Factsheet 2014 Annual

... Stock Exchange on May 15, 1997, and the Company subsequently obtained a secondary listing on the London Stock Exchange on May 5, 2000. On February 14, 2002, a Level I American Depositary Receipt program sponsored by the Company in respect of its H Shares was established in the United States. ...

... Stock Exchange on May 15, 1997, and the Company subsequently obtained a secondary listing on the London Stock Exchange on May 5, 2000. On February 14, 2002, a Level I American Depositary Receipt program sponsored by the Company in respect of its H Shares was established in the United States. ...

Website Content 1-5-11 - Synergetic Investment Group

... 9/30/09 was -.2%. Marcus & Millichap, the leading commercial real estate brokerage firm in the U.S reports a return of 199% for multi-family assets during the last 10 year period! ...

... 9/30/09 was -.2%. Marcus & Millichap, the leading commercial real estate brokerage firm in the U.S reports a return of 199% for multi-family assets during the last 10 year period! ...

FINANCIAL DERIVATIVES FOR BEGINNERS

... Some say the world will end in fire, Some say in ice Robert Frost (1874–1963) This is what the Derivative world is? ...

... Some say the world will end in fire, Some say in ice Robert Frost (1874–1963) This is what the Derivative world is? ...

Treasury Yield Curve (percent)

... the North American Industry Classification System (NAICS). NAICS is the industry standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing and publishing statistical data related to the US business economy Index returns do not refle ...

... the North American Industry Classification System (NAICS). NAICS is the industry standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing and publishing statistical data related to the US business economy Index returns do not refle ...

Mark scheme - Unit F012 - Accounting applications - June

... of the examination. It shows the basis on which marks were awarded by Examiners. It does not indicate the details of the discussions which took place at an Examiners’ meeting before marking ...

... of the examination. It shows the basis on which marks were awarded by Examiners. It does not indicate the details of the discussions which took place at an Examiners’ meeting before marking ...

Compensation Best Practices Overview

... good results over several years without assuming unnecessarily high risk.” ...

... good results over several years without assuming unnecessarily high risk.” ...

Lessons from history

... Some investors may not know anything different or remember the events leading up to the recent historic bond market run. However, it was a period well worth noting. The 1970s was a turbulent time in U.S. history and for the global economy. The collapse of the Bretton Woods system marked the end of t ...

... Some investors may not know anything different or remember the events leading up to the recent historic bond market run. However, it was a period well worth noting. The 1970s was a turbulent time in U.S. history and for the global economy. The collapse of the Bretton Woods system marked the end of t ...

Richard Jeffrey, Chief Investment Officer

... We have taken all reasonable care to ensure that the information contained within this document is accurate, up to date, and complies with all prevailing UK legislation. However, no liability can be accepted for any errors or omissions, or for any loss resulting from its use. Any data and material p ...

... We have taken all reasonable care to ensure that the information contained within this document is accurate, up to date, and complies with all prevailing UK legislation. However, no liability can be accepted for any errors or omissions, or for any loss resulting from its use. Any data and material p ...

Capital Budgeting Processes And Techniques

... At end of two years assume that Norm receives a salary offer of $90,000, which increases at 8% per year Expected tuition, fees and textbook expenses for next two years while studying in MBA: $35,000 If Norm worked at his current job for two years, his salary ...

... At end of two years assume that Norm receives a salary offer of $90,000, which increases at 8% per year Expected tuition, fees and textbook expenses for next two years while studying in MBA: $35,000 If Norm worked at his current job for two years, his salary ...

Document

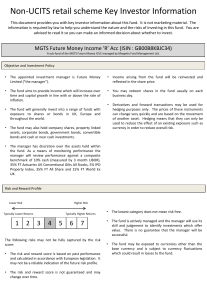

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

China`s Equity Market Turmoil Raises Credit And Market Risks For

... Still, the easing of regulatory margin requirements exposes securities firms to elevated credit losses, particularly at a time of heightened market volatility. In particular, we believe these companies could be burdened with substantial credit risks if the regulators pressure them to further relax r ...

... Still, the easing of regulatory margin requirements exposes securities firms to elevated credit losses, particularly at a time of heightened market volatility. In particular, we believe these companies could be burdened with substantial credit risks if the regulators pressure them to further relax r ...

What type of investor are you?

... and/or a shorter time horizon. It is targeted toward the investor seeking investment stability from the investable assets but still seeking to beat inflation over the long term. The main objective of this investor is to preserve capital while providing income potential. Investors may expect fluctuat ...

... and/or a shorter time horizon. It is targeted toward the investor seeking investment stability from the investable assets but still seeking to beat inflation over the long term. The main objective of this investor is to preserve capital while providing income potential. Investors may expect fluctuat ...

May 2016 Factsheet Monthly

... any warranties of any kind. The data provider and issuer of the document shall have no liability in connection with the third party data. The Prospectus and/or www.schroders.com contain additional disclaimers which apply to the third party data. This document does not constitute an offer to anyone, ...

... any warranties of any kind. The data provider and issuer of the document shall have no liability in connection with the third party data. The Prospectus and/or www.schroders.com contain additional disclaimers which apply to the third party data. This document does not constitute an offer to anyone, ...

equity fund - Sun Life Financial

... Despite trading in negative territory for most part of the month, the PSEi was up 1.87% in March to close at 6,847.4 points, bringing YTD gains to a solid 17.8%. During the last trading day of the month, the index posted its 24th record close and biggest one-day gain for the year as it surged 2.74% ...

... Despite trading in negative territory for most part of the month, the PSEi was up 1.87% in March to close at 6,847.4 points, bringing YTD gains to a solid 17.8%. During the last trading day of the month, the index posted its 24th record close and biggest one-day gain for the year as it surged 2.74% ...

Stewardship Code Statement

... insiders and to ask companies to indicate in advance if they believe that it is necessary for the engagement for inside information to be conveyed. Principle 4: Institutional investors should establish clear guidelines on when and how they will escalate their stewardship activities. We have a specia ...

... insiders and to ask companies to indicate in advance if they believe that it is necessary for the engagement for inside information to be conveyed. Principle 4: Institutional investors should establish clear guidelines on when and how they will escalate their stewardship activities. We have a specia ...

MODIGLIANI-MILLER PROPOSTIONS

... T is the corporate tax savings per dollar of debt, and DL is the market value of the firm’s debt. In the above relationship, T is equal to the firm’s tax rate if all debt interest is tax deductible. However, if some or all of the interest is not tax deductible, T is not the marginal tax rate. For ex ...

... T is the corporate tax savings per dollar of debt, and DL is the market value of the firm’s debt. In the above relationship, T is equal to the firm’s tax rate if all debt interest is tax deductible. However, if some or all of the interest is not tax deductible, T is not the marginal tax rate. For ex ...

Managing Organisational Change within Laing Homes

... Order 2001 (the "Order") or (b) any other persons to whom it may otherwise lawfully be communicated, falling within Article 49(1)of the Order (all such persons being referred to as "relevant persons"). Any person who is not a relevant person should not act or rely on this presentation or any of its ...

... Order 2001 (the "Order") or (b) any other persons to whom it may otherwise lawfully be communicated, falling within Article 49(1)of the Order (all such persons being referred to as "relevant persons"). Any person who is not a relevant person should not act or rely on this presentation or any of its ...

CaPITaL hELd By BFa 64.2% FREE-FLOaT 35.8% nOMInaL shaRE

... conferences, fieldtrips and numerous individual visits to share information on the bank’s performance and results, ...

... conferences, fieldtrips and numerous individual visits to share information on the bank’s performance and results, ...

Download attachment

... The development of a debt securities market is an important initial step towards the formation of the basic rudimentary structure of the capital market. It is an important way of attracting both domestic and international funds should be high priority on the agenda of SADC Stock Exchanges, Committee ...

... The development of a debt securities market is an important initial step towards the formation of the basic rudimentary structure of the capital market. It is an important way of attracting both domestic and international funds should be high priority on the agenda of SADC Stock Exchanges, Committee ...

The Capital Structure Puzzle

... their optimal ratios. But there is nothing in the usual static tradeoff stories suggesting that adjustment costs are a first-order concern-in fact, they are rarelymentioned. Invoking them without modelling them is a cop-out. Any cross-sectional test of financing behavior should specify whether firms ...

... their optimal ratios. But there is nothing in the usual static tradeoff stories suggesting that adjustment costs are a first-order concern-in fact, they are rarelymentioned. Invoking them without modelling them is a cop-out. Any cross-sectional test of financing behavior should specify whether firms ...

Fair Market Value and Blockage Discounts: When the Market Doesn

... If an investor wishes to sell its restricted or control securities to the public, it can follow the applicable conditions set forth in Rule 144. Rule 144 is not the exclusive means for selling restricted or control securities, but provides a “safe harbor” exemption to sellers. The five conditions of ...

... If an investor wishes to sell its restricted or control securities to the public, it can follow the applicable conditions set forth in Rule 144. Rule 144 is not the exclusive means for selling restricted or control securities, but provides a “safe harbor” exemption to sellers. The five conditions of ...