OWNERSHIP STRUCTURE, BOARD STRUCTURE AND

... recognised standards for good and responsible governance. Thus, the separation of ownership and executives is recommended, risk management is prioritised, prudential management is required, and the relevance of financial reporting is advocated as part of this new regulation. THE SAMPLE, VARIABLES, M ...

... recognised standards for good and responsible governance. Thus, the separation of ownership and executives is recommended, risk management is prioritised, prudential management is required, and the relevance of financial reporting is advocated as part of this new regulation. THE SAMPLE, VARIABLES, M ...

Cash, Cash Equivalents, and Investments

... 4.5 RECLASSIFICATION OF NET CASH BALANCE FROM SHORT-TERM INVESTMENTS With the implementation of RMP, campuses are required to record all operating and investment activities within FIRMS object code 101100-Cash/Short-Term Investments (SWIFT), which is mapped to short-term investments on a GAAP basis. ...

... 4.5 RECLASSIFICATION OF NET CASH BALANCE FROM SHORT-TERM INVESTMENTS With the implementation of RMP, campuses are required to record all operating and investment activities within FIRMS object code 101100-Cash/Short-Term Investments (SWIFT), which is mapped to short-term investments on a GAAP basis. ...

Sustainable Landscapes: Investor Mapping in Asia

... Conserve forest/land by purchasing it through a fund, and preserving it for natural ecosystem services, or lease for conservation activities such as permaculture, academic research, eco‐ tourism, etc. ...

... Conserve forest/land by purchasing it through a fund, and preserving it for natural ecosystem services, or lease for conservation activities such as permaculture, academic research, eco‐ tourism, etc. ...

Financial Services Guaranteed Investment

... You can access the Dynamic Market-Linked Guaranteed Investment Return Tracker by logging on to AccèsD and clicking on the Savings/Investments section, or by visiting www.acadie.com/mlgi-return. Information on returns is provided for information purposes only. The return on your investment is also sh ...

... You can access the Dynamic Market-Linked Guaranteed Investment Return Tracker by logging on to AccèsD and clicking on the Savings/Investments section, or by visiting www.acadie.com/mlgi-return. Information on returns is provided for information purposes only. The return on your investment is also sh ...

Endowment Fund - InFaith Community Foundation

... Do create a vision for the fund—what can it do to enhance the life of the congregation, its members, its communities? Do feel free to break down the fund into parts that are recognizable to ordinary people. Do consider near-term projects with big impact and long-term efforts—people need to see the f ...

... Do create a vision for the fund—what can it do to enhance the life of the congregation, its members, its communities? Do feel free to break down the fund into parts that are recognizable to ordinary people. Do consider near-term projects with big impact and long-term efforts—people need to see the f ...

accountability - Mercer County Community College

... After studying Chapter 1, you should be able to: Identify and explain the characteristics that distinguish governmental and not-for-profit entities from forprofit entities Identify the authoritative bodies responsible for setting GAAP and financial reporting standards for all governmental and no ...

... After studying Chapter 1, you should be able to: Identify and explain the characteristics that distinguish governmental and not-for-profit entities from forprofit entities Identify the authoritative bodies responsible for setting GAAP and financial reporting standards for all governmental and no ...

AON CORP (Form: 11-K, Received: 07/01/1996 00

... Aon Stock Fund - Invested principally in common stock of the Company that is purchased on the open market or in private transactions. Investment Contract Fund - Invested principally in unallocated guaranteed insurance contracts, U.S. Treasury bills and short-term investment funds. During 1994, Fidel ...

... Aon Stock Fund - Invested principally in common stock of the Company that is purchased on the open market or in private transactions. Investment Contract Fund - Invested principally in unallocated guaranteed insurance contracts, U.S. Treasury bills and short-term investment funds. During 1994, Fidel ...

Vanguard Emerging Markets Select Stock Fund Prospectus Investor

... The Fund invests primarily in the common stocks of companies located in emerging markets throughout the world, without regard for the size (capitalization) of the companies. The Fund is subject to stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to mo ...

... The Fund invests primarily in the common stocks of companies located in emerging markets throughout the world, without regard for the size (capitalization) of the companies. The Fund is subject to stock market risk, which is the chance that stock prices overall will decline. Stock markets tend to mo ...

Reliance SIP Insure

... Only individual investors whose completed age at entry is greater than 20 years and less than 46 years. ...

... Only individual investors whose completed age at entry is greater than 20 years and less than 46 years. ...

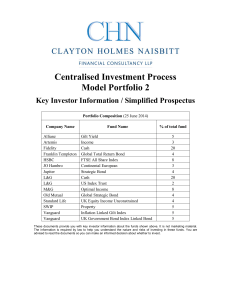

Key Investor Information - Clayton Holmes Naisbitt

... in the Additional Fund Information document. A Guide to Investing with Us gives further information about investing generally. These documents are available from: Legal & General Investments, PO Box 6080, Wolverhampton WV1 9RB. We will provide documents free of charge and in English. ...

... in the Additional Fund Information document. A Guide to Investing with Us gives further information about investing generally. These documents are available from: Legal & General Investments, PO Box 6080, Wolverhampton WV1 9RB. We will provide documents free of charge and in English. ...

Investment-Guidelines-First-Draft-Sep-08-2015

... custodian or trustee of securities in any transaction of which the CAC is a principal may not relinquish control over such securities without written consent of the CAC and the bank. Whenever investments require collateralization, such investments must be collateralized by direct obligations of the ...

... custodian or trustee of securities in any transaction of which the CAC is a principal may not relinquish control over such securities without written consent of the CAC and the bank. Whenever investments require collateralization, such investments must be collateralized by direct obligations of the ...

Equity Investment Philosophy

... Such services require a login to a secure site to retrieve submissions and cannot meet our requirement that the email submission in its exact form remain accessible. This is to ensure access to the exact email submission remains accessible for at least 7 years (most third-party services require pass ...

... Such services require a login to a secure site to retrieve submissions and cannot meet our requirement that the email submission in its exact form remain accessible. This is to ensure access to the exact email submission remains accessible for at least 7 years (most third-party services require pass ...

The Role of Organizational Structure

... family) is not limited to performance maximization, but is also geared to risk/managerial moral hazard control. Therefore, the choice of the degree of hierarchy and specialty can be explained in terms of the characteristics of the financial family the fund belongs to. This lets us identify the exoge ...

... family) is not limited to performance maximization, but is also geared to risk/managerial moral hazard control. Therefore, the choice of the degree of hierarchy and specialty can be explained in terms of the characteristics of the financial family the fund belongs to. This lets us identify the exoge ...

declaration of understanding and direction

... causes of action, suits, duties, debts, claims, demands, interest, penalties, liabilities, damages, costs, expenses, fees, covenants and contracts whatsoever which the Undersigned now has or hereafter can, shall or may have against the Trustee or the Investment Dealer by reason of or in any way aris ...

... causes of action, suits, duties, debts, claims, demands, interest, penalties, liabilities, damages, costs, expenses, fees, covenants and contracts whatsoever which the Undersigned now has or hereafter can, shall or may have against the Trustee or the Investment Dealer by reason of or in any way aris ...

Endowment Policy

... and the University. Because it is critical to maintain the highest standards of stewardship over a long time horizon, and in consideration of the generosity and commitment from our donors, the Endowment Policy is revised from time to time. This assists to avoid unforeseen issues for these long‐ ...

... and the University. Because it is critical to maintain the highest standards of stewardship over a long time horizon, and in consideration of the generosity and commitment from our donors, the Endowment Policy is revised from time to time. This assists to avoid unforeseen issues for these long‐ ...

NBER WORKING PAPER SERIES SOCIAL SECURITY AND TRUST FUND MANAGEMENT Takashi Oshio

... sustain the trust fund at a certain level, they have to give up an opportunity to pay lower taxes or receive higher benefits. Indeed, the MHLW plans to continue raising the tax rate over the next decades, albeit with the trust fund at hand at a high level. More and more politicians and economists no ...

... sustain the trust fund at a certain level, they have to give up an opportunity to pay lower taxes or receive higher benefits. Indeed, the MHLW plans to continue raising the tax rate over the next decades, albeit with the trust fund at hand at a high level. More and more politicians and economists no ...

V7-Mutual Fund year book

... It has always been CRISIL’s endeavour to help investors take better informed investment decisions. As part of our refreshed content, the Year Book contains articles on select themes which were very pertinent in the year gone by and continue to hold relevance. It also covers market and industry overv ...

... It has always been CRISIL’s endeavour to help investors take better informed investment decisions. As part of our refreshed content, the Year Book contains articles on select themes which were very pertinent in the year gone by and continue to hold relevance. It also covers market and industry overv ...

Liquidity Management Policy Summary

... investments via a pooled arrangement in which the underlying assets from each diversified option are invested collectively across the various asset classes. The allocation to these asset classes within each option is the main determinant of the overall risk and return characteristics, including an o ...

... investments via a pooled arrangement in which the underlying assets from each diversified option are invested collectively across the various asset classes. The allocation to these asset classes within each option is the main determinant of the overall risk and return characteristics, including an o ...

Retained Earnings of Mutual Funds

... approach. The European Central Bank’s European Union Balance of Payments/International Investment Position Statistical Methods (SM) also regards shares/units in MFs in the same manner (see subsection 3.8.1). An MF is regarded as a financial intermediary2 as it is considered to create new liabilities ...

... approach. The European Central Bank’s European Union Balance of Payments/International Investment Position Statistical Methods (SM) also regards shares/units in MFs in the same manner (see subsection 3.8.1). An MF is regarded as a financial intermediary2 as it is considered to create new liabilities ...

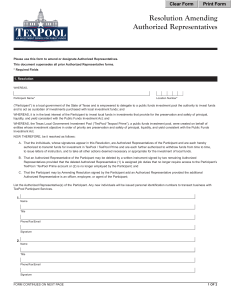

Resolution Amending Authorized Representatives

... a. that the individuals, whose signatures appear in this resolution, are authorized representatives of the participant and are each hereby authorized to transmit funds for investment in texpool / texpool prime and are each further authorized to withdraw funds from time to time, to issue letters of i ...

... a. that the individuals, whose signatures appear in this resolution, are authorized representatives of the participant and are each hereby authorized to transmit funds for investment in texpool / texpool prime and are each further authorized to withdraw funds from time to time, to issue letters of i ...

Policies and Procedures

... and/or stock, or securitizes intellectual property or other assets. All such details will be outlined in the term sheet provided by 49SAF and corresponding legal documents. Other forms of collateral or credit enhancements, such as personal or corporate guarantees, letters of credit, etc., will be co ...

... and/or stock, or securitizes intellectual property or other assets. All such details will be outlined in the term sheet provided by 49SAF and corresponding legal documents. Other forms of collateral or credit enhancements, such as personal or corporate guarantees, letters of credit, etc., will be co ...

Trial Measures for Overseas Securities Investment by Qualified

... Article 18 When the domestic institutional investor conducts the overseas securities investment business, the banks having the qualifications for custody of securities investment funds shall be responsible for the assets custody business. Article 19 The custodian can entrust the overseas assets cust ...

... Article 18 When the domestic institutional investor conducts the overseas securities investment business, the banks having the qualifications for custody of securities investment funds shall be responsible for the assets custody business. Article 19 The custodian can entrust the overseas assets cust ...

OMB APPROVAL ------------------------------ OMB NUMBER: 3235

... ------------------------------------------------The securities with respect to which this Amended Schedule 13D is filed were purchased by the Funds using working capital contributed by their respective partners and shareholders. ITEM 4: PURPOSE OF TRANSACTION: ---------------------The securities wer ...

... ------------------------------------------------The securities with respect to which this Amended Schedule 13D is filed were purchased by the Funds using working capital contributed by their respective partners and shareholders. ITEM 4: PURPOSE OF TRANSACTION: ---------------------The securities wer ...