A Different Way to Invest

... Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To ...

... Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To ...

Regulatory Risk, Cost of Capital and Investment

... used to determine the cost of equity capital but other methodologies exist such as the DCF and the risk premium analysis. Apparently, the regulatory practice is quite different across continents and countries. By and large, regulatory decisions are taken by using alternative financial models to calc ...

... used to determine the cost of equity capital but other methodologies exist such as the DCF and the risk premium analysis. Apparently, the regulatory practice is quite different across continents and countries. By and large, regulatory decisions are taken by using alternative financial models to calc ...

Dreyfus Variable Investment Fund: International Value Portfolio

... Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money. • Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over ...

... Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money. • Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over ...

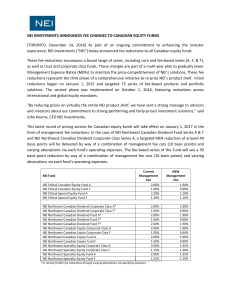

NEI Investments announces fee changes to Canadian equity funds

... form of management fee reductions. In the case of NEI Northwest Canadian Dividend Fund Series A & T and NEI Northwest Canadian Dividend Corporate Class Series A, a targeted MER reduction of around 40 basis points will be delivered by way of a combination of management fee cuts (10 basis points) and ...

... form of management fee reductions. In the case of NEI Northwest Canadian Dividend Fund Series A & T and NEI Northwest Canadian Dividend Corporate Class Series A, a targeted MER reduction of around 40 basis points will be delivered by way of a combination of management fee cuts (10 basis points) and ...

Artisan Partners Targets Australian Market

... jurisdiction outside of the United States. Artisan Partners UK LLP is an investment adviser registered with the SEC and authorised and regulated by the United Kingdom’s Financial Services Authority. Neither Artisan Partners US nor Artisan Partners UK has represented or will represent that it is othe ...

... jurisdiction outside of the United States. Artisan Partners UK LLP is an investment adviser registered with the SEC and authorised and regulated by the United Kingdom’s Financial Services Authority. Neither Artisan Partners US nor Artisan Partners UK has represented or will represent that it is othe ...

Basics with Equity Market Neutral

... Equity market neutral strategies rely on the stock picking ability of a manager to find the most undervalued stocks for the long portfolio and the most overpriced for the short portfolio. The strategy has a “double alpha” effect because a manager can, at the same time, hold favorite stocks and bet a ...

... Equity market neutral strategies rely on the stock picking ability of a manager to find the most undervalued stocks for the long portfolio and the most overpriced for the short portfolio. The strategy has a “double alpha” effect because a manager can, at the same time, hold favorite stocks and bet a ...

WORD - AU EJIR eJournal

... 2003, Developing Corporate Governance Codes of Best Practices, Volume I, Global Corporate Governance). Corporate governance structure and model varies significantly among different countries. In a highly dispersed shareholding system, such as is the case in the USA, members of the board of directors ...

... 2003, Developing Corporate Governance Codes of Best Practices, Volume I, Global Corporate Governance). Corporate governance structure and model varies significantly among different countries. In a highly dispersed shareholding system, such as is the case in the USA, members of the board of directors ...

Operating Endowment Fund - Second Presbyterian Church

... Although it is contemplated that the majority of gifts made to the Endowment will be in the form of cash or other liquid assets, the Session realizes that some gifts may be in the form of real property, or an interest in real property, that may carry with it liability which may include but not neces ...

... Although it is contemplated that the majority of gifts made to the Endowment will be in the form of cash or other liquid assets, the Session realizes that some gifts may be in the form of real property, or an interest in real property, that may carry with it liability which may include but not neces ...

Page 13 April 2012 The Manager, Contributions and Accumulations

... Further, we note that it is not possible to conduct a proper analysis of the exposure draft until other outstanding legislation in relation to MySuper and Choice products is available. The deficiencies and confusion in the exposure draft (as well as the lack of full legislation) highlight further th ...

... Further, we note that it is not possible to conduct a proper analysis of the exposure draft until other outstanding legislation in relation to MySuper and Choice products is available. The deficiencies and confusion in the exposure draft (as well as the lack of full legislation) highlight further th ...

Geometric Average Capitalization

... Japan, Australia/NZ, and Asia ex-Japan), the geometric average capitalization of the fund can be compared to the large-, mid-, and small-cap divisions of the Morningstar Style BoxTM. In these cases, the Style Box size score (raw y) is derived from the natural logarithm of the geometric average capit ...

... Japan, Australia/NZ, and Asia ex-Japan), the geometric average capitalization of the fund can be compared to the large-, mid-, and small-cap divisions of the Morningstar Style BoxTM. In these cases, the Style Box size score (raw y) is derived from the natural logarithm of the geometric average capit ...

Endowments, Foundations, and Investment Management

... is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index designed to developed-market equity performance, excludin ...

... is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index designed to developed-market equity performance, excludin ...

MPF Scheme Series S800

... 7. The Principal MPF Conservative Fund under this Scheme is not a guaranteed fund and does not guarantee the repayment of capital. Fees and charges of a MPF conservative fund can be deducted from either (i) the assets of the fund or (ii) members’ account by way of unit deduction. This Fund uses met ...

... 7. The Principal MPF Conservative Fund under this Scheme is not a guaranteed fund and does not guarantee the repayment of capital. Fees and charges of a MPF conservative fund can be deducted from either (i) the assets of the fund or (ii) members’ account by way of unit deduction. This Fund uses met ...

Market Turmoil and Destabilizing Speculation Supplementary Material

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

Trends in shareholder activism

... always publicly disclosed. It is possible to identify major holders on a quarterly basis in the US once by monitoring 13-d and 13-g filings. But in this modern age activists can accumulate positions very quickly and it is possible a new holder could move into a position of significant ownership in a ...

... always publicly disclosed. It is possible to identify major holders on a quarterly basis in the US once by monitoring 13-d and 13-g filings. But in this modern age activists can accumulate positions very quickly and it is possible a new holder could move into a position of significant ownership in a ...

Supplement to “Output contingent securities and

... We pose a few remarks before proceeding. We first notice that the presence of a continuum of firms is consistent with our behavioral assumption that agents are convinced that a change in the investment of each firm does not affect the probability over the aggregate output. We also stress that shocks ...

... We pose a few remarks before proceeding. We first notice that the presence of a continuum of firms is consistent with our behavioral assumption that agents are convinced that a change in the investment of each firm does not affect the probability over the aggregate output. We also stress that shocks ...

Personalised discretionary portfolio management: the tailor

... This is a commercial document prepared and distributed by ING Private Banking, a commercial division of ING Belgium. It has been prepared for information purposes only and does not contain any investment recommendation within the terms of the royal decree of 5 March 2006. Its content is based on inf ...

... This is a commercial document prepared and distributed by ING Private Banking, a commercial division of ING Belgium. It has been prepared for information purposes only and does not contain any investment recommendation within the terms of the royal decree of 5 March 2006. Its content is based on inf ...

Standard Deviation as a Measure of Risk for a Mutual Fund

... 7. Use the TI83/84 statistical functions to calculate the mean and standard deviation of (a) the data set: 5%, 10%, and -7%. 8. For an ultra short term bond fund, the yearly standard deviation is .64% (Morningstar, Investing Classroom). (a) For a mean rate of return of 3%, assuming a normal distrib ...

... 7. Use the TI83/84 statistical functions to calculate the mean and standard deviation of (a) the data set: 5%, 10%, and -7%. 8. For an ultra short term bond fund, the yearly standard deviation is .64% (Morningstar, Investing Classroom). (a) For a mean rate of return of 3%, assuming a normal distrib ...

Blyth Market Advertising Proposal

... Expenditure on the proposal can only take place when the majority of traders approve this, in agreement with Northumberland County Council who will process payment if approval is given. Each trader will be issued a form and asked to complete a Trader Response (Section B). ...

... Expenditure on the proposal can only take place when the majority of traders approve this, in agreement with Northumberland County Council who will process payment if approval is given. Each trader will be issued a form and asked to complete a Trader Response (Section B). ...

Financial reporting is considered as a key element of corporate

... The relationship between corporate governance and disclosure was also studied by Forker (1992) or Levitt (199), but the former was focused on share option disclosure and the later employed two financial reporting quality measures (instead of information): analysts' published evaluations of corporate ...

... The relationship between corporate governance and disclosure was also studied by Forker (1992) or Levitt (199), but the former was focused on share option disclosure and the later employed two financial reporting quality measures (instead of information): analysts' published evaluations of corporate ...

Source Bloomberg Commodity Ex

... with UCITS guidelines and Source policies, the exposure to any derivative counterparty is tightly controlled but the default of a derivative counterparty may cause a loss to the Fund. It is recommended that potential investors study the Fund prospectus before investing. Lack of track record: Neither ...

... with UCITS guidelines and Source policies, the exposure to any derivative counterparty is tightly controlled but the default of a derivative counterparty may cause a loss to the Fund. It is recommended that potential investors study the Fund prospectus before investing. Lack of track record: Neither ...

the relevance of real estate market trends for investment property

... • Mueller and Laposa (1994) investigated the cyclical movements of fifty-two office markets in the U.S. By examining average vacancy and deviations from this average as an indication of market risk or volatility, they classified and captured the nature of cyclical risk inherent in these markets. The ...

... • Mueller and Laposa (1994) investigated the cyclical movements of fifty-two office markets in the U.S. By examining average vacancy and deviations from this average as an indication of market risk or volatility, they classified and captured the nature of cyclical risk inherent in these markets. The ...

binarynvest

... Furthermore, the FSMA reminds the public that since 18 August 2016, no investment firm (authorized or not) is permitted actively to distribute, within the territory of Belgium, via an electronic trading system, binary options or any other derivative instruments whose maturity is less than one hour a ...

... Furthermore, the FSMA reminds the public that since 18 August 2016, no investment firm (authorized or not) is permitted actively to distribute, within the territory of Belgium, via an electronic trading system, binary options or any other derivative instruments whose maturity is less than one hour a ...

Monthly Commentary—Artisan International Small

... Carefully consider the Fund’s investment objective, risks and charges and expenses. This and other important information is contained in the Fund's prospectus and summary prospectus, which can be obtained by calling 800.344.1770. Read carefully before investing. International investments involve spe ...

... Carefully consider the Fund’s investment objective, risks and charges and expenses. This and other important information is contained in the Fund's prospectus and summary prospectus, which can be obtained by calling 800.344.1770. Read carefully before investing. International investments involve spe ...