Multi-market Trading and Liquidity: Evidence from Cross

... As of 2013, there are over 500 non-U.S. firms listed on the New York Stock Exchange (NYSE). When a firm’s shares trade simultaneously on multiple exchanges, however, there may be more than one price for the same stock, i.e. identical financial assets trade at different prices in different markets. F ...

... As of 2013, there are over 500 non-U.S. firms listed on the New York Stock Exchange (NYSE). When a firm’s shares trade simultaneously on multiple exchanges, however, there may be more than one price for the same stock, i.e. identical financial assets trade at different prices in different markets. F ...

MOOSPEAK-- thru 10.11.2015

... morning the S&P was down 2% on the week, and a few hours later it finished the week up 1%. Suddenly financial engineering was back in play for a little longer. Thing is US long bonds (+3.7%) were up even more than stocks. Normally, a surge in bond prices is a bet that the economy is in trouble. High ...

... morning the S&P was down 2% on the week, and a few hours later it finished the week up 1%. Suddenly financial engineering was back in play for a little longer. Thing is US long bonds (+3.7%) were up even more than stocks. Normally, a surge in bond prices is a bet that the economy is in trouble. High ...

bonds - Cengage

... Reasons management may choose to issue bonds instead of stock: 1. Present owners remain in control of the corporation. 2. Interest is a deductible expense in arriving at taxable income; dividends are not. 3. Current market rates of interest may be favorable relative to stock market prices. 4. The ch ...

... Reasons management may choose to issue bonds instead of stock: 1. Present owners remain in control of the corporation. 2. Interest is a deductible expense in arriving at taxable income; dividends are not. 3. Current market rates of interest may be favorable relative to stock market prices. 4. The ch ...

Standard and Poor`s Criteria for Sovereign Ratings

... and may not include several nuances that are associated and vital. The purpose of this lesson is to clarify the basics of the concept so that readers at large can relate and thereby take more interest in the product / concept. In a nutshell, Professor Simply Simple lessons should be seen from the pe ...

... and may not include several nuances that are associated and vital. The purpose of this lesson is to clarify the basics of the concept so that readers at large can relate and thereby take more interest in the product / concept. In a nutshell, Professor Simply Simple lessons should be seen from the pe ...

Prudential Real Estate Investors

... take this year’s pessimism to extremes. Market players who study recent cycles know that there is greater potential for outsized returns when prices are low, as they are likely to be for the next year or two. Of course, knowing such a proposition intellectually and being in position to act upon thos ...

... take this year’s pessimism to extremes. Market players who study recent cycles know that there is greater potential for outsized returns when prices are low, as they are likely to be for the next year or two. Of course, knowing such a proposition intellectually and being in position to act upon thos ...

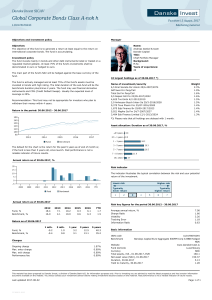

Global Corporate Bonds Class A-nok h

... The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is actively managed and at least 75% of the fund's assets must be invested in bonds with high rating. The total duration of the sub-fund will be the benchmark duration plus/minus 2 years. The fund may use ...

... The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is actively managed and at least 75% of the fund's assets must be invested in bonds with high rating. The total duration of the sub-fund will be the benchmark duration plus/minus 2 years. The fund may use ...

RBC Emerging Markets Bond Fund

... reported MER would have been had management fee changes been in effect throughout 2016. Series H and Series I are not available for purchase by new investors. Existing investors who hold Series H or Series I units can continue to make additional investments into the same series of the funds they hol ...

... reported MER would have been had management fee changes been in effect throughout 2016. Series H and Series I are not available for purchase by new investors. Existing investors who hold Series H or Series I units can continue to make additional investments into the same series of the funds they hol ...

wells fargo/ galliard ultra short bond fund

... Galliard is one of the nation’s largest stable value fixed income managers1 with $84.8 billion in assets under management. As part of Galliard’s stable value management capability, we currently manage approximately $38.4 billion in short-duration fixed income management. Galliard’s Fixed Income Team ...

... Galliard is one of the nation’s largest stable value fixed income managers1 with $84.8 billion in assets under management. As part of Galliard’s stable value management capability, we currently manage approximately $38.4 billion in short-duration fixed income management. Galliard’s Fixed Income Team ...

Insight Quarterly market review with high level

... financial crisis has typically tended to be weaker than during non-crisis periods. Furthermore, such recoveries tend to be slower and last longer. The current US expansion has now lasted for 93 months. There have been only two other periods of economic expansion longer than the current one (from 196 ...

... financial crisis has typically tended to be weaker than during non-crisis periods. Furthermore, such recoveries tend to be slower and last longer. The current US expansion has now lasted for 93 months. There have been only two other periods of economic expansion longer than the current one (from 196 ...

Comparative Financial Statements

... M5-4 Preparing and Interpreting a Multistep Income Statement Nutboy Theater Company reported the following single-step income statement. Prepare a multistep income statement that distinguishes the financial results of the local theater company’s core and peripheral activities. Also, calculate the n ...

... M5-4 Preparing and Interpreting a Multistep Income Statement Nutboy Theater Company reported the following single-step income statement. Prepare a multistep income statement that distinguishes the financial results of the local theater company’s core and peripheral activities. Also, calculate the n ...

April 2015 Newsletter

... Continuing from last year, Becky has had some continued health concerns this time related to a reoccurring herniated disk issue from two vertebrae in her neck along with a bone spur impacting her spinal column. After failed attempts of physical therapy and a cortisone injection to relieve the pain a ...

... Continuing from last year, Becky has had some continued health concerns this time related to a reoccurring herniated disk issue from two vertebrae in her neck along with a bone spur impacting her spinal column. After failed attempts of physical therapy and a cortisone injection to relieve the pain a ...

Wall Street Likes its Women: An Examination of Women in the Top

... firms on the organizations’ short and long-term financial performance. Looking at three different samples, I found that trend data indicate IPO firms are gaining in the number of women they employ in their top management teams (where top management team is defined as those listed in the firm’s prosp ...

... firms on the organizations’ short and long-term financial performance. Looking at three different samples, I found that trend data indicate IPO firms are gaining in the number of women they employ in their top management teams (where top management team is defined as those listed in the firm’s prosp ...

the exchange rate

... including the local economic, and global financial market, risk premium, and investment-flow variables in the regression. The coefficient for the regional credit spread is significant for 16 of the countries. Of these significant coefficients, 14 are positive in sign. Similarly, the coefficient for ...

... including the local economic, and global financial market, risk premium, and investment-flow variables in the regression. The coefficient for the regional credit spread is significant for 16 of the countries. Of these significant coefficients, 14 are positive in sign. Similarly, the coefficient for ...

Information Theory in Horseracing, the Share Markets and in Life

... Aside: At present, UP results contain certain practical limitations, specifically, with the results not being established for the case of no borrowing or short-selling, and the requirement that for each stock, E R V R must be greater than a certain unversal value, not satisfied by many stocks in Wor ...

... Aside: At present, UP results contain certain practical limitations, specifically, with the results not being established for the case of no borrowing or short-selling, and the requirement that for each stock, E R V R must be greater than a certain unversal value, not satisfied by many stocks in Wor ...

CHAPTER 12

... Trading securities are current assets by definition. Individual held-to-maturity and available-for-sale securities are either current or noncurrent depending on when they are expected to be sold. It’s not necessary that a company report individual amounts for the three categories of investments – he ...

... Trading securities are current assets by definition. Individual held-to-maturity and available-for-sale securities are either current or noncurrent depending on when they are expected to be sold. It’s not necessary that a company report individual amounts for the three categories of investments – he ...

The Term Structure of the Risk-Return Tradeoff

... average real return (a mere 1.52% per year) along with low variability. Stocks have an excess return of 6.31% per year compared to 1.42% for the 5-year bond. Although stock return volatility is considerably higher than bond return volatility (16.92% vs. 9.90%), the Sharpe ratio is two and a half tim ...

... average real return (a mere 1.52% per year) along with low variability. Stocks have an excess return of 6.31% per year compared to 1.42% for the 5-year bond. Although stock return volatility is considerably higher than bond return volatility (16.92% vs. 9.90%), the Sharpe ratio is two and a half tim ...

the full article

... “I met [Partner and Investment Consulting Practice Leader] Rob [Boston] from Morneau and thought it was a great environment where this can be developed and pushed forward,” he said. Frishman said the firm’s investment management arm, with $4.5 billion in assets under management, was the perfect size ...

... “I met [Partner and Investment Consulting Practice Leader] Rob [Boston] from Morneau and thought it was a great environment where this can be developed and pushed forward,” he said. Frishman said the firm’s investment management arm, with $4.5 billion in assets under management, was the perfect size ...

Engineering Economic Analysis

... • Under both definitions the process involves, whether explicitly or implicitly, weighing the total expected costs against the total expected benefits of one or more actions in order to choose the best or most profitable option. • The formal process is often referred to as either CBA (Cost-Benefit A ...

... • Under both definitions the process involves, whether explicitly or implicitly, weighing the total expected costs against the total expected benefits of one or more actions in order to choose the best or most profitable option. • The formal process is often referred to as either CBA (Cost-Benefit A ...

Acct 2220 Zeigler - GQ #3 (Chp 10)

... B. cost savings realized due to the investment made. C. the salvage value of the investment at the end of its useful life. D. all of the above represent potential cash inflows (i.e. benefits). ____ 2. Which of the following statements best describes a firm’s “cost of capital”? A. The return that a c ...

... B. cost savings realized due to the investment made. C. the salvage value of the investment at the end of its useful life. D. all of the above represent potential cash inflows (i.e. benefits). ____ 2. Which of the following statements best describes a firm’s “cost of capital”? A. The return that a c ...