a review of the earnings management literature and its implications

... qualify for pooling or purchase accounting, lease contracts can be structured so that lease obligations are on- or off-balance sheet, and equity investments can be structured to avoid or require consolidation. A second point to note is that our definition frames the objective of earnings management ...

... qualify for pooling or purchase accounting, lease contracts can be structured so that lease obligations are on- or off-balance sheet, and equity investments can be structured to avoid or require consolidation. A second point to note is that our definition frames the objective of earnings management ...

CONSIGNMENT STOCK AGREEMENT

... to say excess consignment stock being at the risk of the Supplier: for the purposes of this clause, excess stock shall be defined by date of arrival at the storage facility. ...

... to say excess consignment stock being at the risk of the Supplier: for the purposes of this clause, excess stock shall be defined by date of arrival at the storage facility. ...

Price-Level Accounting, Full Disclosure, and Rule 10b-5

... lack of interest may be explained in part by the fact that traditional depreciation accounting does roughly compensate for increases in replacement costs. The failure to account for the gap between depreciation reserves and replacement cost is offset by the failure to recognize imputed income from i ...

... lack of interest may be explained in part by the fact that traditional depreciation accounting does roughly compensate for increases in replacement costs. The failure to account for the gap between depreciation reserves and replacement cost is offset by the failure to recognize imputed income from i ...

GQG Partners Emerging Markets Equity Fund

... such companies may suffer a decline in response. These factors contribute to price volatility, which is the principal risk of investing in the Fund. IPO Risk – The market value of shares issued in an IPO may fluctuate considerably due to factors such as the absence of a prior public market, unseason ...

... such companies may suffer a decline in response. These factors contribute to price volatility, which is the principal risk of investing in the Fund. IPO Risk – The market value of shares issued in an IPO may fluctuate considerably due to factors such as the absence of a prior public market, unseason ...

PDF

... cattle frequently differ from zero by more than the transaction costs associated with arbitrage, and that fluctuations in basis values may be partly explained by trader expectations and by risk associated with returns to arbitrage. An initial hypothesis about the determination of par-delivery-point ...

... cattle frequently differ from zero by more than the transaction costs associated with arbitrage, and that fluctuations in basis values may be partly explained by trader expectations and by risk associated with returns to arbitrage. An initial hypothesis about the determination of par-delivery-point ...

comparatible analysys of the capital structure

... In order to provide evidence regarding the relationship between the four proposed determinants of corporate capital structure and leverage as well as to make this study more comparable with other research on corporate capital structure, leverage is defined in four ways. First, it is defined as a rat ...

... In order to provide evidence regarding the relationship between the four proposed determinants of corporate capital structure and leverage as well as to make this study more comparable with other research on corporate capital structure, leverage is defined in four ways. First, it is defined as a rat ...

Supplementary Material to - University of Notre Dame

... two-factor cash flow model captures the relation between risk premium and cash flow characteristics in the simple economy discussed in the paper. Section B solves the risk premium on an asset using the usual return-based beta representation, reinforcing the intuition behind the two-factor cash flow ...

... two-factor cash flow model captures the relation between risk premium and cash flow characteristics in the simple economy discussed in the paper. Section B solves the risk premium on an asset using the usual return-based beta representation, reinforcing the intuition behind the two-factor cash flow ...

future value of multiple cash flows

... The power of compounding is not restricted to money. Foresters try to forecast the compound growth rate of trees, demographers the compound growth rate of population. A social commentator once observed that the number of lawyers in the United States is increasing at a higher compound rate than the p ...

... The power of compounding is not restricted to money. Foresters try to forecast the compound growth rate of trees, demographers the compound growth rate of population. A social commentator once observed that the number of lawyers in the United States is increasing at a higher compound rate than the p ...

Lecture Note One

... • 1. Increasing the debt level does not affect the riskiness of the assets, but it does increase the riskiness of the equity • In the same firm, RD is always less than RE, This is because the debt has a higher priority and this is less risky. But the weighted sum of the returns of debt and equity is ...

... • 1. Increasing the debt level does not affect the riskiness of the assets, but it does increase the riskiness of the equity • In the same firm, RD is always less than RE, This is because the debt has a higher priority and this is less risky. But the weighted sum of the returns of debt and equity is ...

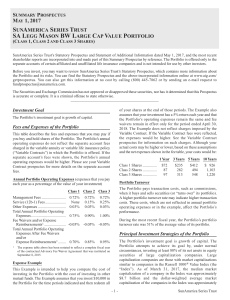

SAST - SA Legg Mason BW Large Cap Value

... the Portfolio’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of ...

... the Portfolio’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of ...

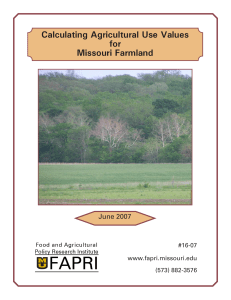

Calculating Agricultural Use Values for Missouri

... different beliefs about the role of speculative forces and interest (discount) rates in farmland price determination. Barton, Adelaja and Seedang (2005) describe speculation in farmland as “the tendency of farmland owners to acquire, dispose or hold on to land based on expectations about the appreci ...

... different beliefs about the role of speculative forces and interest (discount) rates in farmland price determination. Barton, Adelaja and Seedang (2005) describe speculation in farmland as “the tendency of farmland owners to acquire, dispose or hold on to land based on expectations about the appreci ...

Short-term Expectations in Listed Firms: The Effects of Different

... Graves (1988), and in the survey by Graham et al. (2006), where managers pointed out institutional investors as the main category of shareholders causing short-term behavior.7 However, the group of institutional investors is a heterogeneous shareholder class, including both transient and more long-t ...

... Graves (1988), and in the survey by Graham et al. (2006), where managers pointed out institutional investors as the main category of shareholders causing short-term behavior.7 However, the group of institutional investors is a heterogeneous shareholder class, including both transient and more long-t ...

Paper

... We first employ a method to measure loss aversion that is similar in spirit to the one employed by Terence Odean (1998), but we have adapted it for the specific characteristics of the housing markets and of our sample. Odean (1998) uses 10,000 trading records of private traders at a discount brokera ...

... We first employ a method to measure loss aversion that is similar in spirit to the one employed by Terence Odean (1998), but we have adapted it for the specific characteristics of the housing markets and of our sample. Odean (1998) uses 10,000 trading records of private traders at a discount brokera ...

French Mid-Market Companies Display Financial

... For the purpose of this report, we studied two groups of companies. The first group offers an overview of the financial performance of companies for which financial data was available on S&P Capital IQ dating back to 2005. This group consists of 92 large companies (with revenues of greater than €1.5 ...

... For the purpose of this report, we studied two groups of companies. The first group offers an overview of the financial performance of companies for which financial data was available on S&P Capital IQ dating back to 2005. This group consists of 92 large companies (with revenues of greater than €1.5 ...

ethical investment: empirical evidence from ftse islamic index

... banking or any other interest related activity, alcohol, tobacco, gambling, arms manufacturing, life insurance, pork production, packaging and processing any activity related to pork, and companies with gross interest bearing debt to total assets exceeds 33%. GIIS have a management committee which i ...

... banking or any other interest related activity, alcohol, tobacco, gambling, arms manufacturing, life insurance, pork production, packaging and processing any activity related to pork, and companies with gross interest bearing debt to total assets exceeds 33%. GIIS have a management committee which i ...

Supply and Demand

... that we will overcome either greed or fear. So when you find yourself in the middle of the next speculative bubble, and you will, you can expect to hear "this time it is different," and when you do, think seriously about getting out of that market.iv Bubbles and large price swings are not, however, ...

... that we will overcome either greed or fear. So when you find yourself in the middle of the next speculative bubble, and you will, you can expect to hear "this time it is different," and when you do, think seriously about getting out of that market.iv Bubbles and large price swings are not, however, ...

Asset market participation and portfolio choice over the life-cycle

... failure to find evidence of rebalancing in the risky share. Third, evidence so far is based primarily on household surveys which are notoriously subject to measurement problems. Most importantly, measurement and reporting errors are likely to be correlated with age, hiding age patterns when present ...

... failure to find evidence of rebalancing in the risky share. Third, evidence so far is based primarily on household surveys which are notoriously subject to measurement problems. Most importantly, measurement and reporting errors are likely to be correlated with age, hiding age patterns when present ...

PALL CORP (PLL) 10-Q Quarterly report pursuant to sections 13 or

... contingencies be recognized at fair value if fair value can be reasonably determined. If the fair value of such assets or liabilities cannot be reasonably determined, then they would generally be recognized in accordance with certain other pre-existing authoritative guidance. This new guidance also ...

... contingencies be recognized at fair value if fair value can be reasonably determined. If the fair value of such assets or liabilities cannot be reasonably determined, then they would generally be recognized in accordance with certain other pre-existing authoritative guidance. This new guidance also ...

Chapter 25 International Diversification

... • Suppose the risk-free rate in U.K. is 10% and the current exchange rate is $2/£1. • A U.S. investor with $20,000 can buy £10,000 and invest them to obtain £11,000 in one year. • If the £ depreciates to $1.80, the investment will yield only $19, 800, a $200 loss. • The investment was not risk free ...

... • Suppose the risk-free rate in U.K. is 10% and the current exchange rate is $2/£1. • A U.S. investor with $20,000 can buy £10,000 and invest them to obtain £11,000 in one year. • If the £ depreciates to $1.80, the investment will yield only $19, 800, a $200 loss. • The investment was not risk free ...

chapter 7—long-term debt

... 19. Which of the following statements is not correct? a. A ratio that indicates a firm's long-term, debt-paying ability from the income statement view is the times interest earned. b. Some of the items on the income statement that are excluded in order to compute times interest earned are interest ...

... 19. Which of the following statements is not correct? a. A ratio that indicates a firm's long-term, debt-paying ability from the income statement view is the times interest earned. b. Some of the items on the income statement that are excluded in order to compute times interest earned are interest ...

Document

... expect from her investment next year assuming all else remains the same as in the past? • The geometric average answers the question, what rate of return Mary can expect over a five-year period? Copyright © 2011 Pearson Prentice Hall. All rights reserved. ...

... expect from her investment next year assuming all else remains the same as in the past? • The geometric average answers the question, what rate of return Mary can expect over a five-year period? Copyright © 2011 Pearson Prentice Hall. All rights reserved. ...