Archivo fuente en Word 97 - Casa de Bolsa Banorte Ixe

... World rig activity has blossomed since the Asian crisis. Particularly, a strong trend began in June, 1999 to date, fueled by relatively high oil prices. Statistics show that strong market conditions for Tamsa’s products remain, as rig count performed by Baker Hughes reveals that new rigs has increas ...

... World rig activity has blossomed since the Asian crisis. Particularly, a strong trend began in June, 1999 to date, fueled by relatively high oil prices. Statistics show that strong market conditions for Tamsa’s products remain, as rig count performed by Baker Hughes reveals that new rigs has increas ...

bonds plus 400 fund - Insight Investment

... achieved and a capital loss may occur. Funds which have a higher performance aim generally take more risk to achieve this and so have a greater potential for the returns to be significantly different than expected. Past performance is not a guide to future performance. The value of investments and a ...

... achieved and a capital loss may occur. Funds which have a higher performance aim generally take more risk to achieve this and so have a greater potential for the returns to be significantly different than expected. Past performance is not a guide to future performance. The value of investments and a ...

Fund Facts

... and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Investment Management Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purp ...

... and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Investment Management Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purp ...

2-4 Financial Analysis-

... • Market Value Measures: ratios utilizing market prices. Price per share – Price Earnings (PE) Ratio Earnings per share ...

... • Market Value Measures: ratios utilizing market prices. Price per share – Price Earnings (PE) Ratio Earnings per share ...

Capital Markets Policy Update

... Investors will continue to increase their allocations to passive investment vehicles over the next 5-10 years. Asset management fees generally reflect the value provided to clients. Financial centers in Asia will have increasing influence in the investment industry in the next 5-10 years. ...

... Investors will continue to increase their allocations to passive investment vehicles over the next 5-10 years. Asset management fees generally reflect the value provided to clients. Financial centers in Asia will have increasing influence in the investment industry in the next 5-10 years. ...

IFRS: Valuations in financial reporting by Shân Kennedy

... only used if quoted price in active market is not available. objective of technique is to establish what the transaction price would have been at measurement date in an arm’s length transaction motivated by normal business considerations •maximise use of market inputs and minimise entity-specific in ...

... only used if quoted price in active market is not available. objective of technique is to establish what the transaction price would have been at measurement date in an arm’s length transaction motivated by normal business considerations •maximise use of market inputs and minimise entity-specific in ...

corporations - WordPress.com

... limited by shares, have the protection of limited liability- the liability is limited to the amount owing on their shares. The directors of proprietary companies often have to give personal guarantees for loans to the company. -Capacity to contract in the business name: to own land and licence vehic ...

... limited by shares, have the protection of limited liability- the liability is limited to the amount owing on their shares. The directors of proprietary companies often have to give personal guarantees for loans to the company. -Capacity to contract in the business name: to own land and licence vehic ...

Securities Purchase Ad

... pleased to introduce our new Securities Purchase Ad-hoc Facility. It allows you to grasp every investment opportunity for higher potential returns in the dynamic market. Operation Mechanism of the Service: In case of insufficient fund, we will calculate and provide the facility amount based on your ...

... pleased to introduce our new Securities Purchase Ad-hoc Facility. It allows you to grasp every investment opportunity for higher potential returns in the dynamic market. Operation Mechanism of the Service: In case of insufficient fund, we will calculate and provide the facility amount based on your ...

Making Sense of the Markets

... Fed Spread – A measure of future monetary policy, the futures market gives us the difference between the current federal funds rate and the expected federal funds rate six months from now. Typically, a rise in rate hike expectations weighs on the markets since higher rates increase the cost of bank ...

... Fed Spread – A measure of future monetary policy, the futures market gives us the difference between the current federal funds rate and the expected federal funds rate six months from now. Typically, a rise in rate hike expectations weighs on the markets since higher rates increase the cost of bank ...

Trading and Returns under Periodic Market Closures

... investors hold on to their closing positions from the previous trading period despite their desire to trade as new information arrives. Consequently, investors optimally adjust their trading strategies during the trading period (in anticipation of and following market closures), which gives rise to ...

... investors hold on to their closing positions from the previous trading period despite their desire to trade as new information arrives. Consequently, investors optimally adjust their trading strategies during the trading period (in anticipation of and following market closures), which gives rise to ...

Financial Targets / Capital Efficiency

... RoRWA targets to reflect increasing capital requirements ...

... RoRWA targets to reflect increasing capital requirements ...

Monthly Investment Commentary

... developed world. As we’ve discussed previously, deleveraging creates a headwind for economic growth, and high debt levels make for a much higher-than-normal global risk environment. These debt-related problems also increase the odds of economic policy errors that could make things worse. We don’t be ...

... developed world. As we’ve discussed previously, deleveraging creates a headwind for economic growth, and high debt levels make for a much higher-than-normal global risk environment. These debt-related problems also increase the odds of economic policy errors that could make things worse. We don’t be ...

Federal Reserve Policy`s Impact On Economic Releases

... Consumer Price Index (CPI), and GDP. Market movements may occur when indicators show results distinctly above or below market expectations. For example, if a released indicator is better for corporations than expected, one might anticipate that equity prices will head higher. While past research has ...

... Consumer Price Index (CPI), and GDP. Market movements may occur when indicators show results distinctly above or below market expectations. For example, if a released indicator is better for corporations than expected, one might anticipate that equity prices will head higher. While past research has ...

Stock prices volatility and trading volume

... These break dates allow them to partition each country-specific sample into periods of distinctive statistical features of index returns, i.e., to identify different market regimes. These were then used to test the notion of whether the volume–return causality, both linear and in quantiles, is occur ...

... These break dates allow them to partition each country-specific sample into periods of distinctive statistical features of index returns, i.e., to identify different market regimes. These were then used to test the notion of whether the volume–return causality, both linear and in quantiles, is occur ...

Merrill Lynch Fall Media Preview Conference

... procedures in place, and they should adhere to those policies and procedures when they evaluate deals.” Clearly, we have such policies and procedures in place and just as clearly we take them very, very seriously. In our view, ratings criteria and assumptions must be publicly available, non-negotiab ...

... procedures in place, and they should adhere to those policies and procedures when they evaluate deals.” Clearly, we have such policies and procedures in place and just as clearly we take them very, very seriously. In our view, ratings criteria and assumptions must be publicly available, non-negotiab ...

list of eu regulated markets - Agencija za trg vrednostnih papirjev

... authorises each Member State to confer the status of ‘regulated market’ on those markets constituted on its territory and which comply with its regulations. Article 4, paragraph 1, point 14 of Directive 2004/39/EC defines a ‘regulated market’ as a multilateral system operated and/or managed by a mar ...

... authorises each Member State to confer the status of ‘regulated market’ on those markets constituted on its territory and which comply with its regulations. Article 4, paragraph 1, point 14 of Directive 2004/39/EC defines a ‘regulated market’ as a multilateral system operated and/or managed by a mar ...

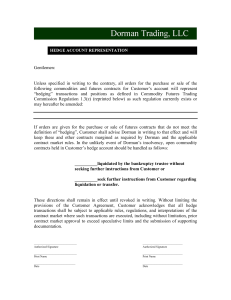

Hedge Accounts - Dorman Trading

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

Weekly Economic Update

... After a fine March, will we see more gains in April? If stocks rise for two straight months, could that hint at a major bullish move in the second half of the year? It is too early to tell if all that will happen, and April (traditionally a strong month for stocks) presents a number of question mark ...

... After a fine March, will we see more gains in April? If stocks rise for two straight months, could that hint at a major bullish move in the second half of the year? It is too early to tell if all that will happen, and April (traditionally a strong month for stocks) presents a number of question mark ...

Portfolio Analysis and Theory in a Nutshell

... in the form of extra return, for assuming financial risk • The risk-free asset has zero risk and is usually assumed to be the one-year U. S. treasury bill • A risk averse investor will hold a risky portfolio only if its expected return is greater than the risk-free rate ...

... in the form of extra return, for assuming financial risk • The risk-free asset has zero risk and is usually assumed to be the one-year U. S. treasury bill • A risk averse investor will hold a risky portfolio only if its expected return is greater than the risk-free rate ...

FUTURE // noun [C, usually pl

... an exchange of different types of payments between two companies, for example payments in different currencies or with different interest rates: The increased volume of swaps has boosted futures trading on the Mexican derivatives exchange. 3 (Finance) an act of exchanging one investment or asset for ...

... an exchange of different types of payments between two companies, for example payments in different currencies or with different interest rates: The increased volume of swaps has boosted futures trading on the Mexican derivatives exchange. 3 (Finance) an act of exchanging one investment or asset for ...