Notes on chapter 9

... known as industrial paper. These papers carry lower than average interest cost and tend to be lower than prime bank loan rate. Often prime rate charged by banks remains unchanged even as market condition changes. However dealer papers are very sensitive to market changes and credit availability cond ...

... known as industrial paper. These papers carry lower than average interest cost and tend to be lower than prime bank loan rate. Often prime rate charged by banks remains unchanged even as market condition changes. However dealer papers are very sensitive to market changes and credit availability cond ...

Diapositive 1 - Brand Center

... This presentation may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business, strategy and plans of TOTAL GROUP that are subject to risk factors and uncertainties caused by ...

... This presentation may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business, strategy and plans of TOTAL GROUP that are subject to risk factors and uncertainties caused by ...

Canadian Securities Regulators to Lower Trading Fee Cap for Non

... traded for an equity or per unit traded for an exchange-traded fund, if the execution price of the security or unit traded is greater than or equal to $1.00. Active trading fees for securities that trade on both Canadian and U.S. exchanges (inter-listed securities) will continue to be capped at $0.0 ...

... traded for an equity or per unit traded for an exchange-traded fund, if the execution price of the security or unit traded is greater than or equal to $1.00. Active trading fees for securities that trade on both Canadian and U.S. exchanges (inter-listed securities) will continue to be capped at $0.0 ...

Allianz US Short Duration High Income Bond

... A performance of the strategy is not guaranteed and losses remain possible. A security mentioned as example above will not necessarily be comprised in the portfolio by the time this document is disclosed or at any other subsequent date. This is no recommendation or solicitation to buy or sell any pa ...

... A performance of the strategy is not guaranteed and losses remain possible. A security mentioned as example above will not necessarily be comprised in the portfolio by the time this document is disclosed or at any other subsequent date. This is no recommendation or solicitation to buy or sell any pa ...

Securities Firms and Investment Banks

... Dramatic increase in number of firms from 1980 to 1987. Decline of 37% following the 1987 crash, to year 2006. 1987: Salomon Brothers held $3.21 billion in capital. 2006: Merrill Lynch held capital of $35.5 billion. Many recent inter-industry mergers (i.e., insurance companies and investment banks). ...

... Dramatic increase in number of firms from 1980 to 1987. Decline of 37% following the 1987 crash, to year 2006. 1987: Salomon Brothers held $3.21 billion in capital. 2006: Merrill Lynch held capital of $35.5 billion. Many recent inter-industry mergers (i.e., insurance companies and investment banks). ...

full report - Profindo International Securities

... years, sent the Dow Jones Industrial Average (DJIA) index to above 18k. The news is favorable for the U.S., but may be not for emerging economies such as Indonesia. When an economy is speeding, the government as well as the central bank may put an effort to slow it down to prevent bubble in the econ ...

... years, sent the Dow Jones Industrial Average (DJIA) index to above 18k. The news is favorable for the U.S., but may be not for emerging economies such as Indonesia. When an economy is speeding, the government as well as the central bank may put an effort to slow it down to prevent bubble in the econ ...

Definition 1 Government bonds Bonds issued by public authorities

... Contract between two parties concerning the selling of an asset at a reference price during a specified time frame, where the buyer of the put option gains the right, but not the obligation, to sell the underlying asset ...

... Contract between two parties concerning the selling of an asset at a reference price during a specified time frame, where the buyer of the put option gains the right, but not the obligation, to sell the underlying asset ...

OFFICER`S CERTIFICATE TO: British Columbia Securities

... been made to have the proxy-related materials for the Meetings sent in compliance with the applicable timing requirements in sections 2.9 and 2.12 of NI 54-101; ...

... been made to have the proxy-related materials for the Meetings sent in compliance with the applicable timing requirements in sections 2.9 and 2.12 of NI 54-101; ...

bworld12050603 - Bureau of the Treasury

... T-bills are debt papers issued by the government to borrow funds from the local debt market on a regular basis.; These debt papers mature in three months, six months and one year. The rates fetched by T-bills are also used by banks as reference in setting loan rates. Mr. Edeza also said the Treasury ...

... T-bills are debt papers issued by the government to borrow funds from the local debt market on a regular basis.; These debt papers mature in three months, six months and one year. The rates fetched by T-bills are also used by banks as reference in setting loan rates. Mr. Edeza also said the Treasury ...

Summer Doldrums - RBC Wealth Management

... optimist would say it’s not going down. Given all the news from March to June (BP oil spill, Greece & the rest of Europe, lawsuits, etc.), most investors would have bet we’d be down. So far this quarter, 80% of S&P 500 companies that reported beat earnings expectations. That’s a good thing. Inflatio ...

... optimist would say it’s not going down. Given all the news from March to June (BP oil spill, Greece & the rest of Europe, lawsuits, etc.), most investors would have bet we’d be down. So far this quarter, 80% of S&P 500 companies that reported beat earnings expectations. That’s a good thing. Inflatio ...

The primary objective of business financial

... d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the timing of expected cash flows. 3. Con ...

... d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the timing of expected cash flows. 3. Con ...

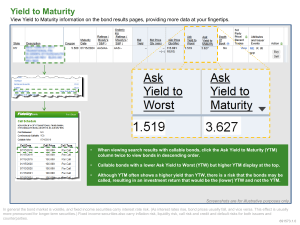

Yield to Maturity

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...

Test Your IQ (Investment Quotient)

... 3. Fixed-Income Securities On what basis do we normally distinguish money market securities from fixed-income securities? a. issuer b. interest rate c. maturity d. tax status 4. Fixed-Income Securities Your friend told you she just received her semi-annual coupon payment on a U.S. Treasury note with ...

... 3. Fixed-Income Securities On what basis do we normally distinguish money market securities from fixed-income securities? a. issuer b. interest rate c. maturity d. tax status 4. Fixed-Income Securities Your friend told you she just received her semi-annual coupon payment on a U.S. Treasury note with ...

Dollarama Closes Initial Public Offering

... proceeds of the offering will be used to repay certain indebtedness of the Corporation, namely, the 8.875% Senior Subordinated Notes due 2012 issued by certain of its subsidiaries, the term loan A facility forming part of its credit facility and notes owing to certain of its shareholders. The underw ...

... proceeds of the offering will be used to repay certain indebtedness of the Corporation, namely, the 8.875% Senior Subordinated Notes due 2012 issued by certain of its subsidiaries, the term loan A facility forming part of its credit facility and notes owing to certain of its shareholders. The underw ...

SECURITIES OPERATIONS

... Securities Exchange Act of 1934; Establishes the SEC Commodities Exchange Act of 1936 Investment Advisors Act of 1940 Securities Investor Protection Corporation Act of 1970 Commodity Futures Trading Commission Act of 1974 Securities Acts Amendments of 1975 Financial Services Modernization Act of 199 ...

... Securities Exchange Act of 1934; Establishes the SEC Commodities Exchange Act of 1936 Investment Advisors Act of 1940 Securities Investor Protection Corporation Act of 1970 Commodity Futures Trading Commission Act of 1974 Securities Acts Amendments of 1975 Financial Services Modernization Act of 199 ...

... the United States (including its territories and possessions, any State of the United States and the District of Columbia). This communication is not and does not constitute or form a part of any offer of, or solicitation to purchase or subscribe for, any securities in the United States. Any such se ...

Government Securities

... Government securities for financing the internal deficit: o Treasury Bills with maturity within one year o Treasury Bills with maturity within 5 years o Treasury Bonds with maturity of 5 years or more Government bonds for financing structural deficits in the financial sector: o ZUNK bonds (long term ...

... Government securities for financing the internal deficit: o Treasury Bills with maturity within one year o Treasury Bills with maturity within 5 years o Treasury Bonds with maturity of 5 years or more Government bonds for financing structural deficits in the financial sector: o ZUNK bonds (long term ...

Manitoba Securities Commission

... Province of Manitoba. Membership: The Securities Act states that the Commission be composed of not more than seven (7) members including the Chair. Length of Terms: Three years and then at pleasure. Desirable Expertise: Law degree and experience in commercial or administrative law. Accounting degree ...

... Province of Manitoba. Membership: The Securities Act states that the Commission be composed of not more than seven (7) members including the Chair. Length of Terms: Three years and then at pleasure. Desirable Expertise: Law degree and experience in commercial or administrative law. Accounting degree ...

please hate the markets

... circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information su ...

... circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information su ...

what would you do with a million dollars?

... agreement to repurchase at a set time and price. Interest is the difference between sale and repurchase prices Similar to a fully collateralized loan Lender can sell the securities if the issuer defaults ...

... agreement to repurchase at a set time and price. Interest is the difference between sale and repurchase prices Similar to a fully collateralized loan Lender can sell the securities if the issuer defaults ...

Valuing Floating Rate Notes (FRN) in Excel/VBA

... and its price shows very low sensitivity to changes in market rates. When market rates rise, the expected coupons of the FRN increase in line with the increase in forward rates, which means its price remains constant. Thus, FRNs differ from fixed rate bonds, whose prices decline when market rates ri ...

... and its price shows very low sensitivity to changes in market rates. When market rates rise, the expected coupons of the FRN increase in line with the increase in forward rates, which means its price remains constant. Thus, FRNs differ from fixed rate bonds, whose prices decline when market rates ri ...

Dhaka Stock Exchange

... I/we hereby declare that I/we have already placed the concerned securities, along with the relevant irrevocable sale/dispose of order with my/our above named stock-broker (document enclosed) for execution at prevailing market price, and that I/we shall submit details of the proposed sell/transfer of ...

... I/we hereby declare that I/we have already placed the concerned securities, along with the relevant irrevocable sale/dispose of order with my/our above named stock-broker (document enclosed) for execution at prevailing market price, and that I/we shall submit details of the proposed sell/transfer of ...

Callable security procedure

... Callable securities provide an issuer (the corporation that issued the debt instrument) with the option to call back or redeem bonds prior to maturity. In some cases, a security may be partially called rather than fully called. To assure that all shareholders are treated fairly in a partial call eve ...

... Callable securities provide an issuer (the corporation that issued the debt instrument) with the option to call back or redeem bonds prior to maturity. In some cases, a security may be partially called rather than fully called. To assure that all shareholders are treated fairly in a partial call eve ...

ESTR.ASpA successfully places EUR 100 million senior notes BNP

... interest at a rate of 3.75%, are listed on the Global Exchange Market of the Irish Stock Exchange. The notes represent Estra’s international debut issuance on the debt capital markets; the net proceeds of the notes will be used to finance the Group’s activities and will strengthen the Group’s financ ...

... interest at a rate of 3.75%, are listed on the Global Exchange Market of the Irish Stock Exchange. The notes represent Estra’s international debut issuance on the debt capital markets; the net proceeds of the notes will be used to finance the Group’s activities and will strengthen the Group’s financ ...