cipperman & company - Cipperman Compliance Services

... – CCO aided and abetted principals’ misuse of funds (SEC v. Duffy) • Bookkeeper who wired funds, documented transfers • CCO benefitted through salary and bonus – In-house lawyers at Enron fined for not disclosing related party transactions in proxy statement (SEC v. Mintz and Rogers) – President and ...

... – CCO aided and abetted principals’ misuse of funds (SEC v. Duffy) • Bookkeeper who wired funds, documented transfers • CCO benefitted through salary and bonus – In-house lawyers at Enron fined for not disclosing related party transactions in proxy statement (SEC v. Mintz and Rogers) – President and ...

Growth/Value/Momentum Returns as a Function of the Cross

... Index publishers such as Frank Russell and Salomon Smith Barney use fundamental information such as book-to-market ratio at a moment in time to define a taxonomy ...

... Index publishers such as Frank Russell and Salomon Smith Barney use fundamental information such as book-to-market ratio at a moment in time to define a taxonomy ...

Altrius Global Absolute Return Strategy

... detracted from relative performance leading to a negative active return against the Russell 1000 Value index for the quarter. The technology, consumer defensive and financial services sectors were our largest attributors to relative outperformance, while the industrials, consumer cyclicals and energ ...

... detracted from relative performance leading to a negative active return against the Russell 1000 Value index for the quarter. The technology, consumer defensive and financial services sectors were our largest attributors to relative outperformance, while the industrials, consumer cyclicals and energ ...

Cap Value Fiduciary Services Equity Investment

... holdings, performance and other data will vary depending on the size of an account, cash flows within an account, and restrictions on an account. Holdings are subject to change daily. The information in this profile is not a recommendation to buy, hold or sell securities. Actual portfolio statistics ...

... holdings, performance and other data will vary depending on the size of an account, cash flows within an account, and restrictions on an account. Holdings are subject to change daily. The information in this profile is not a recommendation to buy, hold or sell securities. Actual portfolio statistics ...

IOSR Journal of Computer Engineering (IOSR-JCE)

... Abstract: The main aim of every investor is to identify a stock that has potential to go up so that the investor can maximize possible returns on investment. After identification of stock the second important point of decision making is the time to make entry in that particular stock so that investo ...

... Abstract: The main aim of every investor is to identify a stock that has potential to go up so that the investor can maximize possible returns on investment. After identification of stock the second important point of decision making is the time to make entry in that particular stock so that investo ...

A New Strategy for Social Security Investment in Latin America

... ultimate risk of the Personal Retirement Account investments.6 There is however a limit to what can be achieved by diversification of investment within the single national capital market. Even in a large economy like that of the United States, in which Personal Retirement Accounts can invest in broa ...

... ultimate risk of the Personal Retirement Account investments.6 There is however a limit to what can be achieved by diversification of investment within the single national capital market. Even in a large economy like that of the United States, in which Personal Retirement Accounts can invest in broa ...

Market Timing: Opportunities and Risks

... important driver of long-term investment success. This is because most market timers typically fail to accurately predict important equity market swings. The long-term odds are not in favor of market timing strategies. ...

... important driver of long-term investment success. This is because most market timers typically fail to accurately predict important equity market swings. The long-term odds are not in favor of market timing strategies. ...

Religious charitable development funds

... Under subsection 11(3) of the Act, a person is guilty of an offence if the person does or fails to do an act and doing or failing to do that act results in a contravention of a condition to which a determination under section 11 is subject (being a determination that is in force and that applies to ...

... Under subsection 11(3) of the Act, a person is guilty of an offence if the person does or fails to do an act and doing or failing to do that act results in a contravention of a condition to which a determination under section 11 is subject (being a determination that is in force and that applies to ...

Word format - Parliament of Australia

... transactions that could be expected to occur. This would, in particular, impact on all members of those funds that do not impose an Exit Fee because the costs would be spread across all members. Alternatively such funds would need to impose a new fee. ii) create significant liquidity and long-term i ...

... transactions that could be expected to occur. This would, in particular, impact on all members of those funds that do not impose an Exit Fee because the costs would be spread across all members. Alternatively such funds would need to impose a new fee. ii) create significant liquidity and long-term i ...

Asset Allocation and Diversification

... perhaps even in recession, there will be no demand for new houses and construction companies will be impacted. Since the company would be performing poorly the value of the company would fall including the share price. ...

... perhaps even in recession, there will be no demand for new houses and construction companies will be impacted. Since the company would be performing poorly the value of the company would fall including the share price. ...

August 29 - Pontiac General Employees` Retirement System

... exception of healthcare, everything is up. Technology was down for the last three months. Growth companies need access to debt. As interest rates increased these were sold off. Emerging companies also were hurt by the interest rate increases as they use borrowing. Lots of these were sold off this qu ...

... exception of healthcare, everything is up. Technology was down for the last three months. Growth companies need access to debt. As interest rates increased these were sold off. Emerging companies also were hurt by the interest rate increases as they use borrowing. Lots of these were sold off this qu ...

Finding a new balance with alternatives

... divergence of central bank policies and China’s transition from a manufacturing-based economy to a service-based economy should create more volatility. It should be increasingly clear that traditional diversification is point dependent, and things have changed. ...

... divergence of central bank policies and China’s transition from a manufacturing-based economy to a service-based economy should create more volatility. It should be increasingly clear that traditional diversification is point dependent, and things have changed. ...

THE (TRUE) COST OF INVESTING

... 3. Indirect Costs – less transparent costs that can take many forms, but the primary drivers are trading commissions and prime brokerage-related costs Similar to mutual funds, indirect trading costs and commissions can add up quickly. Investors generally have little control over costs related to da ...

... 3. Indirect Costs – less transparent costs that can take many forms, but the primary drivers are trading commissions and prime brokerage-related costs Similar to mutual funds, indirect trading costs and commissions can add up quickly. Investors generally have little control over costs related to da ...

New rules for money market funds

... to help promote the financial stability of the U.S. economy. In July 2014, the U.S. Securities and Exchange Commission (SEC) adopted amendments to money market fund rules intended to increase transparency and give investors additional protection. The amendments create a distinction between retail an ...

... to help promote the financial stability of the U.S. economy. In July 2014, the U.S. Securities and Exchange Commission (SEC) adopted amendments to money market fund rules intended to increase transparency and give investors additional protection. The amendments create a distinction between retail an ...

Financial Investments and Stock Markets

... When the career life of an individual begins, a continuous income begins with it. This income is spent on basic needs and over time it will increase. Subsequently, the ability to save and place these savings in investments will generate more revenues and maintain the purchasing power of the individu ...

... When the career life of an individual begins, a continuous income begins with it. This income is spent on basic needs and over time it will increase. Subsequently, the ability to save and place these savings in investments will generate more revenues and maintain the purchasing power of the individu ...

(Attachment: 5)Report (79K/bytes)

... previous short term asset allocation. The current political, economic and market conditions are similar to previous advice provided at meetings and do not suggest any need to make any major strategy changes. Currently, the key component when setting the short term asset allocation is the Bond yield ...

... previous short term asset allocation. The current political, economic and market conditions are similar to previous advice provided at meetings and do not suggest any need to make any major strategy changes. Currently, the key component when setting the short term asset allocation is the Bond yield ...

1 | Page Author Jacob Braude is quoted as saying, “Always behave

... Rim, where countries are starting to debase their respective currencies to gain a trade advantage, is uncomfortably reminiscent of the “competitive devaluations” that led to the “Asian Contagion” crisis of 1997. In that instance, countries throughout the region devalued their currencies, one after a ...

... Rim, where countries are starting to debase their respective currencies to gain a trade advantage, is uncomfortably reminiscent of the “competitive devaluations” that led to the “Asian Contagion” crisis of 1997. In that instance, countries throughout the region devalued their currencies, one after a ...

Investing Social Security Assets

... proposals have tried to mitigate the impact of generally unpopular tax increases or benefit cuts required to maintain solvency by relying on additional income that could be earned from investing the Social Security assets in the relatively volatile equities markets, rather than in special-issue gover ...

... proposals have tried to mitigate the impact of generally unpopular tax increases or benefit cuts required to maintain solvency by relying on additional income that could be earned from investing the Social Security assets in the relatively volatile equities markets, rather than in special-issue gover ...

The Diversified Portfolio Index

... It is not only the average of the annual returns that matter. Strategies may vary from each other year to year but still have the same average annual return. Intuitively, the end result should be that they both produce the same total return, but this is not actually true. The investment with the hig ...

... It is not only the average of the annual returns that matter. Strategies may vary from each other year to year but still have the same average annual return. Intuitively, the end result should be that they both produce the same total return, but this is not actually true. The investment with the hig ...

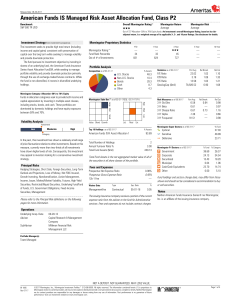

American Funds IS Managed Risk Asset Allocation Fund

... variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar R ...

... variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar R ...

Calvert High Yield Bond Fund

... part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds rate following a similar move last year and the possibility that it may continue with such rate increases and/or unwind its quant ...

... part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds rate following a similar move last year and the possibility that it may continue with such rate increases and/or unwind its quant ...

Do Corporate Managers Time Stock Repurchases Effectively?

... shareholders, which may include repurchasing company shares when they are considered to be undervalued, and issuing shares when values are deemed to be high. Managers who make timing mistakes risk repurchasing shares when valuations are high. They instead could be using the cash to make positive net ...

... shareholders, which may include repurchasing company shares when they are considered to be undervalued, and issuing shares when values are deemed to be high. Managers who make timing mistakes risk repurchasing shares when valuations are high. They instead could be using the cash to make positive net ...

PSG Global Equity Feeder Fund Class A

... coupled with a market-friendly election outcome in France and dollar weakness, drove European stocks 15.91% higher. Emerging markets also ended two years of underperformance and returned 18.55% year to date. (All returns quoted in US dollars.) This does not necessarily mean that all markets and all ...

... coupled with a market-friendly election outcome in France and dollar weakness, drove European stocks 15.91% higher. Emerging markets also ended two years of underperformance and returned 18.55% year to date. (All returns quoted in US dollars.) This does not necessarily mean that all markets and all ...