Director Penalties and Incentives to Restate: Evidence from Stock

... A unique feature of the backdating setting is that external parties could examine publicly available data on options to measure the likely culpability of a given firm independent of a restatement. We gain insight into whether director penalties are levied in this manner by separately examining the p ...

... A unique feature of the backdating setting is that external parties could examine publicly available data on options to measure the likely culpability of a given firm independent of a restatement. We gain insight into whether director penalties are levied in this manner by separately examining the p ...

5.45% Series J Cumulative Preferred Stock

... Stock, par value $0.001 per share (the “Series J Preferred Shares”). The Series J Preferred Shares will constitute a separate series of the Fund’s preferred stock. Investors in Series J Preferred Shares will be entitled to receive cumulative cash dividends at a rate of 5.45% per annum. Dividends and ...

... Stock, par value $0.001 per share (the “Series J Preferred Shares”). The Series J Preferred Shares will constitute a separate series of the Fund’s preferred stock. Investors in Series J Preferred Shares will be entitled to receive cumulative cash dividends at a rate of 5.45% per annum. Dividends and ...

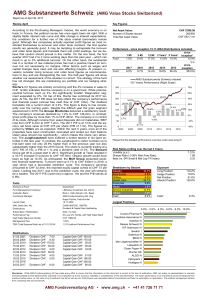

AMG Substanzwerte Schweiz (AMG Value Stocks

... track. In France, the political course has once again been set right. With a slightly flatter interest rate curve and little change in interest expectations, the conditions for a further rise of the stock market barometers remain good. Although few companies actually reported profit figures as most ...

... track. In France, the political course has once again been set right. With a slightly flatter interest rate curve and little change in interest expectations, the conditions for a further rise of the stock market barometers remain good. Although few companies actually reported profit figures as most ...

Morningstar and Barron`s 2014-2015 Alternative Investment Survey

... deceleration is significant, alts still grew at the fastest clip relative to all other asset classes. /Alternative fund launches also reached their highest level in 2014, as more companies are seeking a claim to this fast-growing niche. However, this may not be sustainable given the slowdown in flow ...

... deceleration is significant, alts still grew at the fastest clip relative to all other asset classes. /Alternative fund launches also reached their highest level in 2014, as more companies are seeking a claim to this fast-growing niche. However, this may not be sustainable given the slowdown in flow ...

NBER WORKING PAPER SERIES TRANSPARENCY AND INTERNATIONAL INVESTOR BEHAVIOR R. Gaston Gelos

... International evidence on this question, however, is still lacking. To be sure, there are several empirical studies that measure the degree of herding among funds, including Lakonishok, Shleifer and Vishny (1992), Grinblatt, Titman and Wermers (1995), and Wermers (1999) for the U.S., Choe, Kho and S ...

... International evidence on this question, however, is still lacking. To be sure, there are several empirical studies that measure the degree of herding among funds, including Lakonishok, Shleifer and Vishny (1992), Grinblatt, Titman and Wermers (1995), and Wermers (1999) for the U.S., Choe, Kho and S ...

Fiduciary Obligations of Directors of a Target Company in Resisting

... First, the courts recognize that they are ill-suited to evaluate business judgments made by directors.34 Second, there is a recognition that the imposition of liability for mere good faith errors of business judgment would deter many individuals from serving as directors and inhibit those who are wi ...

... First, the courts recognize that they are ill-suited to evaluate business judgments made by directors.34 Second, there is a recognition that the imposition of liability for mere good faith errors of business judgment would deter many individuals from serving as directors and inhibit those who are wi ...

- Reliance Mutual Fund

... Documents is given in the aforesaid AMFI Guidelines, which is available on our website www.reliancemutual.com. Post Dated Cheques will not be accepted as a mode of payment for application of MICRO SIP. Reliance SIP Inasure facility will not be extended to investors applying under the category of Mic ...

... Documents is given in the aforesaid AMFI Guidelines, which is available on our website www.reliancemutual.com. Post Dated Cheques will not be accepted as a mode of payment for application of MICRO SIP. Reliance SIP Inasure facility will not be extended to investors applying under the category of Mic ...

Pension Fund Asset Allocation and Liability Discount Rates

... require that these are based on high credit quality interest rates and thus cannot be managed by modifying the allocation to risky assets. For instance, Canadian public and private pension plans discount their liabilities using market yields of high-quality corporate debt instruments (Canadian Inst ...

... require that these are based on high credit quality interest rates and thus cannot be managed by modifying the allocation to risky assets. For instance, Canadian public and private pension plans discount their liabilities using market yields of high-quality corporate debt instruments (Canadian Inst ...

- Franklin Templeton Investments

... As co-lead portfolio managers, Messrs. Molumphy and Bayston are jointly and primarily responsible for the day-to-day management of the Fund's portfolio. They have equal authority over all aspects of the Fund's investment portfolio, including but not limited to, purchases and sales of individual sec ...

... As co-lead portfolio managers, Messrs. Molumphy and Bayston are jointly and primarily responsible for the day-to-day management of the Fund's portfolio. They have equal authority over all aspects of the Fund's investment portfolio, including but not limited to, purchases and sales of individual sec ...

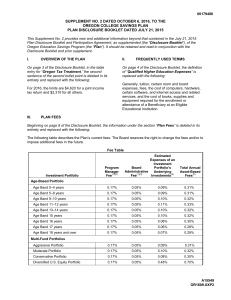

Disclosure Booklet - Oregon College Savings Plan

... risk is inserted into the paragraph under the subheading “Investment Risks” for the Aggressive Portfolio: Cyber Security Risk. On page 14 of the Disclosure Booklet, the following risk is inserted into the paragraph under the subheading “Investment Risks” for the Moderate Portfolio: Cyber Security Ri ...

... risk is inserted into the paragraph under the subheading “Investment Risks” for the Aggressive Portfolio: Cyber Security Risk. On page 14 of the Disclosure Booklet, the following risk is inserted into the paragraph under the subheading “Investment Risks” for the Moderate Portfolio: Cyber Security Ri ...

SCHEME INFORMATION DOCUMENT MAHINDRA MUTUAL FUND BACHAT YOJANA

... The investment objective of the Scheme is to provide reasonable returns, commensurate with a low to moderate level of risk and high degree of liquidity, through a portfolio constituted of money market and debt instruments. However, there is no assurance that the investment objective of the Scheme wi ...

... The investment objective of the Scheme is to provide reasonable returns, commensurate with a low to moderate level of risk and high degree of liquidity, through a portfolio constituted of money market and debt instruments. However, there is no assurance that the investment objective of the Scheme wi ...

The performance of hedge funds and mutual funds in

... hedge fund strategies, it shows that emerging market hedge funds now face more trading opportunities and might thus have changed their strategy. This hypothesis is supported by the empirical findings of Abugri and Dutta (2009). Following Abugri and Dutta (2009), we will also analyze whether hedge fu ...

... hedge fund strategies, it shows that emerging market hedge funds now face more trading opportunities and might thus have changed their strategy. This hypothesis is supported by the empirical findings of Abugri and Dutta (2009). Following Abugri and Dutta (2009), we will also analyze whether hedge fu ...

Gift Acceptance Policy - West Central Initiative

... as contemplated and permitted by Sections 170(c)(2) and 501(c)(3) of the Internal Revenue Code of 1986; and WHEREAS, the WCI Board of Directors has the power to accept gifts to the organization that support the overall vision and mission; and WHEREAS, the WCI Board of Directors has the power to reje ...

... as contemplated and permitted by Sections 170(c)(2) and 501(c)(3) of the Internal Revenue Code of 1986; and WHEREAS, the WCI Board of Directors has the power to accept gifts to the organization that support the overall vision and mission; and WHEREAS, the WCI Board of Directors has the power to reje ...

Retirement Plan Enrollment Booklet

... Your quiz score is an important piece to the Guided process. The score will help identify which pre-mixed portfolio will provide you with a diversified investment strategy that is appropriate for your circumstances. You can then set investment directives and transfer assets to be consistent with the ...

... Your quiz score is an important piece to the Guided process. The score will help identify which pre-mixed portfolio will provide you with a diversified investment strategy that is appropriate for your circumstances. You can then set investment directives and transfer assets to be consistent with the ...

Intertemporal capital budgeting

... competing project that occurs contemporaneously. However, the best alternative use of the firm’s capital is often an investment opportunity that arrives with uncertainty in the future. Therefore, even if headquarters can costlessly monitor the quality of all projects proposed by division managers, di ...

... competing project that occurs contemporaneously. However, the best alternative use of the firm’s capital is often an investment opportunity that arrives with uncertainty in the future. Therefore, even if headquarters can costlessly monitor the quality of all projects proposed by division managers, di ...

JP Morgan Securities LLC | Wrap Fee Program Brochure | Advisory

... which JPMPI seeks to invest in individual securities; and (2) multi-manager strategies (the “Multi-Manager Strategies”) for which JPMPI seeks to invest in one or more Funds available through JPMS, and/or in individual securities following one or more model portfolios provided by affiliated and/or un ...

... which JPMPI seeks to invest in individual securities; and (2) multi-manager strategies (the “Multi-Manager Strategies”) for which JPMPI seeks to invest in one or more Funds available through JPMS, and/or in individual securities following one or more model portfolios provided by affiliated and/or un ...

The concept of investment efficiency and its application to

... future outcomes, or deciding to follow a peer group allocation that was deemed suitable for the achievement of the objectives. 2.5.3 Quantitative methods include asset modelling (AM) and asset liability modelling (ALM). Both AM and ALM are risk assessment techniques that involve making projections o ...

... future outcomes, or deciding to follow a peer group allocation that was deemed suitable for the achievement of the objectives. 2.5.3 Quantitative methods include asset modelling (AM) and asset liability modelling (ALM). Both AM and ALM are risk assessment techniques that involve making projections o ...

Principles of Corporate Governance – 2012

... The principles discussed here are intended to assist corporate boards of directors and management in their individual efforts to implement best practices of corporate governance, as well as to serve as guideposts for the public dialogue on evolving governance standards. As noted above, there is no ...

... The principles discussed here are intended to assist corporate boards of directors and management in their individual efforts to implement best practices of corporate governance, as well as to serve as guideposts for the public dialogue on evolving governance standards. As noted above, there is no ...

Reporting Form SRF 530.0 Investments

... The asset class types are: cash, fixed income, equity, property, infrastructure, commodities and ‘other’. The asset domicile types are: Australia domicile, international domicile and ‘not applicable’. Where the domicile is not known, report domicile type as ‘not applicable’. The asset listing types ...

... The asset class types are: cash, fixed income, equity, property, infrastructure, commodities and ‘other’. The asset domicile types are: Australia domicile, international domicile and ‘not applicable’. Where the domicile is not known, report domicile type as ‘not applicable’. The asset listing types ...

Notice of the Ministry of Labor and Social Security and China

... Article 18 For the enterprise annuity fund under the trusteeship of a clearing participant, the China Clearing Corporation shall check and ratify the corresponding minimum clearing reserve in accordance with the relevant provisions on the management of clearing reserve. The balance at the end of a ...

... Article 18 For the enterprise annuity fund under the trusteeship of a clearing participant, the China Clearing Corporation shall check and ratify the corresponding minimum clearing reserve in accordance with the relevant provisions on the management of clearing reserve. The balance at the end of a ...

INVESTMENT-CASH FLOW SENSITIVITY IN SMALL AND MEDIUM

... According to Myers (1984) and Myers and Majluf (1984), when additional financing is required there is a hierarchy in the use of funds, which is based on information asymmetry. Whenever possible, funding a firm should be covered by internally generated funds, which are not affected by adverse selecti ...

... According to Myers (1984) and Myers and Majluf (1984), when additional financing is required there is a hierarchy in the use of funds, which is based on information asymmetry. Whenever possible, funding a firm should be covered by internally generated funds, which are not affected by adverse selecti ...

SEC Comment - The Committee For The Fiduciary Standard

... these concerns. Credible analysis and data should also negate the presumption that investment expenses may actually decrease under the fiduciary standard because excessive investment expenses are considered imprudent and a potential fiduciary breach under the fiduciary standard. SIFMA expresses repe ...

... these concerns. Credible analysis and data should also negate the presumption that investment expenses may actually decrease under the fiduciary standard because excessive investment expenses are considered imprudent and a potential fiduciary breach under the fiduciary standard. SIFMA expresses repe ...

Asset Prices and Unit Trusts

... (2005), Khorana, Tufano and Wedge (2007), Khorana, Servaes and Wedge (2007), Chen, Goldstein and Jiang (2008). ...

... (2005), Khorana, Tufano and Wedge (2007), Khorana, Servaes and Wedge (2007), Chen, Goldstein and Jiang (2008). ...

Going mainstream – how absolute return is moving into the

... The concept of investing to achieve an absolute return has been around for over 60 years and has enabled the global hedge fund market to grow to a total value of more than US$1.6 trillion (EUR1.28trn)1. But it is only since 2002 that investors in Europe have been able to access absolute return appro ...

... The concept of investing to achieve an absolute return has been around for over 60 years and has enabled the global hedge fund market to grow to a total value of more than US$1.6 trillion (EUR1.28trn)1. But it is only since 2002 that investors in Europe have been able to access absolute return appro ...