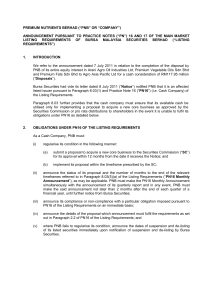

PREMIUM NUTRIENTS BERHAD (“PNB” OR “COMPANY

... Bursa Securities had vide its letter dated 8 July 2011 (“Notice”) notified PNB that it is an affected listed issuer pursuant to Paragraph 8.03(1) and Practice Note 16 (“PN16”) (i.e. Cash Company) of the Listing Requirements. Paragraph 8.03 further provides that the cash company must ensure that its ...

... Bursa Securities had vide its letter dated 8 July 2011 (“Notice”) notified PNB that it is an affected listed issuer pursuant to Paragraph 8.03(1) and Practice Note 16 (“PN16”) (i.e. Cash Company) of the Listing Requirements. Paragraph 8.03 further provides that the cash company must ensure that its ...

table of contents - Napa County

... BROKER: A person or firm that acts as an intermediary by purchasing and selling securities for others rather than for its own account. CERTIFICATE OF DEPOSIT (CD): A time deposit with a specific maturity evidenced by a Certificate. Large-denomination CD’s are typically negotiable. COLLATERAL: Securi ...

... BROKER: A person or firm that acts as an intermediary by purchasing and selling securities for others rather than for its own account. CERTIFICATE OF DEPOSIT (CD): A time deposit with a specific maturity evidenced by a Certificate. Large-denomination CD’s are typically negotiable. COLLATERAL: Securi ...

Chapter 11 Problem 2 (Page 309) If an investor is in a 30 percent

... What is the yield to maturity for the data in problem 6 ? Assume there are 10 years left to maturity. It is a $1,000 par value bond. Use the trial-and-error approach with annual analysis. [Hint: Because the bond is trading for less than par value, you can assume the interest rate (i) for which you a ...

... What is the yield to maturity for the data in problem 6 ? Assume there are 10 years left to maturity. It is a $1,000 par value bond. Use the trial-and-error approach with annual analysis. [Hint: Because the bond is trading for less than par value, you can assume the interest rate (i) for which you a ...

DOC - Europa.eu

... European Union competition rules by colluding to fix commission fees and other trading terms. The Statement is based on evidence made available to the Commission. The sending of a Statement of Objections is a procedural step in EU antitrust proceedings. It does not prejudge the outcome of the invest ...

... European Union competition rules by colluding to fix commission fees and other trading terms. The Statement is based on evidence made available to the Commission. The sending of a Statement of Objections is a procedural step in EU antitrust proceedings. It does not prejudge the outcome of the invest ...

TRANSLATED VERSION As of May 30, 2014 Readers should be

... (6) properly providing any channel to settle the dispute by any other measure other than court, unless the scheme specifies to comply with the Dispute Resolution and Enforcement Mechanism (“DREM”); (7) specifying to disclose material information at least being the same as the information disclosed t ...

... (6) properly providing any channel to settle the dispute by any other measure other than court, unless the scheme specifies to comply with the Dispute Resolution and Enforcement Mechanism (“DREM”); (7) specifying to disclose material information at least being the same as the information disclosed t ...

Investment and Savings

... Net investment is the change in the quantity of capital—equals gross investment minus depreciation. Wealth is the value of all the things that a person owns. Saving is the amount of income that is not paid in taxes or spent on consumption goods and services; saving adds to wealth. Savings = income – ...

... Net investment is the change in the quantity of capital—equals gross investment minus depreciation. Wealth is the value of all the things that a person owns. Saving is the amount of income that is not paid in taxes or spent on consumption goods and services; saving adds to wealth. Savings = income – ...

iShares STOXX Global Select Dividend 100 UCITS ETF (DE)

... BlackRock Advisors (UK) Limited, which is authorised and regulated by the Financial Conduct Authority ('FCA'), registered office at 12 Throgmorton Avenue, London, EC2N 2DL, England, Tel +44 (0)20 7743 3000. For your protection, calls are ususally recorded. The German domiciled funds are "undertaking ...

... BlackRock Advisors (UK) Limited, which is authorised and regulated by the Financial Conduct Authority ('FCA'), registered office at 12 Throgmorton Avenue, London, EC2N 2DL, England, Tel +44 (0)20 7743 3000. For your protection, calls are ususally recorded. The German domiciled funds are "undertaking ...

CHAPTER 5: INTRODUCTION TO RISK, RETURN, AND THE HISTORICAL RECORD

... the bond will fall, and the resulting capital loss will wipe out some or all of the 9% return you would have earned if bond yields had remained unchanged over the course of the year. ...

... the bond will fall, and the resulting capital loss will wipe out some or all of the 9% return you would have earned if bond yields had remained unchanged over the course of the year. ...

Investment products risk and fees disclosure

... position and experience in investing into securities) and investment objectives (incl. the desired temporal length of investment). Prior to investing into securities, Swedbank would recommend to visit an investment consultation, where customer will be assisted by investment adviser in making those e ...

... position and experience in investing into securities) and investment objectives (incl. the desired temporal length of investment). Prior to investing into securities, Swedbank would recommend to visit an investment consultation, where customer will be assisted by investment adviser in making those e ...

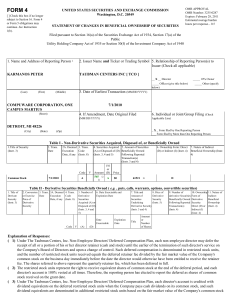

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... and the number of restricted stock units received equals the deferred retainer fee divided by the fair market value of the Company's common stock on the business day immediately before the date the director would otherwise have been entitled to receive the retainer fee. The shares referred to above ...

... and the number of restricted stock units received equals the deferred retainer fee divided by the fair market value of the Company's common stock on the business day immediately before the date the director would otherwise have been entitled to receive the retainer fee. The shares referred to above ...

Chapter 2

... of debt or equity in the primary market. To underwrite a new security issue, the investment banker buys the entire issue at a guaranteed price from the issuing firm and resells the securities to institutional investors and the public. ...

... of debt or equity in the primary market. To underwrite a new security issue, the investment banker buys the entire issue at a guaranteed price from the issuing firm and resells the securities to institutional investors and the public. ...

More Cash Balance Plan Sponsors Choosing ash

... advantages. Kravitz has received many IRS favorable determination letters for these plans since new IRS regulations were issued in 2010, and final regulations are pending. For plan sponsors seeking greater flexibility and reduced investment risk, Actual Rate of Return is an increasingly popular choi ...

... advantages. Kravitz has received many IRS favorable determination letters for these plans since new IRS regulations were issued in 2010, and final regulations are pending. For plan sponsors seeking greater flexibility and reduced investment risk, Actual Rate of Return is an increasingly popular choi ...

Investment Securities Internal Control Questionnaire

... bank have established written policies and procedures ensuring: a. That bank officers and employees who make investment recommendations or decisions for the accounts of customers, who participate in the determination of such recommendations or decisions, or who, in connection with their duties, obta ...

... bank have established written policies and procedures ensuring: a. That bank officers and employees who make investment recommendations or decisions for the accounts of customers, who participate in the determination of such recommendations or decisions, or who, in connection with their duties, obta ...

Investigators probe $500tn interest rate swaps market

... the market totalled $505tn, around 80 per cent of the global swaps market, according to figures from the Bank for International Settlements. Isdafix prices are also used to settle interest rate swaps futures contracts traded on the Chicago Mercantile Exchange, the world’s most liquid futures market. ...

... the market totalled $505tn, around 80 per cent of the global swaps market, according to figures from the Bank for International Settlements. Isdafix prices are also used to settle interest rate swaps futures contracts traded on the Chicago Mercantile Exchange, the world’s most liquid futures market. ...

securities trading policy

... Were this is to occur at a time when the person possessed inside information, then the sale of Company securities would be a breach of insider trading laws, even though the person’s decision to sell was not influenced by the inside information that the person possessed and the person may not have ma ...

... Were this is to occur at a time when the person possessed inside information, then the sale of Company securities would be a breach of insider trading laws, even though the person’s decision to sell was not influenced by the inside information that the person possessed and the person may not have ma ...

What Are Financial Intermediaries Paid For?

... or so-called ‘‘structured notes,’’ which are customstructured securities designed to meet the needs of trading parties. Undoubtedly, a structured note has exactly the same intermediation function as instruments issued by banks or insurance companies. In contrast, modern analysis of financial interme ...

... or so-called ‘‘structured notes,’’ which are customstructured securities designed to meet the needs of trading parties. Undoubtedly, a structured note has exactly the same intermediation function as instruments issued by banks or insurance companies. In contrast, modern analysis of financial interme ...

MR0159 - Loan Value granted to Significant Security Positions Held

... IDA Regulation 100 sets out the various margin rates for securities. These rates are the minimum regulatory rates that are required to be used for Member firm and customer account positions and they are set based on the type of security (i.e., debt or equity) and other factors such a credit rating, ...

... IDA Regulation 100 sets out the various margin rates for securities. These rates are the minimum regulatory rates that are required to be used for Member firm and customer account positions and they are set based on the type of security (i.e., debt or equity) and other factors such a credit rating, ...

RMS Policy - Dyna Securities Ltd.

... purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first transaction would ...

... purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first transaction would ...

CTRIP COM INTERNATIONAL LTD (Form: SC 13G/A

... on behalf of such person shall be filed with the statement, provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his ...

... on behalf of such person shall be filed with the statement, provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his ...

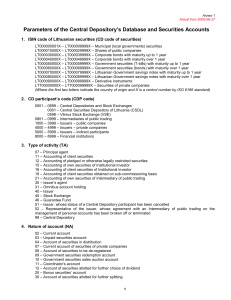

1. ISIN code of Lithuanian securities (CD code of securities)

... 5. Type of operation (TO) Stock events Primary trading in securities 060 – Securities allotment 061 – Initial public offering (IPO) via the Exchange 070 – Issue registration 071 – Payment of the issue 090 – Other transfers of the Central Depository 103 – Primary trading in securities 104 – Primary t ...

... 5. Type of operation (TO) Stock events Primary trading in securities 060 – Securities allotment 061 – Initial public offering (IPO) via the Exchange 070 – Issue registration 071 – Payment of the issue 090 – Other transfers of the Central Depository 103 – Primary trading in securities 104 – Primary t ...

Monopoly - ComLabGames

... most auction and monopoly models 1. Monopolists price discriminate through market segmentation, but auction rules do not make the winner’s payment depend on his type. However holding auctions with multiple rounds (for example restricting entry to qualified bidders in certain auctions) segments the m ...

... most auction and monopoly models 1. Monopolists price discriminate through market segmentation, but auction rules do not make the winner’s payment depend on his type. However holding auctions with multiple rounds (for example restricting entry to qualified bidders in certain auctions) segments the m ...

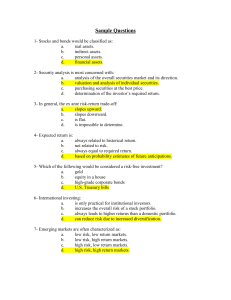

Sample Questions - U of L Class Index

... lowest price at which a dealer will sell. b. highest price at which a dealer will sell. c. highest price offered by a dealer. d. lowest price offered by the dealer. 35- If an investor is attempting to buy a stock that is very volatile, it would be best to use a: a. market order. b. limit order. c. s ...

... lowest price at which a dealer will sell. b. highest price at which a dealer will sell. c. highest price offered by a dealer. d. lowest price offered by the dealer. 35- If an investor is attempting to buy a stock that is very volatile, it would be best to use a: a. market order. b. limit order. c. s ...

SECURITIES TRADING POLICY

... exceptionally long prohibited period or the Company has had a number of consecutive prohibited periods and the restricted person could not reasonably have been expected to exercise it at a time when free to do so; or ...

... exceptionally long prohibited period or the Company has had a number of consecutive prohibited periods and the restricted person could not reasonably have been expected to exercise it at a time when free to do so; or ...

Debt position of the Government of India

... Internal Debt comprises loans raised in the open market, special securities issued to Reserve Bank, compensation and other bonds, etc. It also includes borrowings through treasury bills including treasury bills issued to State Governments, commercial banks and other parties, as well as non-negotiabl ...

... Internal Debt comprises loans raised in the open market, special securities issued to Reserve Bank, compensation and other bonds, etc. It also includes borrowings through treasury bills including treasury bills issued to State Governments, commercial banks and other parties, as well as non-negotiabl ...

Consultation Conclusions on the draft Securities and Futures

... on the application of the draft Notice. The other one was from the Hong Kong Securities Institute attaching the results of a survey to its members on the draft Notice. According to the Hong Kong Securities Institute, the two members who responded to the survey had no comment on the draft Notice. ...

... on the application of the draft Notice. The other one was from the Hong Kong Securities Institute attaching the results of a survey to its members on the draft Notice. According to the Hong Kong Securities Institute, the two members who responded to the survey had no comment on the draft Notice. ...