The Dog That Did not Bark: Insider Trading and

... – Constraint imposed by our model: Has testable implications about when a crash occurs Does not have testable implications about size of crash (because of multiple equilibria) Thus, define crash variable as a 0/1 variable ...

... – Constraint imposed by our model: Has testable implications about when a crash occurs Does not have testable implications about size of crash (because of multiple equilibria) Thus, define crash variable as a 0/1 variable ...

Financial integration and emerging markets capital

... It is also possible that, as noted by Ağca et al. (2007), increased competition from foreign financial intermediaries and markets is likely to make domestic lenders shorten debt maturity as existing relationship lending can be broken as arms-length finance becomes more prominent. Regarding the equi ...

... It is also possible that, as noted by Ağca et al. (2007), increased competition from foreign financial intermediaries and markets is likely to make domestic lenders shorten debt maturity as existing relationship lending can be broken as arms-length finance becomes more prominent. Regarding the equi ...

Ch16 - NYU Stern

... may be an individual who is not well diversified. In fact, the marginal investor may well be a day trader whose time horizon can be measured in minutes rather than years. How would altering the marginal investors’ characteristics change the way you measure risk? Instead of considering only the risk ...

... may be an individual who is not well diversified. In fact, the marginal investor may well be a day trader whose time horizon can be measured in minutes rather than years. How would altering the marginal investors’ characteristics change the way you measure risk? Instead of considering only the risk ...

risks associated with financial instruments (glossary)

... Also, high inflation typically causes the real returns of investments to decrease. The real return of a financial instrument can be approximated as its actual (or nominal) return less inflation. While inflation risk impacts most asset classes, it is particularly acute for fixed-rate products. As a s ...

... Also, high inflation typically causes the real returns of investments to decrease. The real return of a financial instrument can be approximated as its actual (or nominal) return less inflation. While inflation risk impacts most asset classes, it is particularly acute for fixed-rate products. As a s ...

NBER WORKING PAPERS SERIES ASSET BUBBLES AND GROWFH Noriyuki Yanagawa

... large and that the growth rate in the equilibrium without bubbles exceeds the interest rate. large and that the growth rate in the equilibrium without bubbles exceeds the interest rate. Since the growth rate in the bubbleless equilibrium is endogenous, the existence condition Since the growth rate i ...

... large and that the growth rate in the equilibrium without bubbles exceeds the interest rate. large and that the growth rate in the equilibrium without bubbles exceeds the interest rate. Since the growth rate in the bubbleless equilibrium is endogenous, the existence condition Since the growth rate i ...

Chapter 4: Using Futures Markets

... 2. Accuracy: the accuracy of the futures market forecasts of those prices. 3. Performance: the performance of futures market forecasts relative to alternative forecasting techniques. ...

... 2. Accuracy: the accuracy of the futures market forecasts of those prices. 3. Performance: the performance of futures market forecasts relative to alternative forecasting techniques. ...

Forecasting Prices in the Presence of Hidden Liquidity

... We hypothesize that this happens for two reasons: first, markets are fragmented; liquidity is typically posted on various exchanges. In the U.S. stock markets, for example, Reg NMS requires that all market orders be routed to the venue with the best price. Moreover, limit orders that could be immedi ...

... We hypothesize that this happens for two reasons: first, markets are fragmented; liquidity is typically posted on various exchanges. In the U.S. stock markets, for example, Reg NMS requires that all market orders be routed to the venue with the best price. Moreover, limit orders that could be immedi ...

Price Impact of Block Trades in the Saudi Stock Market

... companies or wealthy families.6 At the end of 2008, the free floating stocks (excluding those held by major passive shareholders and government) available for trade represented 37% of the total stock outstanding in the market. Trading in the market is only for common stocks, there is no options mark ...

... companies or wealthy families.6 At the end of 2008, the free floating stocks (excluding those held by major passive shareholders and government) available for trade represented 37% of the total stock outstanding in the market. Trading in the market is only for common stocks, there is no options mark ...

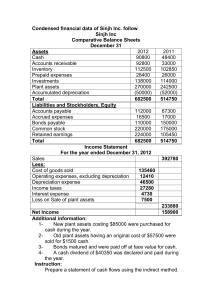

ijcrb.webs.com 732 FINANCIAL PERFORMANCE OF NON

... higher in 2009 whereas ratio 8 and 9 are higher in 2008. Due to the fast decline of the stock market, increase in interest rates and revaluation of TFCs had an unfavorable impact on the financial performance of IAS+AMS. 3.2 Leasing: Ratio 1 is slightly higher in 2008 as compared with 2009. In 2008, ...

... higher in 2009 whereas ratio 8 and 9 are higher in 2008. Due to the fast decline of the stock market, increase in interest rates and revaluation of TFCs had an unfavorable impact on the financial performance of IAS+AMS. 3.2 Leasing: Ratio 1 is slightly higher in 2008 as compared with 2009. In 2008, ...

Foreign debt and capital accumulátion

... Documents in EconStor may be saved and copied for your personal and scholarly purposes. ...

... Documents in EconStor may be saved and copied for your personal and scholarly purposes. ...

PDF

... most liquid financial market of all. The currency combination most traded worldwide is the euro/US dollar, which alone accounted for more than one quarter of total global trading volume in 2010. London traditionally is the world’s largest currency trading hub. Almost half of the trading volume hand ...

... most liquid financial market of all. The currency combination most traded worldwide is the euro/US dollar, which alone accounted for more than one quarter of total global trading volume in 2010. London traditionally is the world’s largest currency trading hub. Almost half of the trading volume hand ...

Evercore ISI named # 3 in US Equity Research by

... 30 ranked analysts in total. This marks the third year in a row that Evercore ISI has placed in the top 5 firms in the annual survey. On a weighted basis (i.e. higher weighting assigned to a #1 rank and lower weighting assigned for a runner-up rank) Evercore ISI ranked #2 to J.P. Morgan. The 2016 Al ...

... 30 ranked analysts in total. This marks the third year in a row that Evercore ISI has placed in the top 5 firms in the annual survey. On a weighted basis (i.e. higher weighting assigned to a #1 rank and lower weighting assigned for a runner-up rank) Evercore ISI ranked #2 to J.P. Morgan. The 2016 Al ...

Testing for imperfect competition at the Fulton fish market - U

... Almost all tests for competition have been performed in oligopolistic industries with high entry barriers, in which an initial case study would suggest anticompetitive behavior.1 These studies use data that have been gathered from public sources such as trade journals, regulatory bodies, or court ca ...

... Almost all tests for competition have been performed in oligopolistic industries with high entry barriers, in which an initial case study would suggest anticompetitive behavior.1 These studies use data that have been gathered from public sources such as trade journals, regulatory bodies, or court ca ...

Forecast for 2001

... The main factors behind the good freight rates are the historically low oil stocks and the healthy economies in the US and Asia, which generated increased demand for oil transportation. Consolidation in the tanker industry also had a positive effect. A natural effect of the freight market improvemen ...

... The main factors behind the good freight rates are the historically low oil stocks and the healthy economies in the US and Asia, which generated increased demand for oil transportation. Consolidation in the tanker industry also had a positive effect. A natural effect of the freight market improvemen ...

“Carry Trade” Model of Commodity Prices

... from the 2008-09 global recession – together with the prospects of continued high growth in those countries in the future. This growth has raised the demand for, and hence the price of, commodities. (See Kilian and Hicks, 2012.) The second explanation -- also highly popular, at least among the publ ...

... from the 2008-09 global recession – together with the prospects of continued high growth in those countries in the future. This growth has raised the demand for, and hence the price of, commodities. (See Kilian and Hicks, 2012.) The second explanation -- also highly popular, at least among the publ ...

Whether a disclosure of the historical dividend yield in the

... omit material facts of an unfavourable nature or fail to accord them with appropriate significance; ...

... omit material facts of an unfavourable nature or fail to accord them with appropriate significance; ...

Estimating an Equilibrium Model of Limit Order Markets

... to the explicitly non-dynamic (static) model of equilibrium in limit order markets. To my knowledge, this is the first paper performing structural econometric analysis in such a setting. I use this econometric framework to address two important questions. First, is information transmitted evenly and ...

... to the explicitly non-dynamic (static) model of equilibrium in limit order markets. To my knowledge, this is the first paper performing structural econometric analysis in such a setting. I use this econometric framework to address two important questions. First, is information transmitted evenly and ...

EMPLOYEE STOCK OWNERSHIP PLANS (“ESOPs”)

... Bank lends money to company, which in turns loans money to ESOP. ESOP used cash to purchase company’s stock. ESOP repays the loan by virtue of tax free contributions from company and stock dividends. Stock used as security for the loan; As loan repaid, stock is released from suspense account ...

... Bank lends money to company, which in turns loans money to ESOP. ESOP used cash to purchase company’s stock. ESOP repays the loan by virtue of tax free contributions from company and stock dividends. Stock used as security for the loan; As loan repaid, stock is released from suspense account ...

Does Population Growth Affect Housing Bubbles?

... The purpose of this dissertation is to investigate the relationship between population growth and house prices. It analyses whether housing bubbles existed in American cities during the recent financial crisis by comparing the housing market development among cities with similar population growth tr ...

... The purpose of this dissertation is to investigate the relationship between population growth and house prices. It analyses whether housing bubbles existed in American cities during the recent financial crisis by comparing the housing market development among cities with similar population growth tr ...

Bonds

... 10.4.8 Corporate Bonds: Debt Ratings The next slide explains in further details the rating scale for corporate debt. The rating scale is for Moody’s. Both Standard and Poor’s and Fitch have similar debt ...

... 10.4.8 Corporate Bonds: Debt Ratings The next slide explains in further details the rating scale for corporate debt. The rating scale is for Moody’s. Both Standard and Poor’s and Fitch have similar debt ...