Scannell Wealth Report April 6, 2009 The Markets One

... the first quarter, the dollar strengthened 5% against the euro, 9% against the Japanese yen, and 4% against a trade-weighted basket of 16 currencies tracked by J.P. Morgan Chase, according to The Wall Street Journal. The dollar’s strength may confound its critics because of the theory of relativity. ...

... the first quarter, the dollar strengthened 5% against the euro, 9% against the Japanese yen, and 4% against a trade-weighted basket of 16 currencies tracked by J.P. Morgan Chase, according to The Wall Street Journal. The dollar’s strength may confound its critics because of the theory of relativity. ...

FIN4504c3

... Qualify as a regulated investment company (earns 90% of its income from security transactions) and If at least 90% of its taxable income each year is passed onto the shareholder Must register with the SEC Not insured or guaranteed Types: Managed ...

... Qualify as a regulated investment company (earns 90% of its income from security transactions) and If at least 90% of its taxable income each year is passed onto the shareholder Must register with the SEC Not insured or guaranteed Types: Managed ...

Contents Stock Market Indicators Measuring market bredth Sample

... Most analysts prefer the A/D ratio as an indicator, because it is more amenable to comparisons than the A-D line. The A/D ratio has an absolute value that does not vary in function of the number of components being analyzed – it remains constant, regardless of the number of stocks under considerati ...

... Most analysts prefer the A/D ratio as an indicator, because it is more amenable to comparisons than the A-D line. The A/D ratio has an absolute value that does not vary in function of the number of components being analyzed – it remains constant, regardless of the number of stocks under considerati ...

Portfolio Advisory Council, LLC presents:

... purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. Al ...

... purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. Al ...

Strong first year for Smartfund 80% Protected

... value during downturns and yet being able to capture value on upswings. This innovative new product was set out to create an investment strategy for investors looking to grow their capital but seeking a smoother journey. After its first year of operation, in trying conditions, it has delivered as pl ...

... value during downturns and yet being able to capture value on upswings. This innovative new product was set out to create an investment strategy for investors looking to grow their capital but seeking a smoother journey. After its first year of operation, in trying conditions, it has delivered as pl ...

Nigerian earnings growth contributes to Sustainable Capital`s

... when comparing Nigeria to other emerging markets as the Nigerian equity market has lagged other emerging markets by more than 130% since 2000 despite improving fundamentals, declining risk and strong earnings growth prospects. ...

... when comparing Nigeria to other emerging markets as the Nigerian equity market has lagged other emerging markets by more than 130% since 2000 despite improving fundamentals, declining risk and strong earnings growth prospects. ...

Meet Shirley Watson EPC, FCSI - Shirley Watson Financial Solutions

... solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation. It is for general information only and is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice. Investors s ...

... solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation. It is for general information only and is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice. Investors s ...

Portfolio Advisory Council, LLC presents:

... purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. Al ...

... purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. Al ...

New Star Asia raises 325m - Investment International

... New Star Capital Guaranteed Asian Hedge Fund has raised $32.5 million. This brings the total amount raised for New Star International guaranteed hedge funds since September 2001 to more than $343 million, a record amount for guaranteed single manager hedge funds. This Fund is designed to provide inv ...

... New Star Capital Guaranteed Asian Hedge Fund has raised $32.5 million. This brings the total amount raised for New Star International guaranteed hedge funds since September 2001 to more than $343 million, a record amount for guaranteed single manager hedge funds. This Fund is designed to provide inv ...

Leveraged ETF credit risks

... ProShares and Rydex are the two biggest issuers of leveraged funds, which seek to provide some multiple of the return on an index or sector. Examples include UltraShort Financials ProShares (NasdaqGS:SKF - News), which seeks to provide twice the opposite of the daily return of the U.S. financials se ...

... ProShares and Rydex are the two biggest issuers of leveraged funds, which seek to provide some multiple of the return on an index or sector. Examples include UltraShort Financials ProShares (NasdaqGS:SKF - News), which seeks to provide twice the opposite of the daily return of the U.S. financials se ...

Factsheet-WisdomTree Germany Equity UCITS ETF - USD

... Dividend Weighted Index: an index that determines the weight of its constituents using the dividends paid by the security rather than another variable (the most common is Market Cap weighted indices). Fully Replicated: assets are invested in securities that match the constituents of the relevant ind ...

... Dividend Weighted Index: an index that determines the weight of its constituents using the dividends paid by the security rather than another variable (the most common is Market Cap weighted indices). Fully Replicated: assets are invested in securities that match the constituents of the relevant ind ...

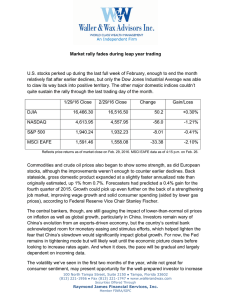

Market rally fades during leap year trading U.S. stocks perked up

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

7IM Specialist Investment Funds-7IM Emerging Markets Equity

... similar valuation ratio. Profitability is defined as high return-on-equity (ROE), return-on-asset (ROA), return-on-invested-capital (ROIC) or similar profitability metrics. High growth companies are characterised by significant positive increments in sales, dividends, earnings or growth in similar i ...

... similar valuation ratio. Profitability is defined as high return-on-equity (ROE), return-on-asset (ROA), return-on-invested-capital (ROIC) or similar profitability metrics. High growth companies are characterised by significant positive increments in sales, dividends, earnings or growth in similar i ...

Mackenzie Cundill Value Fund – Series C

... as of March 31, 2016 including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values ...

... as of March 31, 2016 including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values ...

Emerging Markets presentation. - Undergraduate Investment Society

... S Investments produce returns in origin country’s currency S Investors must convert to realize gains in USD S Currency fluctuations can impact total returns of security ...

... S Investments produce returns in origin country’s currency S Investors must convert to realize gains in USD S Currency fluctuations can impact total returns of security ...

Mth - Prudential Jennison Small Company Fund

... Company offers inexpensive exposure to the Permian Basin, providing leverage to high-quality acreage. In addition, the restructuring story has not only made valuation attractive, but in our view could also provide running room for lowercost growth and a potential monetization option down the road. S ...

... Company offers inexpensive exposure to the Permian Basin, providing leverage to high-quality acreage. In addition, the restructuring story has not only made valuation attractive, but in our view could also provide running room for lowercost growth and a potential monetization option down the road. S ...

BM18_14TrusteeReport_Presentation_en

... On January 31,2005, the assets of Trust Funds were converted into two separate tranches. GFATM participates in both tranches. CY05 return includes pre-tranche returns for January 2005. The return shown above for 2002 to 2004 is for the total Trust Funds (includes GFATM). CY08 return is not annualise ...

... On January 31,2005, the assets of Trust Funds were converted into two separate tranches. GFATM participates in both tranches. CY05 return includes pre-tranche returns for January 2005. The return shown above for 2002 to 2004 is for the total Trust Funds (includes GFATM). CY08 return is not annualise ...

BEF Monthly Report-Master copy_Sep_11.xlsx

... Balanced investment policy that aims at long term capital gains with minimum possible risk to accommodate the fund's nature. Fund's manager may invest in short and mid-term money market/debt instruments until proper investment opportunities arise. ...

... Balanced investment policy that aims at long term capital gains with minimum possible risk to accommodate the fund's nature. Fund's manager may invest in short and mid-term money market/debt instruments until proper investment opportunities arise. ...

Travels (September) - Laurel Wealth Planning

... time, and may help make us more energy independent. • The growth markets of China, India, Indonesia, South America, etc. are still the story. Even if growth slows in these countries, which it has and will over time, substantial middle classes have been created and the companies you own will work har ...

... time, and may help make us more energy independent. • The growth markets of China, India, Indonesia, South America, etc. are still the story. Even if growth slows in these countries, which it has and will over time, substantial middle classes have been created and the companies you own will work har ...

CSI Short Term Note 50 Index Methodology

... 1. Adjustment formula Divisor Adjustment Methodology. 2. Cases for Index Adjustment: Constituents adjustment Amount outstanding Adjustment— if issued amount of constituent bond changes, the index is adjusted before the change occurs. On the last trading day of the month, interest and reinvestm ...

... 1. Adjustment formula Divisor Adjustment Methodology. 2. Cases for Index Adjustment: Constituents adjustment Amount outstanding Adjustment— if issued amount of constituent bond changes, the index is adjusted before the change occurs. On the last trading day of the month, interest and reinvestm ...

Portfolio Management Analyzing Historical Stock Examples

... • Examples (Active Management) – Buying / selling individual stocks – Discuss with your broker which stocks to buy – Choosing between different mutual funds ...

... • Examples (Active Management) – Buying / selling individual stocks – Discuss with your broker which stocks to buy – Choosing between different mutual funds ...

Portfolio Diversification with Municipal Bonds

... Corporation was among the first U.S. money managers helping investors achieve greater diversification through global investing. Today, the firm continues this tradition by offering innovative, actively managed investment choices in hard assets, emerging markets, precious metals including gold, and o ...

... Corporation was among the first U.S. money managers helping investors achieve greater diversification through global investing. Today, the firm continues this tradition by offering innovative, actively managed investment choices in hard assets, emerging markets, precious metals including gold, and o ...

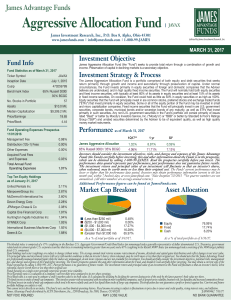

Aggressive Allocation Fund | JAVAX

... related and investment grade U.S. corporate securities that have a remaining maturity greater than one year) and a 65% weighting in the Russell 3000® Index (an unmanaged index consisting of the 3000 largest publicly listed U.S. companies). Fund holdings and sector weightings are subject to change wi ...

... related and investment grade U.S. corporate securities that have a remaining maturity greater than one year) and a 65% weighting in the Russell 3000® Index (an unmanaged index consisting of the 3000 largest publicly listed U.S. companies). Fund holdings and sector weightings are subject to change wi ...