Ed Yardeni - EuroCapital

... (3) European manufacturing purchasing managers are depressed. Manufacturing purchasing managers indexes (M-PMI) were weak in all of the major European countries during October. The UK index dropped to 47.4 from 50.8. The EU index fell to 47.1, the lowest since July 2009. Germany decreased to 49.1, t ...

... (3) European manufacturing purchasing managers are depressed. Manufacturing purchasing managers indexes (M-PMI) were weak in all of the major European countries during October. The UK index dropped to 47.4 from 50.8. The EU index fell to 47.1, the lowest since July 2009. Germany decreased to 49.1, t ...

Mutual fund flows: an analysis of the main macroeconomic factors

... more redemptions). The authors report that net flow behave symmetrically in terms of performance, meaning that investors react similarly to good and bad performances. For inflow and outflow, the authors found an asymmetrical relationship. For inflow, investors tend to allocate more funds to better m ...

... more redemptions). The authors report that net flow behave symmetrically in terms of performance, meaning that investors react similarly to good and bad performances. For inflow and outflow, the authors found an asymmetrical relationship. For inflow, investors tend to allocate more funds to better m ...

The Timeless Case for Floating-Rate Loans as a Strategic Allocation

... An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. There can be no assurance that the liquidation of collateral securing an investment will satisf ...

... An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. There can be no assurance that the liquidation of collateral securing an investment will satisf ...

Alternative Investment Funds

... Fund management contracts could involve a fixed fee and a performance fee component for the performance of the eligible fund managers. In cases where the eligible fund managers are entitled to receive a fixed fee component, irrespective of the performance of the investments being managed by them, on ...

... Fund management contracts could involve a fixed fee and a performance fee component for the performance of the eligible fund managers. In cases where the eligible fund managers are entitled to receive a fixed fee component, irrespective of the performance of the investments being managed by them, on ...

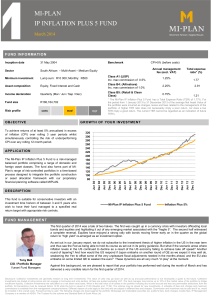

mi-plan ip inflation plus 5 fund

... insufficient liquidity. Collective investments are calculated on a net asset value basis, which is the total value of all assets in the portfolio including any income accrual and less any permissible deductions from the portfolio. All transactions must be received before 14:30 while the fund is valu ...

... insufficient liquidity. Collective investments are calculated on a net asset value basis, which is the total value of all assets in the portfolio including any income accrual and less any permissible deductions from the portfolio. All transactions must be received before 14:30 while the fund is valu ...

Insurance-Linked Securities: A Primer

... What are the risk/return characteristics of ILS? Given the nature of catastrophe insurance, characterized by low frequency and high severity events, ILS can offer higher coupon payments relative to comparably rated corporate bonds. As such, investors may expect relatively high annual returns potenti ...

... What are the risk/return characteristics of ILS? Given the nature of catastrophe insurance, characterized by low frequency and high severity events, ILS can offer higher coupon payments relative to comparably rated corporate bonds. As such, investors may expect relatively high annual returns potenti ...

06042015-Minutes-kl

... Mr. Leonard and Mr. Stronkowsky spoke about updating and maintaining the private equity portion of the portfolios. Currently both the Police and Firefighters’ Pension Plans are invested in Comvest, Park Square and Coller. It is NEPC’s recommendation that the private equity portfolio be addressed on ...

... Mr. Leonard and Mr. Stronkowsky spoke about updating and maintaining the private equity portion of the portfolios. Currently both the Police and Firefighters’ Pension Plans are invested in Comvest, Park Square and Coller. It is NEPC’s recommendation that the private equity portfolio be addressed on ...

SBL 52 Analysis and Report December 2005

... Abstract: By comparing with the main component indices in China Stock Market, the report about the analysis on market performance, correlation and risk return can indicate SBL Component Index is high qualified. The research’s period is between Nov. 1to Nov. 30 of 2005. The data comes from SBL Invest ...

... Abstract: By comparing with the main component indices in China Stock Market, the report about the analysis on market performance, correlation and risk return can indicate SBL Component Index is high qualified. The research’s period is between Nov. 1to Nov. 30 of 2005. The data comes from SBL Invest ...

A Day in the Life of an ETF Portfolio Manager

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

United States - Lazard Asset Management

... has accelerated from lows of about 1.5% year-on-year to roughly 2.7% more recently, can pull more working-age Americans back into the labor force. The prime age (25–54) labor force participation rate bottomed at 80.6% in September 2015 and has since risen to 81.7% as of February 2017. 4. US househo ...

... has accelerated from lows of about 1.5% year-on-year to roughly 2.7% more recently, can pull more working-age Americans back into the labor force. The prime age (25–54) labor force participation rate bottomed at 80.6% in September 2015 and has since risen to 81.7% as of February 2017. 4. US househo ...

definitions - iMercer.com

... the past six months. The terms ‘contraction’, ‘stable’ and ‘expansion’ are used to define the proportion of individuals that in the past six months have received below, at or above market rates, respectively. R EM U N ER AT I O N S EN T I M EN T I N D E X The Remuneration Sentiment Index measures th ...

... the past six months. The terms ‘contraction’, ‘stable’ and ‘expansion’ are used to define the proportion of individuals that in the past six months have received below, at or above market rates, respectively. R EM U N ER AT I O N S EN T I M EN T I N D E X The Remuneration Sentiment Index measures th ...

Focusing on Long-Term Return Objectives in a Low Return World

... The yield curve measures the spread between long and short dated U.S. Treasuries. The yield curve tends to go Raise target allocation to equities negative (i.e., inverts) late in the business cycle as shortterm rates rise above those of longer dated maturities as One seemingly logical solution to mi ...

... The yield curve measures the spread between long and short dated U.S. Treasuries. The yield curve tends to go Raise target allocation to equities negative (i.e., inverts) late in the business cycle as shortterm rates rise above those of longer dated maturities as One seemingly logical solution to mi ...

Creating a Donor-Advised Fund or Scholarship Fund Contributions

... during the first week of each month and will begin to accrue gain and loss after the first full month that funds have been deposited. Please keep in mind that this is our target timeline only, not a guaranteed one. No adjustment will be made for market fluctuations during the liquidation process. It ...

... during the first week of each month and will begin to accrue gain and loss after the first full month that funds have been deposited. Please keep in mind that this is our target timeline only, not a guaranteed one. No adjustment will be made for market fluctuations during the liquidation process. It ...

the-sitrep-for-the-wk-ending-2016-12-16

... great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the ...

... great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the ...

Sizing up active small-cap - Charles Schwab Investment Management

... Inflection points: Better able to deal with market upturns and downturns ...

... Inflection points: Better able to deal with market upturns and downturns ...

money market fund

... Invests in investment grade domestic debt securities, taxable and tax-exempt, all US$ denominated; using yield curve, sector selection and security selection ...

... Invests in investment grade domestic debt securities, taxable and tax-exempt, all US$ denominated; using yield curve, sector selection and security selection ...

Wells Fargo announces effective dates for changes to certain money

... Variable NAV Money Market Funds You could lose money by investing in the fund. Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. The fund may impose a fee upon the sale of your shares or may temporaril ...

... Variable NAV Money Market Funds You could lose money by investing in the fund. Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. The fund may impose a fee upon the sale of your shares or may temporaril ...

BPI Philippine Infrastructure Equity Index Fund

... The BPI Philippine Infrastructure Equity Index Fund is an index tracker UITF that tracks the performance of the BPI Philippine Infrastructure Equity Index. It buys all the stocks that comprise the BPI Philippine Infrastructure Equity Index in the same weights as the index. 2. What is the difference ...

... The BPI Philippine Infrastructure Equity Index Fund is an index tracker UITF that tracks the performance of the BPI Philippine Infrastructure Equity Index. It buys all the stocks that comprise the BPI Philippine Infrastructure Equity Index in the same weights as the index. 2. What is the difference ...

Advanced Practicum in Investment Management (FBE453a and

... Investment Illusions: A Savvy Wall Street Pro Explores Popular Misconceptions About the Markets by Martin Fridson Big Deal: Mergers and Acquisitions in the Digital Age by Bruce Wasserstein Den of Thieves by James B. Stewart Liar's Poker: Rising Through the Wreckage on Wall Street by Michael ...

... Investment Illusions: A Savvy Wall Street Pro Explores Popular Misconceptions About the Markets by Martin Fridson Big Deal: Mergers and Acquisitions in the Digital Age by Bruce Wasserstein Den of Thieves by James B. Stewart Liar's Poker: Rising Through the Wreckage on Wall Street by Michael ...

A Market and Economic Update

... their recession into the fourth quarter of 2016. Hopefully these turn around in 2017, helped by planned government expenditure. Telecommunications held up again with growth at 1% y/y, the same figure as the previous quarter. The Oil Sector experienced another deep contraction in the fourth quarter w ...

... their recession into the fourth quarter of 2016. Hopefully these turn around in 2017, helped by planned government expenditure. Telecommunications held up again with growth at 1% y/y, the same figure as the previous quarter. The Oil Sector experienced another deep contraction in the fourth quarter w ...

Is buy and hold dead - Richard Bernstein Advisors

... Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur ...

... Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur ...

CF Canlife Portfolio Funds

... By investing primarily in in-house funds, Canada Life Investments is able to maintain low costs across their suite of CF Canlife Portfolio Funds. Canada Life Investments Canada Life Investments is a UK-based asset manager responsible for managing more than £35bn of equities, fixed income and propert ...

... By investing primarily in in-house funds, Canada Life Investments is able to maintain low costs across their suite of CF Canlife Portfolio Funds. Canada Life Investments Canada Life Investments is a UK-based asset manager responsible for managing more than £35bn of equities, fixed income and propert ...

The Calm Before the Storm

... benchmark is performing negatively; if a manager captures less than 100% of the declining market it is said to be “defensive.” The Russell 1000® Index is used as the benchmark in all down market capture calculations in this material. Individual portfolios included in the DMC calculations may be mana ...

... benchmark is performing negatively; if a manager captures less than 100% of the declining market it is said to be “defensive.” The Russell 1000® Index is used as the benchmark in all down market capture calculations in this material. Individual portfolios included in the DMC calculations may be mana ...

Oil Gold - CounterPoint Asset Management

... ETF (US exposure) as in our opinion there has been a loss of clear value there. This year has been all about the multiple expansion and given the rise in longer dated treasuries the tail wind from this area has dissipated. We expect earnings to end the year at $108 placing the month end value of the ...

... ETF (US exposure) as in our opinion there has been a loss of clear value there. This year has been all about the multiple expansion and given the rise in longer dated treasuries the tail wind from this area has dissipated. We expect earnings to end the year at $108 placing the month end value of the ...