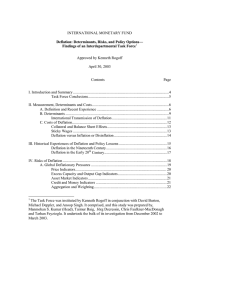

Deflation: Determinants, Risks and Policy Options -- Findings

... characteristics. The magnitude of the overall bias due to these three factors varies across countries, but is generally perceived to range between ½ to 1 percentage point.5 ...

... characteristics. The magnitude of the overall bias due to these three factors varies across countries, but is generally perceived to range between ½ to 1 percentage point.5 ...

Types of Imperfectly Competitive Markets

... Product Differentiation Each firm produces a product that is at least slightly different from those of other firms. Rather than being a price taker, each firm faces a downward-sloping demand curve. ...

... Product Differentiation Each firm produces a product that is at least slightly different from those of other firms. Rather than being a price taker, each firm faces a downward-sloping demand curve. ...

Document

... The difference between the Keynesian and new Keynesian approaches to the short-run aggregate supply curve is that (a) Keynesians assumed that the short-run aggregate supply curve was vertical or nearly vertical, while new Keynesians assume that it is nearly horizontal. (b) Keynesians focused on the ...

... The difference between the Keynesian and new Keynesian approaches to the short-run aggregate supply curve is that (a) Keynesians assumed that the short-run aggregate supply curve was vertical or nearly vertical, while new Keynesians assume that it is nearly horizontal. (b) Keynesians focused on the ...

A Classical View of the Business Cycle

... earlier (1911) investigations of the Quantity Theory and, specifically, that book’s Chapter IV (“Disturbance of Equation [of Exchange] and of Purchasing Power during Transition Periods”), which connected variations in money to variations in the price level and, subsequently, to changes in the real ...

... earlier (1911) investigations of the Quantity Theory and, specifically, that book’s Chapter IV (“Disturbance of Equation [of Exchange] and of Purchasing Power during Transition Periods”), which connected variations in money to variations in the price level and, subsequently, to changes in the real ...

ESSAYS ON MONETARY AND FISCAL POLICY By Andrea Pescatori

... for the business cycle. The view that the financial structure and the performance of credit markets may be important to understand macroeconomic facts dates back at least to Gurley and Shaw (1955). However, many results were found in a (static) partial equilibrium setup. In the recent years a big ef ...

... for the business cycle. The view that the financial structure and the performance of credit markets may be important to understand macroeconomic facts dates back at least to Gurley and Shaw (1955). However, many results were found in a (static) partial equilibrium setup. In the recent years a big ef ...

A recent study found that the demand and supply schedules for

... So when prices of gasoline rise demand for automobiles will decrease. Tastes: If you like ice cream, you buy more of it. Economists normally do not try to explain people’s tastes because tastes are based on historical and psychological forces that are beyond the realm of economics. Economists do, ho ...

... So when prices of gasoline rise demand for automobiles will decrease. Tastes: If you like ice cream, you buy more of it. Economists normally do not try to explain people’s tastes because tastes are based on historical and psychological forces that are beyond the realm of economics. Economists do, ho ...

A New Approach to Monetary Theory and Policy: A Monetary

... received, so the higher the interest, the more money is required in the future, to pay for future debt obligations. Interest is the necessary pre-determined risk-free compensation for the TVM. In explaining the opportunity cost of money, or the inducement to invest, Keynes stated that, “the rate of ...

... received, so the higher the interest, the more money is required in the future, to pay for future debt obligations. Interest is the necessary pre-determined risk-free compensation for the TVM. In explaining the opportunity cost of money, or the inducement to invest, Keynes stated that, “the rate of ...

NBER WORKING PAPER SERIES AN ASSESSMENT OF THE NEW MERCHANTILISM

... became more volatile (see Table 3), but not by the magnitudes that the model would require to explain the observed surge in reserves. Our model also yields an important result in terms of the dynamics associated with the surge in reserves: The large buildup of foreign assets in response to financial ...

... became more volatile (see Table 3), but not by the magnitudes that the model would require to explain the observed surge in reserves. Our model also yields an important result in terms of the dynamics associated with the surge in reserves: The large buildup of foreign assets in response to financial ...

Economic bubble

An economic bubble (sometimes referred to as a speculative bubble, a market bubble, a price bubble, a financial bubble, a speculative mania or a balloon) is trade in an asset at a price or price range that strongly deviates from the corresponding asset's intrinsic value. It could also be described as a situation in which asset prices appear to be based on implausible or inconsistent views about the future.Because it is often difficult to observe intrinsic values in real-life markets, bubbles are often conclusively identified only in retrospect, when a sudden drop in prices appears. Such a drop is known as a crash or a bubble burst. Both the boom and the burst phases of the bubble are examples of a positive feedback mechanism, in contrast to the negative feedback mechanism that determines the equilibrium price under normal market circumstances. Prices in an economic bubble can fluctuate erratically, and become impossible to predict from supply and demand alone.While some economists deny that bubbles occur, the cause of bubbles remains disputed by those who are convinced that asset prices often deviate strongly from intrinsic values. Many explanations have been suggested, and research has recently shown that bubbles may appear even without uncertainty, speculation, or bounded rationality. In such cases, the bubbles may be argued to be rational, where investors at every point fully compensated for the possibility that the bubble might collapse by higher returns. These approaches require that the timing of the bubble collapse can only be forecast probabilistically and the bubble process is often modelled using a Markov switching model. It has also been suggested that bubbles might ultimately be caused by processes of price coordination or emerging social norms.