Ignorance and Influence: U.S. Economists on Argentina`s

... ECONOMISTS CAN BE HAZARDOUS TO YOUR WEALTH IN LATE 1998, ARGENTINA ENTERED AN ECONOMIC DECLINE that was to last until 2002. The decline deepened after Brazil, Argentina’s largest trading partner, devalued its currency substantially in January 1999. Argentina could not devalue under the monetary syst ...

... ECONOMISTS CAN BE HAZARDOUS TO YOUR WEALTH IN LATE 1998, ARGENTINA ENTERED AN ECONOMIC DECLINE that was to last until 2002. The decline deepened after Brazil, Argentina’s largest trading partner, devalued its currency substantially in January 1999. Argentina could not devalue under the monetary syst ...

nding China’s Renminbi Strategy: Understa The Two-track Road To RMB Internationalization

... China has developed into a world economic giant, overtaking US as the world’s largest economy (based on purchasing power parity1) in 2014, first time since starting market reforms in 19782. The economic growth of China has been on average 10% annually since the market reforms up to 2014, making it o ...

... China has developed into a world economic giant, overtaking US as the world’s largest economy (based on purchasing power parity1) in 2014, first time since starting market reforms in 19782. The economic growth of China has been on average 10% annually since the market reforms up to 2014, making it o ...

Dynamic General Equilibrium Analysis: The Open Economy

... The Þndings in the upper panel of Table 1 show that the Þrst regime is easily dominant in the case of full pass through. By allowing the nominal and real exchange rate to vary in response to shocks, targeting nontradables inßation achieves much lower volatility in output and investment, even if CPI ...

... The Þndings in the upper panel of Table 1 show that the Þrst regime is easily dominant in the case of full pass through. By allowing the nominal and real exchange rate to vary in response to shocks, targeting nontradables inßation achieves much lower volatility in output and investment, even if CPI ...

Linda

... example, domestic credit creation above trend may for which no shortages in government revenues or unanticipated expenditures revenues are available. For simplicity random variable. ...

... example, domestic credit creation above trend may for which no shortages in government revenues or unanticipated expenditures revenues are available. For simplicity random variable. ...

OCASSIONAL POLICY PAPER MEASURES FOR FINANCIAL

... The 1990s have been marked by a process of integration of emerging market economies with global capital and currency markets. Domestic financial markets have become much more liberalized and international linkages have also grown remarkably. A central feature of this process has been the increasingl ...

... The 1990s have been marked by a process of integration of emerging market economies with global capital and currency markets. Domestic financial markets have become much more liberalized and international linkages have also grown remarkably. A central feature of this process has been the increasingl ...

The Exchange Rate

... A country that is borrowing more from the rest of the world than it is lending to it is called a net borrower. A country that is lending more to the rest of the world than it is borrowing from it is called a net lender. The United States is currently a net borrower (but as late as the 1970s it was a ...

... A country that is borrowing more from the rest of the world than it is lending to it is called a net borrower. A country that is lending more to the rest of the world than it is borrowing from it is called a net lender. The United States is currently a net borrower (but as late as the 1970s it was a ...

the volatility of somalia`s unregulated exchange rates

... Historically, the monetary system of Somalia was stable and its national currency (Somali Shilling) had very strong value but Somali shilling started to depreciate after 1980s and its value reached to a very low level. Somalia’s central government collapsed in 1990 following three decades of stabili ...

... Historically, the monetary system of Somalia was stable and its national currency (Somali Shilling) had very strong value but Somali shilling started to depreciate after 1980s and its value reached to a very low level. Somalia’s central government collapsed in 1990 following three decades of stabili ...

Capital account liberalisation strategy

... exchange rate. Such capital outflows (immediate and delayed) could have led to further depreciation of the króna, and higher inflation. Because private sector balance sheets are characterised by both high leverage and a large proportion of foreign-denominated and inflationindexed debt, this could tr ...

... exchange rate. Such capital outflows (immediate and delayed) could have led to further depreciation of the króna, and higher inflation. Because private sector balance sheets are characterised by both high leverage and a large proportion of foreign-denominated and inflationindexed debt, this could tr ...

The Relationship between Commodities and Pakistani Currency

... currencies. They stated that at the time there was need to fix the exchange rate for world investors to invest in commodities market who ever there were effects of monetary responses to the strong currency could distract attention from reforms to Canadian tax, industrial and regional policies and al ...

... currencies. They stated that at the time there was need to fix the exchange rate for world investors to invest in commodities market who ever there were effects of monetary responses to the strong currency could distract attention from reforms to Canadian tax, industrial and regional policies and al ...

Alternative Economic System

... Economics is concerned with prosperity as the material aim that contributes to the nonmaterial ultimate objective of welfare. In figures, national product expresses prosperity and its rate of growth reflects the rise in the standard of living. Realization of prosperity requires that the maximum and ...

... Economics is concerned with prosperity as the material aim that contributes to the nonmaterial ultimate objective of welfare. In figures, national product expresses prosperity and its rate of growth reflects the rise in the standard of living. Realization of prosperity requires that the maximum and ...

Chinese Exporters, Exchange Rate Exposure, and the

... a medium-sized (U.S.$100m) textile and apparel exporter based in Shanghai interviewed in preparation for the survey. The …rm exports almost all of its output and its revenues are 100 percent denominated in U.S. dollars while its markets are equally split between the U.S., Europe and Japan. The …rm h ...

... a medium-sized (U.S.$100m) textile and apparel exporter based in Shanghai interviewed in preparation for the survey. The …rm exports almost all of its output and its revenues are 100 percent denominated in U.S. dollars while its markets are equally split between the U.S., Europe and Japan. The …rm h ...

Draft: October 14, 2008 DOLLAR DOMINANCE, EURO ASPIRATIONS

... maintain financial stability. For most supervisory or regulatory powers the ruling principle was to be decentralization, otherwise known as subsidiarity – the notion that the lowest level of government that can efficiently carry out a function should do so. Formal authority for crisis management was ...

... maintain financial stability. For most supervisory or regulatory powers the ruling principle was to be decentralization, otherwise known as subsidiarity – the notion that the lowest level of government that can efficiently carry out a function should do so. Formal authority for crisis management was ...

Currency Wars, Coordination, and Capital Controls

... and sustainable economic growth, world leaders must re-examine the international rules of the monetary game, with advanced and emerging economies alike adopting more mutually beneficial monetary policies”. Complaints by emerging economies about advanced economies’ monetary policies, together with ca ...

... and sustainable economic growth, world leaders must re-examine the international rules of the monetary game, with advanced and emerging economies alike adopting more mutually beneficial monetary policies”. Complaints by emerging economies about advanced economies’ monetary policies, together with ca ...

NBER WORKING PAPER SERIES FINANCIAL POLICY AND SPECULATIVE ARGENTINA 1979-1981

... To enhance the credibility of the program, the rate of crawl was announced several months in advance and the "tablita" was extended periodically long before the existing table expired. ...

... To enhance the credibility of the program, the rate of crawl was announced several months in advance and the "tablita" was extended periodically long before the existing table expired. ...

Corporate Hedging for Foreign Exchange Risk in India

... whose magnitude is not certain at the moment and depends on the value of the foreign exchange rates. The process of identifying risks faced by the firm and implementing the process of protection from these risks by financial or operational hedging is defined as foreign exchange risk management. This ...

... whose magnitude is not certain at the moment and depends on the value of the foreign exchange rates. The process of identifying risks faced by the firm and implementing the process of protection from these risks by financial or operational hedging is defined as foreign exchange risk management. This ...

Adjustment Under Fixed Exchange Rates

... a country is serious about reducing money growth is a pledge to fix its exchange rate, now and in the future. A hard peg is the symbolic or technical mechanism by which a country plans to maintain exchange rate parity. Dollarization is an extreme form of a hard peg. A less extreme way is the use o ...

... a country is serious about reducing money growth is a pledge to fix its exchange rate, now and in the future. A hard peg is the symbolic or technical mechanism by which a country plans to maintain exchange rate parity. Dollarization is an extreme form of a hard peg. A less extreme way is the use o ...

History of Money

... a) Low inflation, stable exchange rates, relatively rapid economic growth and less real instability than in the interwar period (Bordo 1981, 1993). It also was an era of rapidly expanding international trade in commodities, services and factors production (Bordo, 1999). This favorable economic perfo ...

... a) Low inflation, stable exchange rates, relatively rapid economic growth and less real instability than in the interwar period (Bordo 1981, 1993). It also was an era of rapidly expanding international trade in commodities, services and factors production (Bordo, 1999). This favorable economic perfo ...

Currency Wars, Coordination, and Capital Controls

... and sustainable economic growth, world leaders must re-examine the international rules of the monetary game, with advanced and emerging economies alike adopting more mutually beneficial monetary policies”. Complaints by emerging economies about advanced economies’ monetary policies, together with ca ...

... and sustainable economic growth, world leaders must re-examine the international rules of the monetary game, with advanced and emerging economies alike adopting more mutually beneficial monetary policies”. Complaints by emerging economies about advanced economies’ monetary policies, together with ca ...

Peltonen-del05 1039031 en

... that low-income economies have experienced more banking and currency crises than advanced economies during this time. Similar conclusions are drawn in Ghosh et al. (2002), who also find that currency crises are more prevalent under de jure floating exchange rate regimes. Likewise, Rogo et al. (2003 ...

... that low-income economies have experienced more banking and currency crises than advanced economies during this time. Similar conclusions are drawn in Ghosh et al. (2002), who also find that currency crises are more prevalent under de jure floating exchange rate regimes. Likewise, Rogo et al. (2003 ...

THE PROPOSED ECO: SHOULD WEST AFRICA

... WAEMU and WAMZ to form a single currency union in the region with a common currency- the eco. The first track has been completed and the focus is now on achieving the second. The feasibility of a wider monetary unification in ECOWAS poses several economic and institutional peculiarities as discussed ...

... WAEMU and WAMZ to form a single currency union in the region with a common currency- the eco. The first track has been completed and the focus is now on achieving the second. The feasibility of a wider monetary unification in ECOWAS poses several economic and institutional peculiarities as discussed ...

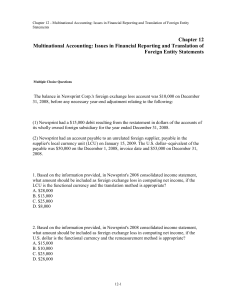

Ch12 – Financial Reporting and Translation of Foreign

... 31, 2008, before any necessary year-end adjustment relating to the following: ...

... 31, 2008, before any necessary year-end adjustment relating to the following: ...

Transaction exposure

... exposure or backlog exposure as a matter of policy – Many firms feel that until the transaction exists on the accounting books of the firm, the probability of the exposure actually occurring is considered to be less than 100% – An increasing number of firms, however, are actively hedging not only ba ...

... exposure or backlog exposure as a matter of policy – Many firms feel that until the transaction exists on the accounting books of the firm, the probability of the exposure actually occurring is considered to be less than 100% – An increasing number of firms, however, are actively hedging not only ba ...

Currency war

Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a country's currency falls so too does the price of exports. Imports to the country become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. However, the price increase for imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.Competitive devaluation has been rare through most of history as countries have generally preferred to maintain a high value for their currency. Countries have generally allowed market forces to work, or have participated in systems of managed exchanges rates. An exception occurred when currency war broke out in the 1930s. As countries abandoned the Gold Standard during the Great Depression, they used currency devaluations to stimulate their economies. Since this effectively pushes unemployment overseas, trading partners quickly retaliated with their own devaluations. The period is considered to have been an adverse situation for all concerned, as unpredictable changes in exchange rates reduced overall international trade.According to Guido Mantega, the Brazilian Minister for Finance, a global currency war broke out in 2010. This view was echoed by numerous other government officials and financial journalists from around the world. Other senior policy makers and journalists suggested the phrase ""currency war"" overstated the extent of hostility. With a few exceptions, such as Mantega, even commentators who agreed there had been a currency war in 2010 generally concluded that it had fizzled out by mid-2011.States engaging in possible competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing. While many countries experienced undesirable upward pressure on their exchange rates and took part in the ongoing arguments, the most notable dimension of the 2010–11 episode was the rhetorical conflict between the United States and China over the valuation of the yuan. In January 2013, measures announced by Japan which were expected to devalue its currency sparked concern of a possible second 21st century currency war breaking out, this time with the principal source of tension being not China versus the US, but Japan versus the Eurozone. By late February, concerns of a new outbreak of currency war had been mostly allayed, after the G7 and G20 issued statements committing to avoid competitive devaluation. After the European Central Bank launched a fresh programme of quantitative easing in January 2015, there was once again an intensification of discussion about currency war.