Phoenix Job Description

... Responsibility for adherence to appropriate Procurement laws Knowledge of principles and practices of general, fund, and governmental accounting including financial statement preparation and methods of financial control and reporting; Knowledge of principles and practices of cost and fixed asset acc ...

... Responsibility for adherence to appropriate Procurement laws Knowledge of principles and practices of general, fund, and governmental accounting including financial statement preparation and methods of financial control and reporting; Knowledge of principles and practices of cost and fixed asset acc ...

DOC - Europa.eu

... following up on irregularities and fraud. They are responsible for collecting EU budget revenue (e.g. Traditional Own Resources) and for managing almost 80% of EU expenditure. To further protect against irregularities and fraudulent activities, the Commission checks whether the national administrati ...

... following up on irregularities and fraud. They are responsible for collecting EU budget revenue (e.g. Traditional Own Resources) and for managing almost 80% of EU expenditure. To further protect against irregularities and fraudulent activities, the Commission checks whether the national administrati ...

No. SEC/Enforcement/645/2007/ May 25, 2008 Prime Insurance

... This refers to the Commission’s show cause cum hearing notice No. SEC/Enforcement/645/2007/46 ...

... This refers to the Commission’s show cause cum hearing notice No. SEC/Enforcement/645/2007/46 ...

Market Risk Management guideline for Co

... is the commonly used benchmark for the Rand. CFIs that have investments in the CFI retail bond, might be affected by increasing or decreasing returns on their investments b) Equity risk: - If the price of equities listed and traded on the major stock exchanges changes, then the CFI balance sheet may ...

... is the commonly used benchmark for the Rand. CFIs that have investments in the CFI retail bond, might be affected by increasing or decreasing returns on their investments b) Equity risk: - If the price of equities listed and traded on the major stock exchanges changes, then the CFI balance sheet may ...

UNI EUROPA FINANCE, Reply to Consultation on the

... sustainable growth for the benefit of society and the wider economy. UEF finds it important that after years of intensifying the regulation of traditional finance, enhancing the capital market union requires that what is today known as the shadow banking system, is appropriately regulated. In this w ...

... sustainable growth for the benefit of society and the wider economy. UEF finds it important that after years of intensifying the regulation of traditional finance, enhancing the capital market union requires that what is today known as the shadow banking system, is appropriately regulated. In this w ...

Who are the end-users in the OTC derivatives market?

... account for 47% and 41% of the notional volume respectively. CDSs are one of those products that received a lot of criticism due to limited transparency regarding counterparty exposures and inadequate collateral posting practices before the crisis – as CDSs involve jump risk, collecting and updating ...

... account for 47% and 41% of the notional volume respectively. CDSs are one of those products that received a lot of criticism due to limited transparency regarding counterparty exposures and inadequate collateral posting practices before the crisis – as CDSs involve jump risk, collecting and updating ...

Accounting degree

... This training is available in Helsinki and Oulu, and can also be tailored tailored to specific companies or groups. The training is suitable for ...

... This training is available in Helsinki and Oulu, and can also be tailored tailored to specific companies or groups. The training is suitable for ...

5 Financial Concepts To Teach Your Teen Before High School

... With graduation around the corner, high school seniors and their parents are focused on their school’s graduation requirements. But what about their personal finance education requirements? Are financial skills included in a student’s formal education? Not usually. In fact, I am astonished by how li ...

... With graduation around the corner, high school seniors and their parents are focused on their school’s graduation requirements. But what about their personal finance education requirements? Are financial skills included in a student’s formal education? Not usually. In fact, I am astonished by how li ...

Hot Charts - Canada: How significant are U.S. import duties on

... Services and Markets Act 2000). National Bank Financial Inc. and/or its parent and/or any companies within or affiliates of the National Bank of Canada group and/or any of their directors, officers and employees may have or may have had interests or long or short positions in, and may at any time ma ...

... Services and Markets Act 2000). National Bank Financial Inc. and/or its parent and/or any companies within or affiliates of the National Bank of Canada group and/or any of their directors, officers and employees may have or may have had interests or long or short positions in, and may at any time ma ...

Abstract - International Association for Energy Economics

... energy speculative bubble or price spike can have negative economic effects through macroeconomic transmission; namely that energy induced inflation is countered by higher interest rates, ultimately leading to lower economic ...

... energy speculative bubble or price spike can have negative economic effects through macroeconomic transmission; namely that energy induced inflation is countered by higher interest rates, ultimately leading to lower economic ...

Tools for a New Economy

... banks, by contrast, could freely invest their clients’ money on Wall Street and undertake other high-risk activities, but they had to steer clear of the commercial banks. Similar regulations were imposed on Savings & Loans (S&Ls) in 1932, and continued to operate through the 1970s. In particular, un ...

... banks, by contrast, could freely invest their clients’ money on Wall Street and undertake other high-risk activities, but they had to steer clear of the commercial banks. Similar regulations were imposed on Savings & Loans (S&Ls) in 1932, and continued to operate through the 1970s. In particular, un ...

Career Opportunities in Public Finance

... In short, investment bankers serve as advisors to, and intermediaries between, the issuer of securities (corporations and governments) and the public and private investor markets. Whether you are interested in investment banking, commercial banking, or financial services, you will find that many of ...

... In short, investment bankers serve as advisors to, and intermediaries between, the issuer of securities (corporations and governments) and the public and private investor markets. Whether you are interested in investment banking, commercial banking, or financial services, you will find that many of ...

MEMBER: Investment Industry Regulatory Organization of Canada

... experience with the US financial crisis, global markets can quickly be captured and exposed to the mercy of ‘macro’ developments faster than a poor earnings report or dividend cut. Macro events, depending on their severity, can cloud economic outlook and drive fear into stock exchanges. As noted ear ...

... experience with the US financial crisis, global markets can quickly be captured and exposed to the mercy of ‘macro’ developments faster than a poor earnings report or dividend cut. Macro events, depending on their severity, can cloud economic outlook and drive fear into stock exchanges. As noted ear ...

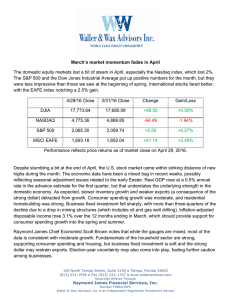

March`s market momentum fades in April The domestic equity

... Despite stumbling a bit at the end of April, the U.S. stock market came within striking distance of new highs during the month. The economic data have been a mixed bag in recent weeks, possibly reflecting seasonal adjustment issues related to the early Easter. Real GDP rose at a 0.5% annual rate in ...

... Despite stumbling a bit at the end of April, the U.S. stock market came within striking distance of new highs during the month. The economic data have been a mixed bag in recent weeks, possibly reflecting seasonal adjustment issues related to the early Easter. Real GDP rose at a 0.5% annual rate in ...

Chapter 2

... Money Markets—a collection of markets with no formal organization or location, each trading distinctly different financial instruments. Financial instruments sold in money markets have very short maturities, usually overnight to 180 days, are highly marketable in that they can be easily converted in ...

... Money Markets—a collection of markets with no formal organization or location, each trading distinctly different financial instruments. Financial instruments sold in money markets have very short maturities, usually overnight to 180 days, are highly marketable in that they can be easily converted in ...

Thoumi. CFA. FRM-144-144

... With trillions of dollars annually spent on agriculture commodities and billions invested each year in agriculture supply chain corporations and tropical deforestation mitigation pressures increasing, corporations, governments, and civil society need to determine pathways to conquer deforestation to ...

... With trillions of dollars annually spent on agriculture commodities and billions invested each year in agriculture supply chain corporations and tropical deforestation mitigation pressures increasing, corporations, governments, and civil society need to determine pathways to conquer deforestation to ...

GSE Credit Risk Transfer Securitizations (CRTs)

... returns and also provide access to a relatively liquid set of instruments for tactically trading residential mortgage credit risk. This piece also serves as an overview of a sector evaluation performed internally that resulted in our investment in CRTs. ...

... returns and also provide access to a relatively liquid set of instruments for tactically trading residential mortgage credit risk. This piece also serves as an overview of a sector evaluation performed internally that resulted in our investment in CRTs. ...