Costs, Benefits, and Constraints of the Basket Currency Regime

... “Little wonder, then, that policymakers involved in dealing with these crises have warned strongly against the use of pegged rates for countries open to international capital flows. That warning has tended to take the form of advice that intermediate policy regimes between hard pegs and floating are ...

... “Little wonder, then, that policymakers involved in dealing with these crises have warned strongly against the use of pegged rates for countries open to international capital flows. That warning has tended to take the form of advice that intermediate policy regimes between hard pegs and floating are ...

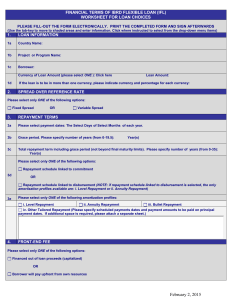

English - World Bank Treasury

... The Borrower represents that it has made its own independent decisions to obtain the Loan on the terms contained in this Worksheet and as to whether the Loan is appropriate for it based upon its own judgment. The Borrower is not relying on any communication (written or oral) of the Bank as a recomme ...

... The Borrower represents that it has made its own independent decisions to obtain the Loan on the terms contained in this Worksheet and as to whether the Loan is appropriate for it based upon its own judgment. The Borrower is not relying on any communication (written or oral) of the Bank as a recomme ...

Chapter 16 - UCSB Economics

... the interest rate differential, so investors get out of $ deposits, leading to $ depreciation. This leads to an immediate drop in E, moving from point 2 to point 3. 2) However, point 3 is still above DD, so the goods market is not in equilibrium. The low value of domestic currency makes home goods i ...

... the interest rate differential, so investors get out of $ deposits, leading to $ depreciation. This leads to an immediate drop in E, moving from point 2 to point 3. 2) However, point 3 is still above DD, so the goods market is not in equilibrium. The low value of domestic currency makes home goods i ...

T d th E dSt fGl b l Towards the End

... • Monetary sovereignty can be secured with floating XR regime • Overall: growth enhancing in world economy • If this is not visible: „bad governance“ and poor use of capital inflows, lack of human capital, fixed XR regime etc. ...

... • Monetary sovereignty can be secured with floating XR regime • Overall: growth enhancing in world economy • If this is not visible: „bad governance“ and poor use of capital inflows, lack of human capital, fixed XR regime etc. ...

Detecting Structural Breaks: Exchange Rates in

... questions: (1) whether there was a break or not, and if yes, when it occurred; (2) whether a break coincides with an administrative step associated with an exchange rate or its regime; and (3) whether the timing of a break coincide for both the nominal and real exchange rate. In doing so, we will at ...

... questions: (1) whether there was a break or not, and if yes, when it occurred; (2) whether a break coincides with an administrative step associated with an exchange rate or its regime; and (3) whether the timing of a break coincide for both the nominal and real exchange rate. In doing so, we will at ...

Cash Management Support

... We-iterate our call that the Riksbank is through easing in this cycle and it will take either weaker growth or a significantly stronger krona to motivate more easing. Another rate cut or the introduction of a 2-tier system in the monetary policy frame work are seen as the most likely measure if more ...

... We-iterate our call that the Riksbank is through easing in this cycle and it will take either weaker growth or a significantly stronger krona to motivate more easing. Another rate cut or the introduction of a 2-tier system in the monetary policy frame work are seen as the most likely measure if more ...

4The Failed Attempts of the Interwar Years

... the tariff truce eroded rapidly as the world economy slid into depression. The best that can be said for trade cooperation in the 1920s is that if it did not advance, it at least survived. The principle of nondiscrimination suffered some assaults but remained largely intact, and though tariffs rose, ...

... the tariff truce eroded rapidly as the world economy slid into depression. The best that can be said for trade cooperation in the 1920s is that if it did not advance, it at least survived. The principle of nondiscrimination suffered some assaults but remained largely intact, and though tariffs rose, ...

Systemic Challenges in the International Monetary System

... current IMS, and proposes some elements for its reform. It focuses on three fundamental challenges commonly perceived as confronting any IMS (see, for example, United Nations, 2009; Erten and Ocampo, 2012), and examines how these challenges and the responses to them have changed over time. It sugges ...

... current IMS, and proposes some elements for its reform. It focuses on three fundamental challenges commonly perceived as confronting any IMS (see, for example, United Nations, 2009; Erten and Ocampo, 2012), and examines how these challenges and the responses to them have changed over time. It sugges ...

Ratib

... the exports and imports of a country are somewhat high, currency depreciation will lead to a current account surplus. However, this may not always be the case if the goods traded are price inelastic. In this case, the current account will be adversely affected, and this shall be explored in the latt ...

... the exports and imports of a country are somewhat high, currency depreciation will lead to a current account surplus. However, this may not always be the case if the goods traded are price inelastic. In this case, the current account will be adversely affected, and this shall be explored in the latt ...

International Trade and Echange Rates

... What is the Presbisch-Singer hypothesis? The Presbisch-Singer hypothesis states the terms of trade between primary products and manufactured goods tend to deteriorate over time. This limits the benefits of developing economies whose main exports are primary commodities eg coffee, bananas and metals. ...

... What is the Presbisch-Singer hypothesis? The Presbisch-Singer hypothesis states the terms of trade between primary products and manufactured goods tend to deteriorate over time. This limits the benefits of developing economies whose main exports are primary commodities eg coffee, bananas and metals. ...

as a Powerpoint presentation

... were announced with the intention to stabilize the situation, but initially with the clear hope and intent not to provide actual financing. Positive announcements were however followed repeatedly by the German refusal to provide help, destabilizing expectations further, increasing the risk of defaul ...

... were announced with the intention to stabilize the situation, but initially with the clear hope and intent not to provide actual financing. Positive announcements were however followed repeatedly by the German refusal to provide help, destabilizing expectations further, increasing the risk of defaul ...

1This paper was written for the Festschrift volume Money, Factor

... confidence is generally linked to the level of exchange reserves. Other things the same, confidence is higher the larger the central bank holdings of foreign exchange" ...

... confidence is generally linked to the level of exchange reserves. Other things the same, confidence is higher the larger the central bank holdings of foreign exchange" ...

NBER WORKING PAPER SERIES THE LOGIC OF CURRENCY CRISES Maurice Obstfeld

... currency, leaves unchanged both the public sector's net debt to the private sector and the national net foreign wealth position. If the peg is in question for reasons other than reserve adequacy, however, the transaction can have strategic implications; see section 3.1 below. Buiter (1987) analyzes ...

... currency, leaves unchanged both the public sector's net debt to the private sector and the national net foreign wealth position. If the peg is in question for reasons other than reserve adequacy, however, the transaction can have strategic implications; see section 3.1 below. Buiter (1987) analyzes ...

relationship of exchange rate with macro economic variables

... introduced an exchange rate system that remained in effect till 1971. ...

... introduced an exchange rate system that remained in effect till 1971. ...

Foreign Exchange Reserves in East Asia: Why the High Demand?

... 70% and 90% of the variation in actual reserve holdings depending on the estimation specification. Our study (Aizenman and Marion 2002a) extended this analysis by adding two political measures that may lower the demand for reserves, namely, political instability and political corruption, in the sens ...

... 70% and 90% of the variation in actual reserve holdings depending on the estimation specification. Our study (Aizenman and Marion 2002a) extended this analysis by adding two political measures that may lower the demand for reserves, namely, political instability and political corruption, in the sens ...

Examples for the WS Environment “GLUE” by TME

... Examples for the WS Environment “GLUE” by TME IExchange.Java package book.soap; ...

... Examples for the WS Environment “GLUE” by TME IExchange.Java package book.soap; ...

Currency Boards

... is to buy and sell their own securities. The second option is to use secured lending which are short-term credit facilities offered against collateral. Both of these options can provide commercial banks access to temporary liquidity when it is needed. Most currency boards hold reserves in excess of ...

... is to buy and sell their own securities. The second option is to use secured lending which are short-term credit facilities offered against collateral. Both of these options can provide commercial banks access to temporary liquidity when it is needed. Most currency boards hold reserves in excess of ...

ISEAS-NTU Financial Reforms and Liberalization Ranking Indices For ASEAN 10 + 5 Economies (i.e. China, Japan, South Korea, Hong Kong Chinese Taipei)*

... category 4 reflecting the 0.5 weight previously assigned. Given that implementing reforms involved time lag and their improvement in terms of ranking may not be readily reflected, and in order to enable economies to keep tract and maintain their good performances, we did ...

... category 4 reflecting the 0.5 weight previously assigned. Given that implementing reforms involved time lag and their improvement in terms of ranking may not be readily reflected, and in order to enable economies to keep tract and maintain their good performances, we did ...

Currency war

Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a country's currency falls so too does the price of exports. Imports to the country become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. However, the price increase for imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.Competitive devaluation has been rare through most of history as countries have generally preferred to maintain a high value for their currency. Countries have generally allowed market forces to work, or have participated in systems of managed exchanges rates. An exception occurred when currency war broke out in the 1930s. As countries abandoned the Gold Standard during the Great Depression, they used currency devaluations to stimulate their economies. Since this effectively pushes unemployment overseas, trading partners quickly retaliated with their own devaluations. The period is considered to have been an adverse situation for all concerned, as unpredictable changes in exchange rates reduced overall international trade.According to Guido Mantega, the Brazilian Minister for Finance, a global currency war broke out in 2010. This view was echoed by numerous other government officials and financial journalists from around the world. Other senior policy makers and journalists suggested the phrase ""currency war"" overstated the extent of hostility. With a few exceptions, such as Mantega, even commentators who agreed there had been a currency war in 2010 generally concluded that it had fizzled out by mid-2011.States engaging in possible competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing. While many countries experienced undesirable upward pressure on their exchange rates and took part in the ongoing arguments, the most notable dimension of the 2010–11 episode was the rhetorical conflict between the United States and China over the valuation of the yuan. In January 2013, measures announced by Japan which were expected to devalue its currency sparked concern of a possible second 21st century currency war breaking out, this time with the principal source of tension being not China versus the US, but Japan versus the Eurozone. By late February, concerns of a new outbreak of currency war had been mostly allayed, after the G7 and G20 issued statements committing to avoid competitive devaluation. After the European Central Bank launched a fresh programme of quantitative easing in January 2015, there was once again an intensification of discussion about currency war.