R14-Chp-00-2-1D-CPA Rev-Sec 61-121-165-1001-1031

... What is Joe’s recognized gain or loss on this sale? a. $0 b $2,300 c. $7,600 d. None of these 3. (CPAM91#23) In a "like-kind" exchange of an investment asset for a similar asset that will also be held as an investment, no taxable gain or loss will be recognized on the transaction if both assets are: ...

... What is Joe’s recognized gain or loss on this sale? a. $0 b $2,300 c. $7,600 d. None of these 3. (CPAM91#23) In a "like-kind" exchange of an investment asset for a similar asset that will also be held as an investment, no taxable gain or loss will be recognized on the transaction if both assets are: ...

Notice Concerning Introduction of Stock Options as

... The adjusted Number of Granted Shares shall be applied on or after the day following the record date in the case of a share split (if no record date is defined, the effective date of the share split) or on or after the effective date in the case of a consolidation of shares. However, if a share spli ...

... The adjusted Number of Granted Shares shall be applied on or after the day following the record date in the case of a share split (if no record date is defined, the effective date of the share split) or on or after the effective date in the case of a consolidation of shares. However, if a share spli ...

,-

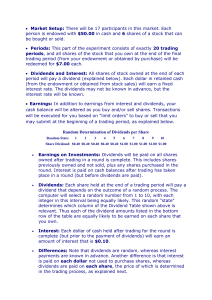

... what each party can expect from entering into the transaction. standardized trading practices reduce the cost of trading. Guarantee of transaction is one of the main features of an organized exchange. 14 ...

... what each party can expect from entering into the transaction. standardized trading practices reduce the cost of trading. Guarantee of transaction is one of the main features of an organized exchange. 14 ...