Strategic Management

... Right to purchase stock in the future at a price set now; compensation determined by “spread” ...

... Right to purchase stock in the future at a price set now; compensation determined by “spread” ...

View the Entire Research Piece as a PDF here.

... over a specific time horizon. Implied volatility is the expected volatility that is priced into the options traded on that security. Options can be valued in many ways. One common approach is to use the Black-Scholes model, a framework in which the value of an option is determined by five parameters ...

... over a specific time horizon. Implied volatility is the expected volatility that is priced into the options traded on that security. Options can be valued in many ways. One common approach is to use the Black-Scholes model, a framework in which the value of an option is determined by five parameters ...

Chapter 6: Reporting and Interpreting Sales Revenue, Receivables

... uncollectible account receivable amounting to $5,000. Assuming a January 1, 2000 balance in allowance for doubtful accounts of $10,000, the December 31, 2000 balance in the allowance for doubtful accounts would be? 10. What is the journal entry when a previously written off accounts receivable is re ...

... uncollectible account receivable amounting to $5,000. Assuming a January 1, 2000 balance in allowance for doubtful accounts of $10,000, the December 31, 2000 balance in the allowance for doubtful accounts would be? 10. What is the journal entry when a previously written off accounts receivable is re ...

Investment Promotion Manual

... local government units (LGUs) to work on the adoption of investment-friendly businessrelated policies and procedures. It also conducts capability building seminars aimed at informing the participants of the different funding schemes and tools that the LGUs can access to fund necessary development pr ...

... local government units (LGUs) to work on the adoption of investment-friendly businessrelated policies and procedures. It also conducts capability building seminars aimed at informing the participants of the different funding schemes and tools that the LGUs can access to fund necessary development pr ...

Consumer Negative Voice and Firm

... the brand equity literature (Keller 2003; Keller and Aaker 1993). According to this literature, a firm’s good brand image and strong public reputation represent another critical intangible asset that has financial content and long-term value. It is likely that in the competitive marketplace, a large ...

... the brand equity literature (Keller 2003; Keller and Aaker 1993). According to this literature, a firm’s good brand image and strong public reputation represent another critical intangible asset that has financial content and long-term value. It is likely that in the competitive marketplace, a large ...

Chapter 1: Financial Accounting and Standards

... • When the FMV is not available for all classes of shares involved • FMV may be available for some, but not all share classes • Use the FMV to allocate the funds for those shares with the known FMV • Remainder is allocated to the shares where the FMV is not known • If the FMV is not known for any of ...

... • When the FMV is not available for all classes of shares involved • FMV may be available for some, but not all share classes • Use the FMV to allocate the funds for those shares with the known FMV • Remainder is allocated to the shares where the FMV is not known • If the FMV is not known for any of ...

Tendency to Choose Big Audit Firms: Case of Indonesia

... highly depended on climate, weather, temperature, and other extraordinary factors that are very difficult to control. If mining companies with greater business risk want to have debt, their financial risk tolerance is lower than those with lower business risk. Beatty (1986) finds that brand name aud ...

... highly depended on climate, weather, temperature, and other extraordinary factors that are very difficult to control. If mining companies with greater business risk want to have debt, their financial risk tolerance is lower than those with lower business risk. Beatty (1986) finds that brand name aud ...

11_Ryanair

... Local competitors’ going bankrupt allows Ryanair to capture their customers and possibly buy equipment they are forced to sell. Lower interest rate on borrowing money. Down cycle of economy has increased potential profit because people are most cost sensitive. ...

... Local competitors’ going bankrupt allows Ryanair to capture their customers and possibly buy equipment they are forced to sell. Lower interest rate on borrowing money. Down cycle of economy has increased potential profit because people are most cost sensitive. ...

B04 Chapter 04 Japanese Candlesticks 1.

... and trendlines can be added to it in order to decide on entrance and exit points, and at what prices to place stops. All these charts can also be displayed on an arithmetic or logarithmic scale. The types of charts and the scale used depends on what information the technical analyst considers to be ...

... and trendlines can be added to it in order to decide on entrance and exit points, and at what prices to place stops. All these charts can also be displayed on an arithmetic or logarithmic scale. The types of charts and the scale used depends on what information the technical analyst considers to be ...

Fair Value Accounting: Information or Confusion for Financial Markets?

... The recent financial crisis has led to a critical evaluation of the role that fair value accounting may have played in undermining the stability of the financial system. Reacting to the pressures of banking regulators and governments, standard-setters have brought forward additional guidance on the ...

... The recent financial crisis has led to a critical evaluation of the role that fair value accounting may have played in undermining the stability of the financial system. Reacting to the pressures of banking regulators and governments, standard-setters have brought forward additional guidance on the ...

Intraday Periodicity Adjustments of Transaction Duration and Their

... large-cap stocks, they are less frequent for small-cap stocks. We would also mention that there is some regularity in the occurrence of multiple trades. For example, many multiple trades occur on the hour. In particular, there are many multiple trades at time stamps 10:00 and 15:45. An important fea ...

... large-cap stocks, they are less frequent for small-cap stocks. We would also mention that there is some regularity in the occurrence of multiple trades. For example, many multiple trades occur on the hour. In particular, there are many multiple trades at time stamps 10:00 and 15:45. An important fea ...

Global Fixed Income

... bond indices, Level 2 of BICS FI defines eligibility. MORTGAGE-BACKED SECURITIES The Bloomberg U.S. Mortgage Pass-Through Securities Index captures mortgage-backed securities issued by Fannie Mae (FNMA), Freddie Mac (FHLMC) and Ginnie Mae (GNMA). The index includes only fixed-rate 30-year, 20-year a ...

... bond indices, Level 2 of BICS FI defines eligibility. MORTGAGE-BACKED SECURITIES The Bloomberg U.S. Mortgage Pass-Through Securities Index captures mortgage-backed securities issued by Fannie Mae (FNMA), Freddie Mac (FHLMC) and Ginnie Mae (GNMA). The index includes only fixed-rate 30-year, 20-year a ...

Zero Coupon Debentures Due 2028 $800,000,000 Freddie Mac

... be adversely affected by changes in prevailing interest rates and the optional redemption feature. This effect on the market value could be magnified substantially in a rising interest rate environment in the case of the Debentures due to their long remaining term to maturity. In such an environment ...

... be adversely affected by changes in prevailing interest rates and the optional redemption feature. This effect on the market value could be magnified substantially in a rising interest rate environment in the case of the Debentures due to their long remaining term to maturity. In such an environment ...

STANDALONE FUN VALUATION

... An updated view of GSN’s financial forecast in a “Base Case”, assuming no formal partnership or merger with FUN Technologies ...

... An updated view of GSN’s financial forecast in a “Base Case”, assuming no formal partnership or merger with FUN Technologies ...

Chapter 4

... -> Financial or Business plan maps out the 2-5 year time frame of the overall long term corporate or strategic plan ...

... -> Financial or Business plan maps out the 2-5 year time frame of the overall long term corporate or strategic plan ...

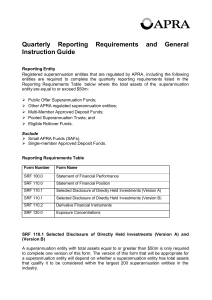

Reporting Requirements and General Instruction guide Quart…

... AASB 1024 ‘Consolidated Accounts’ defines a controlled entity / “subsidiary" as meaning an entity, which is controlled by a parent entity. A parent entity is defined as an entity, which controls another entity. "Entity" means any legal, administrative, or fiduciary arrangement, organisational struct ...

... AASB 1024 ‘Consolidated Accounts’ defines a controlled entity / “subsidiary" as meaning an entity, which is controlled by a parent entity. A parent entity is defined as an entity, which controls another entity. "Entity" means any legal, administrative, or fiduciary arrangement, organisational struct ...

Australian REITs - Regulation and market trends

... the world after the United States.2 REITs (commonly referred to as “listed property trusts” or “LPTs” in Australia)3 play a very important role in the Australian market. LPTs are one of the largest sectors on the Australian Stock Exchange Limited (ASX) and now account for around 10% of total market ...

... the world after the United States.2 REITs (commonly referred to as “listed property trusts” or “LPTs” in Australia)3 play a very important role in the Australian market. LPTs are one of the largest sectors on the Australian Stock Exchange Limited (ASX) and now account for around 10% of total market ...